Table of Contents

- Understanding Routing Numbers: The Backbone of Bank Accounts

- Key characteristics of routing numbers

- Credit Card Numbers: How They Differ from Routing Numbers

- Structure of a credit card number

- When a Routing Number Is Required and How to Provide It

- Credit Card Alternatives for Electronic Payments

- Card‑Based ACH Debit

- Tokenization and Card‑on‑File

- Common Misconceptions and Errors

- Using the Credit Card Number as a Routing Number

- Confusing the Card’s CVV with Routing Information

- Assuming All Cards Have a “Bank Account” Behind Them

- How Issuers Process Payments Without Routing Numbers

- Practical Guidance for Cardholders

- Regulatory Perspective: Why Routing Numbers Remain Exclusive to Depository Accounts

- Future Trends: Virtual Accounts and Emerging Payment Methods

- Summary of Key Takeaways

Do credit cards have routing numbers? This question often surfaces when consumers try to set up electronic payments, direct deposits, or simply understand how their financial tools work. While a routing number is a cornerstone of bank account transactions, credit cards operate on a different identification system. In this article we will walk through the history, the mechanics, and the practical implications of the numbers attached to your credit card, helping you navigate the payment landscape with confidence.

Imagine a story where a young professional, Maya, opens her first credit card and immediately wants to link it to her employer’s payroll portal to receive a bonus. She logs into the portal, sees a field asking for a routing number, and wonders whether the number on her card can fill that slot. Maya’s confusion is common, and the answer lies in the distinct roles that routing numbers and credit card numbers play. By the end of this piece, Maya—and you—will know exactly which numbers belong where, why they matter, and how to avoid common pitfalls.

Understanding Routing Numbers: The Backbone of Bank Accounts

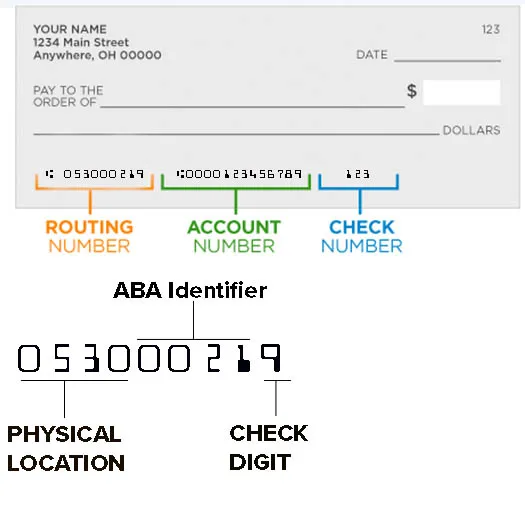

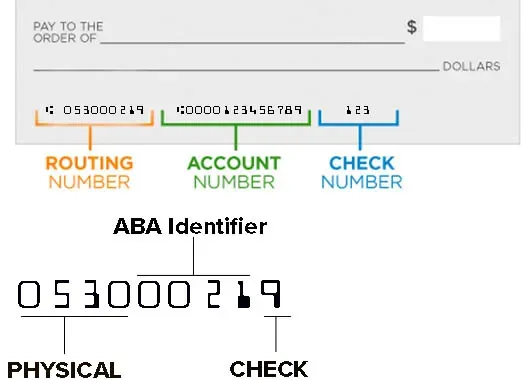

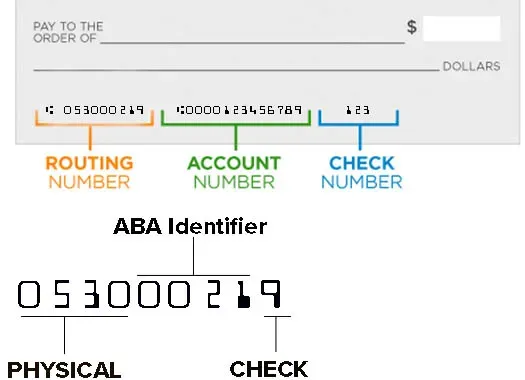

Routing numbers, also known as ABA routing transit numbers, are nine‑digit codes used in the United States to identify financial institutions during electronic transactions. They were introduced by the American Bankers Association in the early 20th century to streamline inter‑bank communication and settlement. When you set up a direct deposit, an ACH (Automated Clearing House) transfer, or a wire, the routing number tells the system which bank should receive or send the funds.

Key characteristics of routing numbers

- Length and format: Exactly nine digits, often displayed on the lower‑left corner of a check.

- Purpose: Directs funds to the correct depository institution for ACH, wire transfers, and check processing.

- Bank‑specific: Each financial institution can have multiple routing numbers, differentiated by state, transaction type, or processing center.

Because routing numbers are tied to a bank’s deposit account, they are irrelevant for credit card accounts, which are revolving credit lines rather than deposit accounts.

Credit Card Numbers: How They Differ from Routing Numbers

Credit cards carry a 15‑ or 16‑digit Primary Account Number (PAN). This number follows the ISO/IEC 7812 standard and serves several functions: identifying the card issuer, the account type, and the individual account holder. The PAN is divided into distinct sections:

Structure of a credit card number

- Issuer Identification Number (IIN): The first six digits, formerly called the Bank Identification Number (BIN), identify the card network (e.g., Visa, Mastercard) and the issuing bank.

- Individual Account Identifier: Digits 7 through the second‑last digit uniquely identify the cardholder’s account within the issuer’s system.

- Check digit: The final digit, calculated using the Luhn algorithm, validates the entire number for data entry errors.

Unlike routing numbers, the PAN does not convey any information about where funds should be sent. Instead, it tells the payment processor which issuer to contact for authorization, settlement, and billing.

When a Routing Number Is Required and How to Provide It

If a merchant or financial service asks for a routing number, they are typically expecting a traditional bank account. Common scenarios include:

- Setting up direct deposit for payroll or government benefits.

- Linking a bank account for ACH transfers to or from a savings account.

- Initiating a wire transfer to another person or business.

In these cases, the correct approach is to provide the routing number printed on a check or obtained from your bank’s online portal. Attempting to use your credit card’s PAN will result in an error, as the system cannot route the transaction to a credit account.

Credit Card Alternatives for Electronic Payments

While credit cards lack routing numbers, they still participate in electronic payment ecosystems through other identifiers. Two common mechanisms enable card‑based payments without a routing number:

Card‑Based ACH Debit

Some modern fintech platforms allow users to authorize ACH debits directly from a credit card, converting the card’s PAN into a virtual bank account number. This service bridges the gap, but it still relies on the underlying bank’s routing number behind the scenes, invisible to the end user.

Tokenization and Card‑on‑File

Online merchants often store a token—a surrogate value derived from the PAN—allowing repeat purchases without re‑entering card details. Tokenization enhances security but does not replace the need for routing numbers when the transaction type explicitly requires a bank account.

For readers interested in leveraging credit cards for specific rewards, the best credit cards for electric car charging can provide high cash‑back rates, yet the underlying payment process still follows the card‑network rules outlined above.

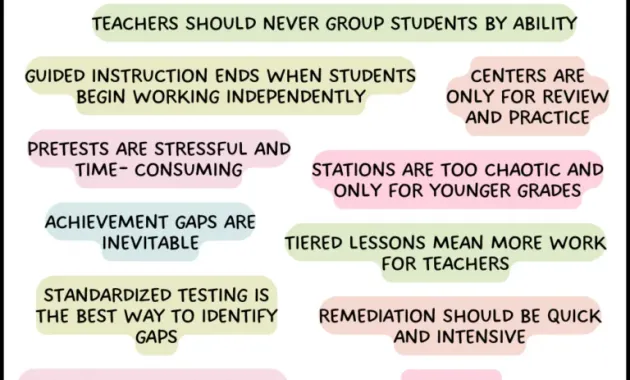

Common Misconceptions and Errors

Confusion often arises from the overlapping terminology used by banks and payment processors. Below are the most frequent mistakes and how to avoid them:

Using the Credit Card Number as a Routing Number

Attempting to fill a routing number field with a PAN will trigger validation failures. Most forms check for a nine‑digit numeric entry, so the longer PAN is instantly rejected.

Confusing the Card’s CVV with Routing Information

The three‑digit Card Verification Value (CVV) printed on the back of the card is a security feature, not a routing identifier. It is used solely for verification during card‑not‑present transactions.

Assuming All Cards Have a “Bank Account” Behind Them

Credit cards are lines of credit, not deposit accounts. Even though they are issued by banks, the bank does not hold a traditional checking or savings account linked to the card, and therefore no routing number exists for the card itself.

How Issuers Process Payments Without Routing Numbers

When a merchant submits a transaction, the following flow occurs:

- Authorization request: The merchant’s payment gateway sends the PAN, expiration date, and CVV to the card network.

- Network routing: The network forwards the request to the issuing bank identified by the IIN.

- Issuer decision: The issuer checks the account’s credit limit, fraud signals, and repayment status, then returns an approval or decline code.

- Settlement: At the end of the day, the issuer transfers funds to the acquiring bank via the card network’s settlement system, not through ACH or wire routes.

This process bypasses the need for a routing number entirely because the settlement occurs within the closed loop of the card network.

Practical Guidance for Cardholders

If you find yourself needing to provide a routing number, follow these steps:

- Identify the purpose: Confirm whether the request is for a direct deposit, ACH transfer, or a simple card payment.

- Locate your bank’s routing number: Check a personal check, your online banking portal, or the bank’s website. Many banks list routing numbers by state.

- Use the correct account number: Pair the routing number with your checking or savings account number, not your credit card number.

- Verify with the institution: If in doubt, contact the requesting organization or your bank’s customer service for clarification.

For those who prefer to keep their credit card details private while still receiving funds, the article Understanding Direct Deposit for Cash‑Back Rewards explains how to set up a separate bank account to capture rewards payouts.

Regulatory Perspective: Why Routing Numbers Remain Exclusive to Depository Accounts

The Federal Reserve and the National Automated Clearing House Association (NACHA) govern the ACH network. Their regulations require a valid routing number to ensure that funds are transferred to an institution that holds a deposit liability. Credit card accounts, classified as revolving credit, do not meet the deposit liability criteria, and therefore cannot be assigned a routing number under current regulations.

Any attempt to create a routing number for a credit card would conflict with these regulatory frameworks, potentially leading to compliance issues for both issuers and merchants.

Future Trends: Virtual Accounts and Emerging Payment Methods

Fintech innovation is blurring the lines between traditional banking and credit services. Some platforms now offer “virtual bank accounts” linked to a credit card, generating a unique routing number for ACH transactions. These services essentially create a custodial account that sits behind the scenes, allowing the credit card to act as a funding source for ACH debits.

While promising, these solutions are still subject to regulatory scrutiny and may not be universally accepted by all merchants. Users should evaluate the security and fees associated with such services before relying on them for regular payroll or bill payments.

Summary of Key Takeaways

Credit cards do not have routing numbers. The numbers associated with credit cards are the PAN and CVV, designed for authorization within the card network, not for routing funds between banks. Routing numbers remain the exclusive identifier for depository accounts involved in ACH, wire, and check transactions. Understanding this distinction helps prevent errors, ensures smooth financial operations, and aligns with regulatory expectations.

When setting up payments that require a routing number, always provide the nine‑digit code linked to a checking or savings account, not your credit card. If you need to receive rewards or other deposits, consider using a dedicated bank account or a fintech solution that generates a virtual routing number, but be mindful of the associated terms and compliance requirements.

By recognizing the roles each number plays, consumers like Maya can confidently manage their finances, avoid transaction rejections, and make the most of their credit cards without confusion.