Table of Contents

- How Secured Credit Cards Differ from Unsecured Cards

- Eligibility and Application Process

- Step‑by‑Step Application Guide

- Cost Structure: Fees and Interest Rates

- Common Fees

- Building Credit with a Secured Card

- Key Credit‑Building Behaviors

- When to Upgrade or Transition to an Unsecured Card

- Common Pitfalls and How to Avoid Them

- Potential Mistakes

- Choosing the Right Secured Credit Card for Your Needs

- Evaluation Checklist

- Real‑World Example: A Journey from No Credit to Prime Lending

- FAQs About Secured Credit Cards

- Do I lose my deposit if I default?

- Can I use a secured card for cash advances?

- Will a secured card affect my credit utilization on other cards?

- How long does it take to see a credit score increase?

- Are secured cards available for students?

What is a secured credit card? At its core, a secured credit card is a revolving credit tool that requires a cash deposit as collateral. The deposit typically matches the credit limit, creating a safety net for the issuer while giving the cardholder a chance to establish or rebuild credit. For many consumers, especially those with limited or damaged credit histories, this type of card serves as a bridge to mainstream, unsecured credit products.

The concept of using a deposit to unlock credit may sound unusual, but it mirrors a simple loan: the bank holds the money and, in return, offers a line of credit. If the cardholder uses the card responsibly—paying balances in full and on time—the deposit can eventually be returned, and the credit record improves. This narrative of trust, risk mitigation, and gradual empowerment has helped countless individuals transition from credit uncertainty to financial confidence.

Understanding how a secured credit card functions, the costs involved, and the strategies for maximizing its benefits can make the difference between a short‑term fix and a long‑term credit‑building solution. The following sections walk through each aspect, offering clear guidance without unnecessary jargon.

How Secured Credit Cards Differ from Unsecured Cards

Traditional, or unsecured, credit cards do not require a deposit because the issuer assesses creditworthiness based on the applicant’s credit score, income, and debt‑to‑income ratio. In contrast, a secured card’s approval hinges primarily on the size of the cash deposit.

Key distinctions include:

- Deposit Requirement: The cardholder must provide a refundable security deposit, often ranging from $200 to $5,000.

- Credit Limit: The limit is usually equal to the deposit amount, though some issuers may offer a slightly higher limit based on additional factors.

- Risk Exposure: The issuer’s risk is limited to the deposited amount, which often results in lower interest rates and fewer fees compared to high‑risk unsecured cards.

- Credit Reporting: Most secured cards report activity to the major credit bureaus, enabling users to build a positive payment history.

Eligibility and Application Process

Eligibility for a secured credit card is generally more inclusive than for unsecured cards. Applicants with no credit history, a low credit score, or past delinquencies can still qualify, provided they can supply the required deposit.

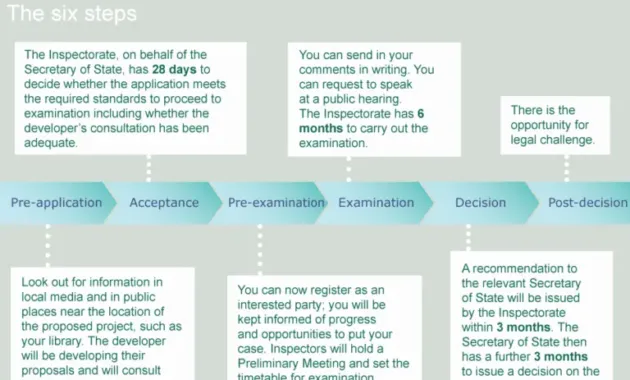

Step‑by‑Step Application Guide

- Gather personal identification, proof of income, and a bank account for the deposit.

- Research issuers to compare fees, interest rates, and reporting practices.

- Complete the online or in‑person application, indicating the desired deposit amount.

- Transfer the deposit to the issuer’s designated account; the funds are held in a separate, interest‑bearing account in most cases.

- Receive the card, activate it, and begin using it responsibly.

Many issuers also offer online tools that let you estimate the impact of a secured card on your credit score. For example, the What Is a Good APR for a Credit Card? The Numbers Behind the Rate You Should Aim For guide provides context on how interest rates affect overall credit costs, which can be especially relevant when selecting a secured card with a competitive APR.

Cost Structure: Fees and Interest Rates

While secured cards are designed for low‑risk borrowers, they are not free of costs. Understanding the fee landscape helps users avoid surprises.

Common Fees

- Annual Fee: Ranges from $0 to $50; some premium secured cards may charge higher fees in exchange for additional benefits.

- Transaction Fees: Foreign transaction fees may apply if you use the card abroad.

- Late Payment Fee: Typically $25–$35, reinforcing the importance of timely payments.

- Returned Payment Fee: Charged if a payment bounces due to insufficient funds.

Interest rates on secured cards can vary widely. Some issuers offer promotional 0% APR periods for purchases or balance transfers, while others maintain standard rates comparable to unsecured cards for consumers with similar risk profiles. Reviewing the Overview of Wells Fargo Credit Card Services can illustrate how different banks structure their APRs and fees, aiding in a more informed decision.

Building Credit with a Secured Card

The primary purpose of a secured credit card is to establish or rebuild a credit history. Credit bureaus evaluate several factors when calculating a credit score, and a secured card can positively influence each of them when used wisely.

Key Credit‑Building Behaviors

- On‑time Payments: Payment history accounts for about 35% of most scoring models. Paying the full balance each month eliminates interest and demonstrates reliability.

- Low Credit Utilization: Keep the balance below 30% of the credit limit. For a $500 limit, aim for a balance under $150.

- Length of Credit History: The longer the account remains open, the better. Avoid closing the card prematurely.

- Diverse Credit Mix: While a secured card alone won’t create a mix, it can complement other credit lines such as a student loan or auto loan.

Most issuers review your account monthly and report the activity to the three major bureaus—Equifax, Experian, and TransUnion. Over a period of six to twelve months of consistent, responsible usage, you may see measurable improvements in your credit score.

When to Upgrade or Transition to an Unsecured Card

After demonstrating responsible credit behavior, many issuers allow you to graduate to an unsecured card. The timing and process vary:

- Automatic Review: Some banks automatically evaluate your account after a set period (often 12 months) and may offer a higher‑limit unsecured card.

- Manual Request: You can contact the issuer and request an upgrade once you meet their criteria, typically a good payment record and a stable credit score.

- Deposit Refund: Upon approval for an unsecured card, the original deposit is usually refunded, sometimes with interest.

Transitioning to an unsecured card can reduce the opportunity cost of having cash tied up as a deposit, freeing those funds for other financial goals.

Common Pitfalls and How to Avoid Them

Even with a straightforward product, users can stumble into habits that undermine the credit‑building benefits.

Potential Mistakes

- Carrying a Balance: Paying interest defeats the purpose of a low‑cost secured card. Aim to pay the full statement balance each month.

- Missing Payments: Late payments can be reported and damage your score, nullifying the card’s benefits.

- Exceeding Credit Limit: Over‑limit usage may trigger fees and increase utilization ratios, harming your score.

- Neglecting Annual Fee Considerations: An annual fee that outweighs benefits can erode your financial position.

By treating the secured card as a budgeting tool rather than a source of easy credit, you align its use with long‑term financial health.

Choosing the Right Secured Credit Card for Your Needs

Selecting a secured card involves balancing several factors: deposit size, fees, APR, and additional perks such as rewards or cash back. While many secured cards focus solely on credit building, a few offer modest reward structures that can add value.

Evaluation Checklist

- Deposit amount required versus your available cash.

- Annual fee—preferably $0 or low.

- APR—compare with other secured options.

- Reporting to all three major credit bureaus.

- Potential for upgrade to an unsecured card.

- Any ancillary benefits (e.g., purchase protection, travel insurance).

For readers interested in how specific rewards compare, the The Ultimate Showdown: Rewards Credit Cards vs Cash Back – Which One Pays Off More? article outlines the trade‑offs between reward types, which can inform your decision if you prioritize benefits alongside credit building.

Real‑World Example: A Journey from No Credit to Prime Lending

Consider the case of Maya, a recent college graduate who entered the workforce with no credit history. She applied for a secured credit card with a $500 deposit, paid the full balance each month, and kept her utilization at 20%. After eight months, her credit score rose from “unscored” to 680, qualifying her for an unsecured card with a $1,000 limit and a 0% introductory APR on purchases. Maya’s deposit was refunded, and she redirected those funds toward her emergency savings. This progression illustrates how disciplined use of a secured card can unlock broader financial opportunities.

FAQs About Secured Credit Cards

Below are concise answers to common questions that arise when people explore secured credit cards.

Do I lose my deposit if I default?

Yes. The deposit serves as collateral, so if you fail to pay the balance, the issuer can apply the deposit toward the outstanding amount.

Can I use a secured card for cash advances?

Most issuers allow cash advances, but they often carry higher fees and interest rates. It is advisable to avoid them unless absolutely necessary.

Will a secured card affect my credit utilization on other cards?

Utilization is calculated per card and across all revolving accounts. A low limit on a secured card can increase overall utilization if you carry balances on other cards, so monitor total credit usage.

How long does it take to see a credit score increase?

Improvements can appear within three to six months of consistent on‑time payments and low utilization, though exact timing varies by scoring model and reporting schedule.

Are secured cards available for students?

Many issuers target students with low‑deposit secured cards, sometimes offering educational resources on credit management.

By addressing these questions, prospective cardholders can set realistic expectations and avoid common misconceptions.

Secured credit cards occupy a unique niche in the financial ecosystem, providing a practical pathway for individuals to build or repair credit while managing risk for lenders. By understanding the mechanics, costs, and best practices, users can turn a simple deposit into a stepping stone toward broader financial inclusion. Whether you are starting from scratch or seeking to recover from past credit setbacks, a secured card—when chosen and used wisely—can be a reliable ally in your journey toward credit health.