Table of Contents

- Why Gas Station Credit Cards Matter

- Key Benefits to Look For

- Top Gas Station Credit Cards Reviewed

- 1. ExxonMobil® Smart Card

- 2. Shell Fuel Rewards® Card

- 3. Chevron Texaco® Credit Card

- 4. Costco Anywhere Visa® Card by Citi

- 5. American Express® Blue Cash Preferred® Card

- How to Evaluate a Gas Station Credit Card

- Step‑by‑Step Evaluation Guide

- Real‑World Scenarios

- Scenario A: The Long‑Distance Commuter

- Scenario B: The Occasional Driver

- Scenario C: The Family Shopper

- Tips for Maximizing Gas Station Credit Card Rewards

- Use the Right Card for the Right Pump

- Combine Rewards with Loyalty Programs

- Pay Off Your Balance Monthly

- Monitor Promotional Boosts

- Leverage Annual Fee Offsets

- Potential Drawbacks and How to Avoid Them

- Reward Caps and Tier Limits

- Variable Redemption Values

- Foreign Transaction Fees

- Complex Terms and Conditions

- Integrating Gas Station Cards with Your Overall Credit Strategy

- Future Trends in Gas Station Credit Cards

When it comes to everyday expenses, few purchases are as routine as filling up your vehicle. The keyword gas station credit card reviews appears in the search queries of millions of drivers looking to stretch every dollar at the pump. Understanding how these cards work, what rewards they offer, and the hidden costs involved can transform a simple transaction into a strategic financial move.

In this article we will walk through the most popular gas station credit cards, break down the mechanics of their reward structures, and provide practical tips for matching a card to your driving habits. By the end, you’ll have a clear picture of which card aligns with your mileage, budget, and long‑term financial goals.

Why Gas Station Credit Cards Matter

Fuel expenses represent a significant slice of the average household budget. According to the U.S. Energy Information Administration, the average American driver spends roughly $2,300 per year on gasoline. A credit card that returns cash back, points, or discounts on those purchases can shave off a noticeable amount of that cost. Moreover, many of these cards extend benefits beyond the pump—such as travel insurance, roadside assistance, and bonus categories for groceries or dining.

Key Benefits to Look For

- Cash back percentages – Some cards offer a flat 3% back on gas, while others provide tiered rewards that increase with spending.

- Fuel price protection – Certain issuers cap the amount you can earn per gallon or limit the number of gallons per month.

- Additional perks – Free roadside assistance, rental car insurance, and travel credit can add value beyond fuel savings.

- Annual fees – Weigh the fee against the potential rewards; a higher fee may be justified if you spend enough on gas.

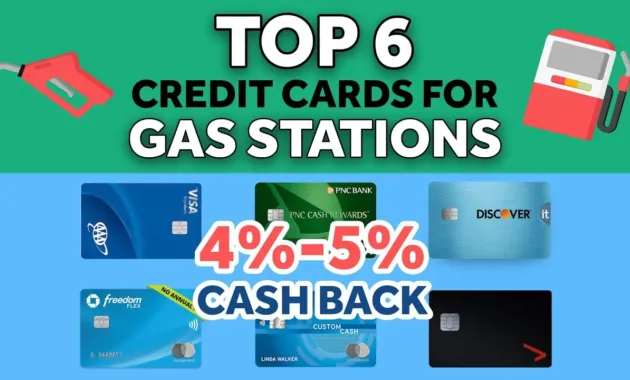

Top Gas Station Credit Cards Reviewed

Below is a curated list of the most frequently reviewed gas station credit cards, based on data from consumer surveys, issuer disclosures, and third‑party analysis. Each card is examined for its reward rate, fee structure, and ancillary benefits.

1. ExxonMobil® Smart Card

The ExxonMobil Smart Card targets drivers who frequent Exxon or Mobil stations. It offers 3% cash back on fuel purchases at participating locations, with no limit on the amount of cash back you can earn. The card has a $0 annual fee, making it an accessible choice for budget‑conscious consumers. Additional perks include a $25 statement credit for a convenience store purchase after you spend $500 in the first three months.

2. Shell Fuel Rewards® Card

Shell’s card provides 5 cents per gallon in rewards, redeemable at any Shell station. The effective cash back rate varies with fuel price fluctuations; when gasoline costs $3.00 per gallon, the reward translates to about 1.7% cash back. This card carries a $95 annual fee, but the fee is offset for high‑volume drivers who can earn more than $115 in rewards annually. Cardholders also receive free roadside assistance and a complimentary car wash each year.

3. Chevron Texaco® Credit Card

Chevron’s offering gives 2% cash back on gas purchases at Chevron or Texaco stations and 1% on all other purchases. With a modest $0 annual fee, the card is suitable for occasional drivers who still want a small boost on fuel costs. A notable feature is the ability to combine cash back with Chevron’s loyalty program, allowing points to be exchanged for merchandise or travel.

4. Costco Anywhere Visa® Card by Citi

Although not a dedicated gas station card, the Costco Anywhere Visa delivers 4% cash back on eligible gas purchases worldwide, up to $7,000 per year, after which the rate drops to 1%. The card has no annual fee for Costco members (the membership fee itself applies). Its broader reward structure includes 3% on restaurants and travel, 2% on Costco purchases, and 1% on everything else. For drivers who already shop at Costco, this card can be a powerful all‑round performer.

5. American Express® Blue Cash Preferred® Card

Offering 3% cash back at U.S. gas stations, the Blue Cash Preferred also provides 6% on groceries (up to $6,000 per year) and 1% on other purchases. The card carries a $95 annual fee, which is waived for the first year for new members. The higher fee is justified for households that spend heavily on groceries and fuel, potentially delivering over $300 in combined cash back annually.

How to Evaluate a Gas Station Credit Card

Choosing the right card involves more than just looking at the headline cash back rate. A systematic evaluation framework helps you compare cards on an apples‑to‑apples basis.

Step‑by‑Step Evaluation Guide

- Calculate your annual fuel spend. Multiply your average monthly gallons by the average price per gallon and then by 12.

- Apply the card’s reward rate. For flat‑percentage cards, multiply your spend by the percentage. For per‑gallon rewards, divide your annual gallons by the reward per gallon.

- Subtract any annual fee. This gives you the net cash back you can expect.

- Factor in additional perks. Estimate the monetary value of roadside assistance, travel credits, or free services.

- Consider redemption flexibility. Cash back is straightforward, while points may have varying value depending on how you redeem them.

For example, a driver who purchases 1,200 gallons a year at $3.30 per gallon spends $3,960 annually on fuel. With the ExxonMobil Smart Card’s 3% cash back, the yearly reward equals $118.80, and because the card has no annual fee, the net benefit remains $118.80. If the same driver chooses the Chevron Texaco Card (2% cash back), the reward drops to $79.20, highlighting the importance of the reward rate.

Real‑World Scenarios

Below are three common driver profiles and the cards that best suit each scenario. These narratives illustrate how the same set of cards can serve different needs.

Scenario A: The Long‑Distance Commuter

Maria drives 25,000 miles per year, averaging 15 gallons per week. Her annual fuel spend is roughly $5,500. The Shell Fuel Rewards® Card, despite its $95 annual fee, yields around $165 in rewards (5 cents per gallon × 15 gallons × 52 weeks). After subtracting the fee, net cash back is $70, plus the added value of a free car wash and roadside assistance, making it a competitive choice.

Scenario B: The Occasional Driver

James only uses his car for weekend trips, spending about $800 a year on gas. The Chevron Texaco® Credit Card’s 2% cash back returns $16, with no annual fee. While the absolute amount is modest, the absence of a fee ensures the card never costs him more than it saves.

Scenario C: The Family Shopper

Linda’s household spends heavily on both groceries and gas, totaling $4,000 on fuel and $7,500 on groceries annually. The American Express® Blue Cash Preferred® Card’s 3% cash back on gas ($120) plus 6% on groceries ($450) yields $570 in cash back. Even after the $95 annual fee, the net benefit is $475, making it the clear winner for families with diversified spending.

Tips for Maximizing Gas Station Credit Card Rewards

Even the best card can fall short if you don’t use it strategically. Below are practical tips that can help you squeeze the most value from your fuel purchases.

Use the Right Card for the Right Pump

Some cards, like the ExxonMobil Smart Card, only earn the enhanced rate at specific brand stations. If you have multiple cards, keep a small notebook or phone note indicating which card to use at each location.

Combine Rewards with Loyalty Programs

Many gas stations have their own loyalty apps that offer cents‑per‑gallon discounts. Stacking a credit‑card cash back on top of a loyalty discount can effectively double your savings.

Pay Off Your Balance Monthly

Reward earnings are wiped out by interest charges if you carry a balance. Treat your credit card as a cash‑back tool, not a financing source.

Monitor Promotional Boosts

Issuers occasionally run limited‑time offers that increase cash back rates or provide bonus points for fuel purchases. Set up alerts in your banking app to stay informed.

Leverage Annual Fee Offsets

If a card’s annual fee seems steep, calculate whether your projected rewards exceed the fee. If not, consider downgrading to a no‑fee version or switching to a different card.

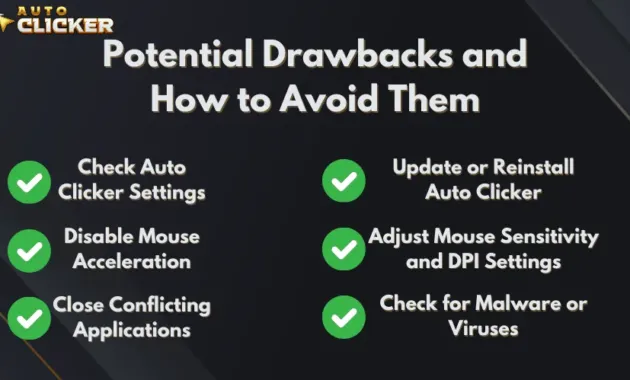

Potential Drawbacks and How to Avoid Them

While gas station credit cards can be rewarding, they also come with pitfalls that may erode benefits.

Reward Caps and Tier Limits

Some cards cap the amount of cash back you can earn each quarter or year. Keep track of your spending to avoid hitting the ceiling prematurely.

Variable Redemption Values

Points earned through certain programs may have fluctuating values when redeemed for travel versus merchandise. Understand the conversion rate before committing to a points‑centric card.

Foreign Transaction Fees

If you travel abroad and fill up at overseas stations, foreign transaction fees (often 3%) can negate the cash back earned. Look for cards that waive these fees if international travel is part of your routine.

Complex Terms and Conditions

Read the fine print regarding “eligible purchases.” Some cards exclude pre‑paying for fuel or using the card for fuel at convenience stores that are not part of the station brand.

Integrating Gas Station Cards with Your Overall Credit Strategy

Choosing a gas station credit card should complement, not disrupt, your broader credit portfolio. A balanced approach typically includes a mix of cards that cover high‑spend categories (e.g., travel, dining) and everyday expenses (e.g., groceries, gas). By aligning the gas card with a card that offers strong travel rewards, you can convert fuel cash back into airline miles or hotel points, amplifying overall value.

For instance, pairing the Costco Anywhere Visa® Card’s 4% gas cash back with a premium travel card that offers 2× points on travel purchases can create a synergy where cash back offsets travel costs, while the travel card accumulates points for future trips. This strategic layering is discussed in depth in the Ultimate Showdown: Rewards Credit Cards vs Cash Back – Which One Pays Off More? article, which provides a broader context for decision‑making.

Future Trends in Gas Station Credit Cards

The landscape of fuel‑related credit cards is evolving alongside technology and consumer expectations. Emerging trends include:

- Dynamic cash back rates that adjust based on real‑time fuel prices, offering higher percentages when gas prices peak.

- Integration with mobile wallets that automatically apply the best available discount at the pump without needing to present a physical card.

- Eco‑incentives where cards reward purchases of alternative fuels (e.g., electric vehicle charging) with higher points.

- Enhanced security features such as tokenization to protect card data during in‑pump transactions.

Keeping an eye on these developments can help you anticipate when to upgrade or switch cards to capture new benefits.

In summary, the world of gas station credit card reviews is rich with options that can cater to a variety of driving habits and financial goals. By calculating your fuel spend, weighing fees against potential rewards, and considering ancillary perks, you can select a card that not only reduces your per‑gallon cost but also fits seamlessly into your overall credit strategy. Remember to stay vigilant about promotional offers, avoid unnecessary fees, and combine rewards with station loyalty programs for maximal savings.