Table of Contents

- Primary Discover Card Customer Service Phone Numbers

- How to Navigate the Automated Menu Efficiently

- Operating Hours and Best Times to Call

- Peak Call Times

- Off‑Peak Recommendations

- Alternative Ways to Reach Discover Support

- Secure Messaging Through the Online Account

- Mobile App Chat

- Social Media Channels

- Preparing for the Call: Information to Have On Hand

- Common Scenarios and How the Phone Support Handles Them

- Disputing a Charge

- Reporting a Lost or Stolen Card

- Setting Up Payment Plans

- International Call Considerations

- Using a Mobile Phone Abroad

- Tips for Reducing Wait Times and Enhancing the Experience

- Utilize the Call‑Back Feature

- Leverage the “Do Not Call” Preference

- Prepare a Concise Script

- When to Escalate the Call

- Integrating Discover Support with Other Financial Tools

- Future Trends: How Discover Is Evolving Customer Support

When you need immediate assistance with your Discover card, knowing the right phone number can make all the difference. The Discover card customer service phone number connects you to a dedicated team ready to handle billing inquiries, fraud alerts, and account management—all within minutes. This guide walks you through the primary numbers, operating hours, and practical tips to ensure your call is efficient and effective.

Whether you are traveling abroad, dealing with a disputed charge, or simply want to update your personal information, having the correct contact information at your fingertips prevents unnecessary frustration. Below, we break down the essential details, explain the best times to call, and provide alternatives when the phone lines are busy.

Primary Discover Card Customer Service Phone Numbers

Discover offers a range of phone numbers tailored to specific needs. Using the appropriate line not only shortens wait times but also routes you directly to specialists who can address your concern.

- General Card Services:

1‑800‑347‑2683– Available 24/7 for most inquiries, including balance checks, payment assistance, and rewards questions. - Fraud & Lost Card Reporting:

1‑800‑347‑2683– Same number as general services, but select the “lost or stolen card” option for priority handling. - International Assistance:

1‑702‑771‑7112– Dedicated line for callers outside the United States, operating 24/7 with multilingual support. - Business Card Services:

1‑877‑235‑7241– For Discover Business Card holders needing account management or merchant services support.

How to Navigate the Automated Menu Efficiently

Discover’s phone system uses a layered menu to route callers. Follow these steps to reach a live representative quickly:

- Dial the appropriate number for your issue.

- When prompted, say “Representative” or press “0” repeatedly; the system often recognizes repeated requests for human assistance.

- Listen for the option that matches your need (e.g., “Press 1 for account balance,” “Press 2 for fraud alerts”).

- If you reach a dead end, stay on the line; the system may redirect you after a brief hold.

Operating Hours and Best Times to Call

While most Discover services are available 24/7, call volume fluctuates throughout the day. Understanding peak periods helps you avoid long wait times.

Peak Call Times

- Weekday Mornings (8 am – 10 am EST): High volume due to early‑day account checks and payment processing.

- Lunchtime (12 pm – 2 pm EST): Many callers use lunch breaks, causing a secondary spike.

- Evening Hours (6 pm – 9 pm EST): After‑work inquiries increase, especially for balance reviews and fraud reports.

Off‑Peak Recommendations

For the quickest response, aim for early afternoon (2 pm – 4 pm EST) or late evening (9 pm – 11 pm EST). Weekends generally see lower traffic, though certain services like fraud reporting remain fully staffed.

Alternative Ways to Reach Discover Support

Phone contact is not the only avenue. Discover offers several digital channels that can resolve many issues without waiting on hold.

Secure Messaging Through the Online Account

Log in to your Discover online account and use the “Secure Message” feature. This method is ideal for non‑urgent questions, document uploads, or follow‑up on a previously reported issue.

Mobile App Chat

The Discover mobile app includes a live‑chat function available 24/7. Chat agents can provide real‑time assistance, view transaction histories, and even place a temporary hold on a compromised card.

Social Media Channels

Discover maintains an official presence on Twitter (@Discover) and Facebook. While these platforms are not meant for sharing personal account details, they can be useful for general inquiries and updates on service outages.

Preparing for the Call: Information to Have On Hand

Before you dial, gather the following items to streamline the conversation:

- Card Number (last four digits): For security verification.

- Personal Identification: Full name, date of birth, and Social Security Number (or last four digits).

- Recent Transaction Details: Dates, merchant names, and amounts for any disputed charges.

- Contact Information: Updated phone number and email address on file.

Having this data ready reduces the need for repeated verification steps, allowing the representative to focus on resolving your issue.

Common Scenarios and How the Phone Support Handles Them

Disputing a Charge

When you notice an unfamiliar transaction, call the general services line and select the “dispute a charge” option. The agent will:

- Verify your identity using the information above.

- Gather details about the disputed transaction.

- Open a formal investigation, which typically takes 30‑45 days.

- Provide a provisional credit if the investigation warrants it.

Reporting a Lost or Stolen Card

Immediately calling 1‑800‑347‑2683 and selecting the “lost or stolen card” menu will trigger an emergency block. The representative will:

- Cancel the compromised card and issue a temporary replacement if needed.

- Send a confirmation email with instructions for ordering a new card.

- Review recent activity for potential fraud and advise on next steps.

Setting Up Payment Plans

If you’re facing financial hardship, Discover’s customer service can discuss flexible payment options. The agent may propose:

- Extended payment plans with reduced interest.

- Hardship programs that temporarily suspend fees.

- Balance transfer offers to lower your monthly obligation.

International Call Considerations

Travelers should note that dialing the U.S. number from abroad incurs standard international rates unless you use a local alternative. The dedicated international line (1‑702‑771‑7112) routes calls through a toll‑free gateway for most countries, but verifying with your carrier is prudent.

Using a Mobile Phone Abroad

Most smartphones can connect to the U.S. toll‑free number without extra charges if you have an international roaming plan that includes free or low‑cost calls to the United States. If you lack such a plan, consider using a VoIP service (e.g., Skype or Google Voice) to dial the U.S. number at a reduced rate.

Tips for Reducing Wait Times and Enhancing the Experience

Utilize the Call‑Back Feature

When the hold queue is long, Discover often offers a call‑back option. Opt for this service to receive a return call at a convenient time, freeing you from waiting on hold.

Leverage the “Do Not Call” Preference

If you have opted out of marketing calls, you may experience shorter wait times because fewer promotional scripts are triggered. Ensure your preferences are updated in your online account settings.

Prepare a Concise Script

Writing a brief script outlining your issue, key dates, and desired outcome helps you stay focused and reduces the likelihood of repeating information.

When to Escalate the Call

![What is Escalated Call? [Guide for Call Centers] - VoiceSpin](https://blog.avaller.com/wp-content/uploads/2026/01/what-is-escalated-call-guide-for-call-centers-voicespin-630x380.webp)

Most routine matters are resolved by frontline agents, but certain situations warrant escalation:

- Repeated billing errors that have not been corrected after multiple contacts.

- Unresolved fraud investigations exceeding the standard 45‑day window.

- Requests for account closure that encounter resistance.

In these cases, politely ask to speak with a supervisor or a “specialist” who has authority to make exceptions or provide higher‑level assistance.

Integrating Discover Support with Other Financial Tools

For users who manage multiple credit products, coordinating Discover support with other accounts can streamline finances. For example, if you also hold an Uber Visa Card, you might find it useful to review the How to Log In to Your Uber Visa Card Account in Minutes – The Complete Guide to ensure all balances are updated before contacting Discover.

Similarly, understanding how your credit profile interacts with various lenders can be beneficial. The article Unlock Your Experian Credit Report Login in Minutes – The Ultimate Guide to Fast, Secure Access provides a quick pathway to view your credit standing, which may be relevant when discussing credit limit adjustments with Discover.

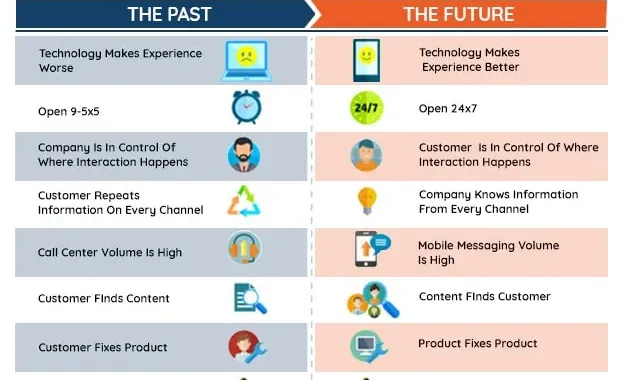

Future Trends: How Discover Is Evolving Customer Support

Discover continues to invest in AI‑driven virtual assistants that can handle simple inquiries without human intervention. While the phone remains a core channel, upcoming features may include:

- Voice‑activated authentication using biometric data.

- Real‑time fraud alerts with one‑click confirmation through the mobile app.

- Predictive assistance that anticipates user needs based on spending patterns.

These advancements aim to reduce reliance on traditional call centers while maintaining high security standards.

Having the correct Discover card customer service phone number is the first step toward swift resolution of any issue you may encounter. By preparing the necessary information, selecting the appropriate line, and timing your call strategically, you can minimize wait times and achieve satisfactory outcomes. Whether you prefer speaking to a live representative, using secure messaging, or exploring emerging digital tools, Discover offers multiple pathways to support. Keep this guide handy, and you’ll be equipped to handle any card‑related situation with confidence.