Table of Contents

- Why Consider an Upgrade?

- Assessing Your Current Card’s Limitations

- When Is the Right Time to Upgrade?

- Annual Fee Waiver Periods

- Credit Score Milestones

- Evaluating Potential Upgraded Cards

- Compare Reward Categories

- Calculate Net Value After Fees

- Review Credit Limit Increases

- How to Initiate the Upgrade Process

- Contact Your Issuer

- Understand the Impact on Your Account Number

- Plan for Transition of Rewards

- Managing the Upgrade After Activation

- Set Up Autopay and Alerts

- Update Recurring Payments

- Monitor Your Credit Report

- Potential Risks and How to Mitigate Them

- Annual Fee Surprise

- Impact of Closing the Old Card

- Overextension of Credit

- Case Study: From a Basic Cashback Card to a Premium Travel Card

- Step‑by‑Step Checklist for a Successful Upgrade

Upgrading your credit card to a better version can feel like moving to a higher floor in a skyscraper: the view expands, the amenities improve, and the overall experience becomes more rewarding. The process, however, is not always as straightforward as swapping one card for another. By understanding the motivations behind an upgrade, the criteria to evaluate, and the practical steps involved, you can make a decision that aligns with your financial goals and lifestyle.

Many cardholders start their journey with a basic rewards card and, after a period of consistent use, wonder whether a premium version could unlock higher cash‑back rates, travel perks, or lower interest rates. This curiosity often stems from seeing friends enjoy lounge access, fee waivers, or accelerated points earnings. While those benefits can be enticing, the decision must be grounded in a realistic assessment of your spending patterns, credit profile, and long‑term plans.

In the sections that follow, we walk through the entire upgrade lifecycle—from recognizing the right timing to executing the switch and managing the transition. The guide is structured to provide a narrative that mirrors a typical cardholder’s experience, ensuring each step feels familiar and actionable.

Why Consider an Upgrade?

Before diving into the mechanics, it helps to clarify the core reasons why a cardholder might seek a better version of their current credit card.

- Enhanced Rewards Structure: Premium cards often offer higher earn rates on categories that match your spending, such as travel, dining, or groceries.

- Reduced Fees Over Time: Some upgrades replace an annual fee with a waived fee after meeting spending thresholds.

- Improved Credit Benefits: Higher credit limits, better interest rates, and additional fraud protection can accompany a newer product.

- Access to Exclusive Perks: Airport lounge access, travel insurance, and concierge services are common in upgraded cards.

Assessing Your Current Card’s Limitations

Take a moment to list the features you feel are missing. For instance, if you frequently travel but lack lounge access, that could be a catalyst for an upgrade. Similarly, if your current cash‑back rate caps at 1% while a premium version offers 3% on grocery purchases, the difference becomes measurable in your monthly budget.

When Is the Right Time to Upgrade?

The timing of an upgrade can influence both the cost and the credit impact. Two primary windows are worth monitoring:

Annual Fee Waiver Periods

Many issuers waive the annual fee for the first year of a new card. Initiating an upgrade during this window lets you enjoy premium benefits without an immediate fee, providing a trial period to assess value.

Credit Score Milestones

If your credit score has improved since you first opened the card—perhaps due to responsible payment history or reduced debt—your eligibility for higher‑tier cards increases. Upgrading after a score rise can result in better interest rates and higher credit limits.

Evaluating Potential Upgraded Cards

Choosing the right upgrade is not just about chasing the flashiest perks. A systematic evaluation helps ensure the new card aligns with your financial habits.

Compare Reward Categories

Map your average monthly expenditures across categories such as travel, dining, groceries, and online shopping. Then, match those categories against the reward structures of potential upgrades. For example, the Key Factors to Evaluate Before Selecting a Grocery Cash Back Card article provides a framework you can adapt for broader reward comparisons.

Calculate Net Value After Fees

Subtract the annual fee from the estimated annual rewards to determine net benefit. If a card offers $800 in rewards but charges a $95 fee, the net value is $705. Compare this figure across candidates to identify the most cost‑effective upgrade.

Review Credit Limit Increases

A higher credit limit can improve your credit utilization ratio, which in turn can boost your credit score. However, be cautious of cards that increase limits only after a prolonged usage period.

How to Initiate the Upgrade Process

Once you have selected a target card, follow these steps to execute the upgrade smoothly.

Contact Your Issuer

Most banks allow you to request an upgrade via phone, secure messaging, or the online account portal. Mention the specific card you wish to upgrade to, and ask about any promotional offers, such as fee waivers or bonus points.

Understand the Impact on Your Account Number

Some upgrades retain your existing account number, while others issue a new one. Keeping the same number preserves your credit history length, which is beneficial for your score. Ask the representative to clarify this detail before confirming the upgrade.

Plan for Transition of Rewards

Confirm whether existing points, cash back, or miles will transfer automatically to the new card. In most cases, they do, but a few issuers may treat the upgraded card as a separate product, requiring manual transfer or forfeiture.

Managing the Upgrade After Activation

After the new card arrives, there are several post‑activation tasks to ensure a seamless transition.

Set Up Autopay and Alerts

Link your new card to autopay to avoid missed payments. The How to Set Up Autopay for Your Credit Card in Minutes – A Complete Guide article walks you through setting up recurring payments quickly.

Update Recurring Payments

Replace the old card number on any subscriptions, utilities, or online services. Many platforms allow you to save multiple cards; keep the old card active temporarily until you verify the new one is functioning correctly.

Monitor Your Credit Report

Upgrading can result in a hard inquiry, which may cause a temporary dip in your score. Additionally, a new account or change in credit limit can affect your utilization ratio. Keep an eye on your credit reports for the next 30‑60 days to ensure everything reflects the upgrade accurately.

Potential Risks and How to Mitigate Them

While upgrades offer many advantages, they also carry risks that require attention.

Annual Fee Surprise

If the upgraded card carries a higher annual fee after the introductory period, calculate whether the ongoing rewards offset the cost. If not, consider downgrading back to the original tier before the fee renews.

Impact of Closing the Old Card

Some cardholders choose to close the original card after an upgrade. This action can affect your credit utilization and length of credit history. The The Surprising Impact of Closing a Credit Card Account on Your Financial Profile article explains why maintaining the original account—especially if it has a long history—might be preferable.

Overextension of Credit

A higher credit limit can be tempting, but it should not lead to increased spending beyond your repayment ability. Treat the additional limit as a safety net, not an invitation to spend more.

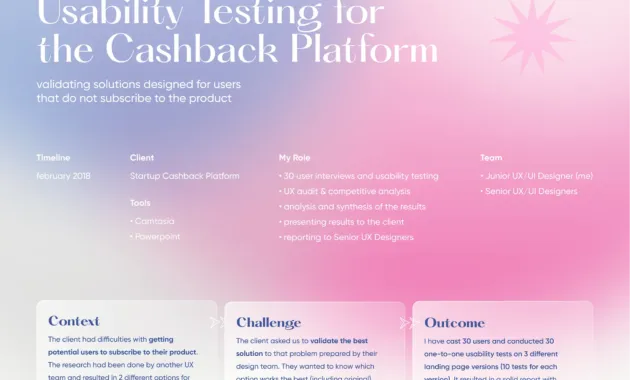

Case Study: From a Basic Cashback Card to a Premium Travel Card

Consider Maya, a 32‑year‑old marketing professional who started with a basic 1% cash‑back card. After three years of consistent usage, her credit score rose from 680 to 740. She reviewed her monthly expenses and realized that 45% of her spending fell into travel and dining categories.

Following the evaluation framework outlined above, Maya compared three potential upgrades:

- Card A: 2% cash back on travel, $95 annual fee.

- Card B: 3% on dining, 1% on other purchases, $150 annual fee, includes lounge access.

- Card C: 5x points on travel, $0 fee for the first year, $550 fee thereafter.

She calculated net annual rewards after fees and found Card B offered the highest net benefit for her spending pattern. Maya called her issuer, requested the upgrade, and confirmed that her existing points would transfer. After receiving the new card, she set up autopay, updated her recurring payments, and kept the old card active for a few months to ensure no pending transactions were missed.

Six months later, Maya’s annual travel expenses generated $1,200 in rewards, comfortably covering the $95 fee and leaving an additional $105 in net value. Her credit utilization dropped from 28% to 21% due to the higher limit, providing a modest boost to her credit score.

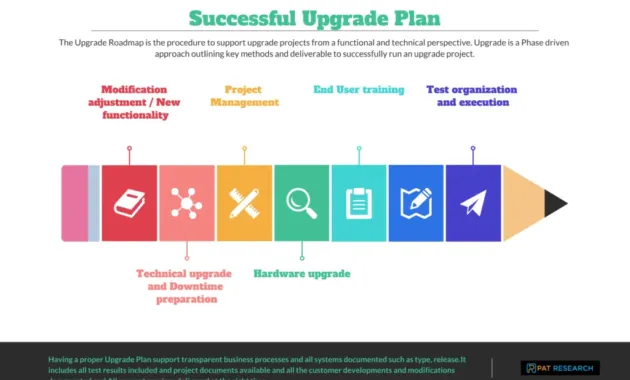

Step‑by‑Step Checklist for a Successful Upgrade

- Review current card benefits and identify gaps.

- Check your credit score and recent credit report for any errors.

- Map your spending categories and calculate potential reward gains.

- Compare annual fees, net rewards, and additional perks across upgrade candidates.

- Contact the issuer to confirm upgrade details, including account number continuity and reward transfer.

- Complete the upgrade request through the preferred channel (phone, online portal, or app).

- Set up autopay and update all recurring payment information.

- Monitor your credit reports for changes in utilization and any hard inquiries.

- Reassess after 12 months to ensure the upgraded card still meets your needs.

By following this structured approach, you can transition to a better credit card version with confidence, knowing that the decision is backed by data, timing considerations, and a clear post‑upgrade plan.

Ultimately, upgrading your credit card should enhance your financial flexibility, not complicate it. Treat the process as a strategic move—much like a chess player positioning a piece for a stronger attack—rather than a spontaneous impulse. With careful analysis and disciplined execution, the upgraded card becomes a tool that works in harmony with your broader financial objectives.