Table of Contents

- Why You Might Need a New PIN

- Forgotten or Mistyped PIN

- Security Concerns

- Regulatory or Policy Changes

- Methods to Request a New PIN

- 1. Online Banking Portal

- 2. Mobile Banking App

- 3. Phone Banking

- 4. In‑Branch Request

- 5. Mail Request

- Preparing for the Request

- Essential Documentation

- Verification Steps

- Choosing a Secure PIN

- What to Expect After Submitting the Request

- Processing Time

- Delivery Options

- Temporary PINs

- Best Practices for Managing Your PIN

- Create a Strong PIN

- Memorize, Don’t Write Down

- Change Your PIN Periodically

- Avoid Using the Same PIN Across Multiple Cards

- Stay Vigilant at ATMs and POS Terminals

- Additional Resources for Cardholders

When you need to request a new credit card PIN, the process can feel like a maze of options, especially if you’ve never done it before. The keyword “request a new credit card PIN” appears in many FAQs, but the reality is that each issuer has its own nuances. This article walks you through the entire journey, from recognizing why a new PIN is necessary to completing the request through the most reliable channels.

Imagine you’re standing in line at a coffee shop, ready to pay, and the terminal prompts you for a PIN you can’t recall. You’ve tried the usual combinations, but nothing works. In that moment, a new PIN becomes more than a convenience—it’s a necessity to keep your purchases flowing and your account secure. The following sections break down the process into clear, actionable steps that any cardholder can follow.

Before diving into the mechanics, it’s worth noting that the ability to request a new PIN is typically built into the digital tools most banks provide. Whether you prefer a mobile app, an online portal, or a quick phone call, understanding the strengths and limitations of each method will help you choose the path that best fits your schedule and security preferences.

Why You Might Need a New PIN

A credit card PIN serves as a secondary layer of protection, especially for transactions that require chip‑and‑pin verification. Several scenarios can trigger the need for a fresh code.

Forgotten or Mistyped PIN

- Accidental lockout after multiple incorrect attempts.

- Memory lapse after a period of inactivity.

Security Concerns

- Potential exposure after a data breach at a merchant.

- Suspicion that someone else may have observed your entry.

Regulatory or Policy Changes

- Issuer mandates periodic PIN resets for enhanced security.

- Transition to a new encryption standard that requires new credentials.

Identifying the reason behind the request can influence which channel you select, as some issuers prioritize security for certain cases and may require additional verification steps.

Methods to Request a New PIN

Most banks offer at least three distinct ways to obtain a new PIN: through their online banking portal, via a mobile app, or by contacting customer service. Below, each method is described in detail, highlighting the steps, required information, and typical turnaround time.

1. Online Banking Portal

Logging into your issuer’s website is often the fastest route. After authentication, locate the “Security Settings” or “Card Services” section, then select “Reset PIN” or “Request New PIN.” Follow the prompts, which usually ask for your card number, the last four digits of your Social Security Number, and a verification code sent to your registered email or phone.

If you’re already familiar with logging in, you may find the process intuitive. For a practical example of navigating an online portal, see our guide on how to quickly log in to your Citibank credit card account. Once inside, the PIN reset option is typically a few clicks away.

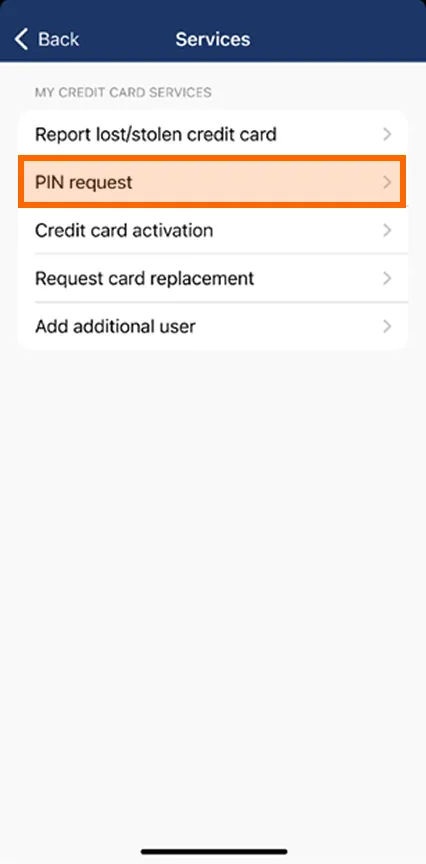

2. Mobile Banking App

Most modern banking apps include a “Card Management” tab. After opening the app and completing biometric or password verification, tap “Change PIN.” Some apps generate a temporary PIN that you can use immediately, while others send a new PIN via secure in‑app messaging.

Advantages of the mobile route include real‑time confirmation and the ability to set a new PIN on the spot, eliminating the waiting period associated with mailed PINs.

3. Phone Banking

Calling the issuer’s dedicated phone line remains a reliable fallback, especially if you lack internet access. After confirming your identity—often through a series of security questions—the representative will either provide a new PIN over the phone or mail a printed slip.

Be prepared for longer hold times during peak hours, and ensure you have a pen and paper ready if the PIN is delivered verbally.

4. In‑Branch Request

Visiting a branch offers the benefit of face‑to‑face verification. Bring a government‑issued ID and your existing card. A teller can process the request on the spot, and many banks will print a new PIN card immediately.

This method is useful when you need a PIN urgently and prefer a personal interaction.

5. Mail Request

Some issuers still support a mailed request form. Download the form from the bank’s website, complete it, and send it to the address provided. The new PIN will arrive by regular mail, typically within 7‑10 business days.

While slower, this option can be valuable for customers who prefer a paper trail or have limited digital access.

Preparing for the Request

Before you initiate any of the above methods, gather the necessary information to streamline the process. Preparation reduces the risk of delays and ensures you meet the issuer’s security requirements.

Essential Documentation

- Full credit card number (or at least the last four digits).

- Personal identification number (e.g., SSN or Tax ID).

- Recent billing address and phone number on file.

- Valid government‑issued photo ID for in‑branch visits.

Verification Steps

Most channels will require you to answer security questions, such as “What is the name of your first pet?” or “What was the amount of your last transaction?” Having these answers ready can prevent repeated authentication cycles.

Choosing a Secure PIN

When you receive a new PIN, consider changing it to something memorable yet unpredictable. Avoid common patterns like “1234,” “0000,” or repeating digits. A good practice is to use a four‑digit number derived from a personal mnemonic that isn’t easily guessed.

What to Expect After Submitting the Request

The experience varies by issuer, but most follow a predictable timeline. Knowing what to expect helps you plan your purchases without interruption.

Processing Time

- Online or mobile requests: Immediate to a few minutes for a temporary PIN; up to 24‑48 hours for a permanent PIN.

- Phone or in‑branch requests: Often same‑day issuance, especially if a printed PIN card is provided.

- Mail requests: 7‑10 business days, depending on postal service speed.

Delivery Options

Some issuers let you choose between electronic delivery (secure email, in‑app message) or physical mail. Electronic delivery is faster but may require you to activate the PIN at an ATM before use.

Temporary PINs

When a temporary PIN is issued, you’ll typically be prompted to change it at the next chip‑and‑pin transaction. This adds an extra layer of security, ensuring only you can set the final PIN.

Best Practices for Managing Your PIN

Obtaining a new PIN is only half the battle; maintaining its security is an ongoing responsibility. Below are practical habits that reinforce protection.

Create a Strong PIN

- Choose a number that doesn’t appear in your personal documents.

- Avoid sequential or repeating digits.

- Consider using a random four‑digit code generated by a password manager.

Memorize, Don’t Write Down

Writing your PIN on a sticky note or storing it in an unsecured location defeats the purpose of the protection. Instead, commit it to memory using a mnemonic technique.

Change Your PIN Periodically

Even if there’s no indication of compromise, resetting your PIN every six to twelve months reduces the window of opportunity for potential attackers.

Avoid Using the Same PIN Across Multiple Cards

Reusing a PIN for several credit cards creates a single point of failure. If one card’s PIN is exposed, the others become vulnerable.

Stay Vigilant at ATMs and POS Terminals

Cover the keypad while entering your PIN, and be wary of “shoulder surfing” in public spaces. If you suspect that a terminal has been tampered with, report it to your issuer immediately.

Additional Resources for Cardholders

Managing a credit card involves more than just PINs. For related tasks, you might explore how to add an authorized user to your account, which can simplify shared expenses while preserving your credit history. If you’re a Lowe’s cardholder, the guide on unlocking your Lowe’s credit card account offers a quick path to regain access when you’re locked out.

By following the steps outlined above, you can request a new credit card PIN efficiently, maintain strong security habits, and continue using your card without disruption. The process, while procedural, becomes straightforward once you know which channel aligns with your needs and how to prepare for each interaction.