Table of Contents

- Getting Started: Registering for Online Access

- Why a Strong Password Matters

- Logging In: Step‑by‑Step Guide

- Using the Mobile App for Faster Access

- Troubleshooting Common Login Problems

- Security Tip: Monitor Your Account Regularly

- Advanced Features Available After Login

- Optimizing Your Payments

- Maintaining Account Security Over Time

Barclaycard credit card login is the gateway to managing your finances, checking balances, and making payments from the comfort of your home or on the go. For many cardholders, the first time they enter the secure portal feels like stepping into a new world where every transaction is visible at a glance. This article follows the typical journey of a Barclaycard user—from the moment they receive their welcome kit to the point where they master the online dashboard and avoid common pitfalls.

Imagine receiving a sleek, embossed Barclaycard in the mail, accompanied by a letter that explains how to set up your online profile. You scan the QR code, click the link, and are prompted to create a username and password. The experience is straightforward, yet the stakes are high: a forgotten password or a mistyped email can lock you out of essential services, such as making a minimum payment or disputing a charge. Understanding each step of the login process, as well as the security layers built around it, can turn a potentially stressful situation into a routine part of your financial routine.

In the sections that follow, we will walk through the entire Barclaycard login ecosystem. You will discover how to register, reset credentials, use the mobile app, and keep your account secure. Along the way, we will embed practical tips—like setting up two‑factor authentication—and reference related resources, such as the untold truth about credit cards: benefits, risks, and how to make them work for you, to give you a broader perspective on responsible credit‑card usage.

Getting Started: Registering for Online Access

The first interaction with the Barclaycard online portal begins with registration. Even if you have an existing account, you must create a distinct online profile to gain access. The registration page asks for the following information:

- Card number (the 16‑digit number on the front of your Barclaycard)

- Last four digits of your Social Security Number (or equivalent national identifier)

- Personal details such as date of birth and mailing address

- A valid email address where verification links will be sent

After submitting these details, Barclaycard sends a verification email containing a unique link. Clicking this link confirms your email address and activates your account. At this point, you will be prompted to create a strong password. A good password combines uppercase and lowercase letters, numbers, and special characters, and is at least 12 characters long. Avoid using obvious patterns like “1234abcd” or personal information such as birthdays.

Why a Strong Password Matters

Cyber‑threats target financial institutions because they hold valuable data. A robust password reduces the risk of unauthorized access. Moreover, Barclaycard employs additional security measures—most notably two‑factor authentication (2FA)—which we will discuss later. By establishing a strong password from the outset, you set a solid foundation for these extra layers to work effectively.

Logging In: Step‑by‑Step Guide

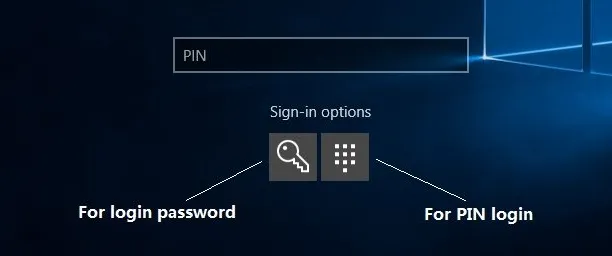

Once your account is registered, the daily login routine is simple:

- Navigate to the official Barclaycard login page (always verify the URL ends with .com and includes “barclaycard”).

- Enter your username (usually the email address you registered with) and password.

- If 2FA is enabled, receive a one‑time code via SMS or an authenticator app, and input the code.

- Click “Sign In” to access the dashboard.

The dashboard presents a clean interface: your current balance, recent transactions, available credit, and quick links to pay your bill, view statements, and manage alerts. Each element is clickable, allowing you to drill down for more details without leaving the page.

Using the Mobile App for Faster Access

Barclaycard offers a mobile application for iOS and Android that mirrors the web experience. After downloading the app, you log in using the same credentials. The app adds convenient features such as push notifications for new charges, biometric login (fingerprint or facial recognition), and the ability to freeze or unfreeze your card instantly.

For users who prefer a seamless experience across devices, the app syncs with the web portal, ensuring that any changes—like setting a new payment due date—are reflected instantly. This cross‑platform consistency is especially useful for frequent travelers who may switch between laptop and smartphone depending on Wi‑Fi availability.

Troubleshooting Common Login Problems

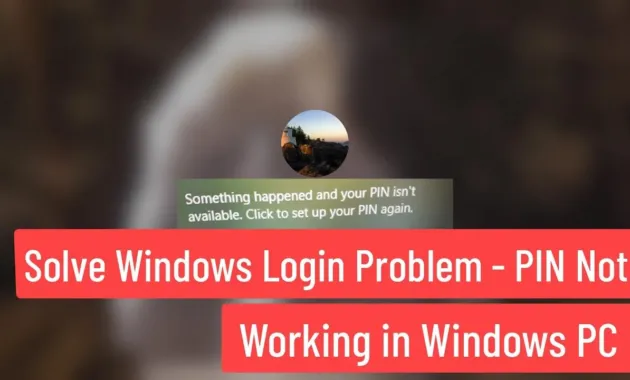

Even with careful setup, you may encounter obstacles. Below are the most frequent issues and how to resolve them.

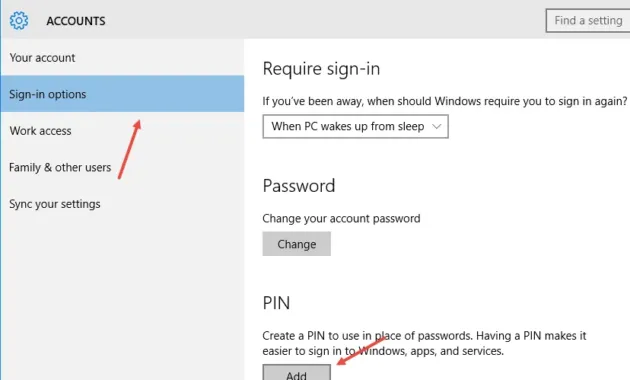

- Forgotten Password: Click “Forgot password?” on the login page. You will receive an email with a password‑reset link. Follow the instructions, and choose a new password that meets the strength criteria.

- Incorrect Username or Email: Double‑check the spelling and case sensitivity. If you suspect a typo in your registered email, use the “Update email” feature after logging in, or contact customer support for assistance.

- Account Locked After Multiple Attempts: For security, the system locks the account after several failed attempts. Wait 15 minutes, then try again, or use the “Unlock account” link that appears after the lockout period. If the lock persists, call the support line.

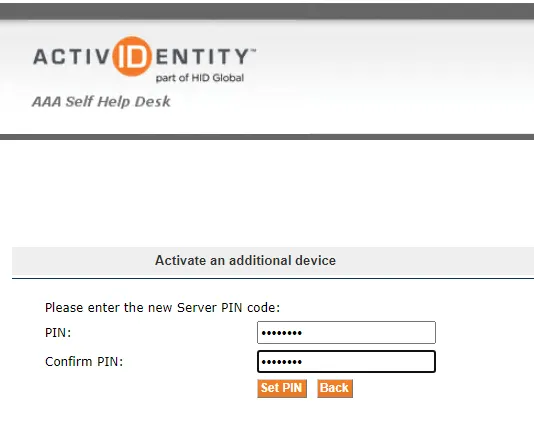

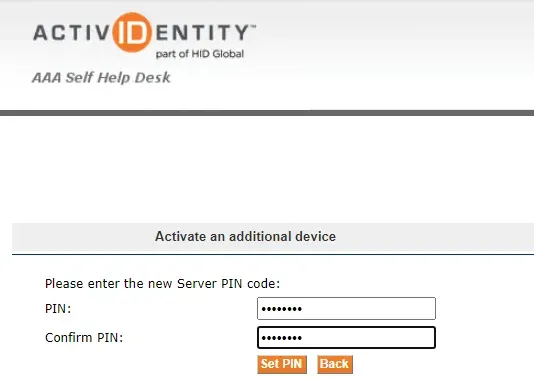

- Two‑Factor Authentication Issues: Ensure your phone number is up‑to‑date. If you change devices, reinstall the authenticator app and scan the QR code from your account settings.

- Browser Compatibility: Some older browsers may not render the login page correctly. Use the latest version of Chrome, Firefox, Safari, or Edge.

When all else fails, the Barclaycard support team is reachable 24/7 via phone or secure chat. They can verify your identity using personal details and guide you through the recovery process.

Security Tip: Monitor Your Account Regularly

Regularly reviewing your transactions can alert you to unauthorized activity early. The online dashboard allows you to set up custom alerts—email or SMS notifications for purchases over a certain amount, international transactions, or when your balance exceeds a threshold. Proactive monitoring works hand‑in‑hand with the login process to keep your account safe.

Advanced Features Available After Login

Beyond basic balance checks, the Barclaycard portal offers tools that help you manage credit responsibly.

- Automatic Payments: Set up recurring payments from a linked bank account to avoid missed due dates.

- Statement Download: Export PDF or CSV statements for personal records or tax purposes.

- Reward Redemption: If your card includes a rewards program, browse available options and redeem points directly.

- Dispute a Charge: Initiate a dispute through the “Help” section. The process is outlined clearly, and you can upload supporting documents. For a deeper dive on the dispute process, see how to dispute a credit card charge – the simple process that saves your money.

- Credit Score Monitoring: Some Barclaycard tiers provide free credit score updates. Understanding where you stand can inform decisions about applying for new credit. Learn more about credit scores in understanding the mechanics of credit scores.

Optimizing Your Payments

Paying the full balance each month avoids interest charges, but if you need to carry a balance, the portal shows the exact interest calculation based on your daily balance. Use the built‑in calculator to see how extra payments reduce interest over time. This aligns with the principles discussed in how to calculate credit card interest—the simple formula everyone needs, giving you a clear picture of cost versus benefit.

Maintaining Account Security Over Time

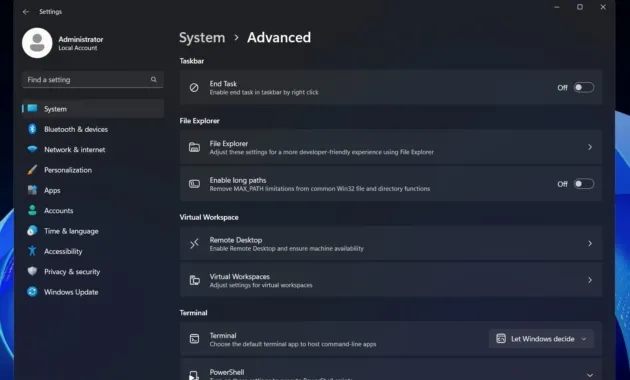

Security isn’t a one‑time setup; it requires ongoing attention. Here are actions you should take periodically:

- Update your password every six months. Choose a fresh phrase rather than a simple variation of the old one.

- Review the list of devices that have logged into your account. Remove any you no longer use.

- Enable biometric authentication on the mobile app for faster yet secure access.

- Check the “Security Settings” page for new features, such as hardware security keys.

- Stay informed about phishing scams. Barclaycard will never ask for your password via email or text.

By treating your Barclaycard login credentials like a key to a safe, you protect not only your own finances but also the broader financial ecosystem that relies on trust and data integrity.

In summary, the Barclaycard credit card login experience is designed to be intuitive while embedding multiple layers of security. From the initial registration, through daily access on desktop or mobile, to troubleshooting and advanced account management, each step builds on the previous one. By following the guidelines outlined above—using strong passwords, enabling two‑factor authentication, monitoring alerts, and leveraging the portal’s tools—you can confidently manage your credit card, avoid common pitfalls, and keep your personal information secure.