Table of Contents

- Assess Your Current Situation

- List Every Card and Its Terms

- Calculate Your Debt‑to‑Income Ratio

- Choose the Right Repayment Strategy

- Debt Avalanche (Interest‑Focused)

- Debt Snowball (Motivation‑Focused)

- Boost Your Payment Power

- Trim Unnecessary Expenses

- Increase Income Streams

- Apply Savings Directly to Debt

- Utilize Low‑Interest or Balance Transfer Options Wisely

- Key Considerations for Balance Transfers

- Negotiate Lower Interest Rates or Fees

- Automate Payments and Monitor Progress

- Use Alerts and Tracking Tools

- Address the Psychology of Debt

- Adopt the “No‑Spend” Days

- Reward Milestones Without Spending

- Consider Professional Help When Needed

- When to Seek a Debt Management Plan (DMP)

- Maintain Good Credit Habits After Paying Off Debt

- Keep Utilization Low

- Avoid New High‑Interest Debt

Paying off credit card debt fast is a priority for many who feel the weight of mounting balances and high interest rates. The first step begins with acknowledging the total amount owed and committing to a concrete plan. By understanding how interest compounds and where your money goes each month, you can create a roadmap that accelerates repayment without sacrificing essential expenses.

In this article we walk through a systematic approach that blends budgeting, smart debt‑management tactics, and behavioral changes. The goal is to equip you with a clear, step‑by‑step framework that transforms overwhelming debt into manageable milestones, ultimately freeing you from the cycle of minimum payments.

Assess Your Current Situation

Before you can pay off credit card debt fast, you need a precise snapshot of your financial picture. This includes gathering statements, noting interest rates, and calculating the total balance across all cards. A simple spreadsheet or a budgeting app can help you visualize where each dollar is allocated.

List Every Card and Its Terms

- Card name and issuer

- Outstanding balance

- Annual Percentage Rate (APR)

- Minimum monthly payment

- Due date

Having this information at hand makes it easier to prioritize which debt to attack first. Generally, the “avalanche” method—targeting the highest‑interest card—yields the fastest overall payoff because it reduces the amount of interest you pay over time.

Calculate Your Debt‑to‑Income Ratio

Divide your total monthly debt obligations by your gross monthly income. A ratio above 40 % signals that a larger portion of earnings is already committed to debt, indicating that you may need to cut discretionary spending or seek additional income to accelerate repayment.

Choose the Right Repayment Strategy

Two popular strategies dominate the debt‑payoff conversation: the avalanche method and the snowball method. While the avalanche method saves you the most money on interest, the snowball method can provide psychological momentum by eliminating smaller balances first.

Debt Avalanche (Interest‑Focused)

- Rank cards from highest to lowest APR.

- Pay the minimum on all cards except the highest‑APR card.

- Allocate any extra funds to the top‑ranked card until it’s cleared.

- Move to the next highest APR card and repeat.

Debt Snowball (Motivation‑Focused)

- Rank cards from smallest to largest balance.

- Pay the minimum on every card except the smallest balance.

- Direct all extra cash toward the smallest balance until it’s paid off.

- Roll the amount you were paying on that card into the next smallest balance.

Whichever method you select, consistency is key. Many find success by combining both: start with the snowball to gain confidence, then switch to the avalanche once larger balances remain.

Boost Your Payment Power

Increasing the amount you can put toward debt each month shortens the payoff timeline dramatically. Below are practical ways to free up cash without drastic lifestyle changes.

Trim Unnecessary Expenses

- Cancel unused subscriptions (streaming services, gym memberships, etc.).

- Shop with a list to avoid impulse purchases.

- Cook at home more often; meal prepping can cut food costs by up to 30 %.

Increase Income Streams

- Take on freelance work or gig‑economy jobs (rideshare, tutoring, etc.).

- Sell items you no longer need on online marketplaces.

- Negotiate a raise or explore a part‑time role that aligns with your skill set.

Apply Savings Directly to Debt

Whenever you receive a tax refund, bonus, or cash gift, treat it as a “debt windfall.” Direct the full amount to the card you’re focusing on, and you’ll notice the balance shrink faster than expected.

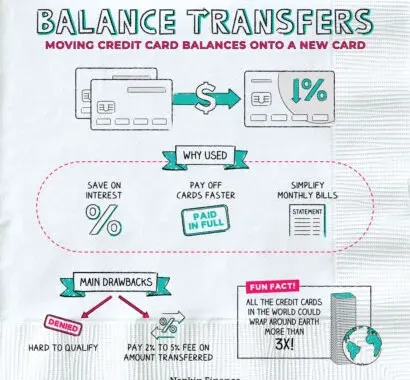

Utilize Low‑Interest or Balance Transfer Options Wisely

Many credit card issuers offer promotional balance‑transfer rates—often 0 % for 12 to 18 months. Transferring high‑interest balances to such an offer can dramatically reduce the interest you pay, allowing more of each payment to chip away at principal.

Key Considerations for Balance Transfers

- Check the transfer fee (typically 3‑5 % of the amount transferred).

- Confirm the length of the 0 % period and the post‑promo APR.

- Ensure you can pay off the transferred amount before the promotional period ends.

If you’re unsure whether a balance transfer makes sense, you can read more about managing interest in our article The Hidden Power of Your Credit Card Grace Period – How to Keep Interest at Bay, which explains how timing your payments can save you money.

Negotiate Lower Interest Rates or Fees

Contacting your credit card issuer and requesting a lower APR can be surprisingly effective, especially if you have a solid payment history. A reduction of even 2‑3 % can shave months off your payoff schedule.

During the call, be prepared to mention:

- Your on‑time payment record.

- Competitive offers from other banks.

- Your desire to stay a loyal customer.

If the issuer refuses to lower the rate, you may still ask about waiving annual fees or other charges that add to the overall cost.

Automate Payments and Monitor Progress

Automation removes the risk of missed payments, which can trigger penalties and raise your APR. Set up automatic transfers that cover at least the minimum due plus any extra amount you’ve budgeted for debt reduction.

Use Alerts and Tracking Tools

- Enable email or SMS alerts for due dates and balance changes.

- Regularly review statements to spot any unauthorized charges; if you find a discrepancy, learn how to dispute a credit card charge promptly.

- Track your payoff progress with a visual chart; seeing the balance decline can reinforce disciplined behavior.

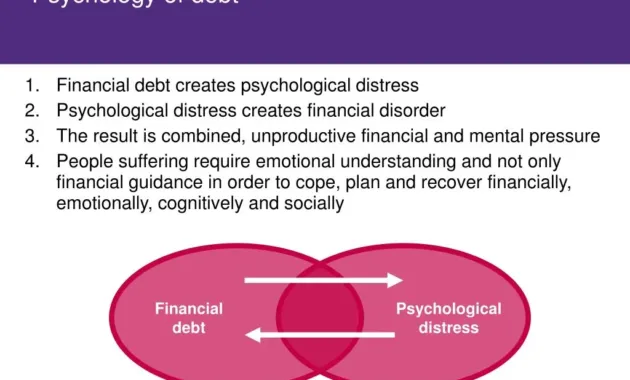

Address the Psychology of Debt

Debt repayment is not only a numbers game; mindset plays a crucial role. Recognizing the emotional triggers that lead to overspending helps you avoid relapse.

Adopt the “No‑Spend” Days

Designate specific days each month where you commit to zero discretionary spending. Over a year, this simple habit can free up a substantial amount for debt payments.

Reward Milestones Without Spending

When you clear a card or reach a payment milestone, celebrate with low‑cost activities—like a hike, a movie night at home, or a favorite podcast episode. The reward reinforces progress without adding new debt.

Consider Professional Help When Needed

If you find the debt overwhelming despite your best efforts, credit counseling agencies can provide structured repayment plans and negotiate with creditors on your behalf. Ensure you choose a reputable, nonprofit agency accredited by the National Foundation for Credit Counseling (NFCC) or a similar body.

When to Seek a Debt Management Plan (DMP)

- Multiple high‑interest balances with no clear repayment strategy.

- Difficulty making minimum payments on time.

- Desire for a single monthly payment to simplify budgeting.

A DMP typically reduces interest rates and may waive fees, but it also requires a strict adherence to the plan for three to five years.

Maintain Good Credit Habits After Paying Off Debt

Eliminating credit card debt is a milestone, not an endpoint. To protect the progress you’ve made, continue practicing responsible credit usage.

Keep Utilization Low

Even after paying off a card, keep the balance below 30 % of the credit limit. This habit supports a healthy credit utilization ratio and protects your credit score.

Avoid New High‑Interest Debt

If you need a credit card for convenience or rewards, choose one with a low APR and no annual fee. Use it only for purchases you can pay off in full each month.

Understanding the long‑term impact of credit utilization can be deepened by reading our guide on Understanding Credit Utilization Ratio. This knowledge helps you keep your credit health strong while you enjoy the freedom of a debt‑free life.

By combining a clear assessment, a disciplined repayment method, strategic use of balance transfers, and consistent monitoring, you can pay off credit card debt fast and stay on the path to financial stability. Each step builds on the last, creating a momentum that carries you from a burdened balance to a clean slate. Remember, the journey is incremental—every extra dollar, every avoided fee, and every mindful purchase contributes to the ultimate goal of debt freedom.