Table of Contents

- Understanding When a Replacement Is Necessary

- Physical Damage or Wear

- Expiration Date Approaching

- Loss or Theft

- Security Concerns

- Preparing the Required Information

- Personal Identification

- Account Details

- Preferred Delivery Options

- Choosing the Right Communication Channel

- Phone Support

- Online Banking Portal

- Mobile App

- Secure Messaging

- Step‑by‑Step Process to Request a Replacement

- 1. Verify Your Identity

- 2. State the Reason for Replacement

- 3. Confirm Delivery Preferences

- 4. Review Fees (if any)

- 5. Obtain a Confirmation Number

- 6. Activate the New Card

- 7. Update Recurring Payments

- Special Considerations for Specific Scenarios

- International Travel

- Business Credit Cards

- Premium or Reward Cards

- Preventing Future Card Issues

- Maintain Card Hygiene

- Set Up Card Alerts

- Regularly Review Account Settings

- Leveraging Related Resources

Requesting a credit card replacement is a routine task that most cardholders will face at least once in their financial journey. Whether your card is damaged, about to expire, or has been lost or stolen, understanding the correct procedure can save you time and protect your credit profile. This guide walks you through the essential steps, highlights common pitfalls, and provides practical tips to ensure a smooth transition to your new card.

In the modern banking environment, most issuers offer multiple channels—phone, online portal, mobile app, and even secure messaging—to handle replacement requests. Knowing which channel best fits your situation, and what information you need to provide, can make the experience feel as seamless as a short factual story rather than a bureaucratic hurdle.

Below, we break down the process into clear, actionable sections, supplemented with real‑world examples and internal resources that deepen your understanding of related credit‑card topics.

Understanding When a Replacement Is Necessary

A credit card replacement may be required for several reasons. Recognizing the trigger early helps you act promptly, minimizing the risk of unauthorized use.

Physical Damage or Wear

- Cracked chip, bent magnetic stripe, or broken card body can cause transaction failures.

- Most issuers replace a damaged card for free; however, some may charge a nominal fee for expedited shipping.

Expiration Date Approaching

- Issuers typically send a new card 30–45 days before the current one expires.

- If you haven’t received it, contact customer service to confirm the mailing address.

Loss or Theft

- Immediate reporting is critical to prevent fraud.

- Refer to Lost Your Credit Card? 7 Immediate Actions to Stop Fraud and Keep Your Money Safe for a detailed checklist.

Security Concerns

- Suspicious activity alerts or data breaches may prompt the issuer to issue a new card pre‑emptively.

- Even if you haven’t observed fraud, a proactive replacement can safeguard your account.

Preparing the Required Information

Before you pick up the phone or log in to your online banking dashboard, gather the following details to streamline the request.

Personal Identification

- Full legal name as it appears on the account.

- Social Security Number (or national identification number) for verification.

- Recent billing address and contact phone number.

Account Details

- Current credit card number (if you still have it) or the last four digits.

- Recent transaction history that may help the representative confirm ownership.

- Any pending balances or authorized payments that could be affected by a card change.

Preferred Delivery Options

- Standard mail, tracked courier, or in‑branch pickup.

- Special instructions for delivery to a secondary address or PO box (if allowed).

Choosing the Right Communication Channel

Each issuer’s customer service ecosystem offers several avenues for submitting a replacement request. Selecting the most convenient channel can reduce waiting time and avoid unnecessary steps.

Phone Support

Calling the dedicated credit‑card helpline is often the fastest method, especially for urgent situations like theft. Have your identification ready, as the representative will likely ask security questions.

Online Banking Portal

Log in to your account, navigate to the “Card Services” or “Manage Card” section, and look for “Replace Card.” This self‑service option lets you select delivery speed and view estimated arrival dates.

Mobile App

Most banks mirror portal functionality within their smartphone apps. The advantage is push notifications that keep you informed about shipping status in real time.

Secure Messaging

If you prefer a written record, use the secure message center within your online banking interface. This method is slower but provides a documented trail of the request.

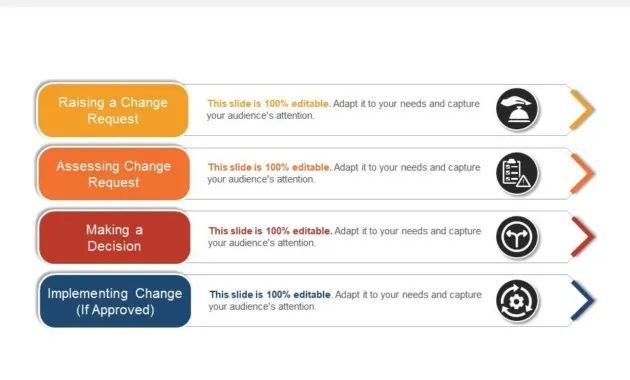

Step‑by‑Step Process to Request a Replacement

The following checklist works for most major issuers. Adjust the specifics based on your bank’s procedures.

1. Verify Your Identity

Whether you’re on the phone or online, you’ll be asked to confirm personal details. Answer security questions accurately to avoid verification delays.

2. State the Reason for Replacement

Be concise: “My card is damaged,” “My card is expiring soon,” or “My card was lost/stolen.” Clear communication helps the representative choose the correct processing path.

3. Confirm Delivery Preferences

Specify if you need expedited shipping, a tracked package, or an in‑branch pickup. Some issuers charge extra for express delivery; weigh the cost against urgency.

4. Review Fees (if any)

Most standard replacements are free, but a damaged card replacement or a rush order might incur a fee. Ask for a clear breakdown before authorizing any charge.

5. Obtain a Confirmation Number

Once the request is processed, the representative will provide a reference or ticket number. Record it for future follow‑up, especially if the new card does not arrive within the promised timeframe.

6. Activate the New Card

When the replacement arrives, follow the activation steps—usually a phone call or an online activation page. Destroy the old card by cutting it into multiple pieces to prevent accidental reuse.

7. Update Recurring Payments

Update the card information for any subscriptions, automatic bill payments, or online accounts that stored the old number. Failure to do so may lead to missed payments and late fees.

Special Considerations for Specific Scenarios

Some replacement requests involve additional layers of complexity. Understanding these nuances can help you avoid common setbacks.

International Travel

If you’re abroad when your card is compromised, request a replacement to a local address if the issuer permits. Many banks also partner with global networks to provide temporary card numbers via digital wallets.

Business Credit Cards

For corporate cards, the authorized signatory may need to approve the replacement. Coordinate with your finance department to ensure proper documentation.

Premium or Reward Cards

Cards with high annual fees or exclusive benefits (e.g., airline miles) may have unique replacement policies. Review the card’s terms to ensure you retain any accrued rewards during the transition.

Preventing Future Card Issues

While a replacement resolves the immediate problem, proactive steps can reduce the likelihood of needing another card soon.

Maintain Card Hygiene

- Store the card in a protective sleeve to guard against bending and wear.

- Avoid exposing the chip and magnetic stripe to extreme temperatures or moisture.

Set Up Card Alerts

Enable transaction notifications via email or SMS. Prompt alerts help you spot unauthorized activity quickly, allowing you to freeze the card before damage escalates.

Regularly Review Account Settings

Periodically check your account for updated contact information, authorized users, and linked accounts. Keeping these details current ensures that replacement cards are sent to the right address without delay.

Leveraging Related Resources

Understanding the broader context of your credit card usage can further enhance your financial management.

- Explore how your credit limit is calculated and what factors influence it in What Is a Credit Limit and How Is It Determined? The Insider’s Guide to Unlocking Your Buying Power.

- If you’re a frequent flyer, the Unlock the Full Power of Your Delta SkyMiles Credit Card Account guide explains how to maximize benefits, which may be affected during a card replacement.

- Considering a balance transfer? Review the article Why Consider a Balance Transfer? to see how a new card could impact transfer options.

By following the structured approach outlined above, you can request a credit card replacement confidently, keep your credit line active, and minimize any disruption to your everyday spending.

Remember that a prompt request, accurate information, and clear communication are the cornerstones of a hassle‑free replacement. As soon as your new card arrives, activate it, update any linked services, and resume your financial activities with peace of mind.