Table of Contents

- Understanding the Relationship Between Credit Cards and Checking Accounts

- Why Many Consumers Prefer Direct Payments

- Methods to Pay Your Credit Card Using a Checking Account

- Online Bill Pay Through Your Bank’s Website

- Mobile Banking Apps

- Automatic Payments (AutoPay)

- Phone Payments and In‑Person Options

- Key Considerations Before Setting Up Payments

- Timing and Due Dates

- Avoiding Overdrafts

- Fees and Transaction Limits

- Common Mistakes and How to Prevent Them

- Missing the Cut‑off Time

- Paying the Wrong Account Number

- Relying Solely on Manual Checks

- Enhancing Your Credit Card Management Experience

- Linking Accounts for Real‑Time Alerts

- Using Credit Card Perks

- Managing Multiple Cards Efficiently

Paying a credit card with a checking account is a routine financial task that many consumers treat as a background operation. Yet, the process holds subtle complexities that can affect cash flow, credit scores, and overall financial health. By understanding the mechanics behind this interaction, you can turn a simple payment into a strategic move that safeguards your accounts and maximizes convenience.

In this article we walk through the step‑by‑step methods, highlight the essential considerations, and share practical tips to help you master the art of paying your credit card from a checking account. Whether you prefer online banking, mobile apps, or automatic withdrawals, each approach is examined with a focus on reliability and security.

We’ll also weave in real‑world examples and link to related resources that deepen your knowledge of credit‑card management, such as how to manage your Target RedCard account or leverage hidden perks like free credit‑score tracking.

Understanding the Relationship Between Credit Cards and Checking Accounts

A credit card is essentially a revolving line of credit that the issuer extends to you, while a checking account is a deposit account that holds your liquid funds. When you make a payment, you are moving money from the checking account (debit) to the credit card account (credit), thereby reducing the balance you owe. This transaction is recorded as a “payment” on the credit‑card statement and as a “debit” on your bank statement.

Why Many Consumers Prefer Direct Payments

- Speed and certainty: Payments initiated directly from a checking account typically clear within one to two business days, ensuring timely credit‑card balance reductions.

- Cost‑effectiveness: Most banks do not charge a fee for standard electronic transfers, making this method cheaper than mailing checks or using third‑party services.

- Ease of tracking: Both bank and credit‑card statements reflect the same transaction, simplifying reconciliation during budgeting.

Methods to Pay Your Credit Card Using a Checking Account

There are several channels through which you can initiate a payment. Selecting the right one depends on your comfort with technology, the frequency of payments, and how much control you want over timing.

Online Bill Pay Through Your Bank’s Website

Most banks offer a dedicated “Bill Pay” section on their online portals. After logging in, you add your credit‑card issuer as a payee, input the account number, and specify the amount and date. The system then generates an electronic payment (ACH) that is sent to the issuer’s processing center.

Key advantages include the ability to schedule future payments and keep a digital record of each transaction. To ensure accuracy, double‑check the credit‑card account number each time you set up a new payee.

Mobile Banking Apps

Smartphone banking apps replicate the online portal experience with the added benefit of on‑the‑go access. Many apps allow you to use your device’s camera to scan the credit‑card’s barcode, automatically populating the account number and reducing manual entry errors.

For instance, the Citibank mobile app provides a one‑tap “Pay Now” button that pulls the checking‑account balance in real time, giving you immediate confirmation of sufficient funds.

Automatic Payments (AutoPay)

AutoPay sets up a recurring transfer that pulls the minimum payment, full balance, or a custom amount each month on a pre‑selected date. This method is especially useful for avoiding late fees and protecting your credit score.

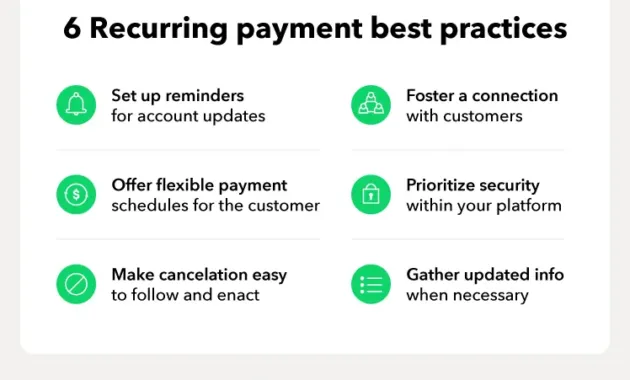

When configuring AutoPay, consider these best practices:

- Choose a payment date that falls a few days after your paycheck deposits to avoid overdrafts.

- Regularly review the auto‑payment amount, especially after large purchases, to ensure you’re not paying only the minimum and accruing interest.

- Maintain a buffer of at least $100 in your checking account as a safety net.

Phone Payments and In‑Person Options

If you prefer a human touch, you can call the credit‑card issuer’s automated payment line and follow the prompts to link your checking account. Some banks also allow you to make payments at a branch teller or ATM by providing your credit‑card details and checking‑account information.

While phone and in‑person methods are reliable, they may involve longer processing times compared to electronic ACH transfers. Expect a 1‑3 day clearance period for these payments.

Key Considerations Before Setting Up Payments

Before you start moving money, it’s wise to assess a few critical factors that influence how smoothly your payments will flow.

Timing and Due Dates

Credit‑card due dates are usually set on a monthly cycle, but the exact cut‑off time varies by issuer. Payments received after the cut‑off are considered late and may trigger fees. Always verify the “post‑by” time (often 5 PM EST) and schedule your transfer accordingly.

Avoiding Overdrafts

Overdrafts happen when the payment amount exceeds the available balance in your checking account. Most banks charge a flat fee plus interest on the overdrawn amount. To prevent this, set up low‑balance alerts, and keep a modest cushion in the account.

Fees and Transaction Limits

While most ACH transfers are free, some banks impose a per‑transaction fee for expedited or same‑day transfers. Additionally, daily or monthly limits may restrict how much you can move at once. Review your bank’s fee schedule and limits before initiating large payments.

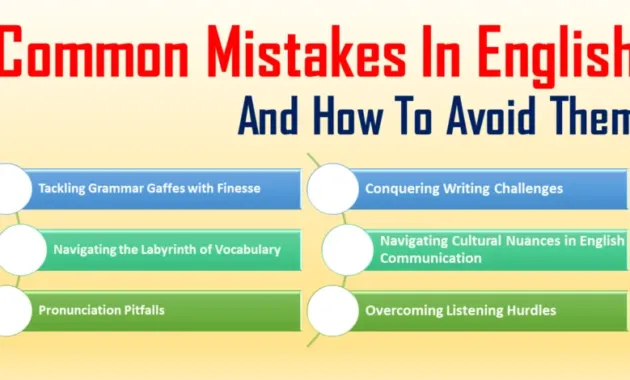

Common Mistakes and How to Prevent Them

Even seasoned payers can slip up. Below are frequent errors and straightforward ways to avoid them.

Missing the Cut‑off Time

Many users assume that initiating a payment on the due date guarantees on‑time posting. In reality, the payment must be submitted before the issuer’s cut‑off time. To stay safe, aim to pay at least two business days in advance.

Paying the Wrong Account Number

A single digit error in the credit‑card account number can send your money to a different account, creating a delay and potential dispute. Always copy the number directly from your credit‑card statement or use the “copy‑and‑paste” feature where available.

Relying Solely on Manual Checks

Manual checks introduce human error and longer mailing times. Transitioning to electronic methods not only speeds up processing but also provides an audit trail in your online banking portal.

Enhancing Your Credit Card Management Experience

Beyond making payments, you can integrate your checking and credit‑card accounts for a more holistic financial picture.

Linking Accounts for Real‑Time Alerts

Many banks let you set up push notifications for both debits from your checking account and credits to your credit‑card balance. Real‑time alerts help you spot unexpected activity and confirm that payments have cleared.

Using Credit Card Perks

Some cards now include free credit‑score tracking, travel insurance, or cash‑back bonuses. Understanding these perks can offset payment costs or even generate additional value. For a deeper dive, read the article on credit cards that offer free credit score tracking.

Managing Multiple Cards Efficiently

If you hold several credit cards, consider consolidating payment schedules into a single calendar view. Tools like budgeting apps can sync with both your checking and credit‑card accounts, providing a unified dashboard. This strategy reduces the chance of missed payments and helps you allocate funds where they earn the most rewards.

When you have a store‑specific card, such as a Target RedCard, the same principles apply, but you might also benefit from exclusive financing offers. The guide on managing your Target RedCard account outlines how to align store rewards with your payment routine.

In summary, paying a credit card with a checking account is more than a simple debit; it’s a coordinated action that influences cash management, credit health, and overall financial stability. By choosing the right payment method, staying aware of timing nuances, and leveraging technology for alerts and automation, you create a reliable system that works quietly in the background, allowing you to focus on larger financial goals.