Table of Contents

- Understanding the Mechanics of Credit Scores

- Key Strategies to Boost Your Score with a Credit Card

- 1. Keep Utilization Low and Consistent

- 2. Prioritize On‑Time Payments

- 3. Maintain a Long Credit History

- 4. Build a Healthy Credit Mix

- 5. Leverage Rewards Without Compromising Credit Health

- Common Pitfalls to Avoid

- Overspending Due to “Free Money” Illusion

- Carrying a Balance to Earn Rewards

- Ignoring Statements and Fees

- Practical Steps to Implement the Strategy

- Step 1: Assess Your Current Situation

- Step 2: Set Clear, Measurable Goals

- Step 3: Choose the Right Card

- Step 4: Automate and Monitor

- Step 5: Review and Adjust Quarterly

- Real‑World Example: From 620 to 750 in One Year

- Integrating Credit Card Management with Debt Repayment

- Final Thoughts

- Understanding the Mechanics of Credit Scores

- Key Strategies to Boost Your Score with a Credit Card

- 1. Keep Utilization Low and Consistent

- 2. Prioritize On‑Time Payments

- 3. Maintain a Long Credit History

- 4. Build a Healthy Credit Mix

- 5. Leverage Rewards Without Compromising Credit Health

- Common Pitfalls to Avoid

- Overspending Due to “Free Money” Illusion

- Carrying a Balance to Earn Rewards

- Ignoring Statements and Fees

- Practical Steps to Implement the Strategy

- Step 1: Assess Your Current Situation

- Step 2: Set Clear, Measurable Goals

- Step 3: Choose the Right Card

- Step 4: Automate and Monitor

- Step 5: Review and Adjust Quarterly

- Real‑World Example: From 620 to 750 in One Year

- Integrating Credit Card Management with Debt Repayment

- Final Thoughts

When you first receive a credit card, the excitement of new buying power can be overwhelming. Yet, beneath the glossy rewards and introductory offers lies a powerful tool for financial health: the ability to improve your credit score. Understanding how to use that tool correctly can transform a simple plastic piece into a catalyst for better loan terms, lower insurance premiums, and greater financial flexibility.

The journey begins with a single, often underestimated action: treating your credit card as a deliberate, data‑driven instrument rather than a free pass to spend. By tracking balances, payment dates, and utilization ratios, you can create a disciplined routine that sends positive signals to the major credit bureaus. Over time, these signals accumulate, nudging your score upward in measurable ways.

Imagine a scenario where a young professional, Maya, opens her first unsecured credit card with a $1,000 limit. She decides to use the card for everyday expenses—groceries, gas, and a monthly subscription—while paying the full balance each month. Within six months, her credit utilization consistently hovers around 10 %, and her on‑time payment record is flawless. When she later applies for a mortgage, lenders view her as a low‑risk borrower, granting her a favorable interest rate that saves thousands over the life of the loan. This story illustrates how thoughtful credit‑card management directly translates into a stronger credit profile.

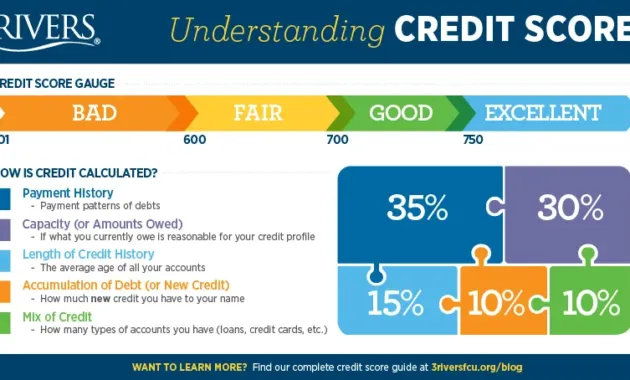

Understanding the Mechanics of Credit Scores

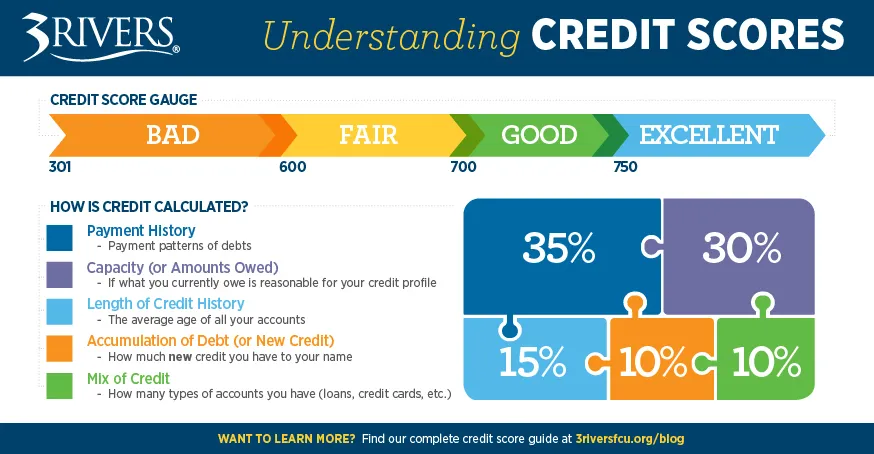

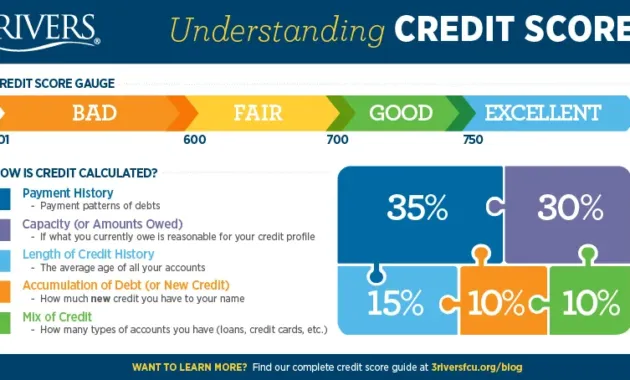

Before diving into specific strategies, it helps to grasp the five main components that compose most credit scoring models, such as FICO and VantageScore. Each component carries a weight that influences the overall score:

- Payment History (35 %): Timely payments are the single most influential factor.

- Credit Utilization (30 %): The ratio of your revolving balances to total credit limits.

- Length of Credit History (15 %): The age of your oldest account and the average age of all accounts.

- Credit Mix (10 %): The variety of credit types—revolving, installment, mortgage, etc.

- New Credit (10 %): Recent inquiries and newly opened accounts.

Credit cards affect each of these pillars, either positively or negatively, depending on how you wield them. The following sections break down actionable steps that target each factor, turning a credit card from a potential liability into a strategic asset.

Key Strategies to Boost Your Score with a Credit Card

1. Keep Utilization Low and Consistent

Credit utilization is calculated by dividing your total revolving balances by your total credit limits. A lower percentage signals to lenders that you are not overextended. Aim for a utilization rate below 30 %, and ideally under 10 % for the fastest score gains.

- Spread purchases across multiple cards: If you have more than one card, distribute expenses to keep each card’s individual utilization low.

- Request a credit limit increase: Higher limits lower your utilization automatically. For example, a $200 balance on a $2,000 limit yields 10 % utilization, versus 20 % on a $1,000 limit.

- Pay mid‑cycle: Some issuers report balances to bureaus on statement closing dates. By making a payment before that date, you can lower the reported balance.

For a deeper look at how a limit increase works, see our article Why Consider an Online Credit Limit Increase?.

2. Prioritize On‑Time Payments

Missing a payment can cause a sharp drop of 100 points or more, and the impact can linger for years. Set up automatic payments for at least the minimum amount, but aim to pay the full balance to avoid interest charges.

- Use calendar reminders: Even if you have autopay, a reminder helps you verify that the correct amount is being deducted.

- Leverage the grace period: Most cards offer a grace period on purchases if you pay the previous statement balance in full. This window lets you keep cash on hand while still avoiding interest.

- Monitor statements regularly: Spot errors early and dispute them promptly, a process explained in How to Dispute a Credit Card Charge – The Simple Process That Saves Your Money.

3. Maintain a Long Credit History

Age matters. The longer an account remains open and in good standing, the more it contributes to a positive score. If you’re tempted to close an older card after receiving a new one, resist the urge.

- Keep dormant cards active: Use them for a small, recurring charge (like a streaming subscription) and pay it off immediately.

- Avoid frequent account churn: Opening multiple new cards in a short period triggers hard inquiries, which can temporarily lower your score.

4. Build a Healthy Credit Mix

While a credit card alone can significantly improve your score, adding another type of credit—such as an installment loan—creates a more robust credit profile. If you already have a mortgage or auto loan, your credit card activity complements the mix.

When evaluating a new credit product, consider how it will affect your overall mix and whether you can manage the additional payment responsibly.

5. Leverage Rewards Without Compromising Credit Health

Many credit cards offer cash back, travel points, or other incentives. Using rewards wisely can enhance your financial situation without hurting your credit. For instance, redeeming cash back to pay down a balance effectively reduces utilization.

For a broader view on how to maximize a card’s value, read The Unfiltered Truth About Credit Cards: Benefits, Risks, and How to Maximize Their Value.

Common Pitfalls to Avoid

Overspending Due to “Free Money” Illusion

Seeing a credit limit as unlimited can lead to high balances that spike utilization and increase debt. Stick to a budget and treat your credit card like a debit card—spend only what you can afford to pay in full.

Carrying a Balance to Earn Rewards

Interest charges typically outweigh any rewards earned. The only scenario where carrying a balance might make sense is if you have a 0 % introductory APR that you plan to pay off before the period ends.

Ignoring Statements and Fees

Late fees, annual fees, and foreign transaction fees can erode your financial advantage. Review statements each month to catch unexpected charges early.

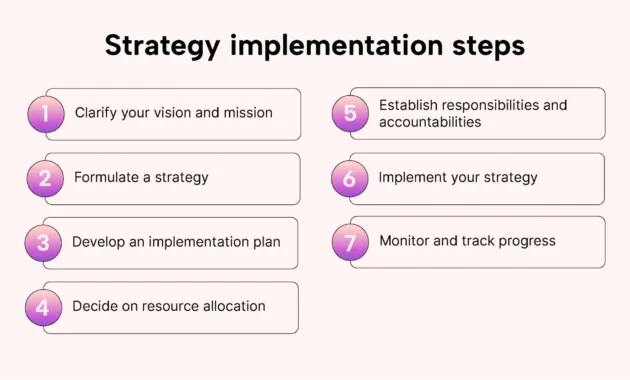

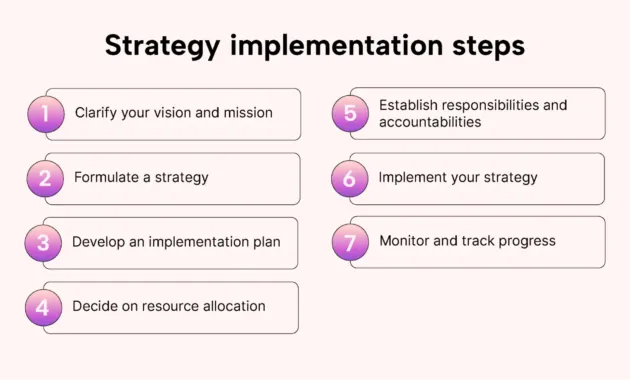

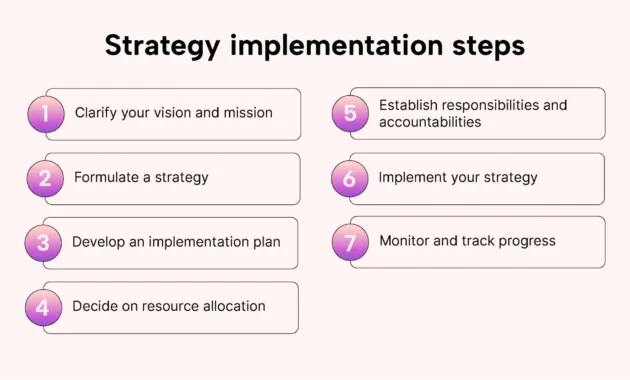

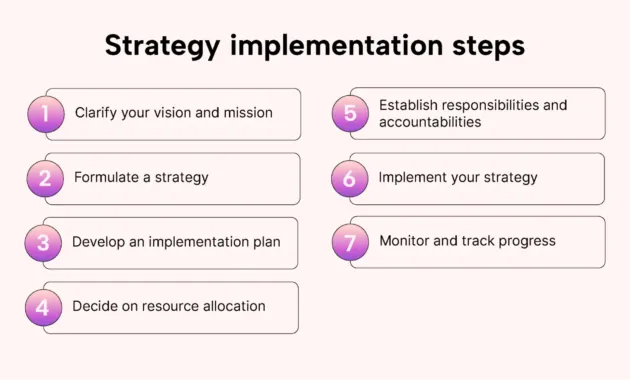

Practical Steps to Implement the Strategy

Step 1: Assess Your Current Situation

Obtain a free credit report from each of the three major bureaus (Equifax, Experian, TransUnion). Identify your current utilization, payment history, and any negative items.

Step 2: Set Clear, Measurable Goals

For example, aim to reduce utilization to 15 % within three months, or achieve a streak of 12 consecutive on‑time payments.

Step 3: Choose the Right Card

If you are new to credit, a secured card or a card with a modest limit can help you build history without excessive risk. If you already have a solid foundation, consider a card with a higher limit and valuable rewards, but ensure you can manage the increased exposure.

Step 4: Automate and Monitor

Set up autopay for the full balance, schedule monthly alerts for due dates, and use budgeting apps to track spending against your credit limit.

Step 5: Review and Adjust Quarterly

Every three months, re‑evaluate your utilization, payment patterns, and any changes in credit limits. Adjust your strategy—perhaps request a limit increase or add a new card—to keep momentum.

Real‑World Example: From 620 to 750 in One Year

John, a 28‑year‑old software engineer, started with a credit score of 620, a single credit card with a $500 limit, and a utilization of 70 % due to occasional overspending. He implemented the following plan:

- Requested a $1,500 limit increase, which was approved after six months of on‑time payments.

- Set up autopay for the full balance each month.

- Moved all recurring expenses to the card and paid the balance before the statement close date, keeping reported utilization under 15 %.

- Opened a second, low‑interest credit‑builder loan to diversify his credit mix.

Within twelve months, his utilization dropped to 8 %, his payment history remained flawless, and his average account age increased. Consequently, his score rose to 750, qualifying him for a low‑interest auto loan.

Integrating Credit Card Management with Debt Repayment

If you carry existing credit‑card debt, improving your score involves simultaneously reducing balances. Our guide on How to Pay Off Credit Card Debt Fast – 7 Proven Strategies That Actually Work outlines snowball and avalanche methods, which can be paired with the utilization‑reduction tactics discussed here.

By focusing on both repayment and responsible usage, you create a virtuous cycle: lower balances improve utilization, which lifts your score, making future borrowing cheaper and faster.

Final Thoughts

Improving a credit score with a credit card is less about chasing rewards and more about disciplined financial habits. By maintaining low utilization, paying on time, preserving account age, diversifying credit types, and avoiding common traps, you can steadily elevate your score. The benefits extend beyond a higher number; they translate into lower interest rates, better loan terms, and greater confidence in managing personal finances. Treat your credit card as a strategic tool, and watch it work quietly but effectively to build a stronger credit foundation.

When you first receive a credit card, the excitement of new buying power can be overwhelming. Yet, beneath the glossy rewards and introductory offers lies a powerful tool for financial health: the ability to improve your credit score. Understanding how to use that tool correctly can transform a simple plastic piece into a catalyst for better loan terms, lower insurance premiums, and greater financial flexibility.

The journey begins with a single, often underestimated action: treating your credit card as a deliberate, data‑driven instrument rather than a free pass to spend. By tracking balances, payment dates, and utilization ratios, you can create a disciplined routine that sends positive signals to the major credit bureaus. Over time, these signals accumulate, nudging your score upward in measurable ways.

Imagine a scenario where a young professional, Maya, opens her first unsecured credit card with a $1,000 limit. She decides to use the card for everyday expenses—groceries, gas, and a monthly subscription—while paying the full balance each month. Within six months, her credit utilization consistently hovers around 10 %, and her on‑time payment record is flawless. When she later applies for a mortgage, lenders view her as a low‑risk borrower, granting her a favorable interest rate that saves thousands over the life of the loan. This story illustrates how thoughtful credit‑card management directly translates into a stronger credit profile.

Understanding the Mechanics of Credit Scores

Before diving into specific strategies, it helps to grasp the five main components that compose most credit scoring models, such as FICO and VantageScore. Each component carries a weight that influences the overall score:

- Payment History (35 %): Timely payments are the single most influential factor.

- Credit Utilization (30 %): The ratio of your revolving balances to total credit limits.

- Length of Credit History (15 %): The age of your oldest account and the average age of all accounts.

- Credit Mix (10 %): The variety of credit types—revolving, installment, mortgage, etc.

- New Credit (10 %): Recent inquiries and newly opened accounts.

Credit cards affect each of these pillars, either positively or negatively, depending on how you wield them. The following sections break down actionable steps that target each factor, turning a credit card from a potential liability into a strategic asset.

Key Strategies to Boost Your Score with a Credit Card

1. Keep Utilization Low and Consistent

Credit utilization is calculated by dividing your total revolving balances by your total credit limits. A lower percentage signals to lenders that you are not overextended. Aim for a utilization rate below 30 %, and ideally under 10 % for the fastest score gains.

- Spread purchases across multiple cards: If you have more than one card, distribute expenses to keep each card’s individual utilization low.

- Request a credit limit increase: Higher limits lower your utilization automatically. For example, a $200 balance on a $2,000 limit yields 10 % utilization, versus 20 % on a $1,000 limit.

- Pay mid‑cycle: Some issuers report balances to bureaus on statement closing dates. By making a payment before that date, you can lower the reported balance.

For a deeper look at how a limit increase works, see our article Why Consider an Online Credit Limit Increase?.

2. Prioritize On‑Time Payments

Missing a payment can cause a sharp drop of 100 points or more, and the impact can linger for years. Set up automatic payments for at least the minimum amount, but aim to pay the full balance to avoid interest charges.

- Use calendar reminders: Even if you have autopay, a reminder helps you verify that the correct amount is being deducted.

- Leverage the grace period: Most cards offer a grace period on purchases if you pay the previous statement balance in full. This window lets you keep cash on hand while still avoiding interest.

- Monitor statements regularly: Spot errors early and dispute them promptly, a process explained in How to Dispute a Credit Card Charge – The Simple Process That Saves Your Money.

3. Maintain a Long Credit History

Age matters. The longer an account remains open and in good standing, the more it contributes to a positive score. If you’re tempted to close an older card after receiving a new one, resist the urge.

- Keep dormant cards active: Use them for a small, recurring charge (like a streaming subscription) and pay it off immediately.

- Avoid frequent account churn: Opening multiple new cards in a short period triggers hard inquiries, which can temporarily lower your score.

4. Build a Healthy Credit Mix

While a credit card alone can significantly improve your score, adding another type of credit—such as an installment loan—creates a more robust credit profile. If you already have a mortgage or auto loan, your credit card activity complements the mix.

When evaluating a new credit product, consider how it will affect your overall mix and whether you can manage the additional payment responsibly.

5. Leverage Rewards Without Compromising Credit Health

Many credit cards offer cash back, travel points, or other incentives. Using rewards wisely can enhance your financial situation without hurting your credit. For instance, redeeming cash back to pay down a balance effectively reduces utilization.

For a broader view on how to maximize a card’s value, read The Unfiltered Truth About Credit Cards: Benefits, Risks, and How to Maximize Their Value.

Common Pitfalls to Avoid

Overspending Due to “Free Money” Illusion

Seeing a credit limit as unlimited can lead to high balances that spike utilization and increase debt. Stick to a budget and treat your credit card like a debit card—spend only what you can afford to pay in full.

Carrying a Balance to Earn Rewards

Interest charges typically outweigh any rewards earned. The only scenario where carrying a balance might make sense is if you have a 0 % introductory APR that you plan to pay off before the period ends.

Ignoring Statements and Fees

Late fees, annual fees, and foreign transaction fees can erode your financial advantage. Review statements each month to catch unexpected charges early.

Practical Steps to Implement the Strategy

Step 1: Assess Your Current Situation

Obtain a free credit report from each of the three major bureaus (Equifax, Experian, TransUnion). Identify your current utilization, payment history, and any negative items.

Step 2: Set Clear, Measurable Goals

For example, aim to reduce utilization to 15 % within three months, or achieve a streak of 12 consecutive on‑time payments.

Step 3: Choose the Right Card

If you are new to credit, a secured card or a card with a modest limit can help you build history without excessive risk. If you already have a solid foundation, consider a card with a higher limit and valuable rewards, but ensure you can manage the increased exposure.

Step 4: Automate and Monitor

Set up autopay for the full balance, schedule monthly alerts for due dates, and use budgeting apps to track spending against your credit limit.

Step 5: Review and Adjust Quarterly

Every three months, re‑evaluate your utilization, payment patterns, and any changes in credit limits. Adjust your strategy—perhaps request a limit increase or add a new card—to keep momentum.

Real‑World Example: From 620 to 750 in One Year

John, a 28‑year‑old software engineer, started with a credit score of 620, a single credit card with a $500 limit, and a utilization of 70 % due to occasional overspending. He implemented the following plan:

- Requested a $1,500 limit increase, which was approved after six months of on‑time payments.

- Set up autopay for the full balance each month.

- Moved all recurring expenses to the card and paid the balance before the statement close date, keeping reported utilization under 15 %.

- Opened a second, low‑interest credit‑builder loan to diversify his credit mix.

Within twelve months, his utilization dropped to 8 %, his payment history remained flawless, and his average account age increased. Consequently, his score rose to 750, qualifying him for a low‑interest auto loan.

Integrating Credit Card Management with Debt Repayment

If you carry existing credit‑card debt, improving your score involves simultaneously reducing balances. Our guide on How to Pay Off Credit Card Debt Fast – 7 Proven Strategies That Actually Work outlines snowball and avalanche methods, which can be paired with the utilization‑reduction tactics discussed here.

By focusing on both repayment and responsible usage, you create a virtuous cycle: lower balances improve utilization, which lifts your score, making future borrowing cheaper and faster.

Final Thoughts

Improving a credit score with a credit card is less about chasing rewards and more about disciplined financial habits. By maintaining low utilization, paying on time, preserving account age, diversifying credit types, and avoiding common traps, you can steadily elevate your score. The benefits extend beyond a higher number; they translate into lower interest rates, better loan terms, and greater confidence in managing personal finances. Treat your credit card as a strategic tool, and watch it work quietly but effectively to build a stronger credit foundation.

[TAGS]: credit score improvement, credit card usage, credit utilization, on-time payments, credit history, credit mix, financial planning, debt management, credit limit increase, personal finance