Table of Contents

- Understanding Credit Card Fraud

- Skimming and Cloning

- Phishing and Vishing

- Data Breaches

- Card‑Not‑Present (CNP) Fraud

- Lost or Stolen Cards

- Preventive Measures You Can Take Today

- Secure Your Physical Card

- Guard Your Digital Footprint

- Leverage Alerts and Monitoring Tools

- Adopt Safe Online Practices

- Use Autopay Strategically

- When Fraud Happens: Immediate Actions

- Contact Your Issuer Without Delay

- Document Everything

- File a Dispute

- Monitor Your Credit Reports

- Consider Identity Theft Protection

- Long‑Term Habits for Ongoing Safety

- Review Card Settings Periodically

- Stay Informed About New Scams

- Educate Family Members

- Combine Multiple Cards Wisely

Protecting your credit card from fraud has become a daily responsibility for many consumers. How to protect credit card from fraud is no longer a vague question—it demands concrete actions that blend technology, vigilance, and disciplined habits. The story begins the moment you receive a new card, and it continues each time you swipe, tap, or type your number online.

Imagine you have just activated your brand‑new Visa, feeling the smooth plastic in your hand. You set it up for everyday purchases, perhaps even linking it to an autopay system so bills are never missed. In that quiet moment, a subtle decision—like enrolling in automatic payments—can already reduce exposure to theft. For a practical guide on setting that up, see our article on how to set up autopay for your credit card in minutes.

Yet, even the most cautious cardholder can face unexpected threats. Fraudsters evolve, exploiting weak spots in both physical cards and digital transactions. By understanding the methods they use, you can anticipate risks and respond with confidence.

Understanding Credit Card Fraud

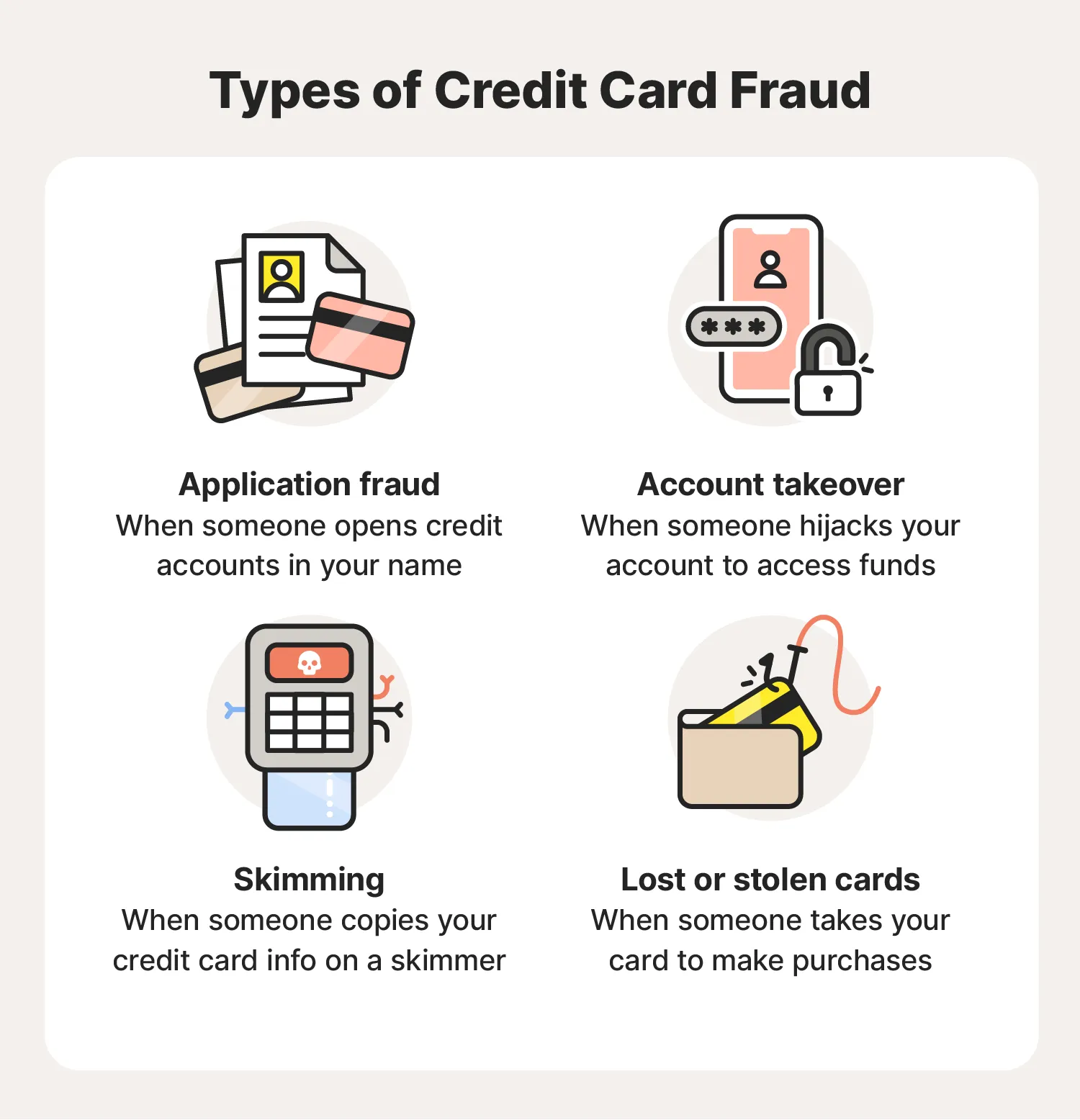

Before you can defend against fraud, you need to know what you’re defending against. Credit card fraud takes many forms, each exploiting a different vulnerability. Below is a brief overview of the most common schemes.

Skimming and Cloning

Criminals attach tiny devices to ATMs or point‑of‑sale terminals to capture the magnetic stripe data. Later, they encode that data onto a blank card, creating an exact clone that can be used until the bank detects unusual activity.

Phishing and Vishing

These social‑engineering attacks trick you into revealing your card number, expiration date, CVV, or even login credentials. A fake email that looks like it came from your bank, or a phone call from a “representative,” may ask you to verify a transaction.

Data Breaches

When merchants or payment processors suffer a security breach, millions of card numbers can be exposed at once. Hackers then sell the data on dark‑web marketplaces, where it’s purchased for fraudulent purchases.

Card‑Not‑Present (CNP) Fraud

Online shopping, subscription services, and mobile apps often require only the card number, expiration date, and CVV. Without a physical card present, fraudsters can test a stolen number on small purchases before committing larger scams.

Lost or Stolen Cards

Sometimes the simplest scenario—misplacing a card—creates an opening for unauthorized use. Even a brief window before you report the loss can be enough for a fraudster to make a purchase.

Preventive Measures You Can Take Today

Now that the threat landscape is clearer, let’s move to actionable steps. Each measure below can be adopted immediately, and together they create a layered defense that makes fraud significantly harder.

Secure Your Physical Card

- Keep it out of sight. Store your card in a wallet that closes securely, and never leave it unattended on a table.

- Use chip‑and‑pin wherever possible. The EMV chip adds an encryption layer that is far more difficult to clone than a magnetic stripe.

- Report loss instantly. The moment you realize a card is missing, call your issuer. Quick reporting limits the window for unauthorized transactions.

Guard Your Digital Footprint

- Enable two‑factor authentication (2FA). For your online banking portal, choose an authenticator app rather than SMS whenever possible.

- Use virtual card numbers. Many issuers provide a temporary number for online shopping; this shields your real account number.

- Update your contact information. Accurate phone numbers and email addresses ensure you receive fraud alerts promptly. Learn the exact steps in the simple, foolproof way to update your credit card contact info and keep your account safe.

Leverage Alerts and Monitoring Tools

- Set up transaction alerts. Receive an instant push notification for any purchase over a chosen amount.

- Regularly review statements. Make it a habit to scan your monthly statement within 24 hours of receipt.

- Utilize credit monitoring services. Some issuers provide free credit score updates and alerts for new credit inquiries.

Adopt Safe Online Practices

- Shop on secure websites. Look for “https://” and a padlock icon in the address bar before entering card details.

- Avoid public Wi‑Fi for transactions. If you must use a public network, connect through a reputable VPN.

- Limit saved card information. Remove card data from e‑commerce platforms you no longer use.

Use Autopay Strategically

Automating recurring payments not only prevents missed bills but also reduces the number of times you manually enter your card number. Each manual entry is a potential exposure point. For a step‑by‑step tutorial, see our guide on setting up autopay for your credit card.

When Fraud Happens: Immediate Actions

No defense is 100% foolproof, and a breach may still occur. Acting quickly can minimize damage and protect your credit reputation.

Contact Your Issuer Without Delay

Call the fraud department—usually a toll‑free number printed on the back of the card. Request a card freeze or replacement, and ask for a fraud investigation number for future reference.

Document Everything

Write down dates, amounts, and merchant names for each suspicious transaction. Save any phishing emails or screenshots of fraudulent websites. This documentation speeds up the dispute process.

File a Dispute

Under the Fair Credit Billing Act (FCBA), you have 60 days from the statement date to dispute unauthorized charges. Most banks let you file disputes online, but a phone call can expedite the resolution.

Monitor Your Credit Reports

Request a free credit report from each of the three major bureaus (Equifax, Experian, TransUnion). Look for new accounts or hard inquiries you didn’t authorize. If you spot anything, place a fraud alert or freeze.

Consider Identity Theft Protection

If the breach involved personal data beyond your card number—such as Social Security or a driver’s license—enroll in an identity theft protection service. These services can alert you to misuse and assist with remediation.

Long‑Term Habits for Ongoing Safety

Fraud prevention is a continuous journey rather than a one‑time checklist. Building habits that reinforce security will keep you ahead of evolving threats.

Review Card Settings Periodically

Many issuers allow you to set transaction limits, disable international purchases, or require a PIN for online transactions. Review these settings quarterly to ensure they match your current usage.

Stay Informed About New Scams

Subscribe to security newsletters from your bank or reputable consumer‑protection agencies. Awareness of emerging scams lets you adapt quickly.

Educate Family Members

Children and older relatives may be less familiar with phishing tactics. Share simple guidelines—like never sharing card details over the phone—to protect the entire household.

Combine Multiple Cards Wisely

Use a dedicated “shopping” card for online purchases and keep a separate “travel” card for trips. If one is compromised, the other remains untouched, limiting the overall exposure.

By weaving these practices into your daily routine, you create a resilient shield around your financial life. Each precaution, from securing the physical card to monitoring digital activity, adds a layer of protection that fraudsters must overcome—making it far more likely they will move on to an easier target.

In the end, safeguarding your credit card is about vigilance, technology, and timely response. Treat every transaction as a small story in the larger narrative of your financial health, and you’ll find that the plot stays firmly under your control.