Table of Contents

- What Defines a Premium Credit Card with Lounge Access?

- Key Features to Look For

- Top Premium Cards Offering Lounge Access (2026 Edition)

- 1. American Express Platinum Card

- 2. Chase Sapphire Reserve®

- 3. Citi Prestige® Card (Limited Availability)

- 4. Capital One Venture X Rewards Credit Card

- 5. U.S. Bank Altitude® Reserve Visa Infinite® Card

- Eligibility and Application Tips

- 1. Review Your Credit Report

- 2. Build a Consistent Payment History

- 3. Align Your Spending Patterns

- 4. Leverage Existing Relationships

- Maximizing Lounge Access Without Paying Extra Fees

- Enroll Promptly in the Lounge Program

- Plan Guest Visits Wisely

- Combine Multiple Lounge Networks

- Utilize “Day Pass” Options for Non‑Members

- Monitor Annual Fee Justifications

- Hidden Costs and Common Pitfalls

- 1. Guest Fees After a Certain Threshold

- 2. “Non‑Transferable” Lounge Credits

- 3. In‑Flight Service Fees Not Covered

- 4. Overlooked Travel Insurance Exclusions

- Integrating Lounge Access with Overall Travel Strategy

- Step 1: Map Your Travel Calendar

- Step 2: Align Points Redemption with Lounge Visits

- Step 3: Combine Card Benefits with Airline Loyalty Programs

- Real‑World Example: A Business Traveler’s Cost‑Benefit Analysis

- How to Keep Your Lounge Privileges Active

- Monitor Card Activity

- Stay Informed About Policy Changes

- Renew Memberships Promptly

- Linking Lounge Access to Broader Financial Management

Premium credit cards with lounge access have become a cornerstone of modern travel, offering a seamless blend of convenience, comfort, and status. For frequent flyers, business travelers, and even occasional vacationers, the ability to step into a quiet, well‑served airport lounge can transform a hectic journey into a pleasant experience. This article walks through the essential aspects of these cards, from eligibility criteria to strategic tips for extracting the most value.

Understanding why lounge access matters begins with recognizing the typical airport environment: crowded terminals, long security lines, and unpredictable flight delays. A premium lounge provides a reprieve—soft seating, complimentary refreshments, high‑speed Wi‑Fi, and often private workstations or shower facilities. When a credit card bundles this privilege, the cardholder gains a tangible advantage that can justify higher annual fees.

Before diving into the specific cards and strategies, it’s useful to explore the broader ecosystem of travel‑related credit benefits. Many premium cards also feature complimentary hotel elite status, airline fee credits, and points‑earning structures tailored for travel spend. By treating lounge access as one piece of a larger rewards puzzle, you can select a card that aligns with your overall travel habits.

What Defines a Premium Credit Card with Lounge Access?

At its core, a premium credit card is characterized by a higher annual fee—often ranging from $95 to $550—paired with an elevated suite of perks. Lounge access is typically delivered through one of three mechanisms:

- Direct lounge network membership: The card issuer partners with a specific lounge brand (e.g., American Express Platinum’s Centurion Lounges).

- Third‑party lounge program enrollment: Access is granted via a program like Priority Pass, which aggregates lounges worldwide.

- Airline‑specific lounge passes: Cardholders receive complimentary passes to airline lounges such as Delta Sky Club or United Club.

Each model comes with its own set of rules—some allow unlimited visits for the primary cardholder and guests, while others impose a limited number of complimentary entries per year. Understanding these nuances helps avoid unexpected charges at the door.

Key Features to Look For

- Guest policy: Whether you can bring family, friends, or travel companions for free or at a reduced rate.

- Global coverage: The number of lounges in major hubs versus regional airports.

- Additional travel benefits: Airline fee credits, TSA PreCheck/Global Entry reimbursements, and travel insurance.

- Points earning rate: How many reward points or miles you earn on travel, dining, and everyday purchases.

Top Premium Cards Offering Lounge Access (2026 Edition)

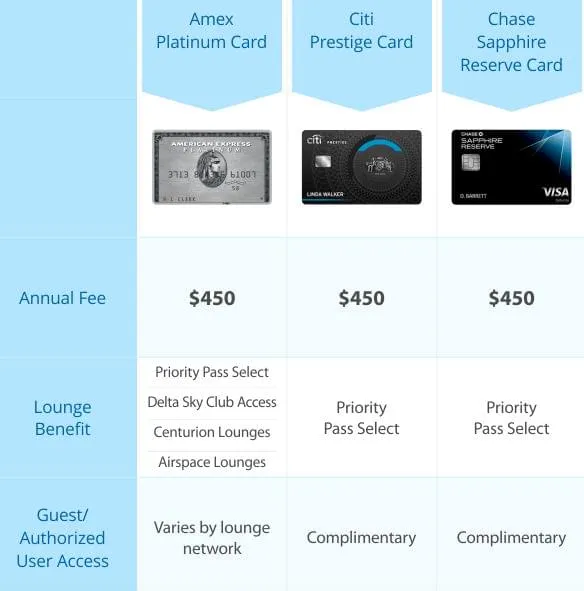

Below is a curated list of the most widely recognized premium cards that provide lounge access. The selection reflects a balance of annual fee, lounge network, and overall travel value.

1. American Express Platinum Card

- Annual fee: $695

- Lounge access: Complimentary entry to Amex Centurion Lounges, International American Express Lounges, and a Priority Pass Select membership (enrollment required).

- Guest policy: One guest per visit for Centurion Lounges; Priority Pass guests may incur a $39 per‑visit fee.

- Travel credits: Up to $200 airline fee credit, $200 Uber cash, $100 Saks Fifth Avenue credit.

- Points rate: 5 X Membership Rewards® points on flights booked directly with airlines or through Amex Travel, 5 X on prepaid hotels, 1 X on other purchases.

2. Chase Sapphire Reserve®

- Annual fee: $550

- Lounge access: Priority Pass Select membership with unlimited visits for the cardholder and up to two guests.

- Travel credits: $300 annual travel reimbursement, $100 Global Entry/TSA PreCheck credit.

- Points rate: 3 X points on travel after earning the travel credit, 3 X on dining, 1 X on everything else.

3. Citi Prestige® Card (Limited Availability)

- Annual fee: $495

- Lounge access: Priority Pass Select (unlimited visits for the cardholder, guests at $39 each).

- Travel perks: $250 annual air travel credit, 4th night free hotel benefit, $100 Global Entry/TSA PreCheck credit.

- Points rate: 5 X points on air travel and restaurants, 3 X on hotels and cruise lines, 1 X on other purchases.

4. Capital One Venture X Rewards Credit Card

- Annual fee: $395

- Lounge access: Unlimited Priority Pass Select visits for the primary cardholder, plus two complimentary guest visits per year; additional guests at $39 each.

- Travel credit: $300 annual statement credit for bookings through Capital One Travel.

- Points rate: 10 X miles on hotels and rental cars booked via Capital One Travel, 5 X on flights, 2 X on all other purchases.

5. U.S. Bank Altitude® Reserve Visa Infinite® Card

- Annual fee: $400

- Lounge access: Priority Pass Select with unlimited visits for the cardholder and two guests.

- Travel perks: $325 annual travel credit, $100 Global Entry/TSA PreCheck credit.

- Points rate: 3 X points on travel and dining, 1 X on everything else.

Eligibility and Application Tips

Securing a premium card typically requires a strong credit profile—most issuers look for a credit score of 720 or higher, a low debt‑to‑income ratio, and a solid history of on‑time payments. Below are practical steps to improve your chances of approval:

1. Review Your Credit Report

Obtain a free copy of your credit report from the major bureaus. Check for inaccuracies, dispute any errors, and pay down lingering balances that could inflate your utilization rate.

2. Build a Consistent Payment History

Even a few months of on‑time payments on existing cards can demonstrate reliability. If you’re close to meeting a card’s minimum income requirement, consider a short-term personal loan that you repay promptly; the positive payment record can boost your credit profile.

3. Align Your Spending Patterns

Most premium cards reward travel‑related purchases heavily. If you spend a significant portion of your budget on flights, hotels, or dining, the points multiplier will quickly offset the annual fee. For example, a frequent traveler who spends $2,000 annually on airline tickets can earn 10,000 bonus points on the American Express Platinum Card (5 X points), translating into a potential $100–$150 in travel redemption value.

4. Leverage Existing Relationships

Some issuers prioritize existing customers who have a long-standing relationship. If you already hold a basic card from a bank, ask a representative about “upgrade” pathways to a premium product.

Maximizing Lounge Access Without Paying Extra Fees

Even after you secure a card, you’ll want to avoid hidden costs that can erode the value of lounge visits. Below are proven strategies:

Enroll Promptly in the Lounge Program

Many cards require you to activate your Priority Pass or similar membership online. Delay can result in missing out on free visits, especially if you travel frequently. Follow the instructions on your issuer’s portal and confirm that the card number is correctly linked.

Plan Guest Visits Wisely

Since guest fees can add up quickly, coordinate with travel companions to share a single lounge entry whenever possible. Some cards, like the Chase Sapphire Reserve, allow two guests for free; make the most of this by traveling with a partner or spouse.

Combine Multiple Lounge Networks

If you hold more than one premium card, you might gain access to different lounge brands. For instance, an American Express Platinum holder can use both Centurion and Priority Pass lounges, while a Delta Sky Club‑eligible card can add airline‑specific lounges. Mapping out which lounge is closest to your gate and which network offers the best amenities can improve your airport experience.

Utilize “Day Pass” Options for Non‑Members

Some lounges sell day passes to non‑members. If you have a friend with a premium card, you can ask them to bring a guest, or you can purchase a pass at a lower price than the typical $40–$60 guest fee charged by some issuers.

Monitor Annual Fee Justifications

Calculate the total monetary value you receive each year—lounge visits, travel credits, points earned, insurance coverage—and compare it to the annual fee. If the sum exceeds the fee by a comfortable margin (often 30–40% is considered a good benchmark), the card remains worthwhile.

Hidden Costs and Common Pitfalls

While lounge access is a headline benefit, premium cards can contain less obvious charges that travel‑savvy consumers should watch for.

1. Guest Fees After a Certain Threshold

Some cards allow unlimited guests, but others impose a per‑visit fee after the first free guest. Keep a tally of how many guest entries you take each year to avoid surprise statements.

2. “Non‑Transferable” Lounge Credits

Credits that are tied to a specific airport or airline lounge network cannot be moved to another brand. If you frequently travel through a hub that lacks participating lounges, the credit may go unused.

3. In‑Flight Service Fees Not Covered

Even with a premium card, certain in‑flight amenities—like premium meal upgrades or Wi‑Fi—might still incur fees unless you have a separate airline‑specific elite status.

4. Overlooked Travel Insurance Exclusions

Many cards bundle trip cancellation or rental car insurance, but the coverage often excludes certain destinations or activities. Read the fine print before relying on it for high‑value trips.

Integrating Lounge Access with Overall Travel Strategy

To truly leverage a premium card, treat lounge access as a component of a broader travel optimization plan. Below are three actionable steps to align your card usage with your itinerary.

Step 1: Map Your Travel Calendar

Identify the airports you’ll visit most often and research which lounges each card grants access to at those locations. Create a simple spreadsheet noting the lounge brand, address, and guest policy. This preparation saves time during busy travel periods.

Step 2: Align Points Redemption with Lounge Visits

Many card issuers allow you to redeem points for lounge passes or upgrades. For example, American Express Membership Rewards points can be transferred to airline partners that include lounge membership as part of elite status benefits. By converting points strategically, you can offset the annual fee or even fund a family member’s lounge experience.

Step 3: Combine Card Benefits with Airline Loyalty Programs

If you’re a frequent flyer with a specific airline, look for co‑branded premium cards that offer both lounge access and elite status fast‑track. The synergy between card perks (e.g., free checked bags, priority boarding) and airline loyalty can compound your travel comfort.

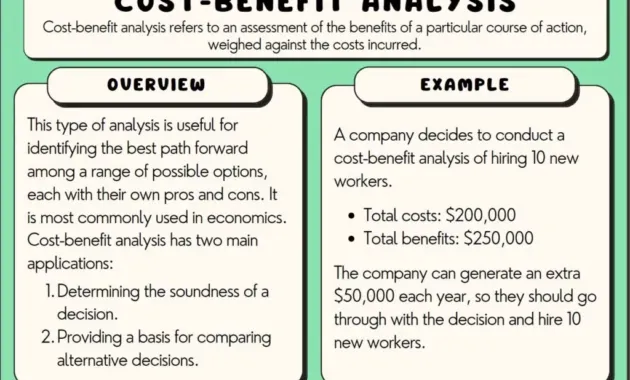

Real‑World Example: A Business Traveler’s Cost‑Benefit Analysis

Consider a consultant who flies 30 round‑trip domestic flights per year, primarily through major hubs like Chicago O’Hare, Dallas/Fort Worth, and Denver. The consultant’s annual spending includes:

- $3,600 on airline tickets

- $1,200 on hotels (booked via a travel portal)

- $800 on dining while traveling

Using the Chase Sapphire Reserve’s 3 X points on travel and dining, the consultant earns:

- 3 X on $3,600 travel = 10,800 points

- 3 X on $800 dining = 2,400 points

- Total = 13,200 points (≈ $132 in travel redemption value)

Adding the $300 travel credit and $100 Global Entry credit, the net benefit before lounge valuation is $532. If the consultant visits a Priority Pass lounge 20 times a year, and each visit would otherwise cost $35, the lounge value adds $700. Subtract the $550 annual fee, and the net annual benefit equals $682—a compelling return for a busy professional.

How to Keep Your Lounge Privileges Active

Maintaining eligibility is as important as obtaining the card. Below are routine actions to ensure uninterrupted access.

Monitor Card Activity

Most issuers suspend lounge benefits if the account is inactive for a prolonged period (often 12 months). Keep the card active by using it for at least a small recurring expense each month, such as a subscription or utility payment.

Stay Informed About Policy Changes

Credit card issuers occasionally modify lounge agreements—adding new locations, adjusting guest policies, or even terminating the partnership. Sign up for email alerts from the issuer’s travel benefits portal, and periodically review the latest terms.

Renew Memberships Promptly

If your lounge access is tied to a third‑party program like Priority Pass, you may need to re‑enroll each year. Failure to confirm enrollment can result in denied entry despite an active credit card.

Linking Lounge Access to Broader Financial Management

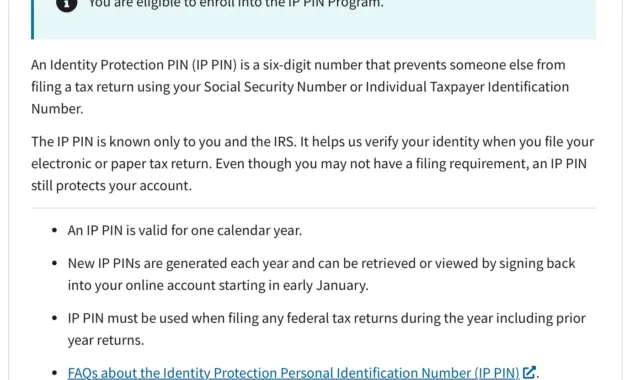

Premium cards often sit at the intersection of travel convenience and overall financial health. For instance, learning how to pay your credit card with a checking account efficiently can reduce interest charges and preserve credit utilization, which in turn protects your eligibility for high‑limit premium cards.

Similarly, integrating your credit‑card strategy with tools that track your credit score for free helps you stay aware of any fluctuations that could impact future card applications or upgrades.

If you ever need to request a new credit card PIN quickly and safely, most issuers provide instant digital PIN delivery via their mobile apps, further streamlining your travel experience.

By treating lounge access as one element of a comprehensive credit‑card ecosystem, you can ensure that each benefit reinforces the others, creating a cohesive strategy that maximizes both comfort and financial efficiency.

In summary, premium credit cards with lounge access offer a tangible upgrade to the travel experience, provided you select the right card, manage its costs, and integrate its benefits into a broader financial plan. With careful consideration of eligibility, guest policies, and complementary rewards, the annual fee becomes an investment rather than an expense. As the travel landscape continues to evolve, these cards remain a reliable tool for those who value comfort, convenience, and the subtle prestige that comes with stepping into an exclusive airport sanctuary.