Table of Contents

- What Is a Secured Credit Card?

- Eligibility and Deposit Requirements

- How It Affects Your Credit Score

- Fees and Interest

- What Is an Unsecured Credit Card?

- Eligibility Criteria

- Credit Building Potential

- Costs and Benefits

- Secured vs Unsecured: Direct Comparison

- 1. Accessibility

- 2. Cost Structure

- 3. Credit Limit Flexibility

- 4. Reward Potential

- 5. Risk Exposure

- 6. Transition Opportunities

- Choosing the Right Card for Your Situation

- Scenario A: Starting From Scratch

- Scenario B: Rebuilding After Damage

- Scenario C: Established Credit Seeking Rewards

- Practical Tips for Maximizing Benefits and Minimizing Risks

When you first hear the terms “secured credit card” and “unsecured credit card,” the distinction may seem subtle, but the impact on your financial journey can be profound. Secured vs unsecured credit cards which is better is a question that surfaces for new borrowers, credit‑building enthusiasts, and even seasoned cardholders looking to diversify their credit portfolio. Understanding how each product works, the risks involved, and the benefits they provide helps you decide which path aligns with your short‑term needs and long‑term financial health.

In the next sections we will walk through the mechanics of both card types, compare their core features, and illustrate real‑world scenarios where one may outshine the other. By the end of this narrative, you’ll have a clear picture of the trade‑offs and the criteria you should weigh before signing up for either a secured or an unsecured card.

What Is a Secured Credit Card?

A secured credit card requires you to place a cash deposit with the issuer, which typically becomes your credit limit. This deposit serves as collateral, protecting the lender in case you fail to meet your payment obligations. Because the risk is mitigated by the deposit, secured cards are often the entry point for individuals with limited or damaged credit histories.

Eligibility and Deposit Requirements

- Most issuers ask for a minimum deposit ranging from $200 to $5,000.

- The deposit amount usually equals your credit limit, though some cards allow a higher limit based on additional factors.

- Applicants with no credit history or recent negative entries can still qualify, making secured cards a practical gateway to credit building.

How It Affects Your Credit Score

Because the account reports to the major credit bureaus, consistent on‑time payments can boost your credit score over time. The process mirrors that of an unsecured card, but the presence of a security deposit can sometimes lead to a slightly slower impact on the score. For a deeper dive into the scoring mechanics, see our guide on understanding the mechanics of credit scores.

Fees and Interest

Secured cards often carry higher annual fees and interest rates compared to their unsecured counterparts, reflecting the higher administrative costs of managing the deposit. However, many issuers waive fees for cardholders who demonstrate responsible use over a set period.

What Is an Unsecured Credit Card?

An unsecured credit card does not require a cash deposit. Instead, the issuer extends credit based on your creditworthiness, income, and overall financial profile. This type of card is the most common and typically offers a broader range of rewards, lower fees, and more flexible credit limits.

Eligibility Criteria

- Credit score requirements vary widely—from “fair” (around 620) to “excellent” (above 750).

- Proof of steady income and a low debt‑to‑income ratio are often required.

- Applicants with a robust credit history can access premium cards with higher limits and attractive perks.

Credit Building Potential

Because the credit limit is not tied to a deposit, the amount of available credit can grow faster with responsible usage, which can accelerate improvements in your credit score. The key is to maintain a low utilization ratio—ideally below 30% of your total limit—and to pay the balance in full each month.

Costs and Benefits

Unsecured cards generally feature lower interest rates, especially for those with higher credit scores. Many also provide rewards programs, travel protections, and purchase warranties that secured cards rarely match. However, they also come with the risk of higher debt accumulation if not managed prudently.

Secured vs Unsecured: Direct Comparison

To decide which card type is better for you, consider the following dimensions. Each factor can tip the scales depending on your personal circumstances, financial goals, and risk tolerance.

1. Accessibility

Secured cards win on accessibility. If you lack a credit history or have recent derogatory marks, the deposit requirement lowers the barrier to entry. Unsecured cards demand a proven credit track record, which can exclude many newcomers.

2. Cost Structure

Unsecured cards typically offer lower annual fees and interest rates. Secured cards may charge higher fees to offset the administrative work of handling deposits. However, some secured cards waive fees after a year of good payment behavior.

3. Credit Limit Flexibility

Unsecured cards often provide higher and more dynamic credit limits that can increase as your credit improves. Secured cards are limited by the size of your deposit, although some issuers will review and raise limits after a period of responsible use.

4. Reward Potential

Reward structures—cash back, points, travel miles—are predominantly found on unsecured cards. Secured cards rarely include such incentives, focusing instead on the fundamental goal of establishing credit.

5. Risk Exposure

With a secured card, the maximum financial loss equals your deposit, providing a built‑in safety net. Unsecured cards expose you to higher potential debt, especially if you carry balances and incur interest. This risk can be mitigated by disciplined spending and regular payments.

6. Transition Opportunities

Many issuers allow you to “graduate” from a secured to an unsecured card after a period of positive activity, often returning your deposit as a credit toward the new card. This pathway can be a strategic stepping stone for credit building.

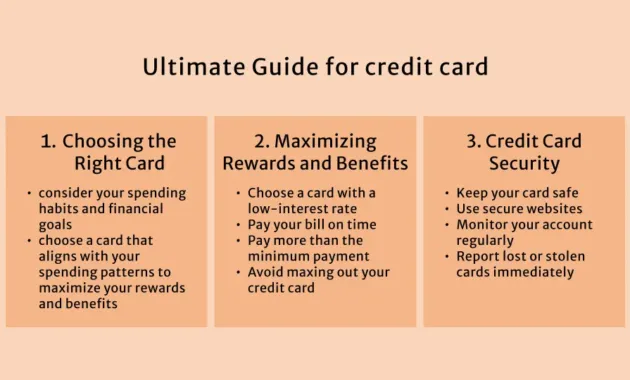

Choosing the Right Card for Your Situation

When evaluating whether a secured or unsecured credit card is better, match the card’s characteristics to your current financial landscape. Below are three common scenarios and the recommended approach for each.

Scenario A: Starting From Scratch

If you have no credit history, a secured card is the most reliable route. Begin with a modest deposit that you can comfortably afford, use the card for regular, low‑value purchases, and pay the balance in full each month. Over 6–12 months, you’ll likely see a measurable improvement in your credit score, positioning you for an unsecured card with better terms.

Scenario B: Rebuilding After Damage

For consumers with a tarnished credit record, a secured card again offers a safe avenue to demonstrate responsible behavior without risking additional debt. Look for cards that report to all three major bureaus and consider those that offer a path to upgrade to an unsecured card once your score rebounds.

Scenario C: Established Credit Seeking Rewards

If you already enjoy a solid credit score (above 700) and want to maximize benefits, an unsecured card with a competitive rewards program is the logical choice. Use the card strategically—pay the balance in full each month, keep utilization low, and take advantage of the rewards that align with your spending habits.

Regardless of the path you choose, mastering the mathematics behind interest can save you money. A quick reference on calculating credit card interest is available in our article how to calculate credit card interest—the simple formula everyone needs.

Practical Tips for Maximizing Benefits and Minimizing Risks

- Monitor Your Utilization: Keep balances under 30% of your limit to avoid negative score impact.

- Set Up Automatic Payments: This ensures you never miss a due date, protecting both your credit score and your deposit (if secured).

- Review Statements Regularly: Spot errors early and dispute any unauthorized charges using our step‑by‑step guide on how to dispute a credit card charge.

- Leverage Grace Periods: Pay off purchases within the grace period to avoid interest—see our discussion on the hidden power of grace periods for details.

- Plan for Upgrade: If you start with a secured card, inquire about the issuer’s upgrade policy after six months of on‑time payments.

By integrating these habits, you can extract the full value of your chosen card while keeping financial pitfalls at bay. Remember, the ultimate goal is not just obtaining a credit line, but using it as a tool for long‑term financial stability.

In the end, the answer to “Secured vs unsecured credit cards which is better?” hinges on where you stand today and where you aim to be tomorrow. If you need a foothold, a secured card offers a low‑risk entry point and a clear path to credit growth. If you already possess a respectable credit history and seek higher limits, lower fees, and rewards, an unsecured card will likely serve you better. Whichever route you select, disciplined use, timely payments, and regular monitoring will ensure the card works for you—not the other way around.