Table of Contents

- Why Access Your Citibank Credit Card Account Online Matters

- Preparing to Log In: What You Need

- Step‑by‑Step Guide to Logging In

- 1. Navigate to the Official Login Page

- 2. Enter Your Username

- 3. Input Your Password

- 4. Click “Log In”

- 5. Complete Any Additional Verification

- 6. Set Up Two‑Factor Authentication (Optional but Recommended)

- Troubleshooting Common Login Issues

- Forgotten Username or Password

- Security Locks and Captcha Challenges

- Browser Compatibility Issues

- Enhancing Security After Login

- Setting Up Two‑Factor Authentication

- Managing Alerts and Notifications

- Reviewing Account Activity Regularly

- Mobile Access: Using the Citi Mobile App

- Additional Resources and Related Topics

Logging in to your Citibank credit card account is the first step to managing your finances, monitoring transactions, and taking advantage of the rewards program. The process is designed to be straightforward, yet the sheer number of options—desktop portal, mobile app, and security features—can feel overwhelming for new users. This guide walks you through each stage, from preparing your credentials to securing your account after you’ve logged in.

Imagine you’ve just received a statement showing an unfamiliar charge. Within minutes, you can log in to your Citibank account, review the transaction, and, if necessary, dispute it. The ability to act quickly hinges on knowing exactly how to access your account without unnecessary delays. This article provides a clear, narrative‑style walkthrough that reads like a short factual story, ensuring you can follow along without getting lost in technical jargon.

Whether you are a first‑time cardholder or a seasoned user looking to refresh your knowledge, the steps below cover every essential detail. The information is organized into logical sections, each with sub‑headings that highlight key actions such as password recovery, two‑factor authentication, and mobile app usage. By the end, you will be equipped to log in confidently, troubleshoot problems, and keep your Citibank credit card information secure.

Why Access Your Citibank Credit Card Account Online Matters

Online access gives you real‑time visibility into your spending patterns, balances, and rewards points. It also provides a platform for managing settings such as payment due dates, autopay enrollment, and notification preferences. In addition, the portal serves as a hub for reporting lost or stolen cards, requesting credit limit increases, and reviewing annual fee details.

Beyond convenience, digital access is a critical component of modern financial security. Citibank employs encryption, continuous monitoring, and optional two‑factor authentication (2FA) to protect your data. By regularly logging in, you can verify that no unauthorized changes have been made and can quickly respond to any alerts generated by suspicious activity.

Preparing to Log In: What You Need

Before you attempt to sign in, gather the following items:

- Your Citibank Online Services username (often your email address or a custom ID).

- The password you set when you first registered for online access.

- A trusted device or browser where you have previously logged in, which can reduce the need for additional verification steps.

- A mobile phone capable of receiving SMS or authenticator app codes, if you plan to enable 2FA.

If you cannot locate your username or have forgotten your password, Citibank provides a “Forgot Username/Password” link on the login page. The recovery process will require personal identification details, such as your Social Security Number (SSN) or card number, to confirm your identity.

Step‑by‑Step Guide to Logging In

1. Navigate to the Official Login Page

Open a web browser and go to https://online.citi.com/US/login.do. Ensure the URL begins with “https” and displays a padlock icon, indicating a secure connection. Avoid clicking links from unsolicited emails, as phishing attacks often mimic the Citibank login page.

2. Enter Your Username

In the first field, type your registered username exactly as it appears. The field is case‑insensitive for most usernames, but it’s good practice to match the original formatting to avoid confusion.

3. Input Your Password

Type your password into the second field. Passwords are case‑sensitive and must meet Citibank’s complexity requirements (typically a mix of letters, numbers, and special characters). If you choose to display the password while typing, click the eye icon to verify accuracy.

4. Click “Log In”

Press the “Log In” button. If your credentials are correct, you will be taken to the account summary page, where you can view balances, recent transactions, and available credit.

5. Complete Any Additional Verification

If you are logging in from a new device or location, Citibank may prompt you for a one‑time passcode sent via SMS or generated by an authenticator app. Enter the code within the time limit to complete the login process.

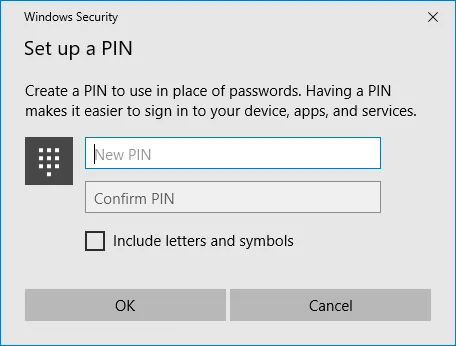

6. Set Up Two‑Factor Authentication (Optional but Recommended)

After logging in, navigate to the “Security Settings” section to enable 2FA. Choose between receiving codes via text message or using an authenticator app such as Google Authenticator or Microsoft Authenticator. This extra layer significantly reduces the risk of unauthorized access.

Troubleshooting Common Login Issues

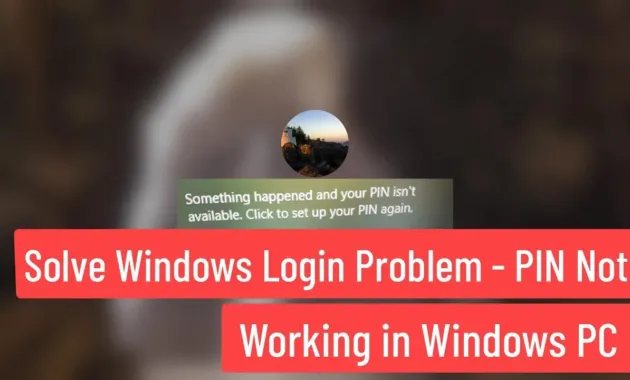

Forgotten Username or Password

If you click the “Forgot Username/Password” link, you will be guided through a verification process. You may be asked to provide your 16‑digit credit card number, the last four digits of your SSN, or answers to security questions you set up during account creation. Follow the on‑screen instructions, and you will receive a temporary password or a reset link via email.

Security Locks and Captcha Challenges

Repeated failed login attempts trigger a temporary lock on your account. The lock typically lasts for 30 minutes, after which you can try again. During this period, you may encounter a CAPTCHA challenge designed to confirm you are not a bot. Accurately solving the CAPTCHA will allow you to proceed.

Browser Compatibility Issues

Citibank’s portal works best with up‑to‑date browsers such as Chrome, Firefox, Safari, or Edge. If the page fails to load or displays incorrectly, clear your browser cache, disable any ad‑blocking extensions, or try a different browser. Mobile browsers may also have limited functionality, so using a desktop computer for the initial setup is advisable.

Enhancing Security After Login

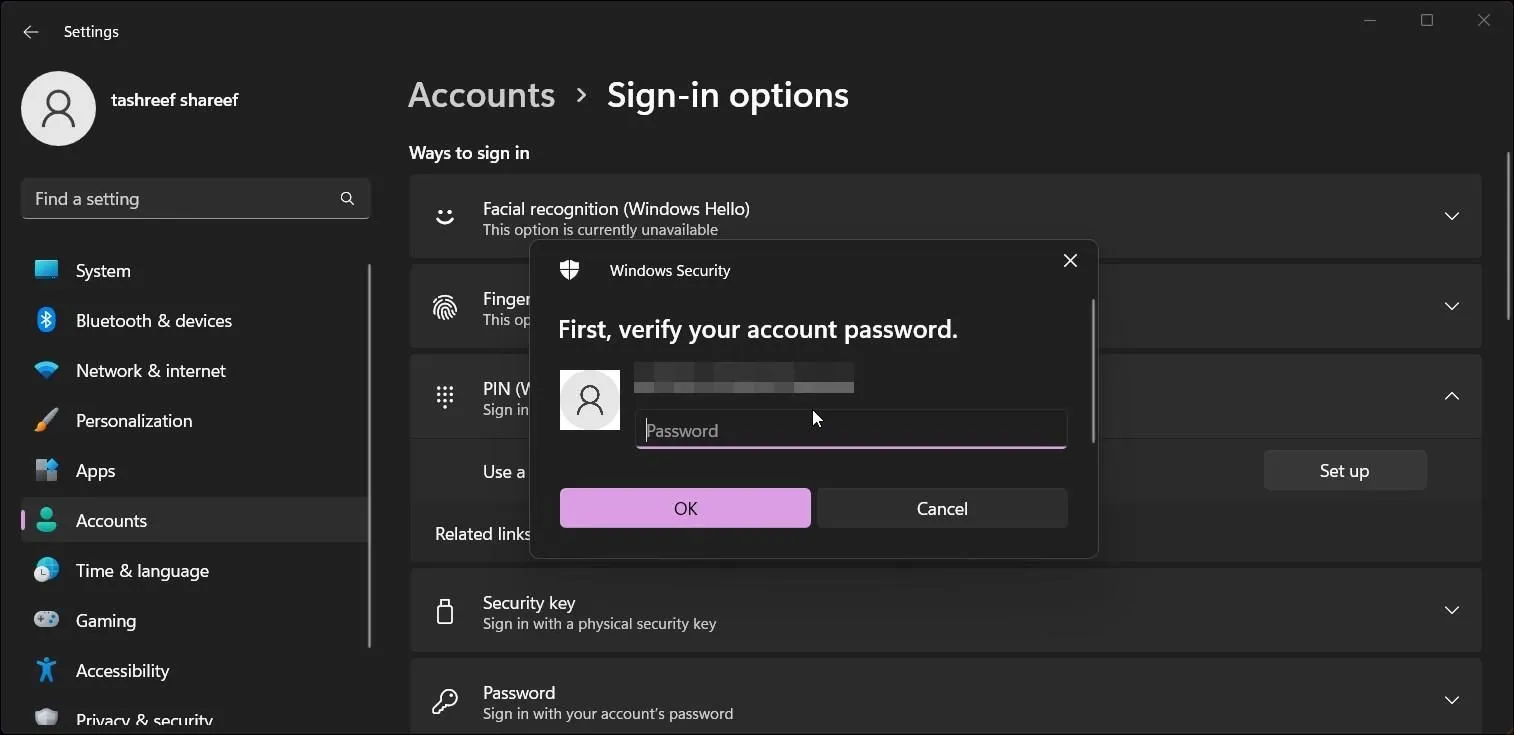

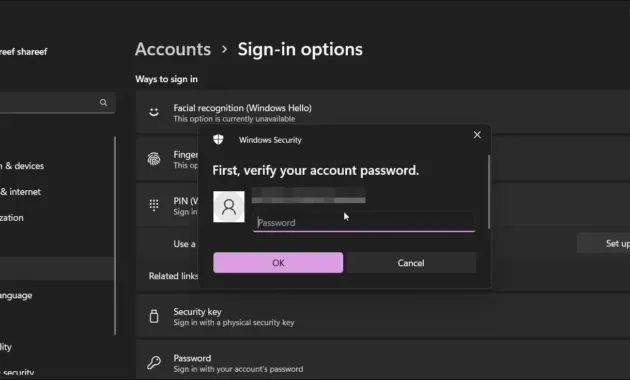

Setting Up Two‑Factor Authentication

Two‑factor authentication adds a second verification step beyond your password. To activate it, go to “Profile & Settings” > “Security” > “Two‑Step Verification.” Choose your preferred method—SMS text messages or an authenticator app—and follow the prompts to link the device. Each time you log in from an unrecognized device, you will receive a code that must be entered to complete the session.

Managing Alerts and Notifications

Citibank offers customizable alerts for transactions, balance thresholds, and payment due dates. Access the “Alerts & Notifications” section to select email, SMS, or push notifications. Setting up real‑time alerts helps you detect fraudulent activity quickly and stay on top of payment schedules, reducing the risk of late fees.

Reviewing Account Activity Regularly

Make it a habit to log in at least once a week to scan recent transactions. Look for unfamiliar purchases, duplicate charges, or unexpected fees. Promptly reporting suspicious activity through the “Report a Problem” link can prevent further unauthorized use.

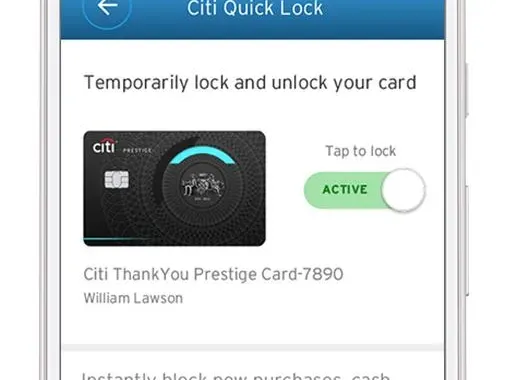

Mobile Access: Using the Citi Mobile App

The Citi Mobile app mirrors the functionality of the desktop portal, providing on‑the‑go access to balances, statements, and payment options. To get started, download the app from the Apple App Store or Google Play Store, then log in using the same credentials described earlier. The app also supports biometric authentication—fingerprint or facial recognition—adding convenience without compromising security.

Once logged in, you can set up quick actions such as “Pay Bill,” “Transfer Funds,” and “View Rewards.” The app’s built‑in security features include remote logout, device encryption, and automatic lock after a period of inactivity.

Additional Resources and Related Topics

Understanding the broader landscape of credit‑card management can enhance your experience with Citibank. For example, learning how to opt out of unwanted promotional offers can keep your inbox clean and reduce phishing risks. Check out How to Opt Out of Credit Card Offers and Reclaim Your Inbox for practical steps.

If you manage multiple credit‑card accounts, comparing features across issuers can help you choose the best fit for your spending habits. The article The Ultimate Showdown: Rewards Credit Cards vs Cash Back – Which One Pays Off More? offers a concise comparison that may influence how you use your Citibank rewards.

Finally, for users of other major card issuers, understanding how to unlock the full potential of your account portal can be valuable. The guide Unlock the Full Potential of Your American Express My Account – A Complete Guide provides similar step‑by‑step instructions that parallel the Citibank process.

By following the steps outlined above, you can confidently log in to your Citibank credit card account, resolve common issues, and keep your financial data protected. Regularly reviewing your account, setting up two‑factor authentication, and staying informed about security best practices are simple yet powerful habits that safeguard your credit and give you peace of mind.