Table of Contents

- Why Prompt Reporting Matters

- Financial Protection

- Peace of Mind

- How to Report a Lost Bank of America Card

- 1. Phone Reporting

- 2. Online Banking Portal

- 3. Mobile Banking App

- Replacing Your Card

- Expedited Shipping

- Virtual Card Options

- Securing Your Account After a Loss

- Review Recent Transactions

- Change Your Online Passwords

- Set Up Account Alerts

- Preventing Future Card Loss

- What to Expect After Reporting

- Common Misconceptions About Lost Cards

When you realize your Bank of America card is missing, the first phrase that flashes across your mind is “report lost card.” Acting quickly can prevent unauthorized charges and keep your credit score intact. This article follows the journey of a typical cardholder—from the moment the card disappears to the point a new card arrives in the mailbox—highlighting each decision that safeguards their financial health.

The scenario often begins in a coffee shop, a grocery aisle, or simply at home when a card slips between couch cushions. Regardless of where it vanishes, the underlying risk remains the same: fraudsters could exploit the card’s magnetic stripe or chip. By understanding Bank of America’s reporting channels and following a clear, step‑by‑step plan, you turn a potentially stressful event into a routine, controlled process.

Below, you’ll find a comprehensive roadmap that combines the bank’s official procedures with practical advice. Whether you prefer to call, log in online, or use the mobile app, each option is detailed with the exact information you’ll need to provide, the expected wait times, and the follow‑up actions that ensure your account stays secure.

Why Prompt Reporting Matters

Bank of America’s policies are designed to limit liability for both the institution and the cardholder. Federal law (Regulation E) states that if you report a lost or stolen card within two business days, your liability for unauthorized transactions caps at $50. Waiting longer can increase that exposure dramatically. Additionally, a swift report triggers a freeze on the compromised card, preventing any pending transactions from being authorized.

Financial Protection

Immediate reporting stops the flow of fraudulent charges, which can otherwise accumulate before the bank becomes aware of the loss. By contacting the bank within hours, you also preserve the integrity of your credit report, as unauthorized balances won’t be mistakenly recorded as your responsibility.

Peace of Mind

Knowing that a real person at Bank of America has blocked the card allows you to focus on daily activities without the lingering anxiety of potential theft. The process is straightforward, and the bank’s 24/7 support ensures help is always available.

How to Report a Lost Bank of America Card

The bank offers three primary channels: phone, online banking, and the mobile app. Each method requires specific details, and the choice often depends on how quickly you can access the service.

1. Phone Reporting

Calling is the fastest way to speak directly with a representative. Dial the 24‑hour Bank of America lost‑card line at 1‑800‑432‑1000. Be prepared to provide:

- Your full name and Social Security Number (or the last four digits).

- The last four digits of the lost card.

- The approximate date and location where the card was last seen.

- A verification of your identity, such as a recent transaction amount.

After verification, the agent will confirm the loss, block the card, and initiate a replacement request. You’ll receive a reference number for future follow‑up.

2. Online Banking Portal

If you have access to a computer, log into your Bank of America online account. Navigate to the “Account Services” tab and select “Report Lost or Stolen Card.” The portal guides you through a short questionnaire mirroring the phone script. Once submitted, the system automatically deactivates the card and queues a new one for shipping.

3. Mobile Banking App

The Bank of America mobile app offers the most convenient on‑the‑go option. Open the app, tap the “Menu” icon, then choose “Card Services.” From there, select “Report Lost Card.” The app’s interface asks the same verification questions and provides an instant confirmation screen. A push notification will also be sent confirming the report.

Replacing Your Card

After reporting, a replacement card is typically mailed within 7–10 business days. You can expedite the process for a fee, or opt for a temporary virtual card that works for online purchases while you wait.

Expedited Shipping

For an additional $15–$20, Bank of America can ship a new card via overnight delivery to the address on file. This service is especially useful for travelers or individuals who rely on their card for daily expenses.

Virtual Card Options

The “Digital Card” feature, accessible through the mobile app, generates a temporary card number that can be used for e‑commerce transactions. It functions just like a physical card but expires after a short period, providing a safe bridge until the physical replacement arrives.

Securing Your Account After a Loss

Reporting the loss is only half the battle. You must also review recent activity, update passwords, and consider additional security layers.

Review Recent Transactions

Log into your account and examine the last 30 days of activity. Flag any unfamiliar charges and dispute them through the “Dispute a Transaction” tool. The bank typically investigates within 7–10 days, and you won’t be held responsible for fraudulent amounts.

Change Your Online Passwords

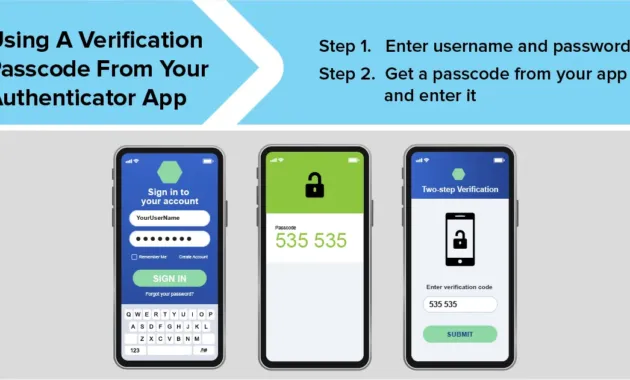

Even though the card is blocked, a compromised card number can sometimes be paired with phishing attempts to gain account access. Update your online banking password and enable two‑factor authentication (2FA) for added protection.

Set Up Account Alerts

Bank of America allows you to customize alerts for transactions exceeding a certain amount, international usage, or any online purchase. Enabling these alerts helps you spot suspicious activity instantly.

Preventing Future Card Loss

While you can’t control every circumstance, a few habits reduce the likelihood of misplacing a card again.

- Designate a Safe Spot: Keep your card in a specific wallet compartment or travel pouch.

- Use Mobile Wallets: Store your card in Apple Pay or Google Pay; you’ll have a digital backup even if the physical card is missing.

- Regularly Check Your Card’s Location: Perform a quick “card check” before leaving any location—home, work, restaurant, or gym.

For broader financial habits, consider reading how to build credit without a credit card. Understanding alternative credit strategies can lessen dependence on a single plastic card and diversify your financial toolkit.

What to Expect After Reporting

Once you’ve completed the report, the bank’s fraud department may reach out for additional verification, especially if suspicious activity was detected before the block. They might ask for copies of identification or a written statement. Keep a record of all communications, including dates, representative names, and reference numbers.

Within a few days, you should receive an email confirming the block and outlining the next steps. The replacement card’s arrival will be tracked through the bank’s shipment system; you can monitor status via the mobile app.

If you notice any lingering unauthorized transactions after the block, file a dispute immediately. Bank of America’s “Zero Liability” policy generally protects you from charges incurred after the loss is reported, but timely action ensures a smoother resolution.

Common Misconceptions About Lost Cards

Many cardholders assume that a lost card automatically results in a hefty fee or that the bank will replace it for free only if it’s stolen. In reality, Bank of America does not charge a replacement fee for lost cards, and the process is the same for both lost and stolen scenarios. The only optional cost is for expedited shipping, which is a convenience rather than a necessity.

Another myth is that reporting a lost card will close your credit line. The bank merely deactivates the specific card number; your overall credit account remains open and continues to contribute to your credit history.

Finally, some believe that once a card is reported lost, they cannot use the same account number again. The bank issues a new card with a different number to maintain security, but the underlying account remains unchanged, preserving your credit limit, rewards balance, and payment history.

By dispelling these myths, you can approach the situation with confidence, knowing that the process is designed to protect you without unnecessary penalties.

In summary, losing a Bank of America card triggers a clear, well‑structured response that safeguards your finances. From the immediate phone call to the final receipt of a replacement, each step is documented and supported by the bank’s 24/7 resources. By following the procedures outlined above, you minimize risk, maintain your credit standing, and restore normal spending habits quickly.