Table of Contents

- Rewards Structure: Points vs. Credits

- Chase Sapphire Preferred

- American Express Gold

- Annual Fees and Interest Rates

- Travel Benefits and Protections

- Chase Sapphire Preferred

- American Express Gold

- Everyday Use and Bonus Categories

- Grocery Shopping

- Dining Out

- Online Shopping and Big‑Ticket Items

- How the Cards Perform in Real‑World Scenarios

- Frequent Flyer

- Food‑Focused Family

- Balanced Spender

- Application Process and Managing the Cards

- Choosing the Right Card for Your Lifestyle

The Chase Sapphire Preferred and the American Express Gold sit at the top of the premium credit‑card market. Both promise generous rewards, travel benefits, and a status boost for savvy spenders. When you first read about the Sapphire Preferred, the phrase “travel rewards” jumps out, while the Amex Gold immediately mentions “dining.” This contrast sets the stage for a story that unfolds in the everyday financial lives of their owners.

Imagine a young professional who just landed a new job, eager to maximize every dollar spent on flights, groceries, and weekend meals. She opens a Chase Sapphire Preferred to capture points on airline tickets, then later adds an Amex Gold for the dining bonus. Over the next twelve months, the points stack, the annual fees bite, and the travel perks begin to shape her decisions. By following her journey, we can see how each card behaves in real‑world scenarios, and where the advantages truly lie.

Rewards Structure: Points vs. Credits

Both cards operate on a points‑based system, but the ways they earn and redeem differ enough to influence spending habits.

Chase Sapphire Preferred

- Earn 2 X points on travel and dining worldwide.

- Earn 1 X point on all other purchases.

- Bonus: 60,000 points after spending $4,000 in the first three months.

- Points are redeemable through Chase Ultimate Rewards, where they can be transferred to airline and hotel partners at a 1:1 ratio.

American Express Gold

- Earn 4 X Membership Rewards points at U.S. supermarkets (up to $25,000 per year).

- Earn 4 X points on restaurants worldwide.

- Earn 3 X points on flights booked directly with airlines or through Amex Travel.

- Bonus: 60,000 points after spending $4,000 in the first six months.

- Points can be transferred to a similar list of airline and hotel partners, but the transfer ratios vary.

The Gold card’s higher earn rates on groceries and restaurants make it attractive for families and food lovers. The Sapphire Preferred, with its broader 2 X on travel and dining, appeals to frequent flyers who also enjoy occasional meals out.

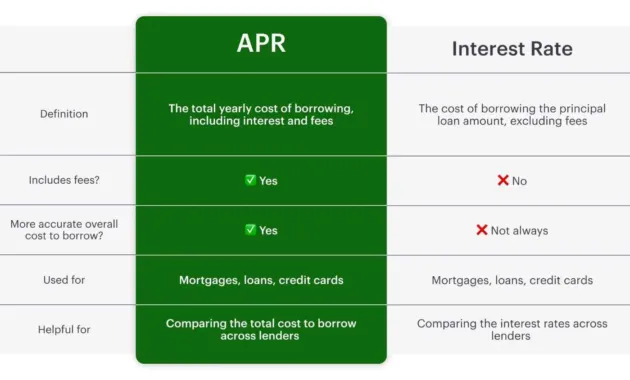

Annual Fees and Interest Rates

Fee structures can tip the balance for anyone watching their budget closely. The Chase Sapphire Preferred carries an annual fee of $95, while the Amex Gold’s fee is $250. The higher fee on the Gold card is partially offset by the 4 X grocery bonus, yet the Sapphire Preferred remains the more affordable option for those who do not spend heavily on supermarkets.

Both cards impose similar variable APR ranges for purchases, typically around 20‑22% depending on creditworthiness. If you plan to carry a balance, the interest cost will quickly eclipse any rewards earned, reinforcing the importance of paying in full each month.

Travel Benefits and Protections

Travel perks are often the decisive factor for premium cards. Below is a snapshot of the most relevant features.

Chase Sapphire Preferred

- Primary rental car insurance—covers collision damage waiver.

- Trip cancellation/interruption insurance up to $10,000 per person.

- Travel and emergency assistance services.

- Access to the premium credit cards with lounge access via airline partners after transferring points.

American Express Gold

- Car rental loss and damage insurance (secondary to personal insurance).

- Travel accident insurance up to $500,000.

- Purchase protection and extended warranty on eligible items.

- Annual airline fee credit of $100 (enrollment required).

Both cards protect purchases and travel, but the Sapphire Preferred’s primary rental car coverage is a step up for renters who rely on rental vehicles abroad. The Amex Gold’s airline fee credit helps offset the higher annual fee, especially for frequent flyers who book with a single airline.

Everyday Use and Bonus Categories

Beyond travel, the way each card handles everyday spending can shape its long‑term value.

Grocery Shopping

The Amex Gold’s 4 X points at U.S. supermarkets dominate this category. If you spend $10,000 a year on groceries, you’ll earn 40,000 points versus 10,000 points with the Sapphire Preferred. That difference translates to roughly $400 in travel value when points are transferred to a high‑value airline partner.

Dining Out

Both cards offer 2 X or 4 X on dining, but the Gold card’s 4 X applies worldwide, while the Sapphire Preferred’s 2 X is limited to travel‑related dining. For a family that dines out regularly, the Gold card can generate a noticeable points boost.

Online Shopping and Big‑Ticket Items

When purchasing larger items—electronics, furniture, or travel gear—the cards’ purchase protection and extended warranty come into play. The Amex Gold’s protections are particularly strong, covering up to $10,000 per claim for accidental damage. For a deeper dive on how credit cards handle these purchases, see our guide on big ticket items.

How the Cards Perform in Real‑World Scenarios

To illustrate the impact of each card, consider three typical spenders.

Frequent Flyer

John travels internationally for work. He books flights through airline partners, rents cars in Europe, and dines at business lunches. John’s primary goal is maximizing travel redemption value. The Sapphire Preferred’s 2 X on travel, primary rental insurance, and 1:1 transfer to airline partners give him a clean, predictable path to free flights. Even with the lower grocery bonus, his overall points per dollar are higher because most of his spend is travel‑centric.

Food‑Focused Family

Maria’s household spends $8,000 a year on groceries and $4,000 on restaurants. The Amex Gold’s 4 X on both categories yields 48,000 points on groceries alone, plus another 16,000 on dining, totaling 64,000 points before the welcome bonus. Those points, when transferred to a partner airline, can cover a round‑trip domestic flight for two. The higher annual fee is offset by the grocery and dining returns, especially if Maria redeems points for travel rather than statement credits.

Balanced Spender

Alex enjoys occasional trips, dines out weekly, and does moderate grocery shopping. Alex values flexibility and wants a card that won’t feel “wasted” if travel slows down. The Sapphire Preferred’s lower fee and solid travel protections make it a safe all‑rounder, while the Amex Gold provides occasional spikes in points for meals and groceries. Alex decides to keep both, using the Gold for grocery and restaurant purchases, and the Sapphire Preferred for all travel‑related spend.

Application Process and Managing the Cards

Applying for either card follows a similar online process. Prospective cardholders should be prepared to provide income information, employment details, and a social‑security number. After approval, the new card arrives within 7‑10 business days. If you ever need to verify the status of your application, you can check your credit card application status through the issuer’s portal.

Both issuers offer robust online dashboards. Chase’s Ultimate Rewards portal lets you track points, book travel, and transfer points with a few clicks. American Express’s Membership Rewards site provides similar functionality, along with a “Shop with Points” marketplace that can be useful for everyday purchases.

Choosing the Right Card for Your Lifestyle

When deciding between the Chase Sapphire Preferred and the American Express Gold, consider the following checklist:

- Primary Spending Category: If groceries and restaurants dominate your budget, the Amex Gold’s 4 X rates are compelling.

- Travel Frequency: Frequent flyers benefit from the Sapphire Preferred’s travel‑focused 2 X and primary rental car insurance.

- Annual Fee Sensitivity: The Sapphire Preferred’s $95 fee is more budget‑friendly; the Gold’s $250 fee requires a higher points yield to justify.

- Transfer Flexibility: Both cards support point transfers, but the Sapphire Preferred’s 1:1 ratio with many airlines is often simpler for travel redemptions.

- Additional Perks: Evaluate lounge access, airline fee credits, and purchase protections against your personal priorities.

By aligning these factors with your financial habits, you can select the card that maximizes value while minimizing unnecessary costs.

In the end, the “winner” is not a single card but the one that matches your spending pattern and travel goals. Whether you lean toward the travel‑centric Sapphire Preferred or the dining‑focused Amex Gold, both cards offer tools that can transform ordinary purchases into future adventures.