Table of Contents

- What Is Purchase Protection and Why It Matters

- Key Features and Coverage Types

- Coverage Duration

- Eligible Items

- Claim Limits

- Types of Incidents Covered

- How to Activate and Use Purchase Protection

- Check Eligibility Before Buying

- Maintain Documentation

- Report Incidents Promptly

- Common Limitations and Exclusions

- Exclusions by Item Category

- Exclusions by Cause

- Geographic Restrictions

- Steps to File a Purchase Protection Claim

- Step 1: Gather Required Documents

- Step 2: Contact the Benefits Department

- Step 3: Follow Up

- Step 4: Receive Reimbursement

- Tips for Maximizing Purchase Protection

- Combine With Manufacturer Warranties

- Leverage Multiple Cards

- Stay Aware of Annual Caps

- Protect Against Fraud

- Review Policy Updates Regularly

Credit cards with purchase protection have become a quiet guardian for millions of shoppers, stepping in when a purchased item gets damaged, stolen, or simply fails to live up to expectations. From the moment you swipe the card, an invisible layer of security begins to form, offering reimbursements or replacements that can turn a frustrating mishap into a manageable incident. Understanding the mechanics behind this feature helps you leverage it effectively, ensuring that the money you spend is not only convenient but also protected.

In this article, we explore the fundamentals of purchase protection, the types of coverage most issuers provide, and practical steps to activate and claim benefits. By weaving real‑world scenarios with clear guidelines, the piece serves as a roadmap for anyone looking to make the most of this built‑in perk. Whether you’re a frequent traveler, a tech enthusiast, or a casual shopper, the insights here will help you safeguard your purchases without extra effort.

What Is Purchase Protection and Why It Matters

Purchase protection, sometimes labeled as “item protection” or “new‑purchase guarantee,” is an ancillary benefit bundled with many credit cards. It typically covers accidental damage, theft, or loss of newly bought items for a limited period—often ranging from 30 to 120 days. The coverage amount may be a percentage of the purchase price, up to a maximum dollar limit per claim or per year.

The value of this benefit becomes clear when an expensive gadget stops working shortly after purchase, or when a suitcase is lost during a trip. Instead of navigating a retailer’s return policy or paying out‑of‑pocket for a replacement, the cardholder can file a claim with the issuer and receive reimbursement, subject to the card’s terms.

Key Features and Coverage Types

Most issuers structure purchase protection around a few core elements. Understanding these helps you gauge whether a particular card aligns with your spending habits.

Coverage Duration

- Standard window: 30‑90 days from the purchase date, ideal for short‑term electronics and accessories.

- Extended window: Up to 120 days for premium cards, providing longer protection for items like furniture or appliances.

Eligible Items

- Physical goods such as electronics, clothing, jewelry, and home furnishings.

- Exclusions often include perishable goods, digital downloads, and items bought for resale.

Claim Limits

- Per‑claim maximum: Usually between $500 and $2,500, depending on the card tier.

- Annual aggregate limit: Many cards cap total reimbursements at $5,000‑$10,000 per year.

Types of Incidents Covered

- Accidental damage: Drops, spills, or cracks that render the item unusable.

- Theft or loss: Items stolen from your home or vehicle, or misplaced during travel.

- Mechanical breakdown: Some premium cards extend coverage to include defects that appear shortly after purchase.

How to Activate and Use Purchase Protection

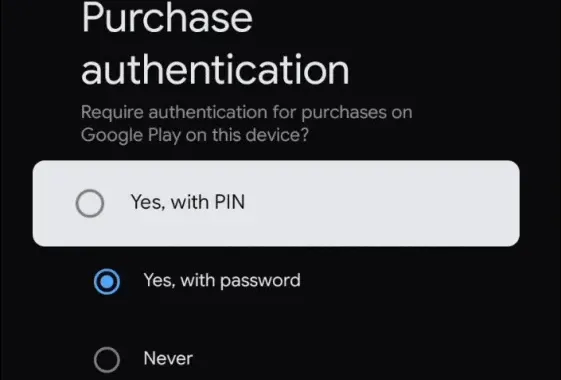

Activation is often automatic when you use the card for the purchase, but confirming the coverage details in your cardmember agreement is essential. Follow these steps to ensure you’re covered:

Check Eligibility Before Buying

- Review the card’s purchase protection policy on the issuer’s website or in the benefits guide.

- Verify that the merchant’s receipt reflects the exact purchase amount, as insurers may require proof of payment.

When you’re unsure whether a specific product qualifies, you can often find clarification through the issuer’s customer service portal. For instance, linking your query to the What Is a Credit Limit and How Is It Determined? guide can help you understand how the credit limit interacts with claim caps.

Maintain Documentation

- Keep original receipts, invoices, and any warranty paperwork.

- Photograph the item at the time of purchase and again if damage occurs; visual evidence speeds up claim processing.

Report Incidents Promptly

- Most issuers require a claim to be filed within 30‑60 days of the incident.

- Contact the card’s benefits department via phone or online portal, providing the documentation gathered.

Common Limitations and Exclusions

While purchase protection is a valuable safety net, it isn’t a universal shield. Knowing the constraints helps you avoid surprise denials.

Exclusions by Item Category

- Perishables, consumables, and services (e.g., airline tickets) are rarely covered.

- High‑value items such as fine art or antique furniture may exceed per‑claim limits, requiring separate insurance.

Exclusions by Cause

- Intentional damage or negligence (e.g., water damage from a known leak) is typically excluded.

- Losses due to natural disasters may fall under a different policy, like homeowner’s insurance.

Geographic Restrictions

- Some issuers limit coverage to purchases made within the United States or specific regions.

- International purchases may still be eligible, but you might need to provide additional documentation.

Steps to File a Purchase Protection Claim

When an incident occurs, a structured approach can reduce friction and expedite reimbursement.

Step 1: Gather Required Documents

- Original receipt showing purchase date, amount, and merchant.

- Proof of incident (police report for theft, photos for damage).

- Any warranty or return‑policy paperwork that might affect the claim.

Step 2: Contact the Benefits Department

Most issuers offer a dedicated phone line or online claim portal. Provide a concise description of the incident, attach the gathered documents, and note the card number used for purchase.

Step 3: Follow Up

- Keep a record of the claim reference number.

- If a response is delayed, follow up within the timeframe specified in the policy—often 14 days.

Step 4: Receive Reimbursement

Reimbursements are typically issued as a credit to your card account or a direct deposit. Review the final settlement to confirm that the amount aligns with the policy’s limits.

Tips for Maximizing Purchase Protection

To turn purchase protection into a practical advantage, consider these best practices.

Combine With Manufacturer Warranties

Purchase protection often fills gaps that manufacturer warranties leave. For example, a laptop’s one‑year warranty may not cover accidental drops; the card’s protection can cover that scenario.

Leverage Multiple Cards

If you own more than one card offering purchase protection, compare their limits and coverage windows. Using the card with the higher per‑claim limit for high‑value items can reduce out‑of‑pocket exposure.

Stay Aware of Annual Caps

Track your yearly claim total to avoid exceeding the aggregate limit. Some issuers provide an online dashboard that shows remaining coverage, similar to how you monitor credit utilization.

Protect Against Fraud

In the event your card is lost or stolen, immediate action is crucial. Follow the steps outlined in Lost Your Credit Card? 7 Immediate Actions to Stop Fraud and Keep Your Money Safe to prevent unauthorized purchases that could affect your protection eligibility.

Review Policy Updates Regularly

Credit card benefits can change annually. Set a reminder to review the latest terms before renewing or applying for a new card, ensuring you always have the most suitable protection in place.

By integrating these strategies into your routine, you transform a passive benefit into an active component of your financial safety net. The result is a smoother, more confident purchasing experience, backed by the assurance that unexpected mishaps won’t derail your budget.

Purchase protection is more than a marketing buzzword; it’s a functional extension of the credit card’s core promise—making spending easier while safeguarding against risk. As you continue to evaluate card offers, prioritize those that blend generous limits, reasonable claim windows, and clear, straightforward processes. In doing so, you’ll harness a tool that not only protects your purchases but also reinforces disciplined financial habits.