Table of Contents

- Why Credit Matters Even Without a Card

- Lenders Look Beyond Revolving Debt

- The Role of Credit Mix

- Future Opportunities Depend on a Track Record

- Alternative Credit‑Building Tools

- Secured Loans and Credit‑Builder Loans

- Becoming an Authorized User

- Rent Reporting Services

- Utility and Telecom Payments

- Leveraging Non‑Traditional Data

- Bank Account Activity

- Employment and Income Verification

- Public Records and Rental History

- Managing Your Credit Profile

- Regular Monitoring

- Disputing Errors Promptly

- Keeping Existing Balances Low

- Practical Steps to Get Started

- 1. Identify a Suitable Credit‑Builder Product

- 2. Set Up Automatic Payments

- 3. Enroll in Rent Reporting

- 4. Add Yourself as an Authorized User (If Feasible)

- 5. Use Experian Boost or Similar Services

- 6. Track Your Progress

- 7. Avoid New Debt While Building

- 8. Educate Yourself on Credit Fundamentals

- Long‑Term Maintenance

- Transitioning to Traditional Credit When Ready

- Periodic Review of Credit Needs

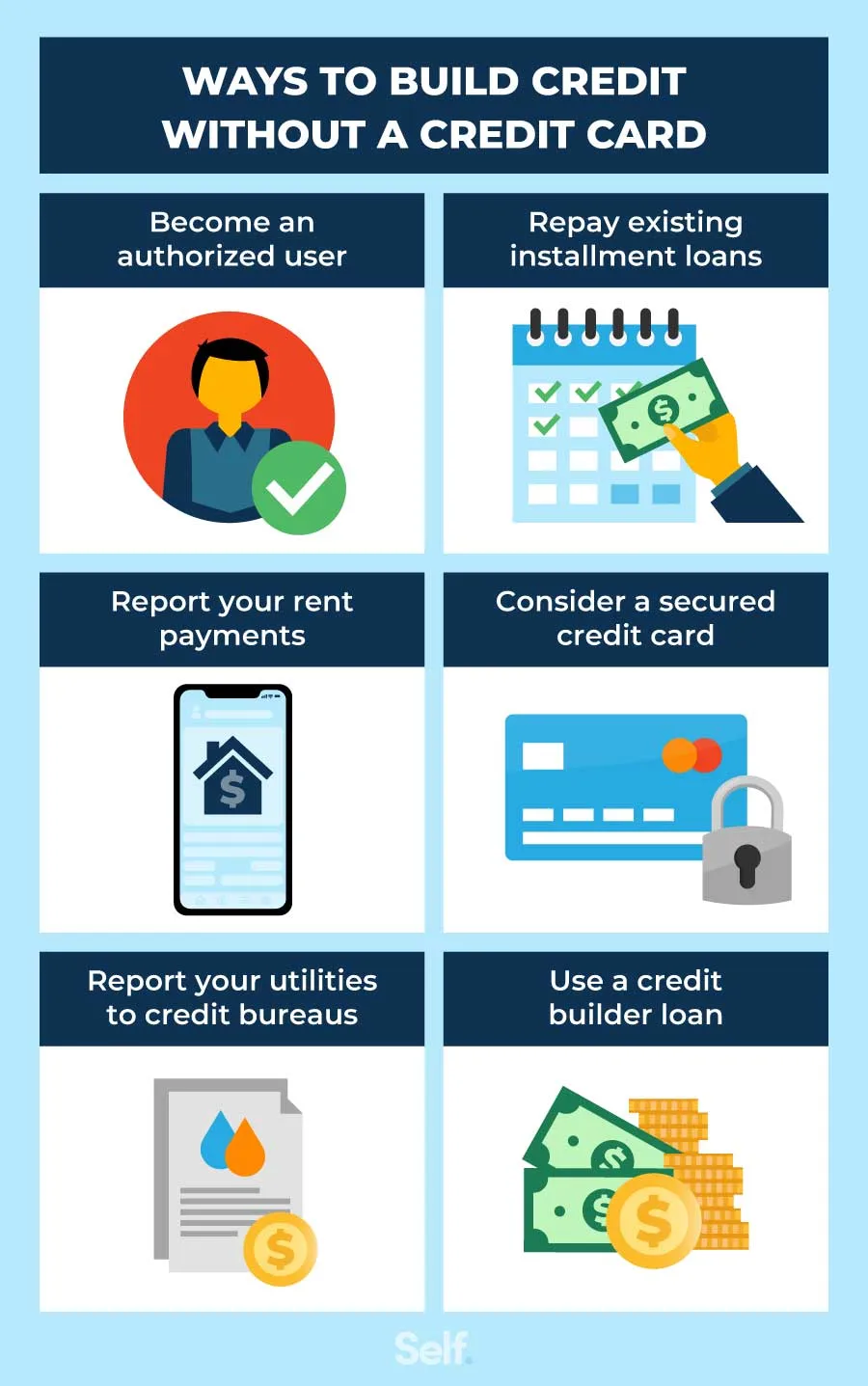

Building a credit history without ever holding a credit card may sound like an impossible task, but it’s a realistic goal for many consumers. The key phrase “build credit without a credit card” appears at the start of this article, signaling that the journey is possible through alternative financial tools, disciplined habits, and strategic use of non‑traditional data. In today’s lending environment, lenders evaluate more than just revolving credit; they look at a mosaic of payment histories, loan performance, and even utility bills. Understanding how to piece together that mosaic can set the stage for future borrowing power.

Imagine a recent college graduate named Maya who wants to buy a car in two years but has never owned a credit card. She worries that without a card, her credit file will stay blank, making lenders view her as high‑risk. Maya’s story mirrors that of thousands who either prefer to avoid credit cards due to high interest rates or simply lack access to one. The good news is that Maya can still create a robust credit profile by tapping into alternative credit‑building avenues, tracking her payments, and strategically leveraging authorized‑user opportunities.

This article walks you through each of those avenues, offering step‑by‑step guidance, practical tips, and resources to help anyone—like Maya—build credit without ever swiping a plastic card.

Why Credit Matters Even Without a Card

Lenders Look Beyond Revolving Debt

Modern underwriting models incorporate a variety of data points. While a traditional credit card balances and utilization ratios remain important, lenders also consider installment loans, rent payments, and even consistent utility bill payments. By demonstrating reliability in these areas, a borrower can signal creditworthiness without any revolving accounts on their report.

The Role of Credit Mix

A healthy credit mix—showcasing both installment and revolving credit—can boost a FICO® score by a few points. When a consumer lacks a credit card, a well‑managed installment loan (such as a secured personal loan or a credit‑builder loan) fills that gap, showing lenders that the individual can handle periodic payments responsibly.

Future Opportunities Depend on a Track Record

Whether it’s qualifying for a mortgage, leasing an apartment, or securing a low‑interest auto loan, lenders often request a credit report. Without any credit history, applicants may face higher deposits, steeper interest rates, or outright denial. Establishing a record early—through non‑card means—creates a foundation for those future milestones.

Alternative Credit‑Building Tools

Secured Loans and Credit‑Builder Loans

Secured loans require collateral, such as a savings account deposit, which reduces the lender’s risk. The borrower receives a loan amount, makes regular payments, and the lender reports those payments to the major credit bureaus. Over time, the positive payment history improves the borrower’s score. Credit‑builder loans operate similarly, but the loan amount is held in an account while the borrower makes payments; the funds are released only after the loan is fully repaid, ensuring that the borrower cannot default on a large sum.

Becoming an Authorized User

One low‑risk method is to be added as an authorized user on a family member’s existing credit card. The primary account holder’s positive payment history can appear on the authorized user’s credit report, even if the authorized user never receives a card. This approach can be especially effective when paired with a credit card that offers free credit score tracking, allowing the authorized user to monitor progress without incurring debt.

Rent Reporting Services

Many landlords now partner with services that report rent payments to the credit bureaus. Tenants can opt‑in and have their on‑time rent payments added to their credit file. Companies like RentTrack, Cozy, and others typically charge a modest fee, but the payoff can be substantial—especially for renters who have otherwise limited credit activity.

Utility and Telecom Payments

Utility providers, phone carriers, and streaming services traditionally do not report payments. However, third‑party platforms such as Experian Boost allow consumers to add on‑time utility and telecom payments directly to their credit files. This can generate an immediate score increase, particularly for those with thin credit histories.

Leveraging Non‑Traditional Data

Bank Account Activity

Lenders are increasingly using “alternative credit data” that includes checking and savings account activity. Consistently maintaining a positive balance, avoiding overdrafts, and setting up regular direct deposits can signal financial stability. Some fintech lenders incorporate this data into their risk models, offering loan products to borrowers with limited traditional credit.

Employment and Income Verification

Stable employment and verified income can also influence credit decisions, especially for installment loans. Platforms like premium credit cards with lounge access often require income verification, but the same principle applies to non‑card loan products. Providing pay stubs or tax returns can improve loan approval odds.

Public Records and Rental History

Positive rental history, as recorded by property management software, can be shared with credit bureaus through specialized reporting agreements. This data adds another layer of proof that the borrower meets financial obligations consistently.

Managing Your Credit Profile

Regular Monitoring

Staying aware of what’s on your credit report is essential. Free annual reports from the three major bureaus (Equifax, Experian, and TransUnion) provide a snapshot of current data. Additionally, many banks and credit‑building apps now offer real‑time score monitoring, allowing you to track the impact of each new payment or account.

Disputing Errors Promptly

Even without a credit card, errors can appear—perhaps an incorrectly reported late payment from a loan or a duplicate account entry. The Fair Credit Reporting Act (FCRA) gives consumers the right to dispute inaccuracies. Submitting a dispute online, via certified mail, or through the bureau’s portal can lead to corrections that improve your score.

Keeping Existing Balances Low

If you have any installment loans (student loans, auto loans, or a credit‑builder loan), aim to keep the balance well below the original amount. While utilization ratios apply mainly to revolving credit, lenders also view the proportion of remaining loan balance to original principal as an indicator of repayment discipline.

Practical Steps to Get Started

1. Identify a Suitable Credit‑Builder Product

- Research local credit unions, community banks, and online lenders that offer credit‑builder loans. Compare interest rates, fees, and reporting policies.

- Confirm that the lender reports to all three major bureaus; this ensures comprehensive coverage.

2. Set Up Automatic Payments

- Automating payments eliminates missed due dates—a common cause of score dips.

- Link the payment to a checking account with sufficient funds to avoid overdraft fees, which could indirectly harm your credit if reported as a negative event.

3. Enroll in Rent Reporting

- Ask your landlord if they already participate in a reporting service.

- If not, sign up with a third‑party provider and authorize them to submit your rent payments each month.

4. Add Yourself as an Authorized User (If Feasible)

- Choose a trusted family member with a strong credit history and low credit utilization.

- Ensure the primary account reports authorized users to the bureaus—most major issuers do.

5. Use Experian Boost or Similar Services

- Connect your utility and telecom accounts securely to the platform.

- Monitor the score change; many users see an increase of 10–30 points within weeks.

6. Track Your Progress

- Keep a simple spreadsheet noting each payment date, amount, and the corresponding effect on your credit score.

- Review quarterly to identify trends and adjust strategies as needed.

7. Avoid New Debt While Building

- Resist the temptation to take out unnecessary loans for the sake of “more credit.”

- Focus on a single, manageable credit‑builder loan or a rent‑reporting plan.

8. Educate Yourself on Credit Fundamentals

Understanding the mechanics behind credit scoring helps you make informed choices. For instance, reading articles like how credit cards handle big ticket items provides insight into how large purchases affect utilization and payment history, even if you’re not using a card yourself.

Long‑Term Maintenance

Transitioning to Traditional Credit When Ready

After establishing a solid foundation—say, a score above 680—consider applying for a low‑interest secured credit card or a student credit card with a modest limit. Using the card sparingly, paying the full balance each month, and maintaining a low utilization rate will further strengthen your credit mix without adding debt burden.

Periodic Review of Credit Needs

Life circumstances change. A new job, a move, or a change in family status may alter your borrowing needs. Review your credit profile annually, adjust payment schedules, and explore new reporting options (like adding a mortgage once you own a home) to keep your score growing.

By following these structured steps—leveraging secured loans, rent reporting, authorized‑user status, and alternative data—anyone can build a respectable credit profile without the need for a traditional credit card. The process requires patience, consistency, and a willingness to explore non‑conventional avenues, but the payoff is a stronger financial standing that opens doors to better loan terms, lower insurance premiums, and greater economic flexibility.