Table of Contents

- Understanding Foreign Transaction Fees

- Why Some Issuers Waive the Fee

- Key Benefits of No Foreign Transaction Fee Cards

- Combining Fee‑Free Cards with Reward Strategies

- How to Choose the Right No‑Fee Card

- Evaluating the Fine Print

- Top No‑Foreign‑Transaction‑Fee Cards in 2024

- 1. Chase Sapphire Preferred® Card

- 2. Capital One Venture Rewards Credit Card

- 3. Discover it® Miles

- 4. Bank of America® Travel Rewards Credit Card

- 5. Citi® Double Cash Card

- Using Your No‑Fee Card Effectively Abroad

- 1. Notify Your Issuer Before Departure

- 2. Choose Local Currency Over DCC

- 3. Keep a Backup Payment Method

- 4. Leverage Mobile Wallets

- 5. Monitor Statements in Real Time

- Common Pitfalls and How to Avoid Them

- Dynamic Currency Conversion (DCC)

- Cash Advances

- Merchant-Specific Fees

- Inadequate Credit Limit

- Tips for Maximizing Rewards While Traveling

- Future Trends in Fee‑Free Travel Cards

Traveling beyond your home country used to mean worrying about hidden fees that could quickly add up. No foreign transaction fee cards have changed that landscape, allowing you to spend in any currency without a 2‑3 % surcharge on each purchase. For frequent globetrotters, digital nomads, or anyone planning an overseas vacation, understanding how these cards work can protect your budget and simplify your experience.

In this article we’ll walk through the mechanics behind foreign transaction fees, explore why some issuers waive them, and outline a step‑by‑step approach to selecting the right card for your needs. Along the way, you’ll find practical tips for using the cards abroad, common pitfalls to avoid, and a curated list of top performers based on recent data. By the end, you’ll have a clear roadmap to travel confidently while keeping your wallet happy.

Before diving into the details, it’s worth noting that the absence of foreign transaction fees is just one piece of the puzzle. Other factors—such as reward structures, acceptance networks, and travel protections—play a significant role in determining the overall value of a card. The sections that follow break each element down, giving you a comprehensive view of the landscape.

Understanding Foreign Transaction Fees

A foreign transaction fee is typically charged by the card issuer whenever a purchase is processed in a currency other than the one used to pay your credit card bill. The fee usually ranges from 2 % to 3 % of the transaction amount and is meant to cover the costs of currency conversion and additional processing.

When a merchant processes a payment, the transaction often passes through the card network (Visa, Mastercard, etc.), which applies an exchange rate and may add a small markup. The issuing bank then adds its own foreign transaction fee before the amount appears on your statement. This layered structure is why the fee can feel like a hidden cost.

Why Some Issuers Waive the Fee

- Competitive Differentiation: Waiving the fee makes a card more attractive to travelers, helping issuers capture a niche market.

- Higher Reward Rates: Some cards offset the lack of a foreign fee by offering stronger rewards on travel or dining, which can be more appealing than the fee itself.

- Network Partnerships: Visa and Mastercard provide the infrastructure for fee‑free processing, allowing issuers to pass the savings to cardholders.

Key Benefits of No Foreign Transaction Fee Cards

The most obvious advantage is cost savings. For a traveler spending $2,000 abroad, a 3 % fee would amount to $60. Eliminating that fee directly improves your purchasing power. Beyond the monetary benefit, these cards often come with travel‑focused perks that enhance the overall experience.

- Transparent Spending: No surprise surcharges appear on your statement, making budgeting easier.

- Global Acceptance: Many fee‑free cards belong to major networks (Visa, Mastercard, Discover, American Express), ensuring acceptance in most countries.

- Travel Protections: Trip cancellation insurance, rental car collision coverage, and emergency card replacement are common add‑ons.

- Rewards Alignment: Cards that waive foreign fees often pair them with travel‑centric reward structures, such as points that can be redeemed for flights or hotel stays.

Combining Fee‑Free Cards with Reward Strategies

Pairing a no‑fee card with a high‑earning travel rewards card can maximize both savings and points accumulation. For example, you might use a fee‑free card for everyday purchases abroad while reserving a high‑bonus card for larger expenses like airline tickets. This approach mirrors the strategy described in Unlock Massive Rewards: The Ultimate Guide to Credit Cards with High Sign‑Up Bonuses, where layering different cards optimizes overall returns.

How to Choose the Right No‑Fee Card

Selecting the best card involves balancing several criteria. Below is a checklist to guide your decision:

- Annual Fee: Some premium cards charge $95‑$450 per year but compensate with richer perks. Determine if the benefits outweigh the cost.

- Rewards Rate: Look for cards offering 1.5–3 % cash back on travel, dining, or general purchases.

- Network Preference: Depending on where you travel, one network may be more widely accepted. The Ultimate Showdown: Comparing Visa vs Mastercard Benefits provides insight into network coverage differences.

- Travel Protections: Verify that the card includes essential protections such as lost‑luggage reimbursement or emergency assistance.

- Introductory Offers: Many cards feature sign‑up bonuses that can be worth several hundred dollars if you meet spending thresholds.

Evaluating the Fine Print

Even when a card advertises “no foreign transaction fees,” read the terms carefully. Some issuers may still charge fees on certain types of transactions, such as cash advances or purchases made with a prepaid card. Additionally, dynamic currency conversion (DCC) at point‑of‑sale can lead to unfavorable exchange rates; always opt to be charged in the local currency.

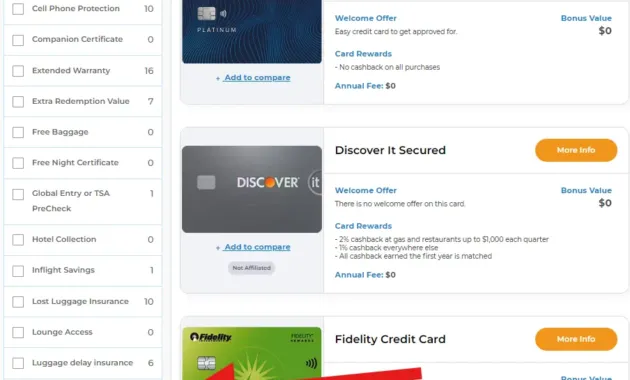

Top No‑Foreign‑Transaction‑Fee Cards in 2024

Based on annual fee, reward structure, and travel benefits, the following cards stand out in the current market. All listed cards are issued by major banks and belong to either the Visa or Mastercard network.

1. Chase Sapphire Preferred® Card

- Annual Fee: $95

- Rewards: 2 X points on travel and dining, 1 X on everything else.

- Travel Perks: Primary rental car insurance, trip cancellation/interruption insurance, and access to the Chase Luxury Hotel & Resort Collection.

- Foreign Transaction Fee: None.

2. Capital One Venture Rewards Credit Card

- Annual Fee: $95

- Rewards: 2 X miles on every purchase.

- Travel Perks: Up to $100 credit for Global Entry/TSA PreCheck, travel accident insurance.

- Foreign Transaction Fee: None.

3. Discover it® Miles

- Annual Fee: $0

- Rewards: 1.5 X miles on all purchases; Discover matches all miles earned in the first year.

- Travel Perks: No foreign transaction fees, free FICO® credit score.

- Foreign Transaction Fee: None.

4. Bank of America® Travel Rewards Credit Card

- Annual Fee: $0

- Rewards: 1.5 X points on all purchases.

- Travel Perks: No foreign transaction fees, easy point redemption for statement credits.

- Foreign Transaction Fee: None.

5. Citi® Double Cash Card

- Annual Fee: $0

- Rewards: 2 % cash back (1 % when you buy, 1 % as you pay).

- Travel Perks: While not travel‑focused, the card’s lack of foreign fees makes it a solid everyday travel companion.

- Foreign Transaction Fee: None.

Using Your No‑Fee Card Effectively Abroad

Having a fee‑free card is only half the battle; how you use it can affect both your costs and your safety. Below are actionable steps to ensure smooth transactions.

1. Notify Your Issuer Before Departure

Most banks allow you to set a travel notice online. This prevents automatic fraud alerts that could freeze your card while you’re abroad.

2. Choose Local Currency Over DCC

When presented with a choice at the point of sale, always select to be charged in the local currency. Paying in your home currency triggers dynamic currency conversion, which often adds a hidden markup.

3. Keep a Backup Payment Method

Even fee‑free cards can be declined due to network issues or merchant preferences. Carry a secondary card (preferably from a different network) or some cash as a safety net.

4. Leverage Mobile Wallets

Digital wallets like Apple Pay or Google Pay can reduce contact‑less transaction failures and sometimes provide an extra layer of security. Many international merchants accept them, and they use the same exchange rates as the underlying card.

5. Monitor Statements in Real Time

Use your issuer’s mobile app to track purchases instantly. If you spot an unfamiliar charge, you can dispute it promptly, reducing the risk of fraud.

Common Pitfalls and How to Avoid Them

Even savvy travelers stumble into traps that erode the benefits of a no‑fee card. Recognizing these pitfalls early can save both money and headaches.

Dynamic Currency Conversion (DCC)

As mentioned, DCC can inflate your cost by up to 5 % on top of the exchange rate. Always opt for local currency and, if unsure, ask the merchant to clarify the conversion process.

Cash Advances

Using your credit card to withdraw cash abroad typically incurs a cash‑advance fee (often 3‑5 %) and an immediate interest charge. Avoid this unless absolutely necessary.

Merchant-Specific Fees

Some overseas merchants, especially in certain regions, add their own surcharge for credit‑card use. Compare the total cost with a debit card or cash before proceeding.

Inadequate Credit Limit

Travel often involves larger purchases (e.g., airline tickets, hotel deposits). Ensure your credit limit can accommodate these expenses to avoid declined transactions.

Tips for Maximizing Rewards While Traveling

Pairing a no‑fee card with a smart rewards strategy can turn everyday expenses into valuable travel points. Below are concise tips that integrate seamlessly into your travel routine.

- Concentrate Spending: Use a single fee‑free card for all foreign purchases to accelerate point accumulation.

- Redeem for Travel: Convert points to airline miles or hotel stays when possible; the value per point is often higher than cash back.

- Take Advantage of Intro Bonuses: Meet the spending threshold within the first three months to secure a large sign‑up bonus—often equivalent to a free flight.

- Combine With Airline Partnerships: Some cards allow you to transfer points to airline loyalty programs at a 1:1 ratio, increasing flexibility.

- Use the Card for Recurring Bills: If you have subscriptions billed in USD, paying them with your fee‑free card still yields rewards without extra fees.

For a deeper dive into point redemption, see How to Redeem Credit Card Points for Cash – A Complete Guide, which explains how to convert travel rewards into cash for everyday use.

Future Trends in Fee‑Free Travel Cards

The market for no foreign transaction fee cards continues to evolve. Emerging trends include:

- Integrated Travel Platforms: Some issuers bundle flight booking tools directly into the app, allowing users to pay with points instantly.

- Dynamic Rewards Boosts: Temporary increases in reward rates for categories like dining or ride‑sharing while traveling abroad.

- Enhanced Security Features: Real‑time tokenization and biometric authentication reduce fraud risk, especially on foreign networks.

- Sustainable Card Options: Eco‑friendly cards made from recycled materials are gaining popularity among conscious travelers.

Staying informed about these developments can help you choose a card that not only saves on fees today but also aligns with future travel habits.

In summary, no foreign transaction fee cards provide a clear financial advantage for anyone spending abroad. By evaluating annual fees, reward structures, network acceptance, and travel protections, you can select a card that fits your itinerary and spending style. Use the practical tips outlined above to avoid common pitfalls, maximize rewards, and keep your finances transparent while exploring the world.