Table of Contents

- What Is a Credit Card Balance Transfer?

- How the Process Works Step by Step

- Step 1: Evaluate Your Current Debt Situation

- Step 2: Research Balance‑Transfer Offers

- Step 3: Apply for the New Credit Card

- Step 4: Initiate the Transfer

- Step 5: Pay the Transfer Fee

- Step 6: Manage Payments During the Introductory Period

- Step 7: Prepare for the End of the Promotional Period

- Key Terms and Fees to Watch

- Balance‑Transfer Fee

- Introductory APR

- Standard APR

- Credit Limit on the New Card

- Payment Allocation Rules

- When a Balance Transfer Makes Sense

- High‑Interest Debt Consolidation

- Predictable Repayment Timeline

- Improving Credit Utilization

- Access to Additional Benefits

- Potential Pitfalls and How to Avoid Them

- Missing a Payment Deadline

- Overlooking the Transfer Fee

- Continuing to Use the Old Cards

- Not Planning for the End of the Intro Period

- Impact on Credit Score

Credit card balance transfers have become a familiar tool for consumers looking to reduce interest costs and simplify debt repayment. In the first paragraph, the concept is introduced by explaining that a balance transfer moves an existing credit card debt to a new card, often with a promotional low‑or‑zero‑interest rate. This mechanism can be a lifeline when high‑interest balances are draining a household budget.

Imagine a borrower named Maya who carries a $5,000 balance on a card that charges 20% APR. She receives an offer for a new card that promises 0% APR on transferred balances for the first 12 months, plus a 3% transfer fee. By moving her debt, Maya could save hundreds of dollars in interest, provided she follows the process correctly. The following sections detail how this transfer works, the costs involved, and the best practices to maximize its benefits.

What Is a Credit Card Balance Transfer?

A credit card balance transfer is a transaction that shifts an outstanding balance from one credit card account to another. The receiving card—often a “balance‑transfer card”—offers a temporary reduced interest rate, usually 0% or a very low fixed rate, for a set introductory period. During this time, the borrower can focus on paying down the principal without the compounding effect of high interest.

Balance transfers are not limited to a single card; a borrower can move balances from several cards onto one new card. This consolidation can reduce the number of monthly due dates and simplify budgeting. However, the new card typically charges a transfer fee, calculated as a percentage of the amount moved, and after the promotional period ends, the standard APR applies to any remaining balance.

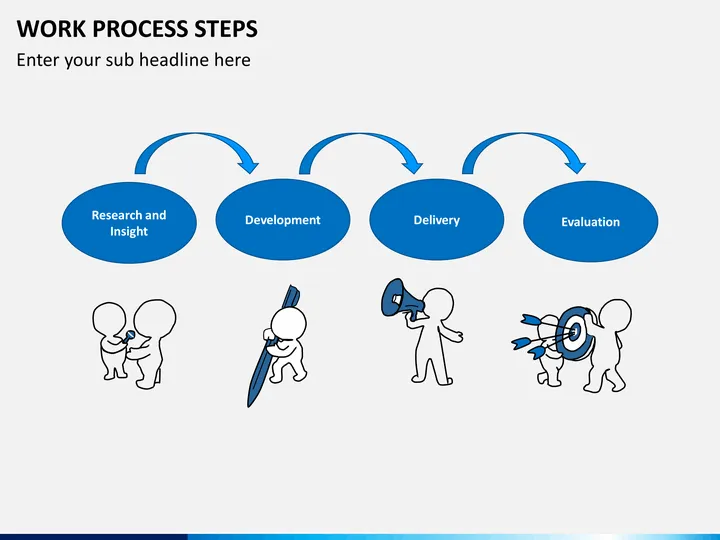

How the Process Works Step by Step

Step 1: Evaluate Your Current Debt Situation

- List every credit card balance, interest rate, and monthly payment.

- Calculate the total amount of debt you wish to transfer.

- Identify any upcoming promotional expirations that might affect your decision.

Step 2: Research Balance‑Transfer Offers

- Look for cards that provide a 0% APR introductory period of at least 12 months.

- Compare transfer fees, usually ranging from 3% to 5% of the transferred amount.

- Check the regular APR that will apply after the promotional period ends.

Step 3: Apply for the New Credit Card

The application process mirrors that of any credit card. You’ll need to provide personal information, income details, and consent to a credit check. Approval often depends on your credit score; a higher score improves the likelihood of receiving the best promotional terms.

Step 4: Initiate the Transfer

Once approved, you can request the balance transfer through the new issuer’s online portal, by phone, or via a paper form. You’ll need the account numbers and balances of the cards you’re moving debt from. Some issuers allow you to transfer multiple balances in a single request, while others require separate requests for each account.

Step 5: Pay the Transfer Fee

The transfer fee is typically charged at the time the balance is moved. For example, a 3% fee on a $5,000 transfer equals $150. This amount is added to the new balance and will accrue interest at the promotional rate, if any.

Step 6: Manage Payments During the Introductory Period

- Make at least the minimum payment each month to avoid penalties.

- Focus on paying down the principal to take full advantage of the interest‑free window.

- Monitor the due date to prevent late fees that could void the promotional rate.

Step 7: Prepare for the End of the Promotional Period

Before the introductory APR expires, calculate how much balance remains and consider whether you can pay it off before the higher rate kicks in. If not, you may explore another balance‑transfer offer or a personal loan with a lower fixed rate.

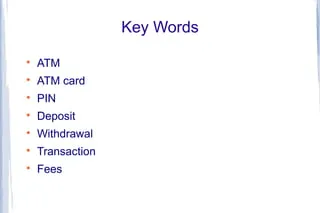

Key Terms and Fees to Watch

Balance‑Transfer Fee

This is a one‑time charge applied when the debt is moved. It’s expressed as a percentage of the transferred amount. Some cards offer a reduced fee for balances under a certain threshold, so reading the fine print is essential.

Introductory APR

The promotional interest rate, often 0%, that applies only for a limited time—commonly 6, 12, or 18 months. After this period, the standard APR takes effect.

Standard APR

The regular interest rate that applies once the introductory period ends. It can be variable, tied to the prime rate, or fixed. Knowing this rate helps you decide whether to refinance again later.

Credit Limit on the New Card

Most balance‑transfer cards set a specific limit for transferred balances, which may be lower than the overall credit limit. Ensure the limit covers the total amount you plan to move.

Payment Allocation Rules

Credit card issuers apply payments to balances with the highest interest rates first. During a 0% promotional period, any extra payment goes directly toward reducing the transferred balance, which maximizes savings.

When a Balance Transfer Makes Sense

High‑Interest Debt Consolidation

If you carry balances on multiple cards with rates above 15%, a balance‑transfer card can dramatically lower the cost of borrowing. The interest savings can be redirected to principal repayment, accelerating debt elimination.

Predictable Repayment Timeline

When you have a clear plan to pay off the debt within the promotional window, the balance transfer becomes a strategic tool. For instance, if you can afford $500 per month on a $5,000 balance, you could clear it in ten months—well before a 12‑month 0% APR expires.

Improving Credit Utilization

Consolidating balances onto one card can lower your overall credit utilization ratio, especially if the new card has a high credit limit. A lower utilization ratio can positively influence your credit score, provided you keep the balance low relative to the limit.

Access to Additional Benefits

Some balance‑transfer cards also offer rewards, travel perks, or purchase protections. While the primary goal is debt reduction, these ancillary benefits can add value if you use the card responsibly after the transfer.

Potential Pitfalls and How to Avoid Them

Missing a Payment Deadline

A single late payment can trigger a penalty APR that nullifies the promotional rate. Set up automatic payments or calendar reminders to stay on track.

Overlooking the Transfer Fee

If the fee outweighs the interest saved, the transfer may not be financially advantageous. Run the numbers: multiply the fee percentage by the transfer amount and compare it to the interest you’d have paid without the transfer.

Continuing to Use the Old Cards

Keeping the original cards open and using them can increase your overall debt load. If you must keep the accounts open for credit‑history reasons, consider freezing them or cutting up the cards to avoid temptation.

Not Planning for the End of the Intro Period

When the 0% APR ends, any remaining balance will be subject to the higher standard rate. Prepare a repayment strategy in advance, such as a personal loan with a lower fixed rate, to avoid a sudden interest spike.

Impact on Credit Score

Applying for a new card results in a hard inquiry, which may dip your score temporarily. Additionally, a high balance relative to the new card’s limit can temporarily raise your utilization ratio. Monitor your credit reports and consider timing the transfer to minimize impact.

For those who need assistance navigating the details of credit accounts, resources such as the Unlock Fast Help: The Ultimate Guide to Discover Card Customer Service Phone Numbers can provide quick support. Likewise, ensuring your credit reports are accurate—see the Unlock Your Experian Credit Report Login in Minutes guide—helps you verify that the balance transfer is reflected correctly across your credit profile.

By following a structured approach—evaluating debt, selecting the right offer, managing the transfer, and planning for the post‑promo period—you can leverage balance transfers as a practical method to lower borrowing costs and accelerate debt freedom. The key is disciplined payment habits, awareness of fees, and proactive planning for the inevitable end of the introductory rate.