Table of Contents

- How Closing a Credit Card Influences Your Credit Score

- Credit Utilization Ratio

- Length of Credit History

- Potential Benefits of Closing a Card

- Eliminating High Annual Fees

- Reducing Temptation to Overspend

- Mitigating Fraud Exposure

- Steps to Close a Credit Card Account Safely

- Pay Off the Balance in Full

- Confirm No Pending Rewards or Benefits

- Request Written Confirmation

- Monitor Your Credit Reports

- Update Automatic Payments

- Mitigating Negative Effects After Closure

- Maintain Low Utilization on Remaining Cards

- Consider a Small “Soft” Credit Inquiry

- Leverage a Credit Builder Loan

- Frequently Asked Questions About Closing Credit Cards

- Long‑Term Perspective: Credit Health After Multiple Closures

Closing a credit card account is a decision that many consumers face at some point in their financial journey. Whether the card is no longer needed, carries a high annual fee, or simply feels burdensome, the act of shutting it down can ripple through a credit report in ways that are not immediately obvious. Understanding the mechanics behind these changes helps you protect your credit score while achieving the personal goals that prompted the closure.

In this article we walk through the key areas affected by a card’s termination: credit utilization, length of credit history, mix of credit types, and the potential for accidental consequences such as lingering balances or fraud exposure. By the end, you’ll have a clear roadmap for closing an account responsibly, and you’ll see why a thoughtful approach can safeguard the credit you’ve built over the years.

Before diving into the specifics, remember that the impact of closing a credit card varies based on the overall composition of your credit file. A single card closure may have a modest effect for someone with multiple long‑standing accounts, while the same action could be more pronounced for a newcomer to credit. The following sections break down each factor in detail, offering actionable tips and linking to related resources for deeper exploration.

How Closing a Credit Card Influences Your Credit Score

A credit score is a composite number derived from several data points in your credit report. The most influential components include payment history, credit utilization, length of credit history, new credit inquiries, and credit mix. When you close a credit card, you directly affect at least two of these pillars: utilization and length of history.

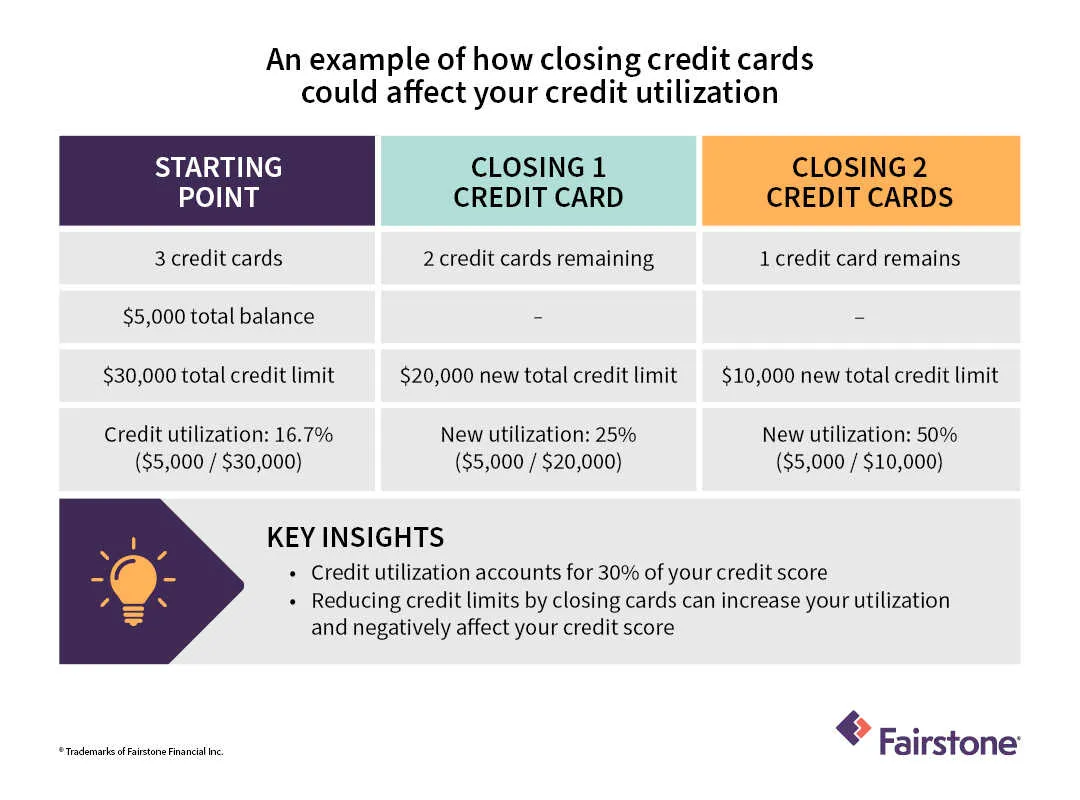

Credit Utilization Ratio

Utilization measures the amount of revolving credit you’re using compared to the total credit available to you. It is calculated by dividing your outstanding balances by your total credit limits across all revolving accounts. For example, if you carry $1,200 in balances on cards with a combined limit of $12,000, your utilization sits at 10%—generally considered healthy.

If you close a card with a $5,000 limit while keeping the $1,200 balance, your total available credit drops to $7,000, pushing utilization to about 17%. Even though the balance hasn’t changed, the perceived risk rises because a larger portion of your available credit is now in use. This shift can cause a modest dip in your score, especially if you were already hovering near the 30% threshold that many scoring models flag as risky.

Length of Credit History

Length of credit history captures both the age of your oldest account and the average age of all accounts. When a long‑standing card—perhaps opened a decade ago—is closed, the average age of your accounts may decrease, nudging the score downward. The impact is more pronounced for older accounts because they contribute heavily to the “longest‑standing account” metric.

Importantly, the closed account does not disappear from your credit report immediately. Most major bureaus retain closed accounts for up to ten years, meaning the historical data continues to influence the average age calculation for a while. However, after it falls off, the average age will be recalculated without that account, potentially lowering the score.

Potential Benefits of Closing a Card

While the negative effects are often highlighted, there are legitimate reasons to close a credit card that can ultimately strengthen your financial position.

Eliminating High Annual Fees

Some premium cards charge fees that outweigh the rewards they provide. If you find yourself paying $150 a year for a card you rarely use, closing it can free up that cash for savings or debt repayment. The cost savings can offset a temporary dip in credit score, especially if you maintain low utilization elsewhere.

Reducing Temptation to Overspend

Having multiple revolving accounts can increase the temptation to carry balances, especially if you receive frequent promotional offers. By trimming your card portfolio to only the cards that truly serve your needs, you simplify your financial life and lower the risk of accumulating debt.

Mitigating Fraud Exposure

Every open credit card is a potential target for fraud. If a card is no longer used and you suspect it may be vulnerable—for instance, after a data breach—closing it can remove an attack vector. For more guidance on safeguarding your accounts, see our article on understanding credit card fraud.

Steps to Close a Credit Card Account Safely

Closing a credit card is not as simple as calling the issuer and asking for termination. A systematic approach ensures you avoid hidden fees, lingering balances, or accidental damage to your credit profile.

Pay Off the Balance in Full

Before initiating the closure, verify that the account balance is zero. If you have a small remaining amount, pay it off and wait for the transaction to post. Some issuers may allow you to close with a small balance, but the balance will continue to accrue interest, and the account may stay open in a “closed‑with‑balance” status, which can be confusing on your credit report.

Confirm No Pending Rewards or Benefits

Check for any unredeemed points, cash back, or travel miles. Some programs automatically forfeit rewards upon closure. If you have valuable points, redeem them or transfer them to a partner program before closing.

Request Written Confirmation

After speaking with a representative—often via the official login page for your issuer—ask for a written confirmation that the account is closed at a zero balance. Keep this document in your records in case the account reappears later.

Monitor Your Credit Reports

Within 30‑45 days after closure, obtain a copy of your credit report from each major bureau (Equifax, Experian, TransUnion). Verify that the account is reported as “closed by consumer” and that the balance is shown as $0. If discrepancies appear, dispute them promptly using the bureaus’ online dispute portals.

Update Automatic Payments

If the card was linked to recurring bills—such as streaming services or utility payments—replace the payment method before the next billing cycle. Failing to do so can result in missed payments, late fees, and a negative impact on your credit score. For a quick guide on managing autopay, see our piece on how to set up autopay for your credit card in minutes.

Mitigating Negative Effects After Closure

Even with careful planning, a slight dip in your credit score may still occur. Here are strategies to cushion the impact and potentially rebound quickly.

Maintain Low Utilization on Remaining Cards

After closing a card, aim to keep the balances on your remaining cards well below 30% of each card’s limit. Paying down existing balances or spreading them across multiple cards can help maintain a favorable utilization ratio.

Consider a Small “Soft” Credit Inquiry

Opening a new, low‑limit credit card can offset the loss of available credit. Because the inquiry is typically a “soft pull” if you’re pre‑qualified, it won’t immediately affect your score. Over time, the added limit can improve your utilization and average age, especially if you keep the new account open for several years.

Leverage a Credit Builder Loan

If your credit file becomes thin after several closures, a small installment loan—such as a credit‑builder loan from a community bank—adds a positive payment history and diversifies your credit mix. This can counterbalance the reduction in revolving accounts.

Frequently Asked Questions About Closing Credit Cards

- Will closing a card erase its payment history? No. All on‑time payments remain on your credit report for up to ten years, contributing positively to your payment‑history component.

- Can I reopen a closed card? Some issuers allow you to reactivate a closed account if you request it within a certain time frame, often without a new credit check. However, the account’s age will not reset; it will retain its original opening date.

- Does closing a secured credit card affect my score? Secured cards count the same as unsecured revolving accounts in the scoring model, so the same utilization and age considerations apply.

- Is there a best time of year to close a card? Closing a card after you’ve paid off a large seasonal balance (e.g., after holiday spending) can minimize utilization spikes.

- What if I have a balance transfer pending? Do not close the card until the transfer completes. Closing prematurely may cause the balance to revert to the original account, potentially leading to higher interest charges.

Long‑Term Perspective: Credit Health After Multiple Closures

For consumers who regularly prune their credit portfolios—perhaps to avoid annual fees or to simplify finances—cumulative effects can become more pronounced. Each closure reduces total available credit and may lower the average age of accounts, leading to a gradual erosion of the score if not offset by responsible credit behavior.

To sustain a strong credit profile over the long run, focus on the following habits:

- Maintain at least one older credit card open, even if you use it sparingly for small recurring purchases.

- Pay all balances in full each month to keep utilization low and demonstrate consistent payment history.

- Periodically review credit reports for accuracy, especially after closing accounts.

- Consider diversifying credit types—adding a small personal loan or a retail card—if your revolving credit mix becomes thin.

By balancing the desire for a leaner wallet with the technical requirements of credit scoring, you can enjoy the benefits of fewer cards while preserving, or even improving, your creditworthiness.

Finally, if you’re uncertain whether closing a particular card aligns with your financial goals, a practical first step is to read a detailed guide that walks you through the process while emphasizing credit preservation. Our comprehensive article on how to close your credit card account permanently—and keep your credit intact provides a step‑by‑step roadmap tailored to both novice and experienced cardholders.

In summary, the decision to close a credit card should be made with a clear understanding of how it will affect your credit utilization, account age, and overall credit mix. By following the outlined steps, monitoring your credit reports, and employing strategies to offset any negative shifts, you can manage closures confidently and maintain a healthy credit profile for future financial milestones.