Table of Contents

- The Basics of Credit Card Functionality

- How Issuers Determine Your Credit Limit

- Key Terms to Know

- The Authorization Process: From Swipe to Approval

- Step‑by‑Step Authorization

- Settlement and Billing Cycle

- Understanding the Billing Cycle

- Interest, Fees, and the Cost of Credit

- How Interest Is Calculated

- Rewards, Points, and Travel Perks

- Maximizing Rewards Without Overspending

- Security Features and Fraud Protection

- Key Security Technologies

- Impact on Credit Scores

- Factors That Affect Your Score

- Best Practices for Cardholders

- Daily Management Tips

- Strategic Long‑Term Tips

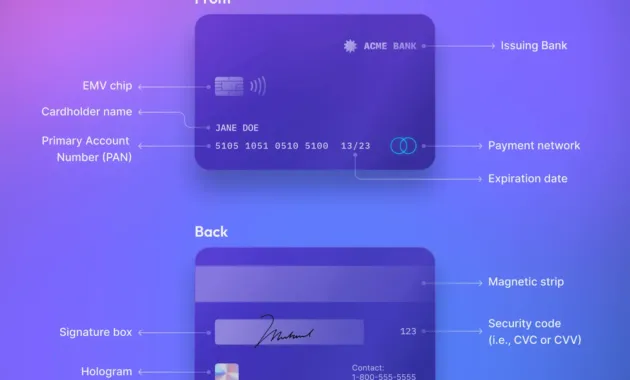

Understanding how a credit card works is essential for anyone who relies on plastic to manage daily expenses, build credit, or earn rewards. In its simplest form, a credit card is a revolving line of credit extended by a financial institution, allowing the cardholder to borrow funds up to an approved limit and repay them over time. This introductory paragraph sets the stage by defining the core concept and highlighting why the mechanics matter to both new users and seasoned spenders.

Beyond the familiar swipe at the checkout, a credit card involves a series of interconnected processes—authorization, settlement, billing, interest accrual, and security checks—that occur in milliseconds behind the scenes. Grasping these steps can help you avoid hidden fees, protect your credit score, and make the most of rewards programs. The following sections break down each component, presenting the information in a clear, narrative style that reads like a short factual story.

Imagine you are at a coffee shop, ready to pay for your latte. You tap your card, the terminal beeps, and a few seconds later the purchase is approved. What just happened? The answer lies in a complex network of technology, agreements, and financial calculations that we will explore in depth.

The Basics of Credit Card Functionality

A credit card is issued by a bank or a specialized credit card company after evaluating the applicant’s creditworthiness. The issuer assigns a credit limit based on income, existing debt, and credit history. This limit represents the maximum amount you can borrow at any given time.

How Issuers Determine Your Credit Limit

- Credit Score: A higher score typically leads to a higher limit.

- Income Verification: Proof of stable earnings reassures the issuer.

- Debt-to-Income Ratio: Lower ratios suggest you can handle additional debt.

Key Terms to Know

- Available Credit: The portion of the limit not currently used.

- Outstanding Balance: The total amount you owe at any moment.

- Grace Period: The time you have to pay the balance in full without incurring interest.

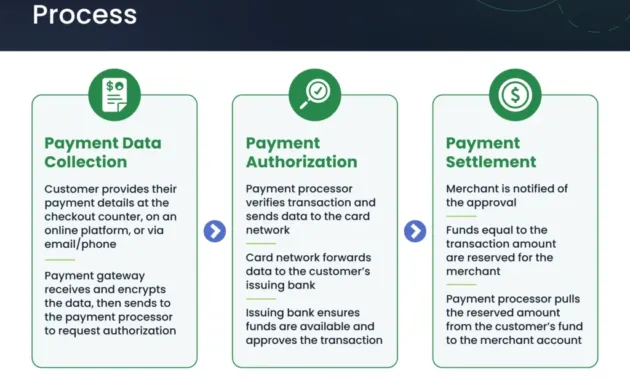

The Authorization Process: From Swipe to Approval

When you present your card, the merchant’s point‑of‑sale (POS) system sends an authorization request to the card network (Visa, Mastercard, etc.). The network forwards this request to your issuing bank, which checks three critical factors: sufficient available credit, the card’s validity, and potential fraud signals.

Step‑by‑Step Authorization

- Request Sent: The merchant’s terminal encrypts the transaction details.

- Network Routing: The data travels through the card network to the issuer.

- Issuer Decision: The bank approves or declines based on credit limit and risk assessment.

- Response Returned: An approval code is sent back, allowing the sale to complete.

If approved, the amount is placed in a temporary hold, reducing your available credit until the transaction settles.

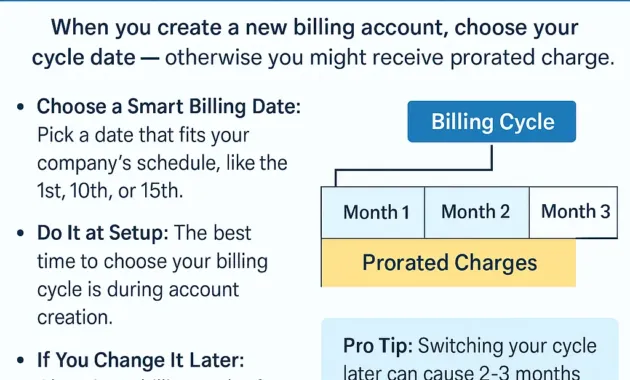

Settlement and Billing Cycle

After authorization, the transaction moves to settlement, usually within one to three business days. The issuer transfers funds to the merchant’s acquiring bank, and the amount becomes part of your outstanding balance.

Understanding the Billing Cycle

- Statement Date: The day the issuer compiles all transactions for the month.

- Due Date: Typically 21‑25 days after the statement date, giving you a grace period.

- Minimum Payment: The smallest amount you must pay to keep the account in good standing.

Paying the full balance by the due date avoids interest charges on purchases. If you only make a partial payment, interest accrues on the remaining balance, often from the day of the original purchase.

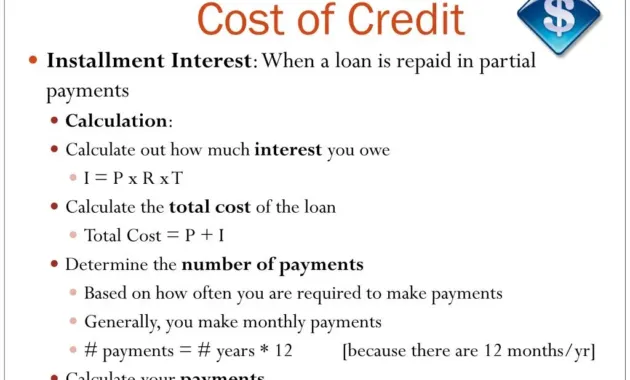

Interest, Fees, and the Cost of Credit

Interest rates on credit cards are expressed as an Annual Percentage Rate (APR). Because most consumers carry balances, understanding how APR translates into daily or monthly interest is crucial.

How Interest Is Calculated

- Convert APR to a daily rate (APR ÷ 365).

- Multiply the daily rate by the outstanding balance each day.

- Sum the daily amounts over the billing cycle to get the interest charge.

Common fees include annual fees, cash‑advance fees, foreign transaction fees, and late‑payment penalties. While some cards waive the annual fee for the first year, others justify high rewards rates with a yearly charge.

Rewards, Points, and Travel Perks

Many cards offer rewards programs that convert spending into points, miles, or cash back. These incentives can offset fees and even generate net savings when used wisely.

Maximizing Rewards Without Overspending

- Identify categories with bonus multipliers (e.g., 3× points on dining).

- Align your regular expenses with those categories.

- Redeem points before they expire or lose value.

For travelers, reward points can be redeemed for flights, hotel stays, or upgrades. A practical example of reward redemption is detailed in Unlock Free Skies: How to Redeem Rewards for Travel Flights and Fly Without Paying, which explains how accumulated points can cover an entire airfare, effectively turning credit card spending into free travel.

Security Features and Fraud Protection

Modern credit cards incorporate multiple layers of security to protect both the issuer and the cardholder.

Key Security Technologies

- EMV Chip: Generates a unique transaction code for each purchase, reducing counterfeit risk.

- Tokenization: Replaces the card number with a digital token for online transactions.

- Two‑Factor Authentication (2FA): Requires an additional verification step, such as a one‑time password.

If suspicious activity is detected, the issuer may issue a temporary block and contact the cardholder for confirmation. Liability for fraudulent charges is usually limited to $50 under the U.S. Fair Credit Billing Act, and many issuers waive even that amount.

Impact on Credit Scores

Credit card usage directly influences your credit score, which in turn affects future borrowing costs.

Factors That Affect Your Score

- Payment History (35%): Timely payments boost your score; missed payments hurt it.

- Credit Utilization (30%): Keeping balances below 30% of the limit is generally recommended.

- Length of Credit History (15%): Older accounts contribute positively.

- New Credit Inquiries (10%): Frequent applications can lower your score.

- Credit Mix (10%): Having both revolving credit (cards) and installment loans (mortgages) is beneficial.

Strategically managing your card—paying on time, maintaining low utilization, and avoiding unnecessary new applications—can gradually improve your score.

Best Practices for Cardholders

Using a credit card responsibly requires more than just paying the bill each month. Below are actionable steps that reinforce good habits.

Daily Management Tips

- Set up automatic payment reminders to avoid missed due dates.

- Review statements promptly for unauthorized transactions.

- Utilize mobile banking apps to track spending in real time.

Strategic Long‑Term Tips

- Rotate between cards to maximize category-specific rewards.

- Consider a balance‑transfer card if you need to reduce high‑interest debt.

- Periodically request a credit limit increase to improve utilization, but only if you can maintain discipline.

For a simple illustration of how a well‑managed credit card can support financial goals, you might recall the introductory post “Hello world!,” which demonstrated basic concepts of financial tools in an accessible way.

In practice, the credit card ecosystem functions as a seamless loop: issuance creates a borrowing line, authorization validates each transaction, settlement records the debt, billing informs the cardholder, and repayment resets the cycle. Each component interacts with the next, forming a reliable framework that powers modern commerce.

By understanding each stage—from the moment a chip signals approval to the final posting of interest—you gain the ability to control costs, protect your credit profile, and extract maximum benefit from rewards. The knowledge also empowers you to spot potential pitfalls, such as hidden fees or inadvertent overspending, before they become problematic.

Ultimately, a credit card is more than a piece of plastic; it is a financial instrument that, when used wisely, can enhance purchasing power, build credit, and open doors to travel and other experiences. Treat it as a tool, not a crutch, and let the mechanisms we’ve explored guide you toward responsible, rewarding use.