Table of Contents

- Understanding Rewards Credit Cards

- How Points and Miles Accumulate

- Redemption Pathways

- Cost Considerations

- Cash Back Cards Explained

- Structure of Cash Back Earnings

- Redemption Simplicity

- Annual Fees and Hidden Costs

- Comparative Analysis: Rewards vs Cash Back

- Earning Potential

- Redemption Flexibility

- Fee Structures and Break‑Even Analysis

- Impact on Credit Score and Financial Discipline

- Travel Benefits and Ancillary Perks

- Long‑Term Value Considerations

- Choosing the Right Card for Your Lifestyle

- Practical Tips for Maximizing Value

When you swipe your plastic, the promise of a perk often follows—points for travel, miles for flights, or a simple cash rebate on everyday purchases. The keyword that starts the conversation for many consumers is “rewards.” Rewards credit cards vs cash back cards is a comparison that determines how much value you actually extract from the credit you use. Understanding the mechanics behind each type helps you decide whether the allure of airline lounges or the simplicity of a statement credit aligns with your financial goals.

In the following story, we will trace the evolution of both card families, examine their core features, and walk through the practical considerations that turn a glossy offer into real savings. By the end, you’ll have a clearer picture of which card design fits your lifestyle, and how to avoid common pitfalls that can erode the benefits you think you’re earning.

Understanding Rewards Credit Cards

Rewards credit cards were born out of the desire to turn spending into experiences. Instead of handing you cash, these cards translate each dollar into points, miles, or other non‑cash currencies that can be redeemed for travel, merchandise, or exclusive services. The underlying premise is simple: the more you spend, the more you accumulate, and the more options you unlock.

How Points and Miles Accumulate

- Earn rates often differ by category (e.g., 3 × points on travel, 2 × points on dining).

- Bonus promotions can accelerate earnings during a limited period, such as “Earn 50,000 points after spending $3,000 in the first three months.”

- Some cards offer tiered structures where elite status multiplies future earnings.

Redemption Pathways

Redeeming rewards can be as straightforward as booking a flight through the card’s portal, or as involved as transferring points to airline partners. Transfer partners often provide better value per point, but they require timing and knowledge of airline award charts. For those who prefer simplicity, many issuers allow direct conversion to statement credits, gift cards, or merchandise.

Cost Considerations

Rewards cards frequently carry higher annual fees, reflecting the premium benefits they provide. However, as highlighted in The Hidden Cost of Convenience: Why Your Credit Card’s Annual Fee Might Be Worth It, the fee can be justified if the earned rewards exceed the cost. Calculating break‑even points or miles is essential before committing.

Cash Back Cards Explained

Cash back cards take a different route: they translate each purchase directly into a percentage of the amount spent, returned as a credit on your statement, a check, or a deposit into a linked bank account. This straightforward approach appeals to consumers who prefer immediate, tangible value without the need to navigate redemption portals.

Structure of Cash Back Earnings

- Flat‑rate cards offer a single percentage on all purchases, typically ranging from 1 % to 2 %.

- Tiered or rotating category cards provide higher percentages (up to 5 % or more) on specific spending categories that change quarterly.

- Some cards combine both structures, offering a base flat rate plus elevated rates for select categories.

Redemption Simplicity

Cash back is usually credited automatically each month or can be accumulated until a minimum threshold is reached. Because the reward appears as a statement credit, there is no need to track points, worry about expiration dates, or manage airline partners. This simplicity reduces the administrative overhead that can diminish the perceived value of rewards cards.

Annual Fees and Hidden Costs

Many cash back cards come with no annual fee, though premium versions may charge a modest fee in exchange for higher earning rates. Understanding the net benefit requires a quick calculation: multiply your typical monthly spend in each category by the cash back rate, then compare the annual total to any fee.

Comparative Analysis: Rewards vs Cash Back

Both card types aim to reward spending, yet they differ fundamentally in value extraction, flexibility, and the effort required to maximize benefits. The following sections break down the core dimensions where the two diverge.

Earning Potential

Rewards cards can offer significantly higher nominal earning rates on travel and dining, sometimes exceeding 5 × points per dollar. However, the conversion of points to dollars varies, often ranging from 0.5 ¢ to 2 ¢ per point depending on redemption method. Cash back, on the other hand, provides a fixed cash value, typically 1 ¢ per 1 % cash back, making it easier to predict the dollar return on any purchase.

Redemption Flexibility

If you enjoy planning trips and leveraging airline partnerships, rewards cards can unlock premium experiences at a lower effective cost per mile. The article Unlock Free Skies: How to Redeem Rewards for Travel Flights and Fly Without Paying illustrates how strategic point transfers can stretch value. Conversely, cash back provides immediate liquidity with no constraints on usage, appealing to those who prioritize financial flexibility over travel perks.

Fee Structures and Break‑Even Analysis

Both card families may impose annual fees, but the calculation of a break‑even point differs. For a rewards card with a $95 fee, you must earn enough points that, when redeemed, exceed $95 in value. For a cash back card with a $0 fee, any cash back earned is net gain. Tools that explain How Each Card Is Funded can help you model these scenarios based on your spending patterns.

Impact on Credit Score and Financial Discipline

Both types of cards affect credit utilization and payment history, the two most influential factors in credit scoring models. The key distinction lies in user behavior: rewards cards often encourage higher spending to chase points, which can raise utilization if balances aren’t paid in full each month. Cash back cards, especially flat‑rate ones, may see steadier usage because the reward is less tied to lifestyle upgrades.

Travel Benefits and Ancillary Perks

Rewards cards frequently bundle travel protections, airport lounge access, and statement credits for airline fees. These perks can offset the annual fee and add value beyond the points themselves. Cash back cards may include basic protections but rarely provide premium travel amenities.

Long‑Term Value Considerations

Over a multi‑year horizon, the value of a rewards card can compound if you consistently leverage point transfers and travel deals. However, the volatility of airline award charts and potential devaluation of points pose risks. Cash back maintains a stable value, making it a reliable component of a long‑term budgeting strategy.

Choosing the Right Card for Your Lifestyle

To decide which card type aligns with your financial narrative, start by mapping your monthly spend across categories: travel, dining, groceries, utilities, and online shopping. Then, apply the earning rates of both a typical rewards card and a cash back card to estimate annual earnings. Subtract any annual fees, and you’ll have a concrete figure to compare.

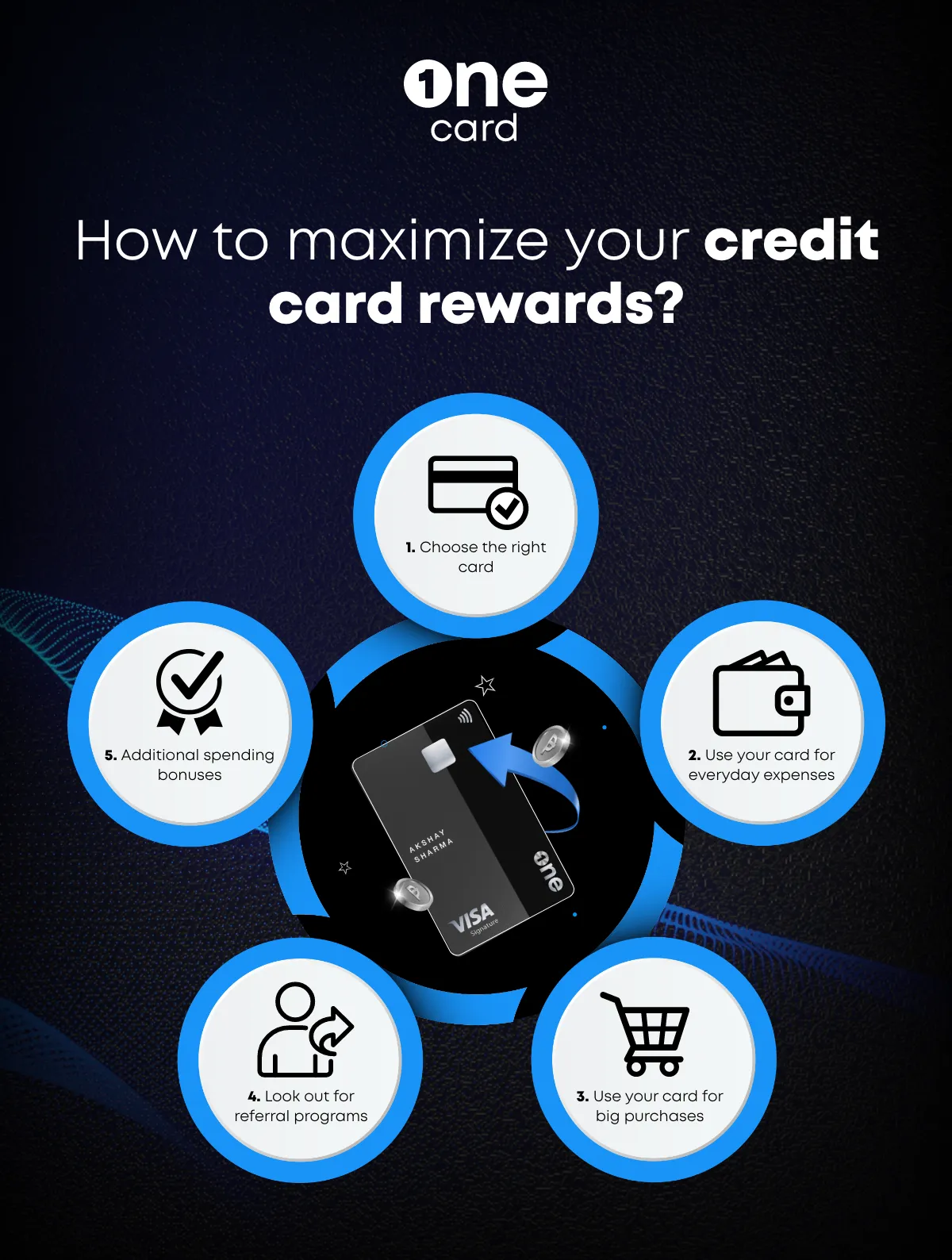

Practical Tips for Maximizing Value

- Combine a high‑earning rewards card for travel and dining with a flat‑rate cash back card for all other purchases to capture the best of both worlds.

- Monitor rotating category deadlines to ensure you activate and use the bonus cash back periods.

- Set up automatic payments to avoid interest, which can quickly outweigh any rewards earned.

- Periodically review your card portfolio; if an annual fee no longer justifies the benefits, consider switching to a no‑fee alternative.

By treating each card as a tool rather than a status symbol, you can align its strengths with your spending habits and financial objectives. Whether you aim for free flights, hotel upgrades, or a simple boost to your savings account, the decision hinges on clarity of purpose and disciplined usage.

In the end, the story of rewards credit cards vs cash back is less about which is universally superior and more about how each fits into your personal finance chapter. A well‑chosen card can turn routine expenses into meaningful returns, while a mismatched card can drain resources through fees and interest. Take the time to assess your patterns, run the numbers, and let the data guide your choice.