Table of Contents

- Getting Started: Creating and Verifying Your Credit Karma Account

- Understanding the Credit Karma Score

- How the Score Is Calculated

- Performing a Credit Karma Score Check

- Using the Mobile App for On‑the‑Go Checks

- Interpreting the Data: What Do the Numbers Mean for You?

- Linking Credit Karma Insights to Real‑World Opportunities

- Improving Your Credit Karma Score: Actionable Strategies

- Monitoring Progress Over Time

- Protecting Your Credit: Security Features on Credit Karma

- When to Seek Professional Advice

- Integrating Credit Karma with Your Broader Financial Strategy

- Learning More About Credit Mechanics

Credit Karma score check has become a routine part of many people’s financial lives. As a free service that aggregates credit data from major bureaus, Credit Karma provides users with a convenient way to monitor their credit health without paying hefty fees. Understanding how to navigate the platform, interpret the scores, and act on the information can empower consumers to make smarter borrowing decisions and avoid costly surprises.

In this article, we walk through the entire process of checking your Credit Karma score, from setting up an account to decoding the factors that influence your rating. By the end, you’ll have a clear picture of what your score represents, how often it updates, and what steps you can take to improve it. Whether you are a first‑time borrower, a seasoned credit‑card user, or simply curious about your credit standing, the guidance below will help you use Credit Karma effectively.

Before diving into the details, it’s worth noting that Credit Karma offers more than just a score; it also delivers personalized recommendations, credit monitoring alerts, and educational resources. These features can be especially valuable when you’re planning a major purchase, applying for a mortgage, or simply aiming to keep your credit profile in good shape.

Getting Started: Creating and Verifying Your Credit Karma Account

To begin your Credit Karma score check, you must first create an account. The registration process is straightforward:

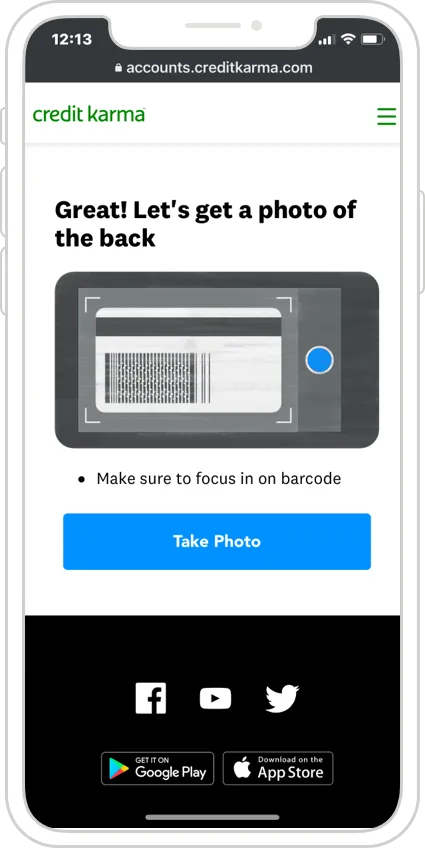

- Visit the Credit Karma website or download the mobile app.

- Enter your personal information, including name, address, date of birth, and Social Security number. This data is used to match you with your credit reports securely.

- Answer a few verification questions based on your credit history. These may involve past loan amounts or previous addresses.

- Set a strong password and enable two‑factor authentication for added security.

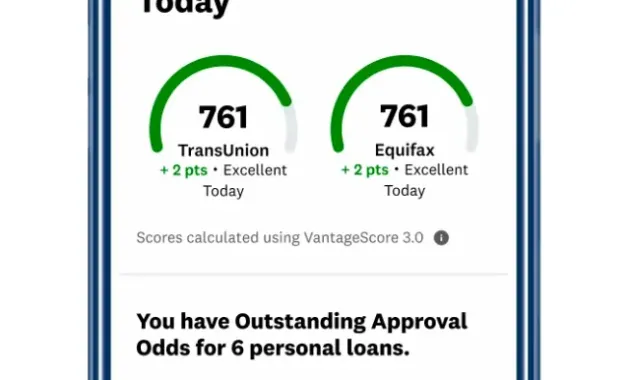

After you submit the information, Credit Karma will perform a soft inquiry—meaning it does not affect your credit score—to retrieve your credit reports from TransUnion and Equifax. Within minutes, you’ll gain access to your dashboard, where your current credit scores and related insights are displayed.

Understanding the Credit Karma Score

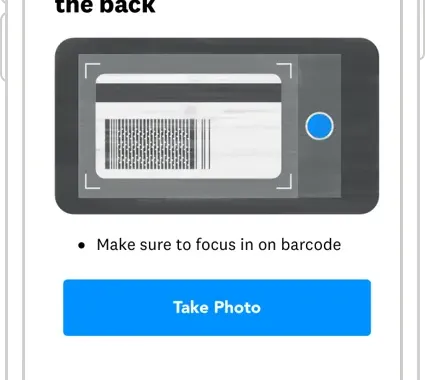

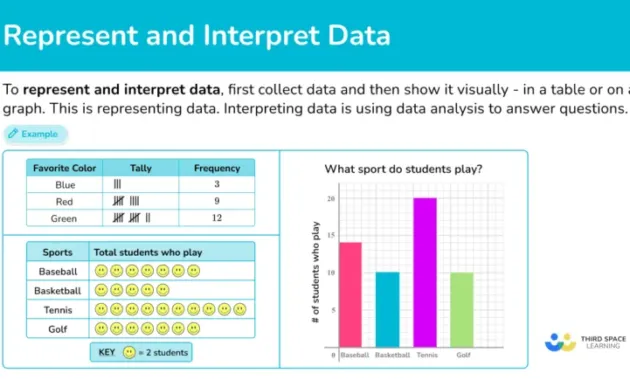

The Credit Karma score is presented as a three‑digit number ranging from 300 to 850, mirroring the FICO scoring model used by many lenders. However, it’s important to recognize that Credit Karma’s score is a VantageScore 3.0, which may differ slightly from a traditional FICO score. Below are the typical score ranges and what they signify:

- Excellent (750‑850): Lenders view you as a low‑risk borrower, often granting the best interest rates.

- Good (700‑749): You qualify for most credit products with favorable terms.

- Fair (650‑699): Approval is possible, but you may face higher rates or stricter conditions.

- Poor (300‑649): Lenders view you as high‑risk; you may need to work on credit building before securing new credit.

How the Score Is Calculated

While the exact algorithm is proprietary, VantageScore 3.0—and by extension Credit Karma’s score—considers five major factors:

- Payment History (40%): Timely payments boost your score; missed or late payments drag it down.

- Credit Utilization (20%): The ratio of balances to total credit limits. Keeping utilization below 30 % is generally advisable.

- Length of Credit History (15%): Older accounts demonstrate stability.

- Credit Mix (10%): A blend of credit cards, installment loans, and other credit types can be beneficial.

- New Credit (15%): Recent hard inquiries and newly opened accounts may temporarily lower your score.

By reviewing the “Score Factors” section on the dashboard, you can see which of these elements are helping or hurting your rating. This transparency is one of Credit Karma’s strengths, as it guides users toward targeted improvements.

Performing a Credit Karma Score Check

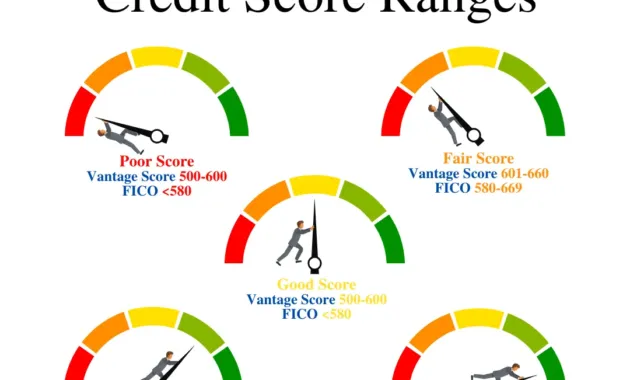

Once your account is active, checking your score is as simple as logging in. The main dashboard displays two scores—one from TransUnion and one from Equifax—along with a summary of recent activity. Here’s how to make the most of the interface:

- Navigate to “Your Score”: Click the score tile on the homepage to expand detailed view.

- Review Score Trends: A small graph shows how your score has changed over the past 12 months.

- Explore “Score Factors”: Click each factor to read a brief explanation and see personalized tips.

- Set Up Alerts: Enable notifications for any significant changes, such as a new hard inquiry or a drop in utilization.

Because Credit Karma updates your score weekly, you can track the impact of recent financial actions—like paying down a credit‑card balance or closing an old account—without waiting for monthly statements.

Using the Mobile App for On‑the‑Go Checks

For users who prefer smartphones, the Credit Karma app mirrors the website’s functionality. After logging in, you can swipe to view your scores, tap on “Insights” for deeper analysis, and even use the built‑in “Credit Simulator” to see how hypothetical actions (e.g., paying $200 toward a credit‑card balance) might affect your rating. The app also supports biometric login, adding an extra layer of convenience.

Interpreting the Data: What Do the Numbers Mean for You?

A score alone tells only part of the story. To make informed decisions, consider the broader context of your credit profile. Below are common scenarios and how you might interpret them:

- Score Drop After a New Credit Card Application: A hard inquiry can temporarily lower your score by a few points. If the drop is larger or persistent, check utilization—new cards often come with credit limits that can affect your ratio.

- High Utilization on a Single Card: Even if the overall utilization is low, a high balance on one card can signal risk to lenders. Credit Karma’s “Utilization by Card” view highlights such imbalances.

- Mixed Scores Between Bureaus: Discrepancies may arise from different reporting schedules. Review each bureau’s report to identify missing or outdated information.

By correlating the score with the underlying factors, you can prioritize actions that deliver the greatest improvement. For instance, paying off a revolving balance often yields a faster boost than opening a new credit line.

Linking Credit Karma Insights to Real‑World Opportunities

Understanding your score opens doors to better financial products. Credit Karma frequently suggests credit cards tailored to your credit tier. If you have a “Good” rating, you might see offers for cards with higher rewards, such as those that allow you to redeem rewards for travel flights and fly without paying. Conversely, a “Fair” score may trigger recommendations for secured cards that help you rebuild credit.

Improving Your Credit Karma Score: Actionable Strategies

Improving a credit score is a gradual process, but targeted actions can accelerate progress. Below are evidence‑based steps that align with the five VantageScore components:

- Automate On‑Time Payments: Set up automatic transfers for credit‑card bills and loan payments to safeguard the 40 % payment‑history factor.

- Reduce Credit Utilization: Aim for a utilization rate under 30 %, preferably under 10 % for optimal impact. Paying down balances before the statement closing date can lower the reported balance.

- Maintain Older Accounts: Keep longstanding credit cards open, even if you rarely use them, to preserve the length‑of‑credit history.

- Diversify Credit Types: If you only have credit cards, consider a small installment loan (e.g., a personal loan or auto loan) to improve the credit‑mix factor.

- Limit New Hard Inquiries: Space out applications for new credit; each hard pull can shave a few points for up to 12 months.

Credit Karma’s “Credit Simulator” lets you model these actions before committing. For example, you can input a plan to pay $500 toward a high‑balance card and see the projected score change within weeks.

Monitoring Progress Over Time

Consistent monitoring is key. Set a monthly reminder to log in and compare your score trend. Celebrate incremental gains—each five‑point increase is a sign that your habits are paying off. If you notice unexpected drops, investigate recent activity: new accounts, missed payments, or identity‑theft alerts.

Protecting Your Credit: Security Features on Credit Karma

While Credit Karma is a valuable tool, safeguarding your personal data remains essential. The platform employs several security measures:

- Encryption: All data transmitted between your device and Credit Karma’s servers is encrypted with industry‑standard TLS protocols.

- Two‑Factor Authentication (2FA): Optional 2FA adds a verification step via SMS or an authenticator app.

- Identity Theft Alerts: Credit Karma monitors for suspicious activity, such as sudden changes in personal information, and notifies you promptly.

- Secure Data Storage: Personal identifiers are stored in encrypted databases, reducing the risk of unauthorized access.

Regularly updating your password, reviewing account activity, and using a reputable password manager are additional best practices that complement Credit Karma’s built‑in protections.

When to Seek Professional Advice

Although Credit Karma provides comprehensive self‑service tools, certain situations benefit from expert guidance. If you are applying for a mortgage, planning a major business loan, or dealing with complex credit disputes, consulting a certified credit counselor or financial planner can provide personalized strategies beyond the scope of an online platform.

Integrating Credit Karma with Your Broader Financial Strategy

Credit Karma should not operate in isolation. Incorporate its insights into a holistic financial plan that includes budgeting, debt repayment, savings, and investment goals. For instance, if your score improves sufficiently, you may qualify for a lower‑interest credit‑card, freeing up cash flow to accelerate contributions to a retirement account. Conversely, a dip in score could signal the need to pause discretionary spending until your credit stabilizes.

By aligning credit health with other financial objectives, you create a synergistic effect: better credit reduces borrowing costs, which in turn amplifies your ability to save and invest.

Learning More About Credit Mechanics

For readers who want a deeper dive into how credit works behind the scenes, the article The Hidden Mechanics of Your Plastic: How a Credit Card Really Works explains the underwriting process, interest calculations, and the role of credit bureaus in shaping your score. Understanding these fundamentals can demystify the credit ecosystem and reinforce the importance of responsible credit‑management habits.

In the digital age, staying informed about your credit status is no longer optional—it’s a core component of financial wellbeing. Credit Karma’s free, user‑friendly platform makes regular score checks accessible to anyone with an internet connection. By following the steps outlined above—setting up an account, interpreting the score factors, acting on actionable insights, and integrating the data into a broader financial plan—you can transform a simple score check into a powerful lever for long‑term financial health.

Remember, credit is a living metric that reflects your financial behavior over time. Regularly reviewing your Credit Karma score, responding to alerts, and implementing proven improvement strategies will keep you on the right track. As you watch your numbers rise, you’ll also notice greater confidence in applying for loans, qualifying for premium credit cards, and achieving the financial milestones you set for yourself.