Table of Contents

- Creating and Activating Your Experian Account

- 1. Gather Required Personal Information

- 2. Visit the Official Experian Sign‑Up Page

- 3. Complete the Registration Form

- 4. Verify Your Identity

- 5. Set Up Account Alerts

- Logging In to Your Experian Credit Report

- Standard Desktop Login

- Mobile Access via Experian App

- Common Login Issues and How to Resolve Them

- Enhancing Security for Your Experian Account

- Enable Two‑Factor Authentication (2FA)

- Use a Password Manager

- Regularly Review Account Activity

- Beware of Phishing Attempts

- Integrating Experian with Other Financial Tools

- Linking to Credit Card Accounts

- Connecting with USAA’s Portal

- Utilizing Third‑Party Budgeting Apps

- What to Do If You Spot Errors on Your Credit Report

- Identify the Discrepancy

- Gather Supporting Documentation

- Track the Dispute Timeline

- Follow Up If Needed

- Understanding the Benefits of Regular Experian Credit Report Checks

- Early Detection of Fraud

- Optimizing Loan and Credit Card Applications

- Improving Financial Discipline

- Leveraging Credit-Building Opportunities

- Frequently Asked Questions About Experian Credit Report Login

- Can I access my Experian report for free?

- Is my Experian login information shared with third parties?

- What should I do if I suspect a phishing email pretending to be Experian?

- How often does Experian update my credit report?

- Can I change my email address associated with my Experian account?

Experian credit report login is the gateway to a detailed snapshot of your financial health. Whether you are checking your score for the first time, disputing an error, or monitoring identity theft, the ability to log in quickly and securely is essential. This article walks you through every stage of the process, from creating an account to navigating the dashboard, while highlighting common pitfalls and best‑practice security measures.

Imagine a busy morning when you need to verify your credit score before applying for a mortgage. You sit down at your laptop, type “Experian credit report login,” and within seconds you’re looking at a clear, color‑coded report that tells you exactly where you stand. The experience should feel effortless, yet many users encounter obstacles such as forgotten passwords, outdated browsers, or fraudulent phishing sites. Understanding the mechanics behind the login process empowers you to avoid these traps and keep your financial information safe.

In the following sections, we’ll break down the entire journey: setting up a new Experian account, using the existing login credentials, accessing the report on mobile devices, and troubleshooting the most frequent errors. By the end, you’ll have a reliable roadmap that turns a potentially stressful task into a routine part of your financial toolkit.

Creating and Activating Your Experian Account

The first step toward a successful Experian credit report login is establishing a verified account. Even if you have used Experian services before, it’s wise to review the activation process to ensure your profile is up to date.

1. Gather Required Personal Information

- Full legal name as it appears on your government ID

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Current residential address and a previous address (if you have lived at the same place for less than two years)

- Date of birth and a valid email address

Having these details on hand speeds up registration and reduces the likelihood of verification delays.

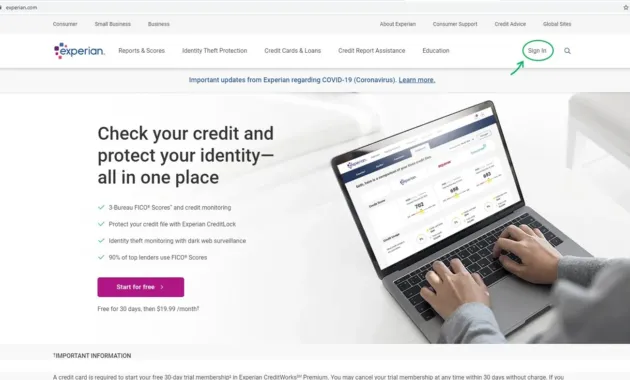

2. Visit the Official Experian Sign‑Up Page

Navigate directly to the official Experian website (https://www.experian.com) and locate the “Create Account” button. Avoid clicking on search‑engine ads or third‑party links, as they may lead to fraudulent sites designed to harvest personal data.

3. Complete the Registration Form

Enter the information you collected, create a strong password (a mix of uppercase, lowercase, numbers, and symbols), and choose a security question that only you can answer. Experian may also ask you to verify your email by sending a confirmation link; click that link promptly to activate your account.

4. Verify Your Identity

Experian uses a multi‑factor verification system. After submitting the form, you’ll typically receive a one‑time passcode (OTP) via SMS or email. Input the code in the designated field to confirm your identity. This step is crucial for protecting your credit file from unauthorized access.

5. Set Up Account Alerts

Once logged in for the first time, configure alerts for important events such as new inquiries, changes to personal information, or potential fraud. These notifications provide an early warning system, allowing you to react swiftly if something looks amiss.

Logging In to Your Experian Credit Report

Now that your account is active, the Experian credit report login process is straightforward. Follow these instructions to access your report on desktop or mobile platforms.

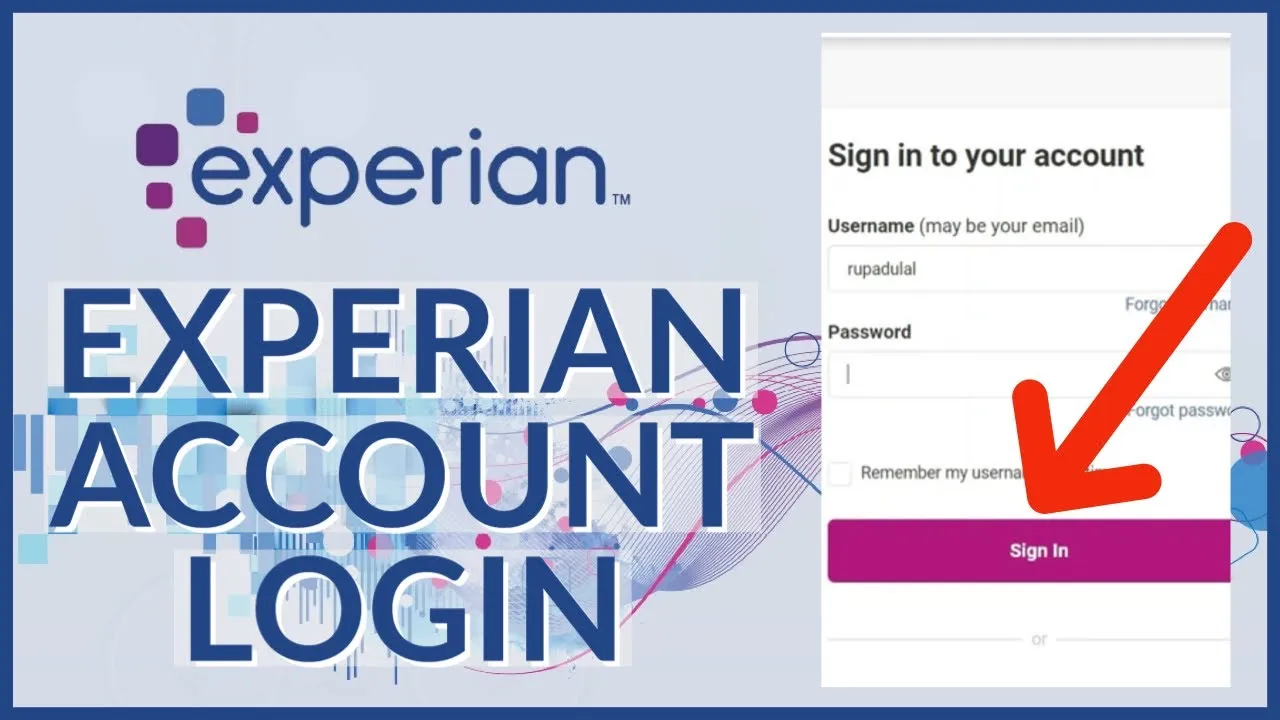

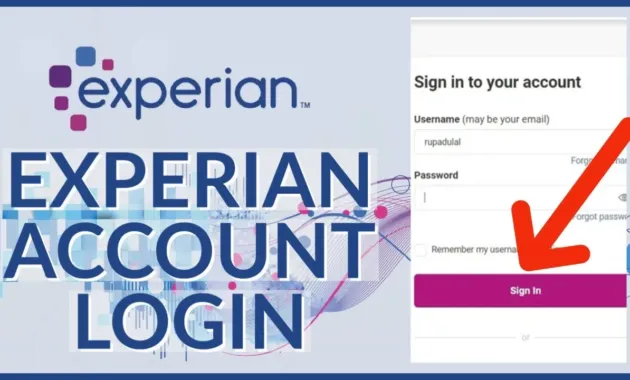

Standard Desktop Login

- Go to Experian’s homepage and click “Sign In.”

- Enter your registered email address and password.

- If you enabled two‑factor authentication (2FA), input the OTP sent to your phone or authenticator app.

- Click “Sign In” to be taken to the dashboard where your credit score, credit report, and monitoring tools are displayed.

Mobile Access via Experian App

The Experian mobile app is available for iOS and Android. After downloading the app from the App Store or Google Play, launch it and use the same credentials as the desktop version. The app also supports biometric login (fingerprint or facial recognition) if your device permits, adding an extra layer of convenience.

Common Login Issues and How to Resolve Them

- Forgotten Password: Click “Forgot Password” on the sign‑in page. You’ll receive a reset link via email. Choose a new password that meets the complexity requirements.

- Incorrect OTP: Ensure your phone has network coverage and that you’re entering the most recent code. If the code expires, request a new one.

- Browser Compatibility: Experian recommends using the latest versions of Chrome, Firefox, Safari, or Edge. Clear cache and cookies if you encounter loading problems.

- Account Locked: After multiple failed attempts, Experian may temporarily lock your account. Contact Experian Support through the “Help Center” to verify your identity and regain access.

Enhancing Security for Your Experian Account

Security is a continuous process, not a one‑time setup. Implementing additional safeguards reduces the risk of identity theft and unauthorized credit checks.

Enable Two‑Factor Authentication (2FA)

2FA requires a second verification step beyond your password, dramatically decreasing the likelihood of a successful breach. Experian supports both SMS‑based OTPs and authenticator apps like Google Authenticator or Authy.

Use a Password Manager

Storing complex passwords in a reputable password manager (e.g., LastPass, 1Password) ensures you never reuse passwords across sites, and it eliminates the temptation to write them down.

Regularly Review Account Activity

Log in at least once a month to check for unfamiliar logins or alerts. Experian’s “Recent Activity” section shows timestamps, IP addresses, and device types for each session.

Beware of Phishing Attempts

Never click on links in unsolicited emails that claim to be from Experian. Genuine communications will address you by name and reference only the email address you registered. If in doubt, navigate directly to Experian’s website rather than following a link.

Integrating Experian with Other Financial Tools

Many users benefit from linking their Experian credit report to broader financial management platforms. This integration can streamline monitoring and provide a holistic view of your credit health.

Linking to Credit Card Accounts

Some credit card issuers allow you to import your Experian score directly into their mobile app for instant updates. For example, you can follow the steps outlined in How to Log In to Your Uber Visa Card Account in Minutes – The Complete Guide to synchronize your credit data safely.

Connecting with USAA’s Portal

If you hold a USAA credit card, you might want to explore the Unlock the USAA Credit Card Login Portal guide, which explains how to merge Experian alerts with USAA’s own credit monitoring features.

Utilizing Third‑Party Budgeting Apps

Apps such as Mint or Personal Capital can import your Experian credit score to provide budgeting suggestions based on your credit standing. Ensure you grant read‑only permissions to protect your account from unintended changes.

What to Do If You Spot Errors on Your Credit Report

Even with a flawless login experience, the content of your credit report may contain inaccuracies. Addressing these promptly protects your credit score and prevents future loan denials.

Identify the Discrepancy

Common errors include misspelled names, incorrect addresses, outdated account statuses, or duplicated entries. Use the “Dispute” button next to each item on the Experian dashboard to start the correction process.

Gather Supporting Documentation

Collect bank statements, loan agreements, or correspondence that prove the correct information. Upload these documents through Experian’s secure portal when filing a dispute.

Track the Dispute Timeline

Experian is required by law to investigate disputes within 30 days. You will receive updates via email, and the corrected report will be reflected on your account once the investigation concludes.

Follow Up If Needed

If the dispute is not resolved to your satisfaction, you can appeal the decision or contact the Consumer Financial Protection Bureau (CFPB) for further assistance.

Understanding the Benefits of Regular Experian Credit Report Checks

Consistently monitoring your Experian credit report yields several tangible advantages beyond merely knowing your score.

Early Detection of Fraud

Unrecognized inquiries or new accounts can signal identity theft. Immediate detection allows you to place fraud alerts or freeze your credit file.

Optimizing Loan and Credit Card Applications

Before applying for a mortgage, auto loan, or new credit card, reviewing your report helps you gauge whether you qualify for the best interest rates. If needed, you can address negative items before submitting an application.

Improving Financial Discipline

Seeing your credit utilization ratio and payment history in real time encourages responsible spending and timely bill payments, which in turn raise your score over time.

Leveraging Credit-Building Opportunities

If your score is lower than desired, Experian’s “Credit Building” tools recommend secured credit cards or credit‑builder loans tailored to your situation.

Frequently Asked Questions About Experian Credit Report Login

Can I access my Experian report for free?

Yes. Experian offers a free monthly credit report through its “Free Credit Report” program. You must register and log in each month to view the latest data.

Is my Experian login information shared with third parties?

No. Experian’s privacy policy states that login credentials are never sold or shared. However, you may choose to link your account to partner services, which will only receive read‑only access if you grant permission.

What should I do if I suspect a phishing email pretending to be Experian?

Do not click any links. Forward the email to phishing@experian.com and delete it. Then, manually type Experian’s URL into your browser to verify any legitimate communications.

How often does Experian update my credit report?

Most lenders report to Experian on a monthly basis, so your report is typically refreshed every 30‑45 days. However, some lenders may update more frequently.

Can I change my email address associated with my Experian account?

Yes. Within the account settings, select “Update Email,” enter the new address, and confirm via the verification link sent to the new inbox.

By mastering the Experian credit report login process, you gain direct control over one of the most important aspects of personal finance. From creating a secure account to troubleshooting common issues, each step builds a foundation for smarter credit management. Regularly reviewing your report, staying vigilant against fraud, and integrating Experian data with other financial tools can transform a simple login into a powerful habit that safeguards and strengthens your financial future.