Table of Contents

- What Sets the Delta SkyMiles Credit Card Apart?

- Eligibility and Application Process

- Step‑by‑Step Application Guide

- Understanding the Rewards Structure

- Managing Your Delta SkyMiles Credit Card Account

- Key Features of the Dashboard

- Fees, Interest, and Other Charges

- Tips for Maximizing Your Miles

- Strategic Redemption

- Everyday Spending Hacks

- Common Issues and How to Resolve Them

- Missing Miles After a Purchase

- Card Lost or Stolen

- Disputing Unauthorized Charges

- Comparing Delta SkyMiles Cards with Other Airline Cards

- Security and Account Protection

Managing a Delta SkyMiles credit card account can feel like navigating a bustling airport: there are many terminals, signs, and procedures, but with the right map, the journey becomes smooth and rewarding. Whether you are a frequent flyer eyeing complimentary upgrades or a casual traveler seeking occasional perks, understanding the intricacies of your Delta SkyMiles credit card account is essential for maximizing value.

This guide walks you through the entire lifecycle of the account—starting from eligibility and application, moving through everyday management, and ending with strategies to avoid common pitfalls. By the end, you will have a clear roadmap for turning every swipe into miles, savings, and a more enjoyable travel experience.

Let’s begin by exploring what makes the Delta SkyMiles credit card distinct among airline co‑branded cards and why it might be the right fit for your travel goals.

What Sets the Delta SkyMiles Credit Card Apart?

Delta Air Lines, in partnership with American Express, offers a family of co‑branded credit cards designed to reward loyalty to the SkyMiles program. Unlike generic cash‑back cards, these cards translate everyday spending into airline miles, offering benefits such as free checked bags, priority boarding, and discounted award flights. The card suite includes:

- Delta SkyMiles® Gold Card

- Delta SkyMiles® Platinum Card

- Delta SkyMiles® Reserve Card

- Delta SkyMiles® Business Gold Card

- Delta SkyMiles® Business Platinum Card

Each tier introduces incremental perks, but the core concept remains the same: every purchase fuels your SkyMiles balance, which can later be redeemed for flights, seat upgrades, or even merchandise.

Eligibility and Application Process

Before you can open a Delta SkyMiles credit card account, you must meet certain eligibility criteria. These typically include a minimum credit score (often in the “good” range, around 670), a U.S. residential address, and an age of at least 18 years.

Step‑by‑Step Application Guide

- Research the tier: Compare the Gold, Platinum, and Reserve cards to determine which aligns with your travel frequency and budget.

- Gather documentation: Have your Social Security number, income details, and employment information ready.

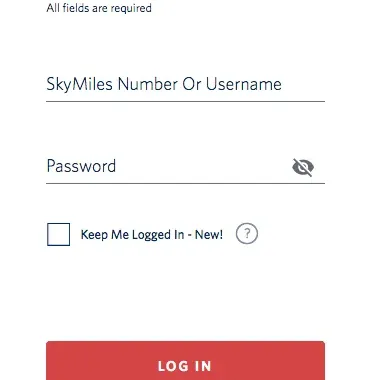

- Apply online: Visit the official Delta or American Express website, select the desired card, and fill out the application form.

- Await approval: Most decisions are instant, but some applications may require additional verification.

- Activate the card: Once approved, follow the activation steps provided in the welcome packet or via the online portal.

Successful applicants receive a welcome bonus—often a sizable chunk of miles after meeting a minimum spend within the first three months. This bonus can jump‑start your mileage balance and set the tone for future rewards.

Understanding the Rewards Structure

Delta SkyMiles cards award miles based on spend categories. While the exact rates differ per tier, a typical structure looks like this:

- 2 miles per dollar on Delta purchases

- 1 mile per dollar on all other purchases

- Additional bonuses for dining, rideshares, and Delta Sky Club access (Reserve tier)

Beyond earning, the program offers “Mile Boosts,” which temporarily increase earning rates for specific categories—ideal for travelers planning a big trip. Keep an eye on promotional periods announced via email or the Amex mobile app.

Managing Your Delta SkyMiles Credit Card Account

Effective account management begins with a reliable online dashboard. The American Express website and mobile app allow you to track balances, view transaction history, and monitor earned miles in real time.

Key Features of the Dashboard

- Spending summary: Visual breakdowns of where your dollars go, helping you identify high‑earning categories.

- Automatic mile redemption: Set preferences for converting points to travel credits or merchandise.

- Alert settings: Receive notifications for large purchases, due dates, or potential fraud.

- Payment options: Pay the full balance or a minimum amount; consider setting up automatic payments to avoid late fees.

For users who prefer a more hands‑on approach, the monthly statement includes a “Miles Earned” section, making it easy to reconcile your credit card activity with your SkyMiles balance.

Fees, Interest, and Other Charges

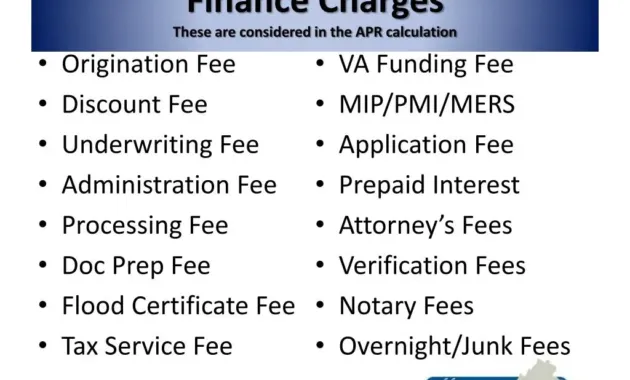

Every credit card carries costs, and the Delta SkyMiles cards are no exception. Understanding these fees helps you avoid unexpected expenses.

- Annual fee: Ranges from $0 (Gold) to $550 (Reserve). The fee is often offset by travel credits, free checked bags, and the value of earned miles.

- Interest rate: Variable APR typically between 16% and 24% APR, depending on creditworthiness.

- Foreign transaction fee: Most Delta cards waive this fee, a valuable feature for international travelers. For cards that do charge, read The Hidden Cost of Global Spending: Foreign Transaction Fees Explained to gauge the impact.

- Late payment fee: Up to $40 per missed payment.

- Balance transfer fee: If you consider moving balances from higher‑interest cards, review Why Consider a Balance Transfer? for potential savings.

Tips for Maximizing Your Miles

Acquiring miles is only half the battle; redeeming them wisely determines the true value of your Delta SkyMiles credit card account.

Strategic Redemption

- Book early: Award seats open 330 days in advance; booking as soon as possible secures the best options.

- Utilize “Pay with Miles”: Combine cash and miles for flexible purchases, especially when award seats are scarce.

- Leverage companion certificates: Higher‑tier cards issue annual companion tickets for domestic flights—great for couples or friends traveling together.

- Watch for “Miles + Cash” deals: These promotions let you stretch miles further during peak travel periods.

Everyday Spending Hacks

- Use the card for all Delta purchases, including in‑flight purchases and baggage fees.

- Enroll in the “Dining” and “Ride‑Share” bonus programs if your tier offers extra miles for those categories.

- Pay recurring bills (utilities, streaming services) with the card to accumulate miles without extra effort.

Common Issues and How to Resolve Them

Even the most well‑designed credit products can encounter hiccups. Below are frequent challenges and practical steps to address them.

Missing Miles After a Purchase

- Verify the transaction appears on your statement as a Delta purchase.

- Check the “Earned Miles” section in the Amex app; sometimes miles post a few days later.

- If still missing, contact American Express customer service with the receipt; most issues resolve within 48 hours.

Card Lost or Stolen

Prompt action is crucial to prevent fraudulent activity. Follow the guidelines in Lost Your Credit Card? 7 Immediate Actions to Stop Fraud and Keep Your Money Safe—freeze the card via the app, request a replacement, and monitor your account for unauthorized charges.

Disputing Unauthorized Charges

- Log into your account and flag the transaction as suspicious.

- Contact the dispute department within 60 days of the statement date.

- Provide supporting documentation (receipts, correspondence) to expedite resolution.

Comparing Delta SkyMiles Cards with Other Airline Cards

When evaluating whether to keep your Delta SkyMiles credit card account or switch to a competitor, consider the following dimensions:

- Annual fee vs. benefits: Some airlines waive fees entirely but offer fewer premium perks.

- Earning rates: Delta’s 2 miles per dollar on airline purchases is competitive, though some cards offer higher multipliers on dining or travel.

- Redemption flexibility: Delta’s award seats often have higher fuel surcharges compared to low‑cost carriers.

- Travel protections: Reserve and Platinum cards include trip delay insurance and lounge access—features that may be absent on lower‑tier cards.

By weighing these factors against your travel patterns, you can decide if the Delta SkyMiles credit card remains the optimal choice or if a switch would yield greater value.

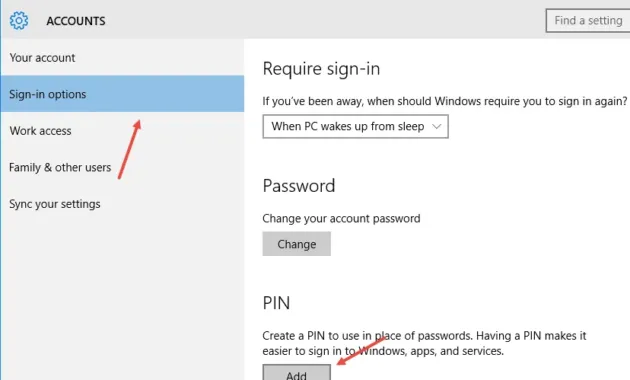

Security and Account Protection

Security is a non‑negotiable aspect of any credit card relationship. Delta SkyMiles cards benefit from American Express’s robust fraud‑detection algorithms, tokenized card numbers for online purchases, and zero‑liability policies for unauthorized transactions.

Nevertheless, maintain personal vigilance: regularly update passwords, enable two‑factor authentication on the Amex portal, and review transaction alerts. Should you suspect any irregular activity, the prompt steps outlined earlier will safeguard your account.

As you continue to use your Delta SkyMiles credit card, treat the account as both a financial tool and a travel companion. Regularly reviewing statements, optimizing spend categories, and staying informed about promotional offers will ensure the card serves you well for years to come.

By mastering the nuances of the Delta SkyMiles credit card account—understanding its fees, leveraging its rewards, and protecting it against fraud—you unlock a seamless travel experience that turns everyday purchases into jet‑setting opportunities.