Table of Contents

- Why Keeping Your Contact Information Current Matters

- Common Triggers That Prompt an Update

- Methods to Update Your Contact Information

- Online Banking Portal

- Mobile Banking App

- Phone Call to Customer Service

- Mail or Secure Message

- Step‑by‑Step Walkthrough: Updating via the Online Portal

- Verification and Security Checks

- Potential Pitfalls and How to Avoid Them

- Delayed Processing Times

- Inconsistent Information Across Platforms

- Missing Confirmation Emails

- Best Practices for Maintaining Accurate Contact Details

- What Happens After the Update?

- Related Topics You Might Find Helpful

- Final Thoughts

Updating contact information on a credit card is a routine task that many cardholders overlook until a problem arises. From a missed statement to a declined transaction, an outdated address or phone number can cause unnecessary stress. The keyword “update contact info on credit card” captures the core action that safeguards communication between the issuer and the cardholder.

This article walks you through the why, when, and how of keeping your contact details current. By following the narrative presented here, you’ll see how a simple change can prevent missed alerts, ensure timely delivery of new cards, and maintain the security of your account. The steps are illustrated with real‑world scenarios, making the process feel less like a chore and more like a logical part of managing your finances.

Imagine receiving a credit‑card statement at an old address, only to discover an unauthorized charge because you never saw the alert. Or think about the moment you try to activate a replacement card, but the issuer can’t reach you for verification. These stories highlight the importance of an up‑to‑date profile. Let’s explore the practical path to a seamless update.

Why Keeping Your Contact Information Current Matters

Credit card issuers rely on accurate contact data for several critical functions. First, they use it to deliver physical cards, statements, and replacement cards. Second, they send security alerts such as fraud notifications, password reset codes, and transaction confirmations. Third, regulatory compliance often mandates that issuers maintain a reliable channel to communicate with the account holder.

When any of these channels break, the consequences can be more than an inconvenience. Missed fraud alerts may lead to larger losses, while delayed statement delivery can affect credit reporting and budgeting. In some cases, an outdated address may cause a new card to be sent to the wrong location, exposing the card to theft. By ensuring your address, phone number, and email are up to date, you maintain a clear line of defense against these risks.

Common Triggers That Prompt an Update

Life events often trigger the need to change contact details. Moving to a new residence, changing your phone carrier, adopting a new email address, or even a name change after marriage are typical scenarios. Additionally, some cardholders discover they need to update info after a card replacement is sent to an old address or after a security alert fails to reach them.

Proactive cardholders treat these triggers as reminders rather than afterthoughts. By setting a personal reminder—perhaps linked to a calendar event for a lease renewal—they can promptly log into their account and verify the stored information.

Methods to Update Your Contact Information

Most issuers provide multiple channels for updating contact details. Choosing the right method depends on convenience, security preferences, and the issuer’s available technology.

Online Banking Portal

- Log in to your account using a secure username and password.

- Navigate to the “Profile” or “Personal Information” section.

- Locate fields for mailing address, phone number, and email.

- Enter the new information and confirm any verification prompts.

- Save changes and review a confirmation screen or email.

Online portals are the most popular option because they provide instant updates and a visible confirmation. Most issuers also log the change date for future reference.

Mobile Banking App

- Open the app and sign in with biometrics or a passcode.

- Tap the menu icon and select “Account Settings.”

- Choose “Contact Info” and edit the desired fields.

- Submit the changes; some apps may request a one‑time PIN sent via SMS.

The mobile app offers a quick on‑the‑go solution, especially useful when you’re already in a new city and need to update your address before the next billing cycle.

Phone Call to Customer Service

- Dial the issuer’s dedicated customer service number (found on the back of your card).

- Verify your identity by answering security questions.

- Request the update and provide the new details to the representative.

- Ask for a confirmation number or email to document the change.

Speaking directly with an agent is helpful for those who prefer a personal touch or have complex situations, such as updating multiple addresses for joint accounts.

Mail or Secure Message

- Write a formal letter including your full name, card number (or last four digits), and the new contact information.

- Sign the letter and include a copy of a government‑issued ID for verification.

- Mail it to the address listed in the issuer’s “Contact Us” section.

- Allow 7‑10 business days for processing and receive a written confirmation.

While slower, mail is still an option for those who lack internet access or who want a paper trail.

Step‑by‑Step Walkthrough: Updating via the Online Portal

Below is a detailed scenario illustrating the online update process. This narrative follows a typical cardholder, Alex, who recently moved to a new apartment.

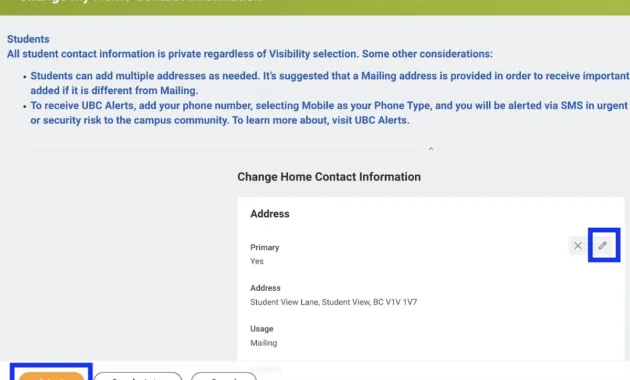

Alex logs into the issuer’s website using two‑factor authentication. After entering the security code sent to his mobile phone, he lands on the dashboard and selects “My Profile.” The “Contact Information” tab displays his current mailing address, phone number, and email.

He clicks “Edit” next to the mailing address field. A form appears, prompting him to fill in the street, city, state, and ZIP code. Alex types the new address, double‑checks the ZIP code for accuracy, and then clicks “Save.” The portal instantly shows a confirmation banner: “Your contact information has been updated successfully.” Within minutes, an automated email arrives, summarizing the changes and providing a reference number.

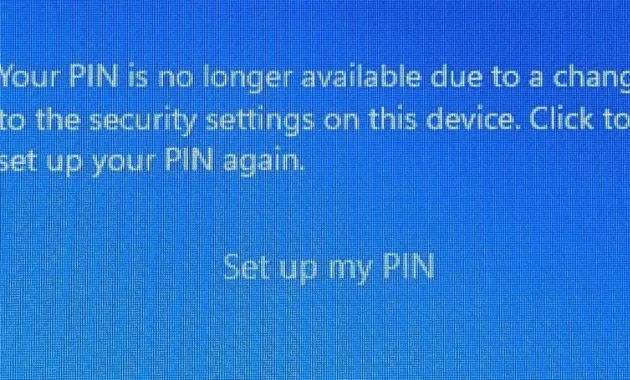

Alex’s experience mirrors the standard flow for most issuers, but it’s important to note that some platforms may require an additional verification step—such as re‑entering the last four digits of the card or confirming via a text message. This extra layer protects against unauthorized changes.

Verification and Security Checks

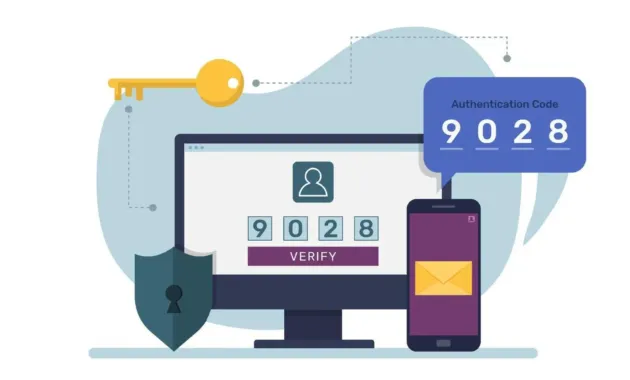

Security is a central theme in any contact‑info update. Issuers implement verification methods to ensure that only the rightful account holder can make changes. Common checks include:

- Security questions (e.g., mother’s maiden name, first pet).

- One‑time passcodes (OTP) sent via SMS or email.

- Biometric authentication through mobile apps (fingerprint or facial recognition).

- Document upload (photo ID) for mail‑in requests.

If the verification fails, the system will block the update and prompt the user to retry or contact support. This safeguard reduces the risk of fraudsters hijacking accounts by altering contact details to intercept communications.

Potential Pitfalls and How to Avoid Them

Delayed Processing Times

Some issuers may take up to 48 hours to propagate changes across all internal systems. During this window, you might still receive statements at the old address. To avoid missing important documents, schedule your update at least a week before any anticipated billing cycle.

Inconsistent Information Across Platforms

It’s possible for the mobile app and the website to display different data if one was updated and the other not. After making a change, verify the information on all platforms you use. If inconsistencies persist, contact customer service for clarification.

Missing Confirmation Emails

Spam filters occasionally block confirmation messages. Add the issuer’s domain to your safe‑sender list, or request an on‑screen confirmation number that you can note for future reference.

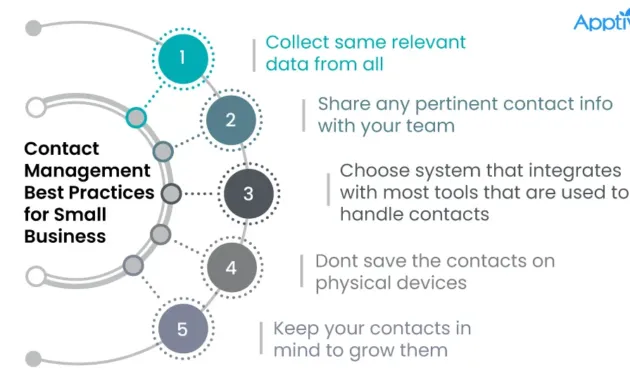

Best Practices for Maintaining Accurate Contact Details

- Set a Calendar Reminder: Align the reminder with major life events, such as lease renewals or annual card renewal dates.

- Use a Single, Verified Email: Consolidate communication to one reliable email address to reduce the chance of missed alerts.

- Keep a Secure Backup: Store a copy of your current contact information in a password‑protected document for quick reference.

- Review Quarterly: Make it a habit to log in every three months and confirm that all details remain correct.

- Leverage Mobile Alerts: Enable push notifications for transaction alerts; this adds an extra safety net even if an email is missed.

These practices not only help you stay organized but also reinforce the security posture of your credit‑card account.

What Happens After the Update?

Once the contact information is successfully updated, issuers typically perform a few automatic actions:

- Send a confirmation email or SMS summarizing the change.

- Update the mailing address for upcoming statements and replacement cards.

- Adjust the contact channel for fraud alerts and verification codes.

- Log the change in the account’s activity history, which you can view in the “Account Activity” section.

If you notice any discrepancies after the update—such as a statement still being mailed to the old address—reach out to customer support promptly. Keeping a record of the confirmation reference number will speed up resolution.

Related Topics You Might Find Helpful

Understanding other aspects of credit‑card management can further enhance your financial wellbeing. For instance, learning what a credit card hold is helps you anticipate temporary balance reductions, while reading about missed payments prepares you for handling unexpected issues.

Final Thoughts

Updating the contact information on your credit card is a straightforward but vital responsibility. By treating it as an integral part of regular account maintenance, you safeguard yourself against missed alerts, delayed cards, and potential fraud. Whether you prefer the immediacy of an online portal, the convenience of a mobile app, or the reassurance of speaking with a live representative, the steps outlined above provide a clear roadmap.

Take a moment today to verify the address, phone number, and email tied to your accounts. A few clicks or a short phone call can prevent a cascade of complications down the road, keeping your financial life running smoothly and securely.