Table of Contents

- Understanding the Basics of Authorized Users

- Key Benefits of Adding an Authorized User

- Potential Risks and Responsibilities

- Step‑by‑Step Process to Add an Authorized User

- Special Considerations for Specific Card Types

- Managing the Relationship After Adding an Authorized User

- Establish Clear Spending Guidelines

- Leverage Online Account Controls

- Review Statements Together

- Adjust Permissions When Needed

- Know the Impact on Credit Scores

- Common Questions and Troubleshooting Tips

- Can I add an authorized user without a Social Security Number?

- Will adding an authorized user increase my credit limit?

- Do I have to pay a fee for each authorized user?

- What happens if the AU exceeds the spending limit?

- Can an authorized user become a joint account holder?

- Best Practices for a Smooth Authorized User Experience

Adding an authorized user to an account is a decision that many primary cardholders face when they want to help a family member or close associate build credit, simplify household expenses, or gain emergency purchasing power. The keyword “add authorized user to account” appears early in this narrative to make clear the focus of the guide. In the following sections we will walk through the entire process, from initial considerations to post‑addition management, while keeping the language straightforward and factual.

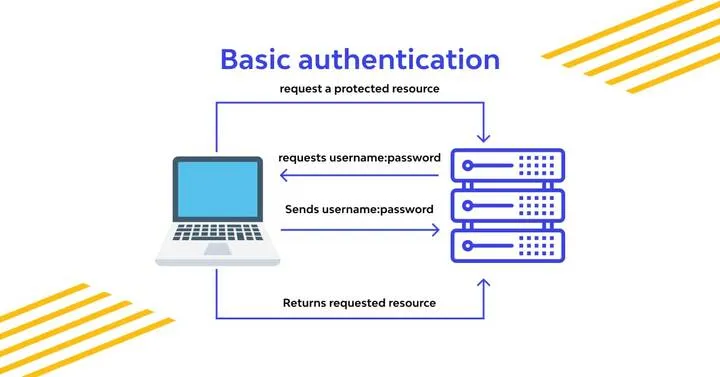

The concept of an authorized user is simple: the primary cardholder grants another person permission to use the credit card, while retaining ultimate responsibility for payments. This arrangement can be a valuable financial tool, but it also requires careful planning. Before we dive into the mechanics, let’s look at why people choose this route and what they should verify before proceeding.

First, many households use an authorized user to consolidate spending on groceries, gas, or online subscriptions, reducing the need for multiple reimbursement processes. Second, adding a spouse, teenager, or elderly parent can help that individual establish a credit history, which can be crucial for future loan approvals. Finally, an authorized user can serve as a backup in emergencies, ensuring that essential purchases can still be made if the primary cardholder is unavailable. With these motivations in mind, the next step is to evaluate eligibility, costs, and the specific policies of the credit card issuer.

Understanding the Basics of Authorized Users

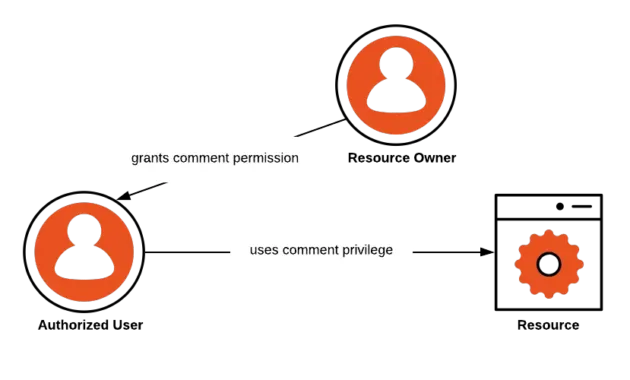

An authorized user (AU) is not the same as a joint account holder. The AU receives a card linked to the primary account but does not have the authority to make changes to the account’s terms, request credit limit increases, or close the account. All charges made by the AU appear on the primary’s statement, and the primary remains liable for the full balance.

Credit reporting varies by issuer. Some banks report the AU’s activity to the major credit bureaus, which can positively affect the AU’s credit score if payments are made on time. Others may only report the primary’s activity. Understanding this distinction is essential for anyone whose primary goal is credit building.

Key Benefits of Adding an Authorized User

- Accelerated credit history for the AU, especially useful for young adults.

- Convenient shared spending for families or small businesses.

- Potential rewards boost, as purchases by the AU contribute to the primary’s reward accumulation.

- Emergency purchasing power without the need for a separate credit line.

Potential Risks and Responsibilities

- Primary remains 100 % responsible for any debt incurred by the AU.

- Misuse or overspending can affect the primary’s credit utilization ratio.

- Some issuers charge a monthly fee for adding an AU, particularly for premium cards.

- In the event of a dispute, the primary may need to resolve issues without direct AU involvement.

Step‑by‑Step Process to Add an Authorized User

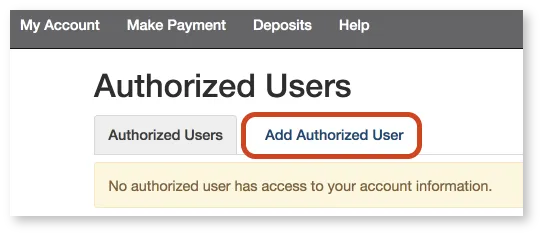

The actual procedure differs slightly among credit card providers, but the general workflow follows a common pattern. Below is a universal outline that can be adapted to most major issuers.

- Log into the primary account online or via mobile app. Most banks have a dedicated “Add Authorized User” section under account management. If you encounter login difficulties, refer to our guide on unlocking the PayPal Credit account for troubleshooting tips.

- Gather required information. Typically you will need the AU’s full legal name, date of birth, and Social Security Number (or Tax Identification Number). Some issuers may also request an address for verification.

- Select the card to which the AU will be linked. If you hold multiple cards, choose the one that best aligns with the AU’s spending needs and the rewards program you wish to maximize.

- Set spending limits (if available). Certain issuers allow the primary to impose a daily or monthly cap on the AU’s purchases, providing an extra layer of control.

- Choose whether the AU receives a physical card. You can often opt for a digital card number only, which the AU can add to a mobile wallet.

- Confirm and submit the request. The system may ask for a final verification step, such as a one‑time password sent to your phone.

- Wait for processing. Most banks add the AU within minutes to a few business days. You will receive a confirmation email once the AU is active.

- Distribute the card. If you opted for a physical card, mail it securely to the AU or hand it over in person.

After the AU is added, it is advisable to monitor the account closely for the first few billing cycles. This helps ensure that spending aligns with expectations and that the AU understands the rules governing the use of the card.

Special Considerations for Specific Card Types

- Student credit cards: Many student cards allow free addition of an AU, but they may limit the number of authorized users per account.

- Secured credit cards: Adding an AU can be a strategic way to help a family member build credit without exposing them to unsecured debt. See our guide on secured credit cards for more details.

- Business credit cards: Some business cards distinguish between employees and authorized users, offering separate expense reporting tools.

Managing the Relationship After Adding an Authorized User

Adding an AU is not a set‑and‑forget action. Ongoing communication and monitoring are essential to maintain a healthy financial relationship.

Establish Clear Spending Guidelines

Discuss with the AU which categories of purchases are acceptable, what the monthly limit is (if any), and how to handle refunds or disputed charges. Written agreements, even informal ones, can prevent misunderstandings.

Leverage Online Account Controls

Most issuers provide real‑time alerts for transactions made by the AU. Enable push notifications or email alerts so you are instantly aware of each purchase. Some platforms also allow you to lock or freeze the AU’s card remotely, which can be useful if the card is lost or if spending spikes unexpectedly.

Review Statements Together

At the end of each billing cycle, sit down with the AU to review the statement. Verify that all charges are recognized and correct any errors promptly. This practice also reinforces responsible spending habits.

Adjust Permissions When Needed

If the AU’s circumstances change—such as graduating from college, moving out, or no longer needing emergency access—you can remove or downgrade their permissions. The removal process mirrors the addition process: log in, locate the AU profile, and select “Remove Authorized User.” Most banks process removals immediately, but the physical card may still need to be destroyed.

Know the Impact on Credit Scores

When the AU’s activity is reported to credit bureaus, the primary’s payment history and credit utilization affect the AU’s credit score. Timely payments can boost the AU’s score, while missed payments or high utilization can have the opposite effect. Regularly check both the primary and AU’s credit reports to ensure accurate reporting.

Common Questions and Troubleshooting Tips

Even with a clear step‑by‑step guide, users often encounter questions. Below are the most frequent concerns and concise answers.

Can I add an authorized user without a Social Security Number?

Most issuers require an SSN or ITIN for reporting purposes. Some may allow a temporary placeholder, but full reporting typically begins once the SSN is provided.

Will adding an authorized user increase my credit limit?

Generally, the credit limit remains unchanged. However, the additional spending capacity of the AU can effectively increase the total purchasing power available to the household.

Do I have to pay a fee for each authorized user?

Fee structures vary. Premium rewards cards often charge $50‑$100 per AU per year, while basic cards may offer free AU additions. Review your card’s terms or check the issuer’s fee schedule.

What happens if the AU exceeds the spending limit?

If a limit is set, the transaction will be declined once the cap is reached. If no limit exists, the primary will be responsible for the excess amount and may face higher utilization ratios, potentially affecting credit scores.

Can an authorized user become a joint account holder?

Yes, but this requires a separate application process, credit check, and potentially a new credit line. Converting an AU to a joint holder is not automatic.

Best Practices for a Smooth Authorized User Experience

To maximize the advantages and minimize the drawbacks, consider the following best practices.

- Start with a low credit limit or spending cap. This provides a safety net while the AU gets accustomed to responsible use.

- Use alerts and notifications. Real‑time updates reduce the risk of surprise balances.

- Periodically reassess the arrangement. Life circumstances change; regular reviews keep the relationship aligned with financial goals.

- Educate the AU about credit scores. Understanding how their actions affect credit can motivate prudent behavior.

- Maintain documentation. Keep copies of the AU agreement, card issuance date, and any correspondence for future reference.

By following these steps, you can effectively add an authorized user to your account, support their credit building journey, and keep your own financial health intact.

If you need assistance with related account tasks—such as unlocking a blocked credit card or navigating online login challenges—our other guides may be useful. For instance, you can explore how to quickly log in to your Citibank credit card account or discover strategies to opt out of unwanted credit card offers. These resources complement the authorized user process by ensuring you have seamless access to your accounts at all times.

Adding an authorized user is a practical tool for families, businesses, and anyone looking to share financial responsibility responsibly. By understanding the mechanics, setting clear expectations, and monitoring activity, the primary cardholder can protect their credit while extending valuable benefits to the authorized user.