Table of Contents

- Understanding the Basics: How Rent Payments Work

- Common Payment Channels

- Benefits of Using a Credit Card for Rent

- Earn Rewards and Cash Back

- Improve Cash Flow Management

- Build Credit History

- Leverage Sign‑Up Bonuses

- Potential Drawbacks and Risks

- Processing Fees

- Interest Charges

- Impact on Credit Utilization

- Potential Landlord Restrictions

- How to Pay Rent with a Credit Card: Step‑by‑Step Guide

- Step 1: Confirm Landlord Acceptance

- Step 2: Choose the Right Processor

- Step 3: Link Your Credit Card

- Step 4: Schedule the Payment

- Step 5: Monitor Fees and Statements

- Step 6: Pay Off the Balance Promptly

- Cost‑Benefit Analysis: When Does It Make Sense?

- Example Scenario

- Alternative Strategies to Leverage Credit Cards Without Direct Rent Payments

- Use a “Cash‑Advance” Alternative

- Employ a “Purchase‑to‑Pay” Service

- Combine With a Savings Buffer

- Legal and Contractual Considerations

- Review Lease Language

- Consumer Protection Laws

- Real‑World Example: A Tenant’s Journey

- Tips for Maximizing Rewards While Minimizing Costs

- Choose Low‑Fee Processors

- Leverage Promotional Offers

- Maintain Low Credit Utilization

- Combine With Other Expenses

- When Not to Use a Credit Card for Rent

- Future Trends: Rent Payments and the Digital Economy

Can I pay my rent with a credit card? This question surfaces often among renters who want to leverage rewards, manage cash flow, or simply enjoy the convenience of digital payments. The answer isn’t a simple yes or no; it depends on the landlord’s policies, the payment platforms available, and the financial implications for the cardholder. In this article we walk through the entire landscape, from the basic mechanics to hidden fees, and provide a clear roadmap for anyone considering this option.

Rent is typically one of the largest recurring expenses in a household budget. For many, the idea of using a credit card feels like a shortcut to earn points or avoid a temporary shortfall. Yet, the decision also touches credit utilization, interest accrual, and even legal considerations. By examining each facet, readers can make an informed choice that aligns with both short‑term needs and long‑term financial health.

Below, we explore the essential components of paying rent with a credit card, outline the benefits and pitfalls, and present practical steps to execute the payment correctly. Whether you are a first‑time renter, a seasoned tenant, or a property manager looking to broaden payment options, the information here is designed to be comprehensive and actionable.

Understanding the Basics: How Rent Payments Work

Before diving into credit‑card specifics, it helps to understand the typical rent‑payment ecosystem. Most landlords accept checks, bank transfers (ACH), or online portal payments that draw directly from a checking account. Some modern property management companies partner with third‑party services that enable credit‑card processing for an additional fee.

Common Payment Channels

- Direct bank transfer (ACH): Low‑cost, automatic, and widely accepted.

- Online portals: Platforms like PayYourRent, RentTrack, or landlord‑specific websites.

- Third‑party processors: Services such as Plastiq, RentMoola, or Cozy that convert credit‑card charges into ACH deposits for the landlord.

Each channel carries its own set of rules, processing times, and potential fees. When a landlord does not accept credit cards directly, a third‑party processor becomes the bridge, but the convenience comes at a price—usually a percentage of the transaction.

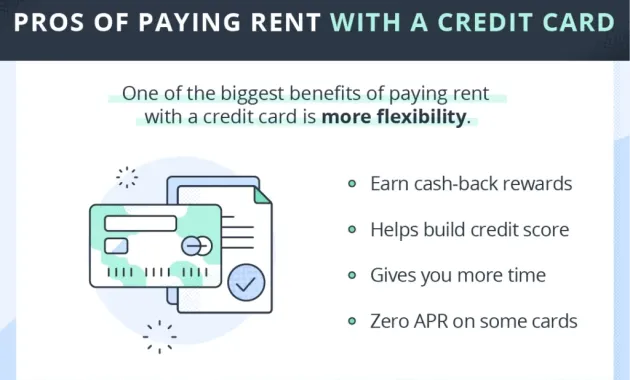

Benefits of Using a Credit Card for Rent

Paying rent with a credit card can be more than a novelty; it can serve strategic financial purposes.

Earn Rewards and Cash Back

Many credit cards offer points, miles, or cash back on every purchase. By allocating a large, predictable expense like rent to a rewards card, renters can accumulate significant benefits over a year. For example, a 2% cash‑back card on a $1,200 monthly rent yields $28.80 per month, or $345.60 annually.

Improve Cash Flow Management

When cash is temporarily tight—perhaps due to an unexpected expense—a credit card can provide a short‑term buffer. The renter can pay the rent now, then settle the balance before interest accrues, effectively using the card as a zero‑interest bridge.

Build Credit History

Consistently paying a sizable monthly balance and then clearing it can positively influence credit utilization ratios and payment history, both critical components of credit scores. However, this benefit only materializes if the balance is paid in full each month.

Leverage Sign‑Up Bonuses

New credit‑card offers often include generous sign‑up bonuses that require a certain amount of spending within the first few months. Using the card for rent can help meet that threshold quickly. For a $500 bonus that requires $3,000 in spend, a three‑month rent payment could satisfy the requirement.

Potential Drawbacks and Risks

While the advantages are appealing, renters must weigh them against the costs and possible negative outcomes.

Processing Fees

Third‑party processors typically charge between 2.5% and 3% of the transaction amount. On a $1,200 rent, a 2.9% fee adds $34.80 each month, eroding or even outweighing any rewards earned.

Interest Charges

If the card balance is not paid in full before the due date, interest accrues on the entire rent amount. With an average APR of 18%, a $1,200 balance carried for one month costs $18 in interest alone, not including fees.

Impact on Credit Utilization

Rent can represent a substantial portion of a credit limit. A $1,200 charge on a $5,000 limit raises utilization to 24%, potentially lowering the credit score if the balance remains high for an extended period.

Potential Landlord Restrictions

Some lease agreements explicitly forbid third‑party payment methods or impose penalties for using them. It is essential to review the lease or consult the landlord before initiating credit‑card payments.

How to Pay Rent with a Credit Card: Step‑by‑Step Guide

Once you have evaluated the benefits and costs, the actual process of paying rent with a credit card follows a clear sequence.

Step 1: Confirm Landlord Acceptance

Start by asking your landlord or property management company whether they accept credit‑card payments directly. If they do not, inquire about preferred third‑party processors. Some landlords may waive the processing fee if you use a specific service.

Step 2: Choose the Right Processor

Compare platforms based on fee structure, payment speed, and user reviews. For instance, Plastiq charges 2.9% but offers a seamless online dashboard, while RentMoola may have a lower fee but limited support. Select a service that aligns with your priorities.

Step 3: Link Your Credit Card

Set up an account with the chosen processor and securely link the credit card you intend to use. Ensure the card has sufficient limit to cover the rent and any associated fees.

Step 4: Schedule the Payment

Most processors allow you to schedule recurring payments. Set the date a few days before your rent is due to accommodate processing time, which can range from 1 to 3 business days.

Step 5: Monitor Fees and Statements

After the payment clears, review your credit‑card statement for the exact amount charged, including the processor’s fee. Keep a record for tax or budgeting purposes.

Step 6: Pay Off the Balance Promptly

To avoid interest, plan to pay the full credit‑card balance before the due date. Many renters use automatic transfers from a checking account to ensure timely payment.

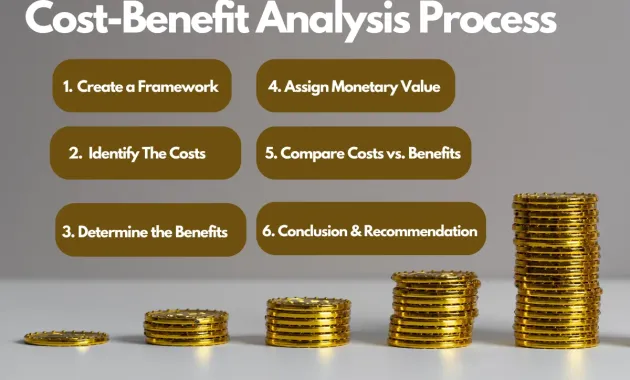

Cost‑Benefit Analysis: When Does It Make Sense?

Running a simple calculation can reveal whether using a credit card is financially advantageous.

Example Scenario

- Monthly rent: $1,200

- Processor fee: 2.9% ($34.80)

- Credit‑card cash‑back rate: 2% ($24)

- Net cost per month: $34.80 – $24 = $10.80

In this example, the renter pays a net cost of $10.80 each month. If the renter can earn a higher‑value reward—such as 5,000 points worth $50 in travel—the net benefit flips positive. Therefore, the decision hinges on the specific rewards program and fee structure.

Alternative Strategies to Leverage Credit Cards Without Direct Rent Payments

If the processing fees outweigh the rewards, consider indirect methods that still let you capitalize on credit‑card benefits.

Use a “Cash‑Advance” Alternative

Some banks allow you to withdraw cash from a credit card at an ATM, though this typically incurs a higher fee and immediate interest. This method is generally not recommended unless absolutely necessary.

Employ a “Purchase‑to‑Pay” Service

Platforms like PayPal or Venmo sometimes allow you to send money to a friend who then pays the landlord on your behalf. You can fund the transfer with a credit card, but be mindful of peer‑to‑peer fees.

Combine With a Savings Buffer

Set aside a portion of each paycheck in a high‑yield savings account. When rent is due, use the credit card for the transaction and immediately transfer the saved amount to pay off the balance. This approach maintains rewards while avoiding interest.

Legal and Contractual Considerations

Rent agreements are legal contracts, and any deviation from the agreed payment method should be documented. Some jurisdictions treat third‑party processing fees as part of the rent, while others consider them a separate charge.

Review Lease Language

Look for clauses that mention “acceptable forms of payment” or “additional fees.” If the lease is silent, a written amendment signed by both parties can provide clarity.

Consumer Protection Laws

In certain states, landlords cannot impose unreasonable fees for credit‑card payments. Familiarize yourself with local regulations or consult a legal professional if you suspect a fee is excessive.

Real‑World Example: A Tenant’s Journey

Maria, a 28‑year‑old graphic designer living in Austin, faced a temporary cash crunch after unexpected car repairs. Her lease did not accept credit cards directly, but her property management company partnered with a third‑party processor that charged 2.5% per transaction. Maria held a credit card offering 3% cash back on all purchases.

She calculated the net benefit: $1,200 rent × 2.5% = $30 fee; cash back earned = $1,200 × 3% = $36. Net gain = $6 per month. Confident in the small profit, Maria set up a recurring payment through the processor, scheduled it three days before her due date, and paid off the balance each month using an automatic transfer from her checking account.

Over a year, Maria accumulated $72 in cash back, offsetting the $360 in processor fees, resulting in a net gain of $12. More importantly, the credit‑card usage helped her meet the $4,000 spend requirement for a new sign‑up bonus, earning an additional $100 in statement credits. Maria’s experience illustrates how a careful cost‑benefit analysis can turn a seemingly costly payment method into a modest financial advantage.

Tips for Maximizing Rewards While Minimizing Costs

Choose Low‑Fee Processors

Some newer platforms negotiate lower rates for high‑volume landlords. Ask your property manager if a discount is possible.

Leverage Promotional Offers

Credit‑card issuers occasionally waive processor fees for specific merchants. Keep an eye on email alerts or the rewards portal for such promotions.

Maintain Low Credit Utilization

Pay the rent balance before the statement closing date to keep utilization low, preserving your credit score.

Combine With Other Expenses

If you already use the credit card for groceries, gas, and utilities, the incremental cost of adding rent may be negligible compared to the overall rewards earned.

When Not to Use a Credit Card for Rent

There are scenarios where the drawbacks outweigh any potential benefit.

- High processor fees: If the fee exceeds the cash‑back rate, you will lose money.

- Inability to pay in full: Carrying a balance will generate interest that quickly dwarfs any rewards.

- Strict lease terms: Some leases impose penalties for non‑standard payment methods.

- Low credit limit: A rent charge that consumes a large portion of your limit can harm your credit score.

Future Trends: Rent Payments and the Digital Economy

As the financial ecosystem evolves, the friction between rent payments and credit‑card usage is decreasing. Emerging solutions include blockchain‑based rent platforms that accept cryptocurrency, as well as “Buy‑Now‑Pay‑Later” services tailored for housing costs. Additionally, some credit‑card issuers are experimenting with direct rent‑pay features integrated into their mobile apps, potentially eliminating third‑party fees altogether.

These innovations suggest that the current landscape—where renters must weigh fees against rewards—may soon shift toward more seamless, cost‑effective options. Until such solutions become mainstream, the careful analysis outlined above remains the best approach for making an informed decision.

In summary, paying rent with a credit card is feasible and can be financially advantageous when the right conditions align: low processing fees, high‑value rewards, and disciplined payment habits. By following the step‑by‑step guide, evaluating costs, and staying aware of legal considerations, renters can harness the power of their credit cards without compromising financial health.