Table of Contents

- Online Account Management: The Core Hub

- Step‑by‑step online payment process

- Mobile App Payments: Speed at Your Fingertips

- Key advantages of the app

- Automatic Payments: Set It and Forget It

- Choosing the right autopay option

- Phone Payments: A Classic Alternative

- Things to keep in mind when paying by phone

- Mail‑In Payments: The Traditional Route

- Best practices for mailing payments

- Third‑Party Payment Services: Expanding Your Options

- Advantages and cautions

- Security Measures: Protecting Your Payment Data

- Simple steps to enhance security

- Reconciliation: Matching Payments to Statements

- Tools for easy reconciliation

- Common Mistakes and How to Avoid Them

- Typical errors

- Rewards and Benefits: Keeping the Perks Flowing

- Maximizing reward potential

- International Considerations: Paying from Abroad

- Strategies for overseas payments

Pay my American Express bill is a phrase you might hear in a busy office, a coffee shop, or a quiet home office. The request often comes from someone who knows that a timely payment protects credit scores and keeps rewards flowing. In this article we follow the steps a typical American Express cardholder takes, exploring each option in detail. By the end, you will see a clear path to paying your balance without confusion.

The story begins with a notification on a phone screen. A push alert from American Express reminds the user that the due date is approaching. The cardholder opens the app, scans the latest statement, and notes the amount due. From here, several routes branch out, each offering a different blend of speed, security, and convenience.

Online Account Management: The Core Hub

American Express maintains a robust online portal that serves as the central hub for most payment activities. Logging in is the first step; the interface presents the current balance, recent transactions, and the minimum payment required. From this dashboard, the user can choose to pay the full balance, a custom amount, or simply the minimum due.

Step‑by‑step online payment process

- Visit the official American Express website and click “Log In.”

- Enter your User ID and password, then complete any two‑factor authentication if prompted.

- Navigate to the “Payments” tab located in the main menu.

- Select the payment amount: “Full Balance,” “Minimum Payment,” or “Custom Amount.”

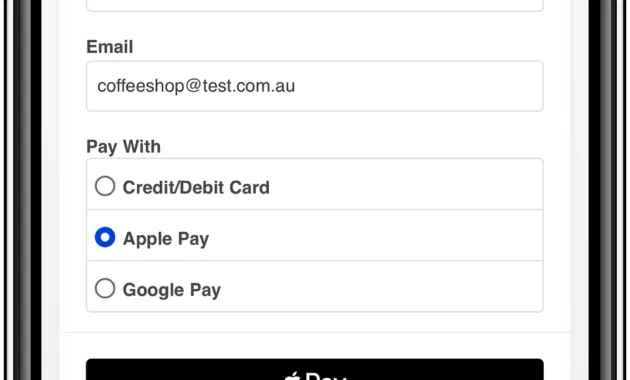

- Choose a funding source: checking account, savings account, or another credit card.

- Review the details, confirm the transaction, and receive a confirmation number.

For many, this method feels familiar because it mirrors other online banking experiences. The confirmation email that follows serves as a receipt, making it easy to reconcile the transaction later. If you need to track statements, see How to Download Credit Card Statements Quickly and Securely – Your Complete Guide for tips on storing these records safely.

Mobile App Payments: Speed at Your Fingertips

The American Express mobile app brings the same functionality to a smartphone, with a few enhancements designed for on‑the‑go users. After logging in, the “Pay My Bill” button is prominently displayed on the home screen. Tapping it launches a streamlined flow that requires fewer clicks than the desktop version.

Key advantages of the app

- Instant notifications: Push alerts remind you of upcoming due dates and confirm when a payment is processed.

- Biometric security: Fingerprint or facial recognition replaces passwords, adding an extra layer of protection.

- One‑tap autopay activation: Enable automatic payments directly from the app, reducing the risk of missed due dates.

Because the app stores your funding sources securely, you can switch accounts without re‑entering routing numbers each month. This convenience is especially useful for freelancers who receive income in multiple banks.

Automatic Payments: Set It and Forget It

Many American Express cardholders prefer the peace of mind that comes with automatic payments. By configuring autopay, the system deducts the selected amount on the due date each month. This approach eliminates manual steps and helps avoid late fees.

Choosing the right autopay option

- Full balance autopay: Guarantees you never carry a balance, which is ideal for those who want to avoid interest charges.

- Minimum payment autopay: Useful if cash flow varies, but it may result in interest accrual on the remaining balance.

- Custom amount autopay: Allows you to pay a set dollar figure each month, providing flexibility while still automating the process.

Setting up autopay can be done through the online portal, the mobile app, or by calling the customer service line. Once activated, you receive a monthly reminder confirming the transaction, which you can cross‑check against your bank statements.

Phone Payments: A Classic Alternative

For cardholders who prefer human interaction or who lack reliable internet access, paying by phone remains a viable option. Dialing the toll‑free number on the back of your card connects you to a representative who can process the payment.

Things to keep in mind when paying by phone

- Have your bank routing and account numbers ready before the call.

- Ask for a reference number or confirmation email to document the payment.

- Be aware of potential wait times during peak hours.

Phone payments are recorded in the same system as online payments, so they appear on your next statement without any special notation.

Mail‑In Payments: The Traditional Route

Although less common today, mailing a check or money order to American Express is still supported. The statement includes a pre‑printed payment coupon that you can detach, fill out, and send to the address indicated.

Best practices for mailing payments

- Write the exact payment amount and include your account number on the check.

- Use a secure envelope and consider tracking services for high‑value payments.

- Send the payment at least five business days before the due date to allow for postal processing.

While this method incurs a longer processing time, it can be useful for individuals who manage finances primarily with paper records.

Third‑Party Payment Services: Expanding Your Options

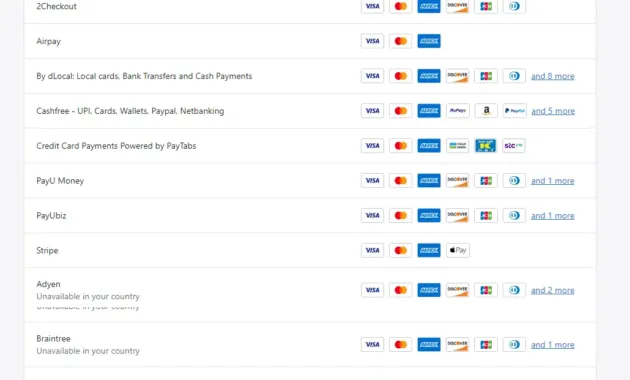

Several third‑party platforms allow you to pay your American Express bill indirectly. Services such as PayPal, Venmo, or online banking portals often support bill pay to credit cards, including Amex.

Advantages and cautions

- Convenient integration: If you already use a service for other bills, adding your Amex payment consolidates your financial tasks.

- Potential fees: Some platforms charge a small processing fee, which can offset the convenience.

- Processing time: Payments may take 1–3 business days to reach American Express, so plan accordingly.

Before using a third‑party service, verify that it supports American Express and review any associated costs. This ensures the payment arrives on time and without surprise charges.

Security Measures: Protecting Your Payment Data

Security is a recurring theme throughout every payment method. American Express employs encryption, tokenization, and fraud monitoring to safeguard transactions. Cardholders also share responsibility by using strong passwords, enabling two‑factor authentication, and monitoring statements regularly.

Simple steps to enhance security

- Update your password every six months and avoid reusing it across sites.

- Enable alerts for any transaction above a set threshold.

- Review the “Security Center” on the American Express website for the latest recommendations.

By following these practices, you reduce the risk of unauthorized charges and maintain confidence in your payment process.

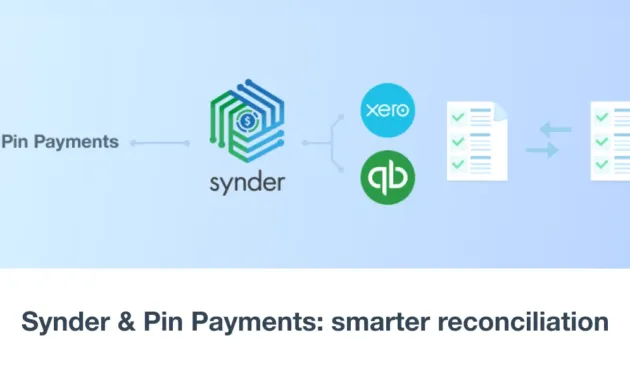

Reconciliation: Matching Payments to Statements

After a payment is made, reconciling it with your monthly statement ensures accuracy. The statement will show a “Payment Received” line, usually with a reference number. Cross‑checking this entry against your bank’s outflow confirms that the correct amount was transferred.

Tools for easy reconciliation

- Spreadsheet tracking: Log each payment date, amount, and reference number for quick reference.

- Personal finance apps: Many apps can import American Express data automatically, highlighting any discrepancies.

- Monthly review habit: Set a calendar reminder to review your statement within three days of receipt.

Consistent reconciliation helps spot errors early, such as duplicate payments or missed amounts, and provides a clear audit trail for personal or tax purposes.

Common Mistakes and How to Avoid Them

Even experienced cardholders sometimes stumble when paying their American Express bill. Recognizing common pitfalls can save time and money.

Typical errors

- Paying the wrong account: Double‑check the routing and account numbers before confirming a transfer.

- Missing the due date due to time zones: Payments submitted late in the day may be processed after midnight, especially with international servers.

- Overlooking minimum payment requirements: If you set autopay for a custom amount that falls below the minimum, a late fee may still be assessed.

To prevent these issues, create a checklist that you run through each month. The habit of verifying details before hitting “Submit” becomes second nature with repetition.

Rewards and Benefits: Keeping the Perks Flowing

American Express cards are known for generous rewards programs. Paying your bill on time ensures you continue to earn points, cash back, or travel miles on each dollar spent. Some cards also offer bonus points for paying the full balance each month.

Maximizing reward potential

- Set autopay for the full balance to guarantee you never miss out on a bonus.

- Use the American Express app to monitor point accrual in real time.

- Redeem points strategically, such as for travel bookings that provide higher value per point.

When you combine timely payments with smart redemption, the credit card transforms from a borrowing tool into a revenue‑generating asset.

International Considerations: Paying from Abroad

For cardholders living or traveling abroad, paying the American Express bill may involve currency conversion. The online portal automatically applies the current exchange rate, but it’s worth noting any foreign transaction fees that could apply.

Strategies for overseas payments

- Use a bank account denominated in U.S. dollars to avoid conversion fees.

- Check whether your American Express card offers a no‑foreign‑transaction‑fee feature; see 7 Must‑Know Secrets About No Foreign Transaction Fee Cards for more details.

- Schedule payments early to account for international processing delays.

By planning ahead, you can keep your account in good standing regardless of where you reside.

In summary, paying an American Express bill offers multiple pathways, each tailored to different preferences and circumstances. Whether you choose the immediacy of the mobile app, the reliability of autopay, the personal touch of a phone call, or the traditional feel of a mailed check, the essential steps remain consistent: verify the amount, select a secure funding source, and confirm the transaction. Maintaining a habit of regular reconciliation and security checks completes the cycle, ensuring that rewards keep accruing and credit health stays strong.