Table of Contents

- Understanding Your American Express Account

- Account Types and Eligibility

- Key Features at a Glance

- How It Connects to the Broader Credit Card Ecosystem

- How to Access and Manage Your Account Online

- Login Process and Two‑Factor Authentication

- Security Measures You Should Activate

- Troubleshooting Common Issues

- Mobile App: A Handy Companion

- Features Available on the American Express App

- Tips for Using the App Effectively

- Billing, Statements, and Payments

- Reading Your Monthly Statement

- Payment Options and Scheduling

- Avoiding Late Fees and Interest

- Customer Support and Dispute Resolution

- Contact Channels

- Escalation Process for Unresolved Issues

American Express my account is the digital hub where millions of cardholders monitor spending, redeem rewards, and stay on top of their finances. Whether you are a first‑time user or have been holding an Amex card for years, understanding the nuances of the online platform can make a significant difference in how efficiently you manage your credit line. This article walks you through the essential features, security protocols, and practical tips to help you get the most out of your American Express account.

From the moment you log in, the interface is designed to present key information at a glance: balances, recent transactions, and upcoming payment due dates. However, the depth of functionality goes far beyond the dashboard. By exploring each section methodically, you can uncover hidden benefits such as personalized offers, travel protections, and tools that streamline expense tracking. The following sections break down the experience into manageable parts, allowing you to build confidence and avoid common pitfalls.

Before diving into the technical steps, it is helpful to recognize that American Express has built a reputation for premium service and robust security. The platform reflects these priorities, offering multiple layers of protection and a suite of resources that cater to both casual shoppers and frequent travelers. Let’s begin by examining the core components of the account.

Understanding Your American Express Account

Account Types and Eligibility

American Express offers a range of cards, each with its own set of features and eligibility criteria. From the no‑annual‑fee cash back cards to the prestigious Platinum and Centurion cards, the type of account you hold dictates the benefits you can access through the online portal. For instance, premium cardholders often see exclusive travel offers and lounge access details directly on the dashboard.

Key Features at a Glance

- Real‑time transaction monitoring – Instantly view purchases, authorizations, and pending charges.

- Rewards overview – Track Membership Rewards points, cash back earnings, or airline miles in a consolidated view.

- Spending insights – Categorized spending reports help you identify trends and manage budgets.

- Security alerts – Immediate notifications for suspicious activity or potential fraud.

How It Connects to the Broader Credit Card Ecosystem

To understand the mechanics behind these features, consider reading The Hidden Mechanics of Your Plastic: How a Credit Card Really Works. That article explains the underlying processes that power rewards accrual and transaction verification, giving you a clearer picture of why certain features behave the way they do within the American Express platform.

How to Access and Manage Your Account Online

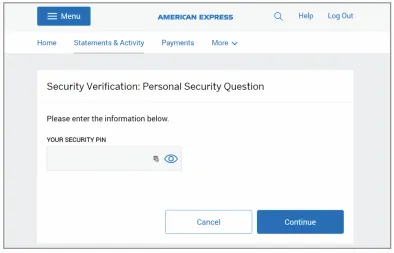

Login Process and Two‑Factor Authentication

Start by visiting the official American Express website and clicking the “Log In” button. You will need your User ID (usually your card number or a chosen username) and password. For added security, Amex employs two‑factor authentication (2FA), which may involve a one‑time code sent via SMS or an authenticator app. Enabling 2FA is strongly recommended to protect your account from unauthorized access.

Security Measures You Should Activate

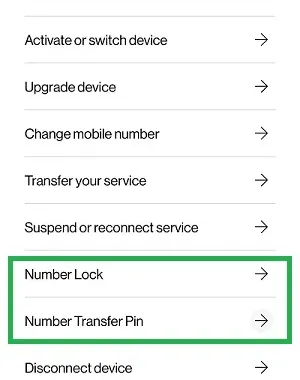

- Device management – Review and remove devices that you no longer use.

- Alert preferences – Customize email and push notifications for purchases, balance thresholds, and payment reminders.

- Account lockout policies – After multiple failed login attempts, the system temporarily locks the account, prompting you to verify your identity.

Troubleshooting Common Issues

If you encounter difficulties, such as forgotten passwords or locked accounts, the “Forgot Password” link initiates a secure recovery flow. In more complex scenarios, the Ultimate Showdown: Rewards Credit Cards vs Cash Back guide can help you compare reward structures, ensuring that the card you use aligns with your financial goals and reduces the likelihood of confusion over point valuations.

Mobile App: A Handy Companion

Features Available on the American Express App

The mobile application mirrors the website’s core functionalities while adding on-the-go conveniences. You can:

- Check balances instantly with a swipe.

- Freeze or unfreeze your card when it’s misplaced.

- Redeem Membership Rewards points for travel, gift cards, or statement credits.

- Access virtual card numbers for online purchases, enhancing security.

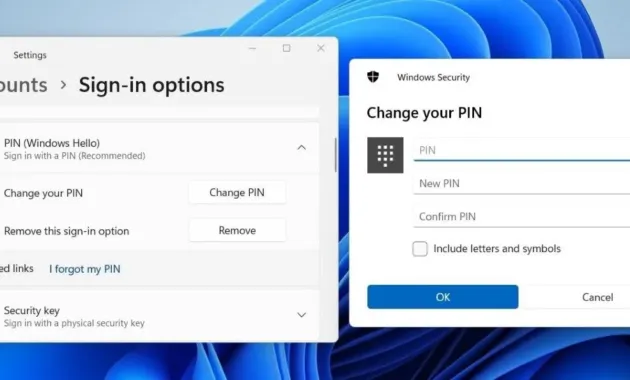

Tips for Using the App Effectively

Set up biometric authentication (fingerprint or facial recognition) to speed up login while maintaining security. Regularly update the app to benefit from new features and security patches. If you travel frequently, enable location‑based alerts so you receive instant notifications when transactions occur abroad.

Billing, Statements, and Payments

Reading Your Monthly Statement

Each statement provides a detailed breakdown of charges, interest, fees, and rewards earned. Pay special attention to the “Due Date” and “Minimum Payment” fields to avoid late fees. The “Rewards Summary” section consolidates all point activity, making it easy to plan redemptions.

Payment Options and Scheduling

- Online bank transfer – Link your checking account for direct payments.

- Automatic payments – Set up autopay for either the full balance or the minimum amount to ensure you never miss a deadline.

- Phone or mail – Traditional methods remain available for those who prefer them.

Avoiding Late Fees and Interest

American Express provides a grace period on purchases when you pay the full statement balance each month. To retain this benefit, schedule payments a few days before the due date, especially if your bank’s processing time is longer than usual. Review the Hidden Cost of Convenience article to weigh the annual fee against the value of perks you receive, ensuring the card remains financially advantageous.

Customer Support and Dispute Resolution

Contact Channels

American Express offers multiple avenues for assistance:

- Secure messaging within the online portal.

- 24/7 phone support – Ideal for urgent matters like fraudulent transactions.

- Live chat – Quick responses for routine inquiries.

- Social media – Monitored accounts provide updates on system status and promotions.

Escalation Process for Unresolved Issues

If an initial representative cannot resolve your dispute, request escalation to a senior specialist. Keep records of all communications, including reference numbers and timestamps. Documenting the timeline helps streamline the investigation and can be useful if you need to file a formal complaint with the Consumer Financial Protection Bureau (CFPB).

In addition to standard dispute procedures, American Express occasionally offers goodwill adjustments for loyal customers who encounter billing errors or service disruptions. Knowing how to articulate the issue clearly and providing supporting documentation (such as receipts or screenshots) can increase the likelihood of a favorable resolution.

By following the steps outlined above, you can confidently navigate the American Express my account platform, safeguard your personal information, and leverage the full suite of benefits that accompany your card. Regularly reviewing statements, updating security settings, and staying informed about new features will keep your financial experience smooth and rewarding.