Table of Contents

- Getting Started: Activating and Accessing Your RedCard Account

- Step 1: Verify Card Delivery

- Step 2: Create Your Online Profile

- Step 3: Set a Permanent PIN

- Customizing Security Settings and Alerts

- Enable Transaction Alerts

- Set Up Two‑Factor Authentication (2FA)

- Review Authorized Users

- Managing Payments and Balances

- Understanding the Billing Cycle

- Payment Options

- Avoiding Interest Charges

- Adding and Managing Authorized Users

- Eligibility Criteria

- Step‑by‑Step Addition Process

- Monitoring Authorized User Activity

- Troubleshooting Common Issues

- Problem: Unable to Log In

- Problem: Card Declined at Checkout

- Problem: Unauthorized Transaction

- Optimizing Your RedCard Benefits

- 5% Discount Mechanics

- Free Shipping and Early Access

- Special Financing Offers

- Keeping Your Account Up to Date

- Update Personal Information

- Review Credit Limit Annually

- Close or Freeze the Account

Target RedCard manage account tasks can feel overwhelming the first time you log in, especially if you’re juggling multiple credit lines. This guide walks you through the entire journey, from initial enrollment to everyday maintenance, using straightforward language and real‑world examples. By the end, you’ll know exactly how to keep your RedCard running smoothly, protect your information, and make the most of the benefits Target offers.

Imagine Sarah, a busy professional who recently received her Target RedCard in the mail. She wants to set up online access, enable alerts, and add an authorized user for her partner. Rather than searching scattered forums, Sarah follows a clear, logical path that mirrors the process described here. Each step is broken down into manageable actions, making the experience as predictable as a well‑written story.

Below, we’ll explore each phase of managing a Target RedCard account, providing practical tips, security best practices, and troubleshooting advice. Whether you’re a new cardholder or a seasoned user looking to fine‑tune your settings, this article serves as your comprehensive reference.

Getting Started: Activating and Accessing Your RedCard Account

The first chapter of any financial story begins with activation. After receiving your RedCard, you’ll need to confirm receipt and set up online access.

Step 1: Verify Card Delivery

- Check the envelope for a welcome letter that includes your temporary PIN and account number.

- If the card hasn’t arrived within 7‑10 business days, contact Target Customer Care to confirm the shipping address.

Step 2: Create Your Online Profile

Visit the official Target RedCard portal and click “Register.” You’ll be prompted to enter your card number, temporary PIN, and personal details such as date of birth and Social Security number (used only for identity verification). Once submitted, you’ll receive a verification code via email or SMS.

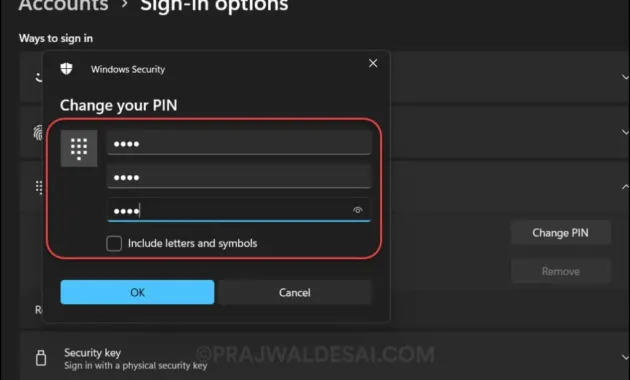

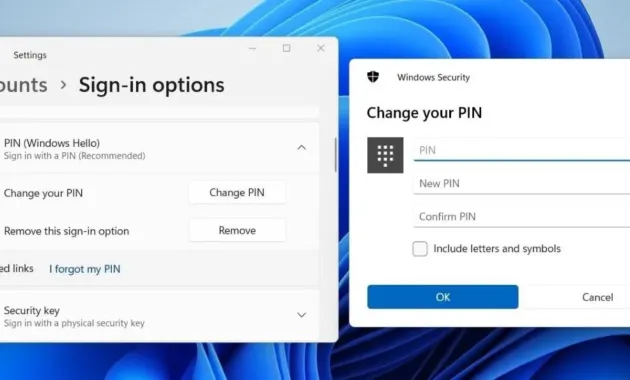

Step 3: Set a Permanent PIN

For added security, choose a PIN that isn’t easily guessed. If you need guidance on PIN best practices, refer to How to Request a New Credit Card PIN Quickly and Safely – The Complete Guide, which outlines common pitfalls and recommended formats.

Customizing Security Settings and Alerts

Once logged in, the next logical step is to configure security features that protect you from fraud and keep you informed of account activity.

Enable Transaction Alerts

- Navigate to “Settings” > “Alerts.”

- Select the types of notifications you prefer: purchase, balance, payment due, and promotional offers.

- Choose delivery method—email, SMS, or push notification through the Target app.

Set Up Two‑Factor Authentication (2FA)

2FA adds a second verification layer whenever you sign in from a new device. The RedCard platform supports authentication apps (e.g., Google Authenticator) and SMS codes. Enabling 2FA reduces the risk of unauthorized access dramatically.

Review Authorized Users

If you plan to share the card, you’ll need to add authorized users. Follow the guidelines in How to Add an Authorized User to Your Account – A Complete, No‑Nonsense Guide to ensure compliance with Target’s policies.

Managing Payments and Balances

Keeping your RedCard balance under control is essential for maintaining a healthy credit profile. Below are the core processes for paying bills, monitoring statements, and avoiding interest.

Understanding the Billing Cycle

- The RedCard billing cycle typically runs from the 1st to the 30th of each month.

- Statement closing date is the last day of the cycle; payment due date is 25 days later, giving you a grace period.

Payment Options

You can pay your balance via:

- Online bank transfer through the Target portal.

- Automatic recurring payments linked to a checking account.

- In‑store payment at any Target location using the card or barcode on the statement.

Avoiding Interest Charges

To stay interest‑free, pay the full statement balance by the due date. If you only make the minimum payment, interest accrues from the transaction date, not the statement date. Setting up an automatic full‑balance payment is a reliable way to prevent accidental carry‑overs.

Adding and Managing Authorized Users

Authorized users can help you consolidate family spending, but they also add responsibilities.

Eligibility Criteria

- The primary account holder must be at least 18 years old.

- Authorized users must be over 13; younger children can be added as “dependents” with limited purchasing power.

Step‑by‑Step Addition Process

- Log into your RedCard account and select “Manage Users.”

- Enter the prospective user’s full name, date of birth, and contact information.

- Choose the spending limit (if you want to impose one).

- Review and confirm; the new user receives a welcome email with activation instructions.

Monitoring Authorized User Activity

Regularly review the “User Activity” tab to see purchases made by each authorized user. This practice mirrors the vigilance recommended in The Hidden Perks: Credit Cards That Offer Free Credit Score Tracking – What You Need to Know, where monitoring helps spot anomalies early.

Troubleshooting Common Issues

Even a well‑written story can encounter unexpected twists. Below are solutions for frequent hurdles encountered by RedCard holders.

Problem: Unable to Log In

- Clear browser cache and cookies; outdated data can cause authentication errors.

- Verify that you’re using the correct username (usually your email) and password.

- If you’ve forgotten your password, click “Forgot Password” to receive a reset link.

Problem: Card Declined at Checkout

Possible reasons include insufficient funds, an expired card, or a temporary hold placed by Target’s fraud team. Call the 24‑hour helpline printed on the back of the card to resolve the hold quickly.

Problem: Unauthorized Transaction

Report the charge within 60 days to limit liability. The RedCard team will investigate and may issue a temporary credit while the review proceeds.

Optimizing Your RedCard Benefits

Target offers a suite of perks that go beyond the 5% discount on purchases.

5% Discount Mechanics

- Applies automatically to purchases made at Target stores, Target.com, and Target-owned restaurants.

- Discount is reflected in real time on your receipt and online order summary.

Free Shipping and Early Access

RedCard holders receive free standard shipping on most online orders, and early access to select sales events. To maximize savings, add items to your cart before the sale starts and complete the purchase using your RedCard.

Special Financing Offers

Target occasionally runs promotional financing (e.g., “0% APR for 12 months”). These offers are tied to the RedCard and appear on the promotional banner within the online portal. Always read the terms before enrolling, as missed payments can revert to the standard APR.

Keeping Your Account Up to Date

Regular maintenance prevents surprises and keeps your RedCard experience smooth.

Update Personal Information

Whenever you change your address, phone number, or email, log into the account and edit the “Profile” section. Accurate contact details ensure you receive alerts and statements promptly.

Review Credit Limit Annually

Target may automatically increase your credit limit based on usage patterns. If you anticipate higher spending, you can request a limit raise through the “Credit Services” tab.

Close or Freeze the Account

If you decide to discontinue the RedCard, use the “Close Account” option or call customer service. For temporary security concerns, the “Freeze Account” feature halts new purchases while retaining your credit history.

By following the structured steps outlined above, you can navigate the entire lifecycle of a Target RedCard account with confidence. From activation and security configuration to managing authorized users and optimizing discounts, each chapter builds on the previous one, creating a seamless narrative that mirrors the practical reality of everyday card management. Maintaining vigilance, leveraging the built-in tools, and staying informed about promotional offers will ensure that your RedCard remains a valuable asset rather than a source of frustration.