Table of Contents

- How a Credit Card Hold Works

- Step‑by‑step flow of a typical hold

- Common Situations Where Holds Occur

- Hospitality and travel

- Restaurants and bars

- Online and e‑commerce

- Pre‑paid services

- Difference Between Holds and Authorizations

- Impact on Your Credit and Available Balance

- Tips to protect your credit utilization

- How Long Does a Hold Last?

- Managing and Releasing Holds

- Monitor pending transactions

- Communicate with the merchant

- Contact your card issuer

- Use online tools

- Plan ahead for large holds

- When Holds Turn Into Disputes

- Key steps for a successful dispute

- Technology Behind Holds: Authorization Networks

- International Holds and Currency Conversion

- Best Practices for Frequent Travelers

- 1. Choose cards with no foreign‑transaction fees

- 2. Keep a small buffer of available credit

- 3. Review your account daily

When you swipe a card at a restaurant, rent a car, or check into a hotel, the amount you see on your receipt may not be the final charge. Instead, the merchant often places a credit card hold on your account. This temporary reservation of funds can be confusing, especially for those who monitor their balances closely. Understanding the purpose, process, and impact of a credit card hold helps you avoid unexpected shortfalls and keep your financial plan on track.

In this article we walk through the life of a hold from the moment a merchant requests it to the point it disappears from your statement. You will learn why businesses rely on holds, how long they typically last, and what you can do if a hold lingers longer than expected. By the end, the concept will feel as familiar as any other credit‑card feature.

How a Credit Card Hold Works

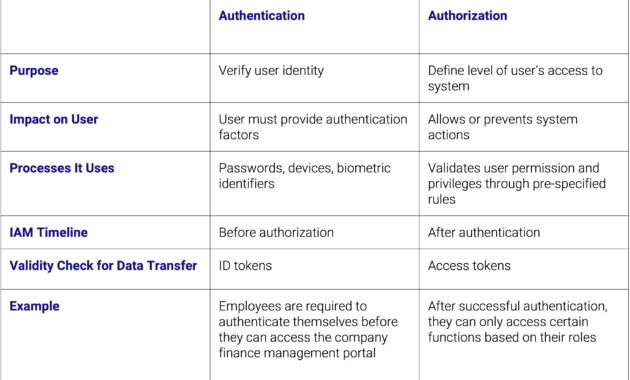

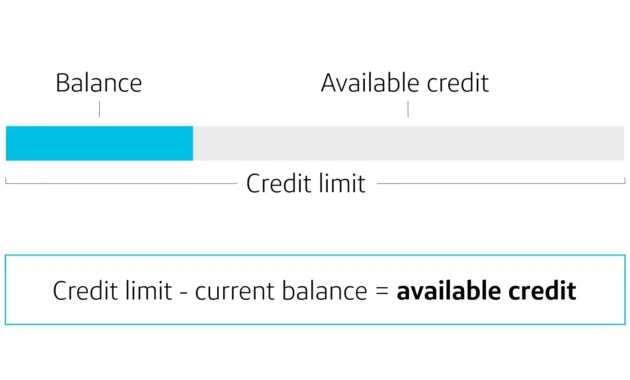

A credit card hold, also called an authorization hold, is a request sent by a merchant to the card‑issuing bank. The request asks the bank to set aside a specific amount of your credit limit or available balance. The bank does not actually deduct the money; it simply earmarks it so the merchant can be assured that the funds exist when the final charge is processed.

Technically, the hold creates a pending transaction in the bank’s system. The pending amount reduces your available credit, but it does not appear in the official statement balance until the merchant submits the final settlement. Once the settlement occurs, the pending transaction converts into a posted charge, and the hold disappears.

Step‑by‑step flow of a typical hold

- Authorization request: The merchant’s point‑of‑sale (POS) system sends a request for a specific amount.

- Bank response: The issuing bank checks the account, confirms the funds, and places a hold for that amount.

- Pending display: Your online banking or app shows the amount as “pending” or “authorized”.

- Final capture: Within a set time window, the merchant submits the actual charge, which may be the same, lower, or higher.

- Release: If the merchant does not capture the amount, the hold expires and the reserved credit returns to your available balance.

Common Situations Where Holds Occur

Not every purchase triggers a hold. Certain industries rely on them more heavily because the final amount can be uncertain or the risk of non‑payment is higher.

Hospitality and travel

Hotels often place a hold equal to the estimated total cost of a stay, plus taxes and incidentals. Car‑rental agencies may authorize a sum that covers the rental fee, insurance, fuel, and potential damage. The hold ensures that the business can recover costs if you exceed the original estimate.

Restaurants and bars

When you dine in, the server may place a hold that matches the bill plus a small buffer for tips. The buffer allows you to add a tip after the fact without the merchant needing a second authorization.

Online and e‑commerce

Many e‑commerce sites use holds to verify that the card is active before shipping goods. The hold is usually for a small amount, such as $0 or $1, that is instantly released.

Pre‑paid services

Ride‑sharing apps, streaming subscriptions, and utility providers sometimes place a temporary hold to confirm payment ability before the service begins.

Difference Between Holds and Authorizations

The terms “hold” and “authorization” are often used interchangeably, but there is a subtle distinction. An authorization is the request sent to the bank, while a hold is the resulting reservation of funds. In practice, both refer to the same temporary restriction on your credit limit.

Another related concept is a “pre‑authorization” used in airline ticketing. Airlines may pre‑authorize a larger amount to cover optional services like baggage fees or seat upgrades. The final ticket price may be lower, and the excess is released after the flight.

Impact on Your Credit and Available Balance

Because a hold reduces your available credit, it can affect your ability to make additional purchases. If you are near your credit limit and a $200 hotel hold is placed, you may find that a $50 grocery transaction is declined even though your statement balance is low.

Credit scoring models, such as FICO, look at your credit utilization ratio—the percentage of available credit you are using. Holds count toward this ratio because they lower the amount of credit that is technically “available.” A high utilization ratio can temporarily lower your credit score, especially if you have multiple large holds at once.

Tips to protect your credit utilization

- Keep an eye on pending transactions in your banking app.

- Request a higher credit limit before a trip that involves multiple holds.

- Pay down the balance before a known hold, even if the hold is pending, to keep utilization low.

How Long Does a Hold Last?

The duration of a hold depends on the merchant category and the issuing bank’s policies. Typical time frames include:

- Hotels and car rentals: 3 to 7 days after checkout, though some hotels keep the hold for up to 30 days for large groups.

- Restaurants and bars: Usually released within 24 to 48 hours after the bill is settled.

- Online retailers: Holds often disappear within 1 to 3 days if the merchant does not capture the amount.

- Airlines: Pre‑authorizations may stay for up to 72 hours after the flight, depending on the airline’s policy.

If a hold persists beyond the typical window, you can contact the merchant or your card issuer. In many cases, the merchant can submit a cancellation request, or the bank can manually release the hold.

Managing and Releasing Holds

Proactive management of holds prevents inconvenience and protects your credit score. Here are practical steps you can take:

Monitor pending transactions

Most banking apps display pending transactions in a separate section. Review this area regularly, especially after traveling or dining out.

Communicate with the merchant

If a hold remains after you have settled the bill, call the merchant’s customer service. Provide the date, amount, and location of the transaction. Many merchants can expedite the release.

Contact your card issuer

If the merchant is unresponsive, call the number on the back of your card. Explain the situation and request a release. The issuer may need a reference number from the merchant, so have any receipts handy.

Use online tools

Some card issuers offer a “dispute” or “release hold” feature directly in the mobile app. This can be quicker than a phone call.

Plan ahead for large holds

Before a trip that involves hotel and car‑rental holds, consider paying down your balance or requesting a temporary credit‑limit increase. This reduces the chance that a hold will push your utilization into a risky range.

For readers looking to choose a card that handles holds smoothly, the Unlock the Best Credit Cards for Fair Credit Scores and Boost Your Financial Future guide provides a curated list of options with favorable hold policies.

When Holds Turn Into Disputes

If a merchant never captures the authorized amount, the hold should automatically expire. However, there are cases where the merchant captures a different amount than originally authorized, leading to a discrepancy. In such scenarios, you have the right to dispute the charge.

Dispute procedures typically involve filing a claim with your issuer within 60 days of the posted charge. Provide supporting documents, such as receipts, correspondence with the merchant, and any screenshots of the pending hold. The issuer will investigate and may temporarily credit the amount while the dispute is resolved.

Key steps for a successful dispute

- Act promptly—most issuers have a 60‑day window.

- Gather all relevant documentation.

- Submit the dispute through the issuer’s online portal or via phone.

- Follow up regularly until the issue is resolved.

If you want to learn more about protecting your account after a dispute, the article How to Temporarily Lock Your Credit Card – A Complete Guide to Safeguarding Your Money offers practical advice on securing your card against unauthorized use.

Technology Behind Holds: Authorization Networks

Authorization holds rely on the communication network between merchants, payment processors, and card issuers. When a transaction is initiated, the POS or online checkout system sends a request through the payment gateway to the card network (Visa, Mastercard, American Express, etc.). The network routes the request to the issuer, which verifies the account and returns an approval code along with the hold amount.

Modern tokenization and EMV chip technology add layers of security to this process. Tokens replace the actual card number in the request, reducing the risk of data breaches. Despite these safeguards, the core principle remains the same: a temporary reservation of funds until the merchant finalizes the charge.

International Holds and Currency Conversion

When you travel abroad, holds can be placed in the local currency. The issuing bank then converts the amount to your home currency using the prevailing exchange rate at the time of authorization. This can lead to slight differences between the authorized amount and the final posted charge, especially if exchange rates fluctuate.

To avoid surprise fees, check whether your card issuer applies a foreign‑transaction fee and whether they use a dynamic currency conversion (DCC) service. Opting out of DCC typically results in a more favorable conversion rate handled by your card network.

Best Practices for Frequent Travelers

Travelers who encounter holds regularly can adopt habits that keep their credit lines flexible:

1. Choose cards with no foreign‑transaction fees

These cards often have more transparent hold handling overseas.

2. Keep a small buffer of available credit

Maintain at least a 30% free credit limit to accommodate multiple simultaneous holds.

3. Review your account daily

Daily checks catch lingering holds early, giving you time to act before the next purchase.

For a deeper dive into travel‑focused cards, the 7 Best Airline Miles Credit Cards That Turn Everyday Purchases into Free Flights article outlines options that pair generous rewards with traveler‑friendly hold policies.

In summary, a credit card hold is a temporary reservation of funds that protects merchants and ensures that you have sufficient credit to cover a future charge. Holds affect your available balance, can influence credit utilization, and may persist for varying lengths of time depending on the industry and issuer. By monitoring pending transactions, communicating with merchants, and understanding the underlying authorization process, you can manage holds effectively and maintain healthy credit habits.