Table of Contents

- Key Criteria for Selecting the Right Business Credit Card for Your LLC

- 1. Reward Structure Aligned with Business Spend

- 2. Annual Fee vs. Net Value

- 3. Credit Reporting to the Business

- 4. Employee Card Management

- 5. Introductory APR and Ongoing Interest Rates

- Top Business Credit Cards for LLCs in 2026

- American Express Business Gold Card

- Capital One Spark Cash Plus

- Chase Ink Business Preferred® Credit Card

- Bank of America Business Advantage Travel Rewards Card

- U.S. Bank Business Platinum Card

- How an LLC Can Leverage a Business Credit Card for Growth

- Streamlined Expense Management

- Cash Flow Optimization

- Reward Redemption for Business Needs

- Building a Separate Business Credit Profile

- Employee Empowerment with Controlled Spending

- Practical Steps to Apply for a Business Credit Card as an LLC

- 1. Gather Essential Documentation

- 2. Verify Personal Credit Health

- 3. Choose the Card that Matches Your Profile

- 4. Complete the Application Accurately

- 5. Follow Up on the Decision

- Common Pitfalls to Avoid When Using a Business Credit Card

- Mixing Personal and Business Expenses

- Ignoring the Credit Utilization Ratio

- Missing Payments

- Overlooking Card Benefits

- Neglecting to Review Statements

When an LLC steps into the competitive world of commerce, the right financial tools can make the difference between smooth growth and constant cash‑flow headaches. Among those tools, a business credit card stands out as a versatile ally—offering expense tracking, rewards, and a bridge to stronger credit. Best business credit cards for LLC are not just about flashy perks; they are about aligning features with the unique structure and needs of a limited liability company.

In the early days of many small enterprises, owners often rely on personal cards to fund purchases, inadvertently mixing personal and business expenses. This practice can complicate accounting, obscure tax deductions, and put personal credit at risk. Transitioning to a dedicated business card separates those streams, simplifies bookkeeping, and builds a credit profile that belongs to the LLC itself.

Choosing the optimal card, however, is not a one‑size‑fits‑all decision. It involves weighing annual fees, reward categories, reporting requirements, and the card issuer’s willingness to work with newer LLCs that may have limited credit history. The following sections walk through the essential criteria, spotlight the leading options for 2026, and provide practical steps for LLC owners to integrate a business credit card into their financial strategy.

Key Criteria for Selecting the Right Business Credit Card for Your LLC

Before diving into specific card recommendations, it’s crucial to establish a framework for evaluation. This framework ensures that the selected card supports both short‑term operational needs and long‑term strategic goals.

1. Reward Structure Aligned with Business Spend

Identify the primary expense categories of your LLC—whether it’s travel, office supplies, advertising, or software subscriptions. Cards that offer higher cash back or points in those areas can quickly offset costs. For example, a card that returns 3% on travel and 2% on dining might be ideal for a consulting firm with frequent client meetings.

2. Annual Fee vs. Net Value

A high‑fee card can still be worthwhile if the rewards and benefits exceed the cost. Calculate the break‑even point by estimating annual spend in bonus categories and applying the card’s reward rate. If the net value (rewards minus fee) is positive, the card may be justified.

3. Credit Reporting to the Business

Not all issuers report activity to the business credit bureaus. For an LLC aiming to build its own credit file, choose a card that reports to Dun & Bradstreet, Experian Business, or Equifax Business. This practice lays the groundwork for future financing, and it’s why understanding why immediate reporting matters is essential for early‑stage companies.

4. Employee Card Management

Most business cards allow you to issue employee cards with customizable limits. Look for platforms that provide real‑time monitoring, spend alerts, and the ability to set category restrictions, which can help control expenses without cumbersome manual approvals.

5. Introductory APR and Ongoing Interest Rates

If your LLC plans to carry a balance occasionally, the card’s APR becomes significant. Some cards offer a 0% introductory APR for purchases or balance transfers, which can be beneficial during periods of cash‑flow lag.

Top Business Credit Cards for LLCs in 2026

After evaluating the criteria above, we examined the most competitive offerings on the market. The following cards emerged as the strongest candidates for LLCs seeking a blend of rewards, flexibility, and credit‑building potential.

American Express Business Gold Card

- Rewards: 4X Membership Rewards points on the two categories where your LLC spends the most each billing cycle (up to $150,000 per year).

- Annual Fee: $295.

- Key Benefit: Flexible points that can be transferred to airline and hotel partners, plus a suite of travel protections.

- Reporting: Reports to business credit bureaus, aiding LLC credit development.

This card shines for businesses with variable spend patterns, as the “choose‑your‑categories” feature adapts month to month. The robust travel insurance and purchase protection align well with companies that frequently purchase equipment or travel for client work.

Capital One Spark Cash Plus

- Rewards: Unlimited 2% cash back on all purchases.

- Annual Fee: $150 (waived for the first year with $5,000 spend).

- Key Benefit: Simple, flat‑rate cash back that’s easy to redeem as a statement credit.

- Reporting: Business credit reporting included.

For LLCs that prefer straightforward rewards without juggling categories, Spark Cash Plus offers predictability. The cash back can be applied directly to the balance, effectively reducing interest costs for businesses that occasionally carry a balance.

Chase Ink Business Preferred® Credit Card

- Rewards: 3X points on travel, shipping, internet, cable, phone services, and advertising purchases.

- Annual Fee: $95.

- Sign‑up Bonus: 100,000 bonus points after spending $15,000 in the first three months.

- Reporting: Reports to major business credit bureaus.

This card is particularly attractive for marketing agencies, e‑commerce businesses, and firms with substantial shipping costs. The generous sign‑up bonus can quickly offset the annual fee, and points can be transferred to leading airline partners for travel redemption.

Bank of America Business Advantage Travel Rewards Card

- Rewards: 1.5 points per $1 on all purchases, with no categories to track.

- Annual Fee: None.

- Key Benefit: Points redeemable for travel purchases at a rate of 1 cent per point.

- Reporting: Business credit reporting is optional but available.

For LLCs that prioritize low cost and a simple reward system, this no‑fee card provides a modest yet consistent earnings rate. It’s a solid starter card for new LLCs building credit without incurring upfront costs.

U.S. Bank Business Platinum Card

- Intro APR: 0% intro APR on purchases for 18 months.

- Ongoing APR: Variable 12.99%–21.99% (based on creditworthiness).

- Annual Fee: None.

- Key Benefit: Ideal for cash‑flow management during growth phases.

While this card lacks a rewards program, its lengthy 0% introductory APR can be a strategic tool for LLCs that need to finance inventory purchases or equipment without immediate interest charges.

How an LLC Can Leverage a Business Credit Card for Growth

Owning a business credit card is more than a convenience; it’s a strategic asset. Below are actionable ways an LLC can turn its card into a growth catalyst.

Streamlined Expense Management

Integrate the card’s reporting tools with your accounting software (e.g., QuickBooks, Xero). Automatic categorization reduces manual entry, ensuring that expense reports are ready for tax season and that deductions are captured accurately.

Cash Flow Optimization

Use the card’s grace period to defer cash outflows. For instance, if a supplier offers net‑30 terms, paying with a card that has a 0% intro APR extends the effective payment window to 60 days, giving the business additional time to collect receivables.

Reward Redemption for Business Needs

Redeem points or cash back toward travel, office supplies, or even a statement credit that directly reduces the balance. Some cards allow point transfers to partner programs, which can be leveraged for employee travel incentives.

Building a Separate Business Credit Profile

Consistent on‑time payments and low utilization ratios are reported to business credit bureaus, gradually establishing a credit score independent of the owner’s personal credit. This score becomes a critical factor when the LLC seeks larger loans, lines of credit, or equipment financing.

Employee Empowerment with Controlled Spending

Issue employee cards with preset limits and real‑time alerts. This approach reduces the need for reimbursements, cuts administrative overhead, and provides visibility into departmental spending.

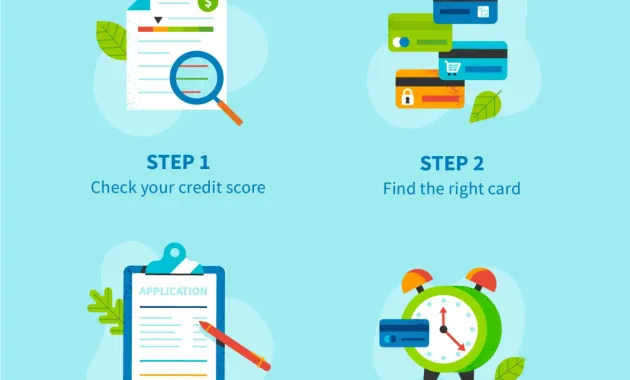

Practical Steps to Apply for a Business Credit Card as an LLC

Applying for a business credit card may feel daunting, especially for newly formed LLCs. Follow these steps to streamline the process and improve approval odds.

1. Gather Essential Documentation

- Employer Identification Number (EIN).

- Business formation documents (Articles of Organization).

- Bank statements covering the past 3–6 months.

- Financial projections or a simple profit‑and‑loss statement.

2. Verify Personal Credit Health

Many issuers still consider the owner’s personal credit as a guarantee, especially for startups. Obtain a copy of your personal credit report, correct any inaccuracies, and address high‑utilization balances before applying.

3. Choose the Card that Matches Your Profile

Match your spend patterns and credit profile with one of the cards highlighted earlier. For example, if your personal credit score is strong and your LLC has moderate revenue, the Chase Ink Business Preferred may be a suitable fit.

4. Complete the Application Accurately

Enter the LLC’s legal name, EIN, and contact information exactly as they appear on official documents. In the “Estimated Annual Spend” field, be realistic; over‑estimating may raise red flags, while under‑estimating could limit your credit line.

5. Follow Up on the Decision

Most issuers provide an instant decision, but some may request additional documentation. Respond promptly to any requests to avoid delays. Once approved, activate the card, set up online account management, and configure employee cards as needed.

For a deeper look at how digital platforms enhance card management, see the article on online account management, which outlines best practices for monitoring transactions and safeguarding your account.

Common Pitfalls to Avoid When Using a Business Credit Card

Even the most advantageous card can become a liability if misused. Below are frequent errors and how to prevent them.

Mixing Personal and Business Expenses

Keep all charges strictly business‑related. If a personal expense slips through, reimburse the LLC promptly and document the transaction to maintain clear records.

Ignoring the Credit Utilization Ratio

High utilization (above 30%) can signal risk to lenders and hurt your business credit score. Aim to keep balances well below the credit limit, and consider requesting a higher limit as your revenue grows.

Missing Payments

Late payments not only incur fees but also damage both personal and business credit histories if the card is personally guaranteed. Set up automatic payments for at least the minimum due to avoid oversight.

Overlooking Card Benefits

Many cards bundle travel insurance, purchase protection, and extended warranties. Review your card’s benefits regularly to ensure you’re taking full advantage of them, especially when making large purchases.

Neglecting to Review Statements

Regularly scrutinize monthly statements for unauthorized charges or billing errors. Prompt dispute resolution prevents unnecessary fees and protects your credit standing.

For those interested in optimizing their credit costs further, the guide on how to lower credit card interest rates fast provides actionable tactics that can be applied to both personal and business cards.

In summary, selecting the best business credit card for your LLC involves aligning rewards with spend, ensuring credit reporting, and leveraging the card’s features to streamline operations and build a solid credit foundation. By following the criteria, reviewing the top card options, and implementing disciplined usage practices, an LLC can turn its credit card from a simple payment tool into a catalyst for sustainable growth.