Table of Contents

- Why Consider an Online Credit Limit Increase?

- Impact on Credit Utilization

- Enhanced Purchasing Power for Big Expenses

- Eligibility Checklist Before You Click “Submit”

- Step‑by‑Step Guide to Requesting an Increase Online

- 1. Log In to Your Cardholder Portal

- 2. Locate the “Credit Limit Increase” Section

- 3. Provide Updated Financial Information

- 4. Specify the Desired Limit

- 5. Review and Submit

- What Happens After Submission?

- Handling a Denial

- Best Practices for Managing Your New Credit Limit

- Maintain Low Utilization

- Pay Balances in Full When Possible

- Avoid Unnecessary Hard Inquiries

- Monitor Your Account Regularly

- Potential Risks and How to Mitigate Them

- Setting Personal Spending Limits

- Reviewing Terms and Conditions

- Alternative Strategies to Boost Credit Without a Limit Increase

Increasing your credit limit online has become a routine task for many cardholders who seek more purchasing power without the hassle of a phone call or a branch visit. The convenience of digital banking platforms means you can submit a request, receive an instant decision, and start using the extra credit within minutes. However, the process is not just about clicking a button; it involves understanding how issuers evaluate your request, preparing the right financial profile, and managing the new credit responsibly.

This article walks you through the entire journey of obtaining a higher credit line via the internet. From preparing your credit report and assessing your utilization ratio to navigating the issuer’s online portal and handling possible rejections, every step is explained in a clear, narrative style. By the end, you’ll know exactly what to do to improve your chances of approval and how to use the increased limit wisely.

Why Consider an Online Credit Limit Increase?

Cardholders often request a higher limit for several practical reasons. A larger credit line can lower your credit utilization ratio, which in turn may boost your credit score. It also provides a safety net for emergencies, larger purchases, or travel expenses where a higher limit reduces the likelihood of hitting a ceiling mid‑transaction. Moreover, many issuers offer better rewards or promotional rates to customers with higher balances, making a limit increase a strategic move for financial flexibility.

Impact on Credit Utilization

Credit utilization is the percentage of your total revolving credit that you are using at any given time. For example, if you have a $5,000 limit and carry a $1,250 balance, your utilization sits at 25 %. Raising the limit to $10,000 while maintaining the same balance drops the utilization to 12.5 %, a figure that credit scoring models typically view more favorably. To understand this metric more deeply, you might explore resources on understanding credit utilization ratio.

Enhanced Purchasing Power for Big Expenses

Whether you are planning a home renovation, a major appliance purchase, or an overseas vacation, a higher limit can prevent transaction declines and reduce the need to split payments across multiple cards. This streamlined approach often saves time and may avoid additional fees associated with multiple small‑limit cards.

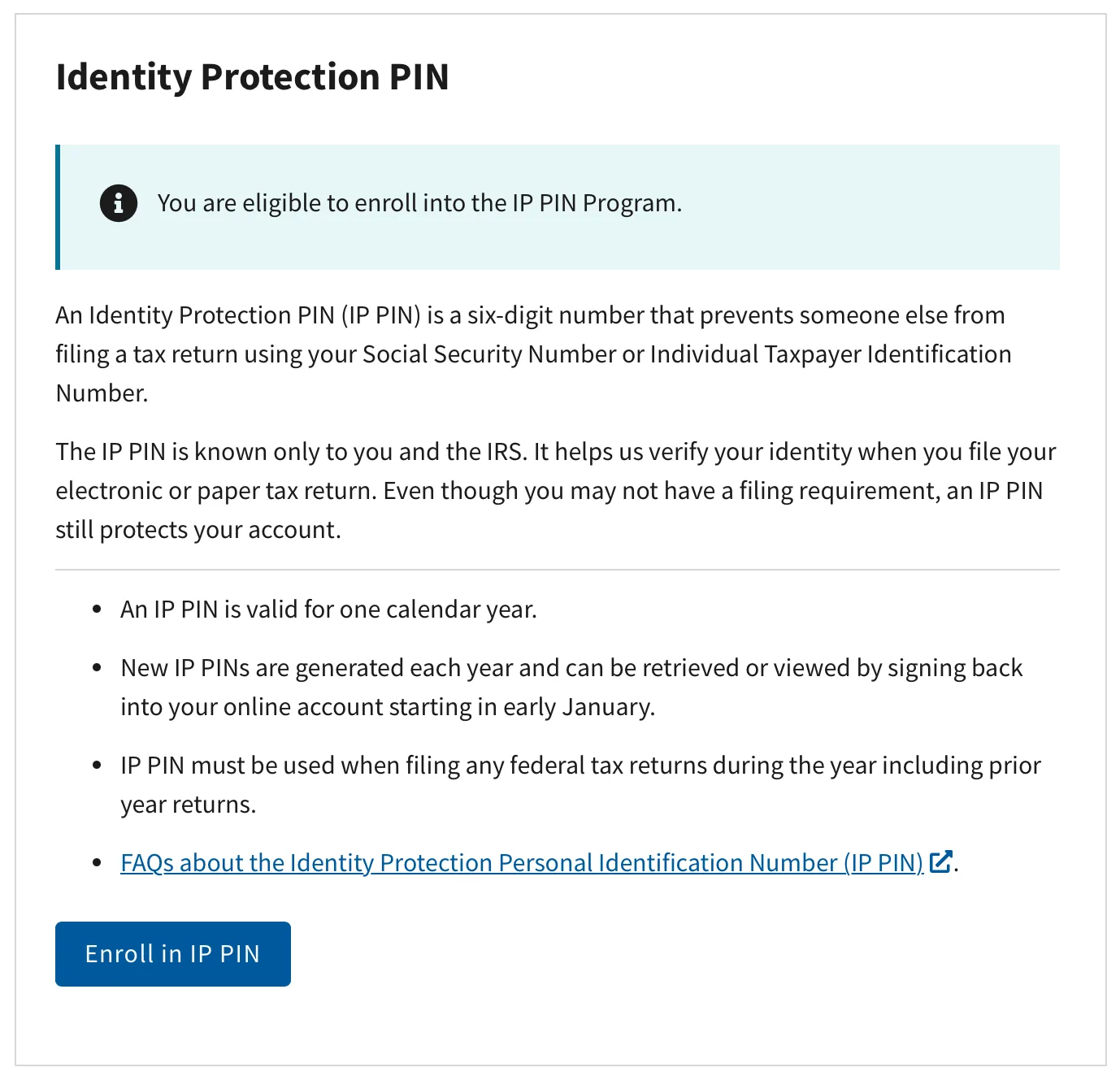

Eligibility Checklist Before You Click “Submit”

Before you log into your online banking portal, verify that you meet the typical criteria issuers use to evaluate limit increase requests. While each bank has its own policies, the following factors are commonly considered:

- Payment History: Consistently paying at least the minimum amount on time, preferably the full balance.

- Current Credit Utilization: Maintaining a utilization below 30 % is generally viewed positively.

- Income Verification: Having a stable and verifiable income that can support a higher borrowing capacity.

- Account Age: Most issuers prefer the account to be open for at least six months before considering a raise.

- Recent Credit Activity: Frequent hard inquiries or recent applications for new credit may signal risk, potentially leading to a denial.

If any of these areas need improvement, take a moment to address them—perhaps by paying down existing balances or updating your income information—before proceeding with the online request.

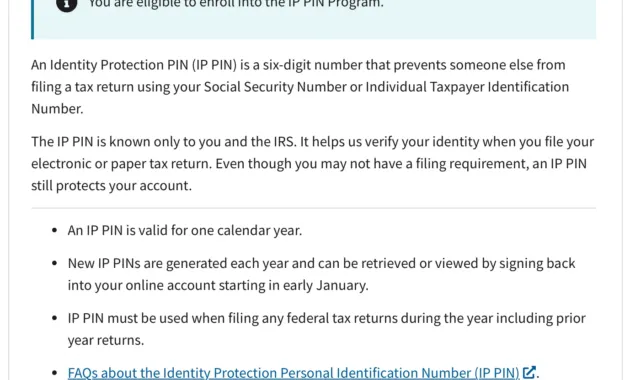

Step‑by‑Step Guide to Requesting an Increase Online

1. Log In to Your Cardholder Portal

Begin by signing into your credit card account through the issuer’s secure website or mobile app. If you are unsure how to access the portal, you can follow a detailed walkthrough such as how to seamlessly sign in to your Bank of America credit card account. Ensure you have your username, password, and any required two‑factor authentication devices ready.

2. Locate the “Credit Limit Increase” Section

Most banks place this option under “Account Services,” “Manage Card,” or a similar menu. Look for a button labeled “Request Increase,” “Increase Credit Limit,” or “Adjust Limit.” If the portal offers a quick FAQ, it may provide insight into typical processing times and required documentation.

3. Provide Updated Financial Information

The online form will ask for details such as:

- Current annual income (including salary, bonuses, and other sources).

- Employment status and employer name.

- Monthly housing costs (rent or mortgage).

- Any additional debts or obligations.

Accurate data helps the issuer’s automated underwriting system make an instant decision. Some platforms may also request a recent pay stub or tax document for verification.

4. Specify the Desired Limit

While you can request a specific amount, many issuers will evaluate your request and offer a limit that aligns with their risk models. It’s often wise to request a modest increase—typically 10‑20 % of your existing limit—to improve approval odds.

5. Review and Submit

Double‑check all entered information for accuracy. Once satisfied, click the submit button. In many cases, the decision is rendered instantly, and you will receive an on‑screen notification indicating approval, a provisional increase, or a denial.

What Happens After Submission?

If approved, the new limit is usually active within minutes, though some issuers may place a brief hold for security verification. You’ll receive an email or in‑app notification confirming the change. If the request is denied, the issuer typically provides a reason—such as insufficient income or high utilization—allowing you to address the issue before trying again.

Handling a Denial

When faced with a rejection, consider these remedial steps:

- Pay down existing balances to improve utilization.

- Update your income information if you recently received a raise.

- Wait at least 30‑60 days before re‑applying, giving your credit profile time to improve.

- Contact customer service for a more detailed explanation; sometimes a brief conversation can resolve misunderstandings.

Understanding the “hidden truth about minimum payments on credit cards” can also help you manage balances more effectively, as explained in the hidden truth about minimum payments. Reducing the balance faster than the minimum can showcase responsible usage to the issuer.

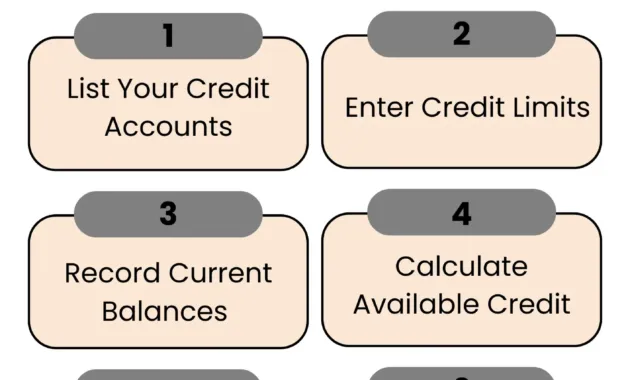

Best Practices for Managing Your New Credit Limit

Obtaining a higher limit is only the first step; responsible usage determines whether the increase benefits your credit health. Follow these guidelines to make the most of your expanded credit line:

Maintain Low Utilization

Even with a higher limit, aim to keep utilization below 30 %, preferably under 10 % for optimal scoring impact. This demonstrates that you are not reliant on credit and can manage debt prudently.

Pay Balances in Full When Possible

While paying the minimum avoids late fees, carrying a balance accrues interest and can erode the benefits of a higher limit. Paying the full statement balance each month preserves your financial flexibility and protects your credit score.

Avoid Unnecessary Hard Inquiries

Each new credit application results in a hard inquiry, which can temporarily dip your score. If you’ve just received a limit increase, postpone applying for additional credit cards or loans for at least six months.

Monitor Your Account Regularly

Set up alerts for large transactions, approaching utilization thresholds, and upcoming payment due dates. Regular monitoring helps you spot fraudulent activity early and stay on top of your spending habits.

Potential Risks and How to Mitigate Them

A larger credit line can tempt some cardholders to overspend, leading to higher balances and increased interest costs. To guard against this, treat the increase as a safety net rather than an invitation to spend more. Additionally, be aware that some issuers may raise your annual fee or adjust the interest rate after a limit increase, especially if your credit profile improves significantly.

Setting Personal Spending Limits

Even if the issuer does not impose a hard limit, you can create a personal budget ceiling within your banking app or through third‑party budgeting tools. This self‑imposed restriction helps you stay aligned with your financial goals.

Reviewing Terms and Conditions

Before confirming the increase, read the updated terms. Look for changes in fee structures, interest rates, or reward program eligibility that might accompany the new limit.

Alternative Strategies to Boost Credit Without a Limit Increase

If your request is denied or you prefer not to increase your existing limit, consider these alternatives:

- Open a New Credit Card: Adding a new account can raise your total available credit, effectively lowering utilization.

- Request a Balance Transfer: Moving high‑interest balances to a card with a promotional 0 % APR can reduce monthly payments and improve utilization.

- Become an Authorized User: Being added to a family member’s card with a high limit can instantly boost your available credit.

For a deeper dive into balance transfers, see how credit card balance transfers actually work. Each of these tactics can complement or replace a direct limit increase, depending on your personal circumstances.

In summary, increasing your credit limit online is a straightforward yet strategic move that can enhance your credit profile, provide financial flexibility, and improve purchasing power. By preparing your financial information, understanding issuer criteria, and following the step‑by‑step online process, you maximize your chances of a successful request. Once approved, disciplined usage—maintaining low utilization, paying balances in full, and monitoring activity—ensures the added credit works for you rather than against you.