Table of Contents

- Overview of the Navy Federal Credit Card Portfolio

- Eligibility and Application Process

- Step‑by‑Step Application Guide

- Deep Dive into Individual Card Features

- Navy Federal Platinum Credit Card

- Navy Federal MoneyBack® Credit Card

- Navy Federal More Rewards® Credit Card

- Navy Federal nRewards® Secured Credit Card

- Rewards Redemption and Statement Management

- Tips for Maximizing Rewards

- Security Features and Member Protection

- Comparing Navy Federal Cards to Market Alternatives

- APR and Fees

- Rewards Structure

- Member Service

- Practical Tips for Current and Prospective Members

- How to Choose the Right Card

- Maintaining a Healthy Credit Profile

- Utilizing NFCU’s Digital Tools

For members of the United States armed forces, veterans, and their families, Navy Federal Credit Union (NFCU) offers a suite of credit cards that blend competitive interest rates with military‑focused perks. When you search for Navy Federal credit union credit cards, you’ll find a portfolio designed to meet everyday spending, travel, and emergency needs. This article walks through the history, card lineup, eligibility requirements, reward structures, security tools, and practical tips for getting the most out of an NFCU card.

Understanding a credit union’s approach differs from a traditional bank. Credit unions are member‑owned, meaning profits are returned to members in the form of lower fees, better rates, and tailored services. Navy Federal, the largest credit union in the United States, leverages this model to provide credit cards that often beat the industry average for APRs and fee structures. Below, we explore each offering in depth, so you can decide which card aligns with your financial goals.

Before diving into specifics, it’s useful to know why a Navy Federal card might be the right choice. If you value a strong customer service reputation, a focus on military life, and the ability to earn rewards without steep annual fees, NFCU’s cards deserve serious consideration. Let’s start by looking at the core lineup.

Overview of the Navy Federal Credit Card Portfolio

Navy Federal currently issues four primary credit cards, each targeting a distinct user profile:

- Navy Federal Platinum Credit Card – A low‑interest, no‑annual‑fee card aimed at members who prioritize balance transfers and everyday purchases.

- Navy Federal MoneyBack® Credit Card – A cash‑back card that offers 1% to 3% rewards on rotating categories and everyday spending.

- Navy Federal More Rewards® Credit Card – Designed for frequent travelers, this card delivers points redeemable for travel, merchandise, or cash.

- Navy Federal nRewards® Secured Credit Card – An entry‑level secured card that helps build or rebuild credit while still offering points.

Each card shares common benefits such as free access to the NFCU mobile app, zero foreign transaction fees on most cards, and robust fraud protection. However, the nuances in rewards, APR ranges, and eligibility criteria set them apart.

Eligibility and Application Process

Eligibility for any Navy Federal credit card requires membership in the credit union, which is open to:

- Active, retired, or veteran members of the U.S. Army, Marine Corps, Navy, Air Force, Coast Guard, Space Force, and National Guard.

- Department of Defense (DoD) civilian employees.

- Immediate family members of eligible individuals.

Prospective members must first open a savings or checking account with a minimum deposit of $5. Once membership is confirmed, the application can be completed online, via phone, or at a branch.

Step‑by‑Step Application Guide

- Step 1: Verify Membership – Confirm you meet one of the eligibility criteria and have an active NFCU account.

- Step 2: Choose the Right Card – Review the card features outlined above and select the one that matches your spending habits.

- Step 3: Gather Documentation – Prepare a government‑issued ID, Social Security number, and recent income information.

- Step 4: Submit Application – Fill out the online form on the Navy Federal website, or submit a paper application at a branch.

- Step 5: Await Decision – Most applications are reviewed within minutes; in some cases, additional verification may be required.

Once approved, the card arrives by mail within 7‑10 business days. Activation can be completed through the mobile app or by calling the toll‑free number.

Deep Dive into Individual Card Features

Navy Federal Platinum Credit Card

The Platinum card is built for low‑cost borrowing. It offers:

- Variable APR ranging from 13.99% to 24.99%, depending on creditworthiness.

- No annual fee.

- Balance transfer fee of 3% (minimum $5) with a promotional 0% APR for the first 12 months on transferred balances.

- Standard rewards of 1 point per $1 spent (redeemable for cash, travel, or merchandise).

This card is ideal for members who carry a balance occasionally but want to avoid high interest charges. The 0% balance transfer offer can be a useful tool for consolidating debt, especially when combined with the low‑interest credit card options discussed in related guides.

Navy Federal MoneyBack® Credit Card

The MoneyBack card focuses on cash back. Its reward structure includes:

- 1% cash back on all purchases.

- Up to 3% cash back on two categories of your choice (e.g., groceries, gas, dining, or recurring bills).

- Annual fee of $0.

- APR between 13.99% and 24.99%.

Points earned can be redeemed directly as a statement credit, which ties into the guidance on turning rewards into real money. The flexibility to select two bonus categories each year makes this card adaptable to changing spending patterns.

Navy Federal More Rewards® Credit Card

Travel enthusiasts will gravitate toward the More Rewards card. Key highlights include:

- Earn 2 points per $1 on travel purchases and 1 point per $1 on all other expenses.

- Points are redeemable for travel bookings through the Navy Federal travel portal, airline partners, or as cash back.

- Annual fee of $0 for the first year, then $95 thereafter (waivable for members with a qualifying direct deposit).

- Variable APR from 13.99% to 24.99%.

Members who frequently fly or stay at hotels can maximize the 2‑point travel multiplier. The card also offers purchase protection, travel insurance, and zero foreign transaction fees—features that align with the purchase protection benefits discussed elsewhere.

Navy Federal nRewards® Secured Credit Card

For individuals building credit, the secured card provides a pathway without sacrificing rewards:

- Requires a security deposit ranging from $200 to $2,000, which becomes your credit limit.

- Earn 1 point per $1 spent.

- No annual fee.

- APR between 14.99% and 24.99%.

After a period of responsible use (typically 12 months), members may be eligible for an unsecured card upgrade, allowing the deposit to be refunded.

Rewards Redemption and Statement Management

All Navy Federal cards funnel points into the same nRewards® platform, simplifying redemption across categories. Members can log into the NFCU online portal or mobile app to view point balances, select redemption options, or convert points to cash back. For those who prefer downloadable statements, the credit union’s online banking system offers secure PDF exports. A step‑by‑step tutorial on how to retrieve statements can be found in the guide on downloading credit card statements quickly and securely.

Tips for Maximizing Rewards

- Align Bonus Categories: For the MoneyBack card, review your yearly spending and select categories that capture the highest expense volumes.

- Combine with Direct Deposits: Some cards waive annual fees when a qualifying direct deposit is in place, effectively increasing net rewards.

- Leverage Travel Portals: When using the More Rewards card, book travel through NFCU’s portal to capture the full 2‑point multiplier.

- Pay in Full: Avoid interest charges that can quickly erode the value of earned points.

Security Features and Member Protection

Security is a cornerstone of Navy Federal’s offering. All cards are EMV chip‑enabled, providing dynamic authentication that reduces counterfeit fraud. Additional safeguards include:

- Real‑time transaction alerts via push notifications.

- Zero liability protection for unauthorized purchases.

- Identity theft monitoring and credit freeze assistance.

- Optional purchase protection that covers damaged or stolen items for up to 90 days.

These tools work together to create a layered defense, ensuring that members can use their cards confidently both online and offline.

Comparing Navy Federal Cards to Market Alternatives

When weighing Navy Federal cards against other issuers, consider three primary dimensions: APR, fees, and rewards flexibility.

APR and Fees

Most mainstream credit cards from large banks start with a variable APR near 15% for qualified borrowers, often climbing above 23% for those with lower credit scores. Navy Federal’s rates are competitive, frequently landing in the lower end of that range, especially for members with a strong banking relationship. Moreover, the absence of annual fees on the Platinum, MoneyBack, and secured cards provides a cost advantage over many retailer‑specific cards that charge $0 annual fees but impose high APRs.

Rewards Structure

While premium cards from issuers like Chase Sapphire or American Express can offer sign‑up bonuses in the thousands of points, Navy Federal’s focus is on consistent, usable rewards without the complexity of tiered bonus thresholds. For members who prioritize steady cash back or travel points without an upfront spending hurdle, the MoneyBack and More Rewards cards present a balanced alternative.

Member Service

Credit unions traditionally score higher in member satisfaction surveys, citing personalized service and quicker dispute resolution. Navy Federal extends this reputation through 24/7 phone support staffed by individuals familiar with military life, a niche that large banks may not match.

Practical Tips for Current and Prospective Members

How to Choose the Right Card

- Assess Your Spending: If most purchases are everyday necessities, the MoneyBack card’s 3% categories may yield the highest cash back.

- Consider Travel Frequency: Frequent flyers should evaluate the More Rewards card, especially if you can meet the direct deposit requirement to waive the annual fee.

- Plan for Debt Management: The Platinum card’s introductory 0% APR on balance transfers can be a strategic tool for consolidating high‑interest balances.

Maintaining a Healthy Credit Profile

Because Navy Federal reports activity to the major credit bureaus, responsible use of any of its cards improves your credit score over time. Key habits include keeping utilization below 30%, paying at least the minimum by the due date, and monitoring statements for inaccuracies.

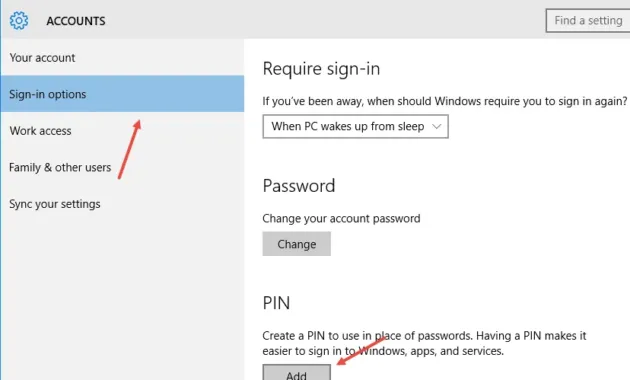

Utilizing NFCU’s Digital Tools

The mobile app not only provides balance and transaction views but also allows you to set custom alerts, lock or unlock your card instantly, and redeem points on the go. Embracing these digital features can streamline budgeting and enhance security.

In summary, Navy Federal Credit Union’s credit card lineup reflects the organization’s member‑first philosophy, delivering low rates, straightforward rewards, and robust security. Whether you are a service member looking for a low‑cost card to manage everyday expenses, a traveler seeking point‑rich options, or someone rebuilding credit, there is a Navy Federal card tailored to those needs. By understanding each product’s nuances, aligning them with your financial habits, and leveraging the credit union’s digital tools, you can make an informed decision that supports both short‑term convenience and long‑term financial health.