Table of Contents

- Defining the Roles: Authorized User and Joint Account Holder

- What Is an Authorized User?

- What Is a Joint Account Holder?

- Key Differences in Credit Reporting and Liability

- Impact on Credit Scores

- Legal Responsibility for Debt

- Account Management Rights

- Benefits and Risks of Each Arrangement

- Authorized User – Benefits

- Authorized User – Risks

- Joint Account Holder – Benefits

- Joint Account Holder – Risks

- How to Add or Remove an Authorized User

- Steps to Add an Authorized User

- Removing an Authorized User

- When a Joint Account Makes More Sense

- Shared Financial Goals

- Legal and Estate Planning

- Business Partnerships

- Practical Tips for Managing Both Types of Access

- Set Clear Boundaries

- Monitor Statements Regularly

- Leverage Alerts and Controls

- Know the Exit Strategy

- Real‑World Scenarios Illustrating the Difference

- Scenario 1: Helping a Young Adult Build Credit

- Scenario 2: Married Couple Managing Household Finances

- Scenario 3: Business Partners Sharing Expenses

- Choosing the Right Path for Your Situation

When you hear the terms “authorized user” and “joint account holder,” it’s easy to assume they refer to the same kind of relationship with a credit card or bank account. In reality, the two designations carry distinct legal, financial, and credit‑building implications. Understanding these nuances can prevent unexpected liability, protect your credit score, and help you structure financial relationships that align with your long‑term goals. This article walks through the core concepts, compares the roles side by side, and offers guidance on when each might be the better choice.

Imagine you are helping a college‑going child establish credit. You could add them as an authorized user on your existing credit card, granting them the ability to make purchases while you retain ultimate responsibility. Alternatively, you might open a new joint checking account with your partner to share household expenses, giving both parties equal rights to deposit, withdraw, and manage the funds. Both scenarios involve shared access, yet the legal responsibilities and credit outcomes differ dramatically. By examining real‑world examples, we can see how each arrangement works in practice.

In the sections that follow, we’ll break down the definitions, explore the financial impact, and outline the steps needed to set up or dissolve each relationship safely. Whether you’re a parent, a spouse, or a friend looking to help someone build credit, this guide will give you the factual foundation to make an informed decision.

Defining the Roles: Authorized User and Joint Account Holder

What Is an Authorized User?

An authorized user (AU) is a person who has permission to use a primary account holder’s credit card but does not own the account. The primary cardholder remains fully responsible for all charges, payments, and any resulting fees. Typically, an AU receives a card with their name on it, allowing them to make purchases that appear on the primary account’s statement.

What Is a Joint Account Holder?

A joint account holder shares ownership of a credit card or bank account with another person. Both parties can make transactions, and each is equally liable for any debt or overdrafts. Joint accounts usually require both individuals to sign the application, and any activity on the account reflects on both owners’ credit reports.

Key Differences in Credit Reporting and Liability

Impact on Credit Scores

Authorized users can benefit from the primary cardholder’s credit history. If the primary maintains a low utilization ratio and a clean payment record, the AU’s credit score may improve. Conversely, any missed payments or high balances can negatively affect the AU’s credit, even though they are not legally responsible for repayment.

Joint account holders, however, share the credit responsibility. Both owners’ credit reports show the account’s activity, balance, and payment history. Late payments or high utilization directly impact each person’s credit score, for better or worse.

Legal Responsibility for Debt

- Authorized User: No legal obligation to repay the debt. The primary cardholder bears full responsibility.

- Joint Account Holder: Equal legal responsibility. Creditors can pursue either owner for the full amount owed.

Account Management Rights

Authorized users can make purchases but typically cannot change account settings, request credit limit increases, or close the account. Joint account holders have full control over account management, including adding or removing users, changing the credit limit, and closing the account.

Benefits and Risks of Each Arrangement

Authorized User – Benefits

- Convenient way to help a family member build credit without exposing them to debt risk.

- Primary holder retains control over spending limits and can remove the AU at any time.

- Often no additional credit check required for the AU.

Authorized User – Risks

- Misuse of the card can inflate the primary’s balance, potentially harming both parties’ credit.

- If the primary holder’s account is frozen or closed, the AU loses access abruptly. Learn more about why issuers freeze cards in this article on common triggers.

- Some lenders may not count AU activity toward credit scoring, limiting the credit‑building benefit.

Joint Account Holder – Benefits

- Shared responsibility encourages transparent budgeting and financial planning.

- Both owners can earn credit benefits such as rewards, cash back, or extended warranty coverage. For instance, many cards offer extended warranty benefits that protect purchases made by either holder.

- Joint accounts simplify bill splitting and household expense management.

Joint Account Holder – Risks

- Each party is fully liable for any debt, regardless of who incurred the charges.

- Disagreements over spending can lead to strained relationships.

- Divorce, separation, or death can complicate ownership, requiring legal intervention to resolve.

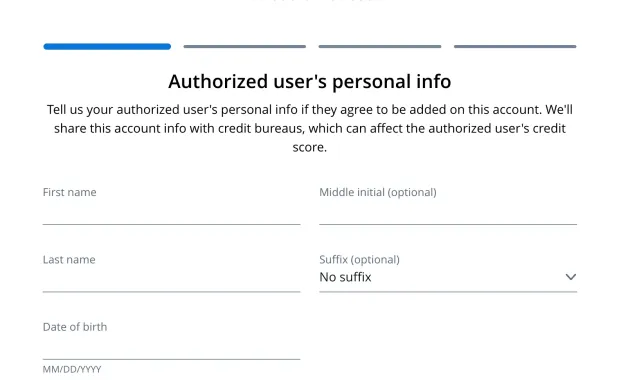

How to Add or Remove an Authorized User

Steps to Add an Authorized User

- Log into your credit card portal or call customer service.

- Provide the AU’s full legal name, date of birth, and possibly a Social Security number for reporting.

- Choose whether to give the AU a physical card or a virtual card number.

- Set spending limits if your issuer allows it.

- Confirm the addition and monitor the account for any unauthorized activity.

Removing an Authorized User

Removal can usually be done instantly through the issuer’s website or by phone. After removal, the AU’s card is deactivated, and any pending transactions are still the primary holder’s responsibility. It’s wise to check the account statement for any lingering charges that might affect the former AU’s credit.

When a Joint Account Makes More Sense

Shared Financial Goals

If you and a partner are saving for a down payment, a joint savings or checking account provides transparency and equal access to funds. Joint credit cards can also help both parties build credit simultaneously, which may be advantageous when applying for a mortgage. Learn how credit cards affect mortgage applications in this comprehensive guide.

Legal and Estate Planning

Joint accounts often have rights of survivorship, meaning the surviving owner automatically inherits the account’s assets upon the other’s death. This can simplify estate planning, but it also means the surviving owner assumes any outstanding debt.

Business Partnerships

Entrepreneurs may open a joint credit card to manage business expenses, ensuring both partners are accountable and can track spending for tax purposes.

Practical Tips for Managing Both Types of Access

Set Clear Boundaries

Communicate spending limits and expectations before adding an AU or opening a joint account. Written agreements can prevent misunderstandings later.

Monitor Statements Regularly

Both primary holders and joint owners should review monthly statements for unauthorized charges. Early detection protects credit scores and reduces the chance of fraud.

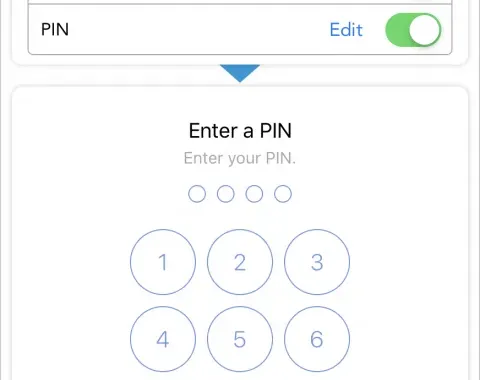

Leverage Alerts and Controls

Many issuers allow you to set purchase alerts, limit cash advances, or disable certain transaction types for AUs. Use these tools to maintain control while granting access.

Know the Exit Strategy

Plan how to remove an AU or close a joint account if circumstances change. Having a clear process helps avoid lingering liability or credit damage.

Real‑World Scenarios Illustrating the Difference

Scenario 1: Helping a Young Adult Build Credit

Maria adds her 19‑year‑old daughter as an authorized user on her credit card. Maria pays the balance in full each month, keeping utilization low. Over a year, her daughter’s credit score rises, making it easier to qualify for a student loan. If Maria missed a payment, her daughter’s score would suffer, even though she isn’t legally responsible.

Scenario 2: Married Couple Managing Household Finances

John and Lisa open a joint checking account and a joint credit card to pay rent, utilities, and groceries. Both monitor the account daily, ensuring the balance stays low. When John’s income temporarily drops, Lisa can cover the shortfall without affecting John’s credit, because the debt is shared. However, if they separate, the joint credit card debt must be divided or one party must refinance the balance.

Scenario 3: Business Partners Sharing Expenses

Two friends launch a startup and obtain a joint credit card to purchase equipment. Both are equally liable for the $10,000 balance. If one partner leaves the business and cannot pay their share, the other partner remains on the hook for the full amount, underscoring the importance of a written partnership agreement.

Choosing the Right Path for Your Situation

Deciding between adding an authorized user or opening a joint account hinges on three key considerations: liability, credit impact, and relationship dynamics. If you want to help someone build credit without exposing yourself to shared debt, an authorized user arrangement is usually safer. If you need equal access to funds, shared responsibility, and mutual credit building, a joint account aligns better with those goals.

Ultimately, both options can be powerful tools when used responsibly. By understanding the legal obligations, monitoring activity closely, and setting clear expectations, you can leverage either structure to support financial growth while safeguarding your own credit health.