Table of Contents

- Understanding the Capital One Login Interface

- User ID Field

- Password Field

- Security Verification (CAPTCHA or Two‑Factor Authentication)

- Key Features Accessible After Login

- Account Summary

- Payments and Transfers

- Rewards and Benefits

- Account Settings

- Common Login Issues and How to Resolve Them

- Forgotten Credentials

- Browser Compatibility Problems

- Two‑Factor Authentication Failures

- Account Lockouts

- Security Best Practices for Ongoing Protection

- Enable Alerts

- Use Secure Networks

- Update Software Regularly

- When to Seek Assistance from Capital One Support

- Phone Support

- Live Chat

- Secure Message Center

- Social Media Caution

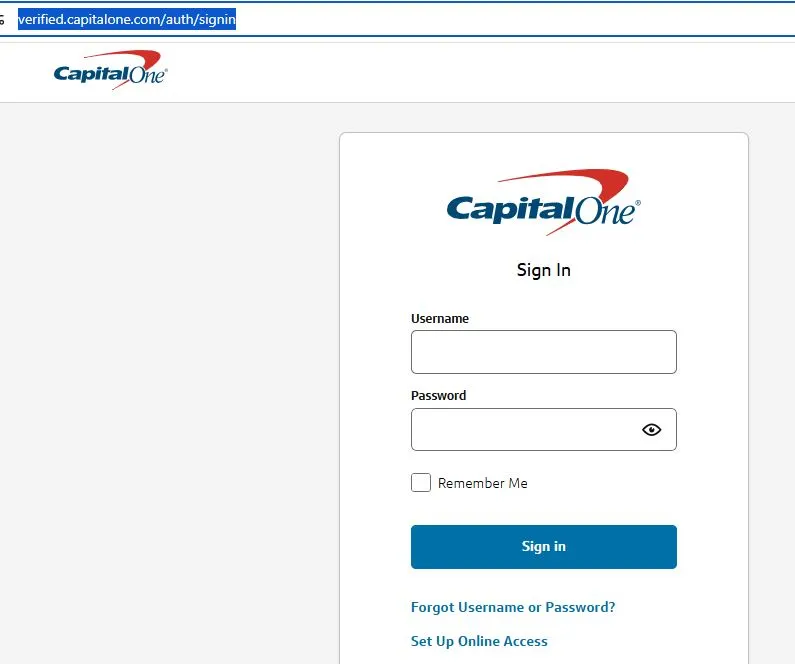

Capital One credit card login page serves as the digital gateway for millions of cardholders who need to monitor balances, make payments, and manage rewards. Accessing this portal correctly is essential for maintaining financial health and preventing unauthorized activity. In this article we walk through the layout of the login screen, explain each function, and outline steps to resolve typical problems without compromising security.

The modern banking experience hinges on a seamless online interface. Capital One has invested heavily in user‑friendly design, mobile responsiveness, and layered security measures. Whether you are a first‑time user or a seasoned member, understanding the page’s components can reduce friction when you need to check a transaction or set up an automatic payment.

Beyond the basics, the login environment interacts with other services such as balance transfers, reward redemption, and card replacement requests. By linking these activities, Capital One creates a cohesive ecosystem that streamlines everyday financial decisions. For example, if you are considering a low‑interest option, you might explore the Unlock Savings with Low Interest Rate Credit Card Options – Your Guide to Smarter Spending article for additional context on how the login portal can help you compare offers.

Understanding the Capital One Login Interface

The login page is intentionally minimalistic, focusing on three primary fields: User ID, Password, and a security verification step. Below we break down each element and its purpose.

User ID Field

- What it stores: Typically your Capital One Online ID, which may be a combination of letters and numbers chosen during account setup.

- Best practice: Keep the ID private and avoid using easily guessable information such as birthdays.

- Troubleshooting tip: If you forget your ID, use the “Forgot ID?” link to receive a reminder via the email address on file.

Password Field

- Complexity requirements: Minimum eight characters, at least one uppercase letter, one number, and one special character.

- Security tip: Use a password manager to generate and store unique passwords for each financial site.

- Recovery process: The “Forgot Password?” link triggers a multi‑factor verification, often involving a text code or security question.

Security Verification (CAPTCHA or Two‑Factor Authentication)

- CAPTCHA helps block automated bots from attempting credential stuffing attacks.

- Two‑factor authentication (2FA) may be optional but is strongly recommended. Capital One can send a one‑time passcode to your registered mobile number or email.

- Enabling 2FA adds a layer of protection that aligns with best practices highlighted in the What Is a 0% APR Balance Transfer? guide, where security considerations are also discussed.

Key Features Accessible After Login

Once authenticated, the dashboard presents a suite of tools designed to give you control over your credit card account.

Account Summary

The top of the screen displays current balance, available credit, and minimum payment due. This snapshot updates in near real‑time, allowing you to track spending patterns and avoid over‑limit fees.

Payments and Transfers

You can schedule a one‑time payment, set up recurring automatic payments, or initiate a balance transfer to another card. Each option includes a confirmation screen that outlines fees and processing times, ensuring transparency before you commit.

Rewards and Benefits

If your Capital One card offers cash back, miles, or points, the rewards tab shows your accrued totals, redemption options, and upcoming offers. The interface often highlights limited‑time promotions that can boost your earnings.

Account Settings

From this section you can update personal information, change your password, enroll in alerts, and manage card preferences such as adding authorized users or ordering a replacement card.

Common Login Issues and How to Resolve Them

Even a well‑designed portal can encounter hiccups. Below are frequent problems and step‑by‑step solutions.

Forgotten Credentials

- Click the “Forgot ID?” or “Forgot Password?” link on the login page.

- Enter the email address associated with your Capital One account.

- Follow the instructions sent to your inbox or phone, which may include answering security questions.

- Reset your password using a strong, unique phrase.

Browser Compatibility Problems

Capital One recommends using the latest version of Chrome, Firefox, Safari, or Edge. If you experience layout distortion or error messages, try clearing your browser cache, disabling extensions that block scripts, or switching to a different browser.

Two‑Factor Authentication Failures

- Ensure the phone number or email listed in your profile is current.

- Check your spam or junk folder for the verification code.

- If you lose access to the registered device, use the “Recovery Options” link to verify identity via alternative methods, such as a security question.

Account Lockouts

After multiple failed login attempts, Capital One temporarily locks the account to protect against brute‑force attacks. To unlock, follow the “Account Locked” prompts, which typically require a verification call or a secure link sent to your email.

Security Best Practices for Ongoing Protection

Maintaining a secure environment extends beyond the initial login. Regular habits can greatly reduce the risk of fraud.

Enable Alerts

Set up transaction alerts via SMS or email. Immediate notifications of unfamiliar activity give you a chance to act quickly.

Review Account Activity Frequently

Make it a habit to log in at least once a week to review recent purchases and verify that all charges are legitimate.

Use Secure Networks

Avoid public Wi‑Fi when accessing financial accounts. If you must use a shared network, enable a reputable VPN to encrypt your connection.

Update Software Regularly

Keep your operating system, browser, and antivirus software up to date. Security patches often address vulnerabilities that could be exploited by attackers.

When to Seek Assistance from Capital One Support

Despite thorough preparation, situations arise that require direct assistance. Knowing the right channels can save time.

Phone Support

Call the number on the back of your card for immediate help with login problems, suspicious activity, or account updates.

Live Chat

Capital One’s website offers a live‑chat feature, which can guide you through troubleshooting steps in real time.

Secure Message Center

After logging in, you can send a secure message to the support team. This method is useful for non‑urgent inquiries or for attaching documents safely.

Social Media Caution

Never share personal credentials on social platforms. Capital One does not handle account issues through public channels.

Understanding the Capital One credit card login page is more than a matter of clicking “Sign In.” It involves recognizing each component’s role, following robust security protocols, and knowing where to turn when obstacles appear. By integrating these practices into your routine, you can enjoy the convenience of online account management while safeguarding your financial information. As digital banking continues to evolve, staying informed about portal features and security measures remains a cornerstone of responsible credit card ownership.