Table of Contents

- What Exactly Is a Foreign Transaction Fee?

- How the Fee Is Calculated

- Who Actually Collects the Fee?

- Issuer vs. Network Fees

- Why Do Issuers Impose These Fees?

- Risk Management Perspective

- How to Identify When a Fee Applies

- Cards That Waive Foreign Transaction Fees

- Examples of Popular No‑Fee Cards

- Practical Strategies to Reduce or Avoid Fees

- 1. Use Local Debit Cards

- 2. Pay in Local Currency

- 3. Choose Card‑Network Partners

- 4. Leverage Business Credit Cards

- 5. Monitor Exchange Rates

- Impact on Credit Scores and Financial Health

- Future Trends: Will the Fee Disappear?

When you swipe your credit card in a foreign currency, the amount you see on your statement often looks higher than what you expected. That difference is usually due to foreign transaction fees, a hidden cost that can add up quickly for frequent travelers and online shoppers alike. Understanding how these fees are calculated, who imposes them, and what alternatives exist can help you keep more of your money in your pocket.

In this article we walk through the entire lifecycle of a foreign transaction fee, from the moment a purchase is made overseas to the point where the fee appears on your monthly statement. By the end, you’ll know exactly why the fee exists, how to spot it, and which strategies can minimize its impact on your spending.

What Exactly Is a Foreign Transaction Fee?

A foreign transaction fee (sometimes called an international transaction fee or overseas purchase fee) is a charge that a card issuer adds when you make a purchase in a currency that differs from the one used for billing your account. The fee is typically expressed as a percentage of the transaction amount, ranging from 0% to 3% of the purchase value. Some issuers may also add a flat fee on top of the percentage.

How the Fee Is Calculated

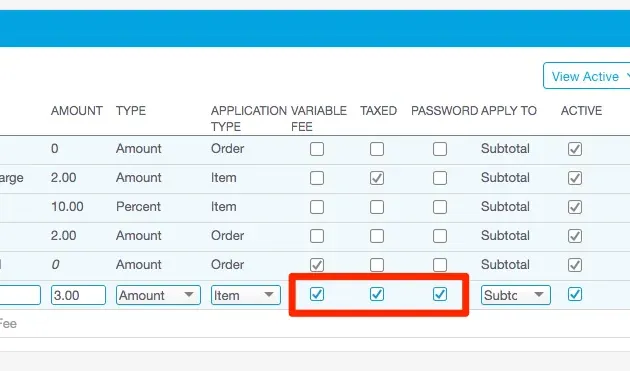

- Percentage component: Most commonly, the fee is 1%–3% of the transaction amount after conversion to your billing currency.

- Flat-rate component: A few cards add a fixed amount (e.g., $5) per transaction, regardless of the purchase size.

- Currency conversion: The issuer’s exchange rate, often based on the Visa or Mastercard wholesale rate plus a small markup, determines the converted amount before the fee is applied.

For example, a $200 purchase in euros with a 2.5% foreign transaction fee would be calculated as follows:

- Converted amount (using issuer’s rate): $220

- Fee (2.5% of $220): $5.50

- Total charged to your account: $225.50

Who Actually Collects the Fee?

The fee is usually collected by the credit card’s issuing bank, not the merchant or the card network. However, the network (Visa, Mastercard, American Express, Discover) may also charge a separate processing fee that is baked into the overall cost. This distinction matters because some issuers waive the fee while still using a network that imposes its own charges, effectively passing the cost back to you in a different form.

Issuer vs. Network Fees

- Issuer fee: The most visible charge on your statement, often labeled “Foreign Transaction Fee” or “International Purchase Fee.”

- Network surcharge: Embedded in the exchange rate or transaction processing cost; rarely itemized separately.

Knowing which party is responsible can guide you toward cards that explicitly waive foreign transaction fees, even if the network still imposes a minor cost.

Why Do Issuers Impose These Fees?

Issuers justify foreign transaction fees as a way to cover the additional costs associated with processing purchases in other currencies. These costs include currency conversion, cross‑border communications, and compliance with foreign banking regulations. While the actual expense to the issuer is often modest, the fee serves as a revenue stream and a risk mitigation tool.

Risk Management Perspective

Cross‑border transactions carry a higher risk of fraud and chargebacks. By adding a fee, issuers offset potential losses and incentivize cardholders to use cards that are specifically designed for international use, which often have stricter fraud‑prevention controls.

How to Identify When a Fee Applies

The easiest way to know whether a fee will be charged is to check the card’s terms and conditions before you travel. Look for sections titled “Foreign Transaction Fees,” “International Fees,” or “Cross‑Border Fees.” Many issuers list the exact percentage and any flat‑rate components clearly.

On your statement, the fee is typically shown as a separate line item. For example, a transaction might appear as “Purchase – XYZ Hotel – $150.00” followed by a line “Foreign Transaction Fee – $3.75.” If you notice a small, unexpected charge after a foreign purchase, it is likely the fee.

Cards That Waive Foreign Transaction Fees

Travel‑focused credit cards often promote “no foreign transaction fee” as a key benefit. These cards usually belong to premium tiers, but some entry‑level options also provide the waiver. Choosing a fee‑free card can save you anywhere from $5 to $30 per $200 purchase abroad.

Examples of Popular No‑Fee Cards

- Chase Sapphire Preferred® Card – 0% foreign transaction fee and strong travel rewards.

- Capital One VentureOne Rewards Credit Card – No fee, flat‑rate miles on all purchases.

- American Express® Gold Card – Waives the fee for purchases made directly with Amex.

When evaluating a new card, compare the fee waiver against other features such as annual fee, rewards structure, and sign‑up bonus. The article Upgrade Your Credit Card to a Better Version – A Step‑by‑Step Guide to Getting More Value provides a systematic approach to weigh these factors.

Practical Strategies to Reduce or Avoid Fees

Even if you already own a card that charges a foreign transaction fee, there are ways to limit the impact.

1. Use Local Debit Cards

Many travelers find that using a debit card linked to a no‑fee checking account can eliminate the fee entirely. However, be aware of potential ATM withdrawal fees and exchange‑rate markups.

2. Pay in Local Currency

When presented with a choice at the point of sale, always select “local currency” rather than “your home currency.” The latter invokes a process called Dynamic Currency Conversion (DCC), which often adds a hidden markup on top of the foreign transaction fee.

3. Choose Card‑Network Partners

Some issuers have partnerships with foreign banks that reduce the fee for specific merchants. For example, a card may waive the fee at hotels that use a particular global reservation system.

4. Leverage Business Credit Cards

If you own a business, a corporate card may include a fee waiver as part of its travel benefits. The article The Startup’s Secret Weapon – How Business Credit Cards Can Accelerate Growth outlines how these cards can be advantageous for both expense management and fee avoidance.

5. Monitor Exchange Rates

Because issuers use their own conversion rates, timing a purchase when the market rate is favorable can reduce the overall cost. While you cannot control the issuer’s markup, you can delay non‑urgent purchases to a more advantageous rate.

Impact on Credit Scores and Financial Health

Foreign transaction fees themselves do not affect your credit score. However, the additional cost can influence your utilization ratio if you end up carrying a higher balance than anticipated. Maintaining a low utilization ratio (<30% of your credit limit) helps preserve a healthy credit score.

Additionally, frequent foreign purchases might trigger fraud alerts, especially if your issuer is not aware of your travel plans. Proactively notifying your bank can prevent temporary card blocks that could otherwise lead to missed payments.

Future Trends: Will the Fee Disappear?

With the rise of fintech and digital wallets that offer real‑time currency conversion at near‑wholesale rates, some analysts predict a gradual decline in traditional foreign transaction fees. Companies like Revolut and Wise already provide low‑cost cross‑border payments without the typical 1%–3% surcharge.

Nevertheless, mainstream credit card issuers still rely on the fee as a source of revenue. Until regulatory pressure or market competition forces a shift, most consumers should expect the fee to remain a standard part of the credit‑card ecosystem.

For those who already manage multiple online accounts, ensuring secure access is crucial. The guide Unlock Seamless Access: The Ultimate Guide to Chase Credit Card Login offers steps to protect your credentials while navigating foreign transactions.

In practice, the best defense against unexpected costs is awareness. By reviewing your card’s fee structure, opting for fee‑free alternatives when possible, and employing the strategies above, you can travel, shop, and conduct business abroad with confidence, knowing exactly how much each transaction will cost.

Ultimately, foreign transaction fees are a small but significant piece of the broader financial picture. They reflect the complexities of global commerce and the extra work banks must do to convert currencies and manage risk. With informed choices, you can turn that complexity into an opportunity to save money and streamline your international spending.