Table of Contents

- Why Fair Credit Cards Matter

- Key Features to Look For

- Low or No Annual Fee

- Reasonable Interest Rates

- Credit Limit

- Rewards and Perks

- Reporting Frequency

- Top Strategies for Securing Approval

- Check Your Credit Reports First

- Consider a Secured Credit Card

- Limit the Number of Applications

- Show Stable Income and Employment

- Use a Co‑Signer or Authorized User Status

- How to Use the Card Responsibly

- Pay the Full Balance Monthly

- Keep Utilization Below 30%

- Monitor Your Account Regularly

- Leverage Credit‑Building Tools

- Potential Pitfalls and How to Avoid Them

- When to Upgrade to a Better Card

- Real‑World Example: Maya’s Journey

Credit cards for fair credit score open a pathway to better financial health for many consumers. When a credit score lands in the “fair” range—typically between 580 and 669—lenders view the applicant as borderline risky, but not impossible. This middle ground creates a unique set of opportunities and challenges. Understanding the options, eligibility criteria, and responsible usage can turn a modest score into a stepping stone toward premium cards and lower borrowing costs.

Imagine a borrower named Maya who recently graduated and landed her first full‑time job. Her credit score sits at 640 after a few years of student loans and a single auto loan. Maya wants to start building a stronger credit history, but she is wary of being denied or falling into debt. By exploring credit cards tailored for fair credit, Maya can find a product that offers a reasonable credit limit, modest fees, and tools to improve her score over time.

This article walks through the landscape of credit cards for fair credit scores, outlines the criteria lenders use, highlights practical tips for selecting and using the right card, and explains how each step contributes to a healthier credit profile. Whether you are a recent graduate, a recent immigrant, or simply someone rebuilding after a setback, the guidance below provides a clear roadmap.

Why Fair Credit Cards Matter

For consumers with a fair credit rating, mainstream premium cards often remain out of reach. Yet the market still offers a range of products designed to meet the needs of this segment. These cards serve three primary purposes:

- Credit building: Regular, on‑time payments are reported to the major bureaus, helping to raise the score.

- Access to revolving credit: They provide a safety net for emergencies or predictable expenses without requiring a loan.

- Financial education: Many issuers include tools—such as budgeting apps, alerts, and free credit score monitoring—to teach responsible use.

Choosing the right card can therefore be a strategic decision that influences future borrowing power, interest rates on mortgages, auto loans, and even rental approvals.

Key Features to Look For

Low or No Annual Fee

Since a fair‑score holder typically starts with a modest credit limit, paying a high annual fee can erode any benefit. Look for cards that waive the fee for the first year or offer a permanently $0 fee. A low fee keeps the cost of ownership manageable while you focus on building credit.

Reasonable Interest Rates

Interest rates (APR) tend to be higher for fair credit cards, but there is still variation. Compare the introductory APR, the regular APR, and any penalty rates. A card that offers a lower ongoing APR can save you money if you ever need to carry a balance.

Credit Limit

Expect an initial limit between $500 and $2,000. While a higher limit can improve your credit utilization ratio—one of the biggest scoring factors—requesting too much credit too quickly can trigger a hard inquiry that temporarily lowers your score. Choose a limit that aligns with your spending habits and repayment ability.

Rewards and Perks

Rewards programs for fair credit cards are usually modest, but they can still add value. Cash‑back on everyday purchases, a small sign‑up bonus, or travel points that are easy to redeem are worth considering. However, avoid cards whose rewards are tied to high fees or steep interest rates.

Reporting Frequency

Most issuers report payment activity to the three major bureaus once a month. Some newer fintech cards update daily, which can accelerate score improvements. Verify that the card you choose reports to all three bureaus—Equifax, Experian, and TransUnion.

Top Strategies for Securing Approval

Check Your Credit Reports First

Before applying, obtain a free copy of your credit report from each bureau. Look for errors, such as incorrect balances or mis‑reported late payments, and dispute them. Cleaning up your report can increase the likelihood of acceptance.

Consider a Secured Credit Card

Secured cards require a refundable cash deposit that typically becomes your credit limit. They are an effective bridge for those with fair scores. For a deeper dive into the differences between secured and unsecured options, see our guide on secured vs unsecured credit cards.

Limit the Number of Applications

Each hard inquiry can shave a few points off your score. Space out applications by at least 30‑60 days, and prioritize cards that match your current credit profile.

Show Stable Income and Employment

Issuers weigh income alongside credit history. Providing recent pay stubs or a stable employment record can offset a fair score, demonstrating your ability to meet monthly obligations.

Use a Co‑Signer or Authorized User Status

If possible, become an authorized user on a family member’s high‑limit, low‑balance card. Their positive payment history can appear on your report, improving your utilization and score.

How to Use the Card Responsibly

Pay the Full Balance Monthly

The simplest way to avoid interest charges is to pay the statement balance in full each month. Set up automatic payments for at least the minimum amount, then manually cover the remaining balance to stay debt‑free.

Keep Utilization Below 30%

Credit utilization is calculated as the ratio of your outstanding balance to your total credit limit. For a $1,000 limit, keep the balance under $300. Lower utilization signals that you are not overly dependent on credit, which positively influences your score.

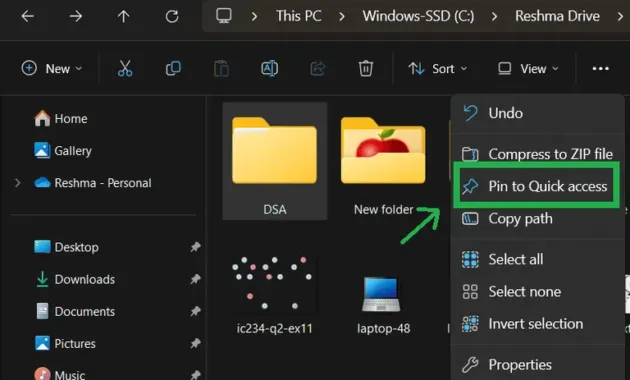

Monitor Your Account Regularly

Frequent monitoring helps catch fraud early and ensures you stay within budget. Many cards now offer real‑time alerts for purchases, approaching limits, or unusual activity. If you need to temporarily stop spending, you can temporarily lock your credit card with a few taps.

Leverage Credit‑Building Tools

Some issuers provide free credit score updates, educational webinars, and budgeting dashboards. Engage with these resources to understand how each action—like a timely payment or a reduced balance—affects your score.

Potential Pitfalls and How to Avoid Them

- Carrying a Balance: Even a modest APR can compound quickly. Stick to paying in full.

- Late Payments: A single missed payment can drop a fair score by 50‑100 points. Use calendar reminders or automatic payments.

- High Fees: Some cards hide fees in foreign transaction charges or cash‑advance fees. Review the fee schedule before using the card abroad or for cash.

- Credit Inquiries: Multiple hard pulls within a short period can signal risk to lenders. Track your applications carefully.

When to Upgrade to a Better Card

![How To Upgrade a Capital One Card: A Complete Guide [2025]](https://blog.avaller.com/wp-content/uploads/2026/01/how-to-upgrade-a-capital-one-card-a-complete-guide-2025-630x380.webp)

As your score climbs into the “good” (670‑739) or “very good” (740‑799) range, you become eligible for cards with higher rewards, lower APRs, and premium benefits like travel insurance and concierge services. The right time to apply for an upgrade is when you have demonstrated at least six months of on‑time payments, maintained utilization under 30%, and have a stable income.

Before applying for a premium card, run a soft credit check—many issuers provide this tool on their websites—to see if you pre‑qualify without harming your score. If approved, consider transferring balances from higher‑interest cards to take advantage of lower rates.

Real‑World Example: Maya’s Journey

Maya followed the steps outlined above. She started with a secured card that required a $500 deposit. By paying her balance in full each month and keeping utilization at 20%, her score rose to 680 within eight months. She then applied for an unsecured cash‑back card with no annual fee, which she was approved for after a single hard inquiry. Over the next year, Maya’s consistent payments and responsible usage allowed her to qualify for a travel rewards card with a modest annual fee but generous point earnings on flights—perfect for her frequent trips home.

Maya’s story illustrates how a fair‑credit consumer can leverage the right products, practice disciplined spending, and gradually unlock better financial opportunities.

In summary, credit cards for fair credit scores serve as essential tools for building a stronger financial foundation. By selecting cards with low fees, reasonable APRs, and helpful reporting, monitoring activity closely, and avoiding common traps, consumers can steadily improve their creditworthiness. The journey from fair to good—and eventually to excellent—requires patience, consistency, and informed decision‑making, but the payoff includes lower loan costs, better housing options, and greater financial flexibility.