Table of Contents

- How a Cash Advance Is Processed

- Key Differences Between Cash Advances and Regular Purchases

- Interest Accrual

- Fees

- Credit Limit Allocation

- Impact on Credit Utilization

- Typical Fees and Rates

- When a Cash Advance Might Be Appropriate

- Emergency Situations

- Travel Needs

- Limited Access to Other Credit

- Risks and Drawbacks

- Rapid Debt Accumulation

- Credit Score Impact

- Potential for Higher Fees

- Strategies to Minimize Cost

- Pay the Balance Immediately

- Use a Card with No Cash‑Advance Fee

- Explore Alternatives First

- Monitor Your Statement

- How a Cash Advance Affects Your Credit Card Statement

- Interaction With Credit Card Holds

- Best Practices for Managing Cash Advances

- Real‑World Example: A Day in the Life of a Cash‑Advance User

What is a cash advance on a credit card? It is a short‑term loan that lets you take out cash using the credit line on your card, often at an ATM or a bank teller. Unlike a regular purchase, the transaction is processed as a cash advance, which triggers a different set of rules, fees, and interest calculations. Many cardholders think of cash advances as a convenient emergency option, but the reality is more nuanced.

Imagine you are traveling abroad and need local currency, or you face an unexpected car repair and your checking account is empty. In those moments, a cash advance can feel like a lifeline. However, the same convenience can become a financial burden if you are unaware of the hidden costs. Understanding how cash advances are structured helps you decide whether to use them or explore alternatives.

In the sections that follow, we will walk through the mechanics of a cash advance, compare it to regular purchases, explore the fees and interest rates involved, and offer practical tips for minimizing the impact on your credit score. By the end of this article, you will have a clear picture of when a cash advance makes sense and when it does not.

How a Cash Advance Is Processed

When you request a cash advance, the credit card issuer treats the transaction as a separate line item from your ordinary purchases. The process typically follows these steps:

- Authorization: The issuer checks your available credit limit for cash advances, which is often lower than the total credit limit.

- Disbursement: Cash is dispensed through an ATM, a bank teller, or a convenience‑store check.

- Posting: The advance appears on your statement as a “cash advance” with its own balance and interest rate.

Because the transaction bypasses the merchant network, the issuer does not receive the usual interchange fee. Instead, they apply a higher interest rate from the moment the cash is withdrawn, and they may also charge a flat fee.

Key Differences Between Cash Advances and Regular Purchases

Interest Accrual

With ordinary purchases, most cards offer a grace period—typically 20‑25 days—during which no interest is charged if the balance is paid in full. Cash advances do not enjoy this grace period. Interest starts accruing immediately, often at a rate that is 3‑5 percentage points higher than the standard purchase APR.

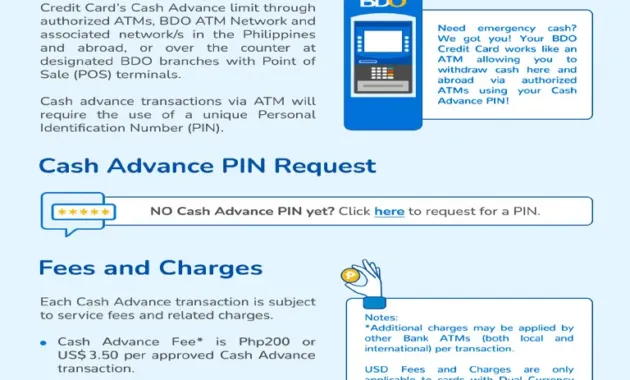

Fees

Most issuers charge a cash‑advance fee that is either a flat amount (e.g., $5‑$10) or a percentage of the withdrawn amount, usually 3‑5 %. Some premium cards waive the fee for certain account types, but the majority still apply it.

Credit Limit Allocation

Credit cards divide the total credit limit into two portions: a purchase limit and a cash‑advance limit. The cash‑advance limit is commonly 20‑30 % of the overall limit. If you have a $10,000 credit line, you might only be able to withdraw $2,000 as a cash advance.

Impact on Credit Utilization

Both purchases and cash advances contribute to your overall credit utilization ratio, which is a key factor in credit scoring models. However, because cash advances often carry higher balances and are repaid slower due to higher interest, they can increase utilization more dramatically.

Typical Fees and Rates

Below is a typical breakdown of costs associated with a cash advance. Your exact numbers will vary by issuer.

- Cash‑advance fee: 3 % of the amount withdrawn, minimum $5.

- APR: 24‑30 % (versus 15‑20 % for purchases).

- No grace period: Interest begins the day the cash is taken.

- ATM surcharge: If you use an out‑of‑network ATM, the operator may add a $2‑$5 fee.

For example, a $500 cash advance with a 3 % fee and a 27 % APR would cost $15 in fees upfront. If you repay the amount over 30 days, the interest accrued would be roughly $33, bringing the total cost to $548.

When a Cash Advance Might Be Appropriate

Emergency Situations

If you face an urgent expense—medical, travel, or home repair—and have no other liquid assets, a cash advance can provide immediate funds. In this scenario, the priority is speed, not cost.

Travel Needs

When traveling abroad, some travelers use cash advances to obtain local currency without relying on foreign‑exchange services that may have unfavorable rates. However, many credit cards now offer fee‑free foreign‑currency withdrawals, so compare options before deciding.

Limited Access to Other Credit

Individuals with low credit limits on other cards may find the cash‑advance limit sufficient for a short‑term need. In such cases, the key is to have a clear repayment plan.

Risks and Drawbacks

Rapid Debt Accumulation

Because interest compounds daily, a cash‑advance balance can balloon quickly if left unpaid. This can lead to a cycle of debt that is difficult to break.

Credit Score Impact

High utilization from a cash advance can lower your credit score, especially if the balance is reported before you have a chance to pay it down. Additionally, frequent cash advances may signal financial distress to lenders.

Potential for Higher Fees

ATM operators may add their own surcharge, and some merchants treat cash‑advance checks as ordinary purchases but still charge the cash‑advance fee. Always read the fine print.

Strategies to Minimize Cost

Pay the Balance Immediately

Since interest accrues from day one, paying off the cash‑advance balance as soon as possible reduces total interest. Even a partial payment can lower the daily interest charge.

Use a Card with No Cash‑Advance Fee

Some premium cards waive cash‑advance fees for elite members. If you travel frequently, consider a card that offers fee‑free cash withdrawals abroad.

Explore Alternatives First

Before taking a cash advance, check if you have a low‑interest personal loan, a line of credit, or a balance‑transfer offer that could be cheaper. Even borrowing from a trusted friend or family member might be a better option.

Monitor Your Statement

Regularly review your credit‑card statement to ensure the cash‑advance fee and interest are calculated correctly. If you notice discrepancies, contact the issuer promptly.

How a Cash Advance Affects Your Credit Card Statement

On your monthly statement, cash advances appear under a separate heading, often labeled “Cash Advances” or “Cash Advance Transactions.” The line item includes the amount withdrawn, the cash‑advance fee, and the accrued interest to date. Understanding this layout helps you track the cost and avoid surprises.

If you want to dive deeper into how credit card statements work, our guide on how to read a credit card statement offers a step‑by‑step walkthrough.

Interaction With Credit Card Holds

A cash advance is distinct from a credit‑card hold, which is a temporary reservation of funds for a pending transaction, such as a hotel booking or car rental. Holds do not generate interest, whereas cash advances do. For a clear picture of these mechanisms, see our article on what is a credit card hold.

Best Practices for Managing Cash Advances

- Set a repayment deadline in your budgeting app the same day you withdraw cash.

- Keep the cash‑advance amount low—only what you truly need.

- Choose an issuer that offers a lower cash‑advance APR or waives the fee.

- Track the daily interest accrual to understand the true cost.

- Consider using a prepaid debit card for short‑term cash needs instead of a credit‑card cash advance.

Real‑World Example: A Day in the Life of a Cash‑Advance User

Maria, a freelance graphic designer, received an unexpected plumbing bill of $750. Her checking account had only $200, and she needed cash quickly to avoid service interruption. She logged into her online banking portal, located the “Cash Advance” option, and withdrew $600 from an ATM. The transaction incurred a $18 fee (3 %) and a 27 % APR. Maria set a reminder to pay off the balance within ten days, transferring $250 from her upcoming client payment and using the remaining $350 from her savings. By the time she cleared the balance, she had paid roughly $25 in interest, far less than the potential penalty for a delayed plumbing service.

Maria’s experience illustrates that a cash advance can be a practical short‑term tool when paired with a disciplined repayment plan. It also shows why understanding fees and interest is essential to avoid unnecessary costs.

In summary, a cash advance on a credit card is a convenient but costly borrowing option that starts accruing interest immediately, carries a fee, and reduces your available credit. It can be useful in emergencies, travel, or when other credit sources are unavailable, but it demands careful management to prevent financial strain. By assessing the true cost, exploring alternatives, and repaying promptly, you can use cash advances responsibly without jeopardizing your credit health.