Table of Contents

- Getting Started: Setting Up Your Rewards Account

- Why Activation Matters

- How to Perform the Navy Federal Rewards Login

- Multi‑Factor Authentication (MFA)

- Common Issues and How to Resolve Them

- Forgotten Username or Password

- Login From an Unrecognized Device

- Rewards Not Updating After a Purchase

- Tips to Maximize Your Rewards Earnings

- Leverage the “Refer a Friend” Feature

- Mobile App vs. Desktop: Which Is Best for Rewards?

- Desktop Experience

- Mobile App Experience

- Security Practices That Protect Your Rewards

- Frequently Asked Questions (FAQ)

- Do I need a separate password for the rewards portal?

- Can I redeem rewards for cash?

- Is there a limit to how many points I can earn?

- How do I contact rewards support?

- What should I do if I suspect unauthorized activity?

For members of Navy Federal Credit Union, the rewards portal is a central hub where points, cash back, and exclusive offers accumulate. The phrase “Navy Federal credit union rewards login” often appears in search queries because members need clear, reliable instructions for accessing their accounts. This article walks you through the entire process, from initial setup to daily usage, while highlighting security features and practical tips.

Understanding the rewards ecosystem begins with recognizing that Navy Federal integrates its loyalty program directly into its online banking platform. That means the same credentials you use for checking balances also unlock your rewards dashboard. By treating the rewards portal as an extension of your primary account, the credit union ensures a seamless experience and consistent protection across all services.

Throughout the following sections, you will find a narrative that mirrors a typical member’s journey: logging in for the first time, navigating the dashboard, addressing common hiccups, and finally, leveraging the earned benefits. The guide is designed to be both comprehensive and easy to follow, making the rewards login process feel as routine as checking your balance each month.

Getting Started: Setting Up Your Rewards Account

The first interaction many members have with the rewards system is the creation of a dedicated profile. Although the rewards program is linked to your existing Navy Federal account, you must activate it before you can see earned points. Follow these steps:

- Log into the main Navy Federal online banking portal using your username and password.

- Navigate to the “Rewards” tab located in the top navigation bar.

- Read and accept the program terms and conditions, then click “Activate Rewards.”

Once activation is complete, the system automatically generates a rewards ID that ties directly to your member number. This ID is used behind the scenes whenever you earn or redeem points, but you rarely need to see it again.

Why Activation Matters

Activating the rewards program not only unlocks the dashboard but also enables real‑time tracking of purchases that qualify for points. The activation step triggers the back‑end integration that records eligible transactions from your debit, credit, and loan accounts. Without this link, your activity would not be reflected in the rewards balance.

How to Perform the Navy Federal Rewards Login

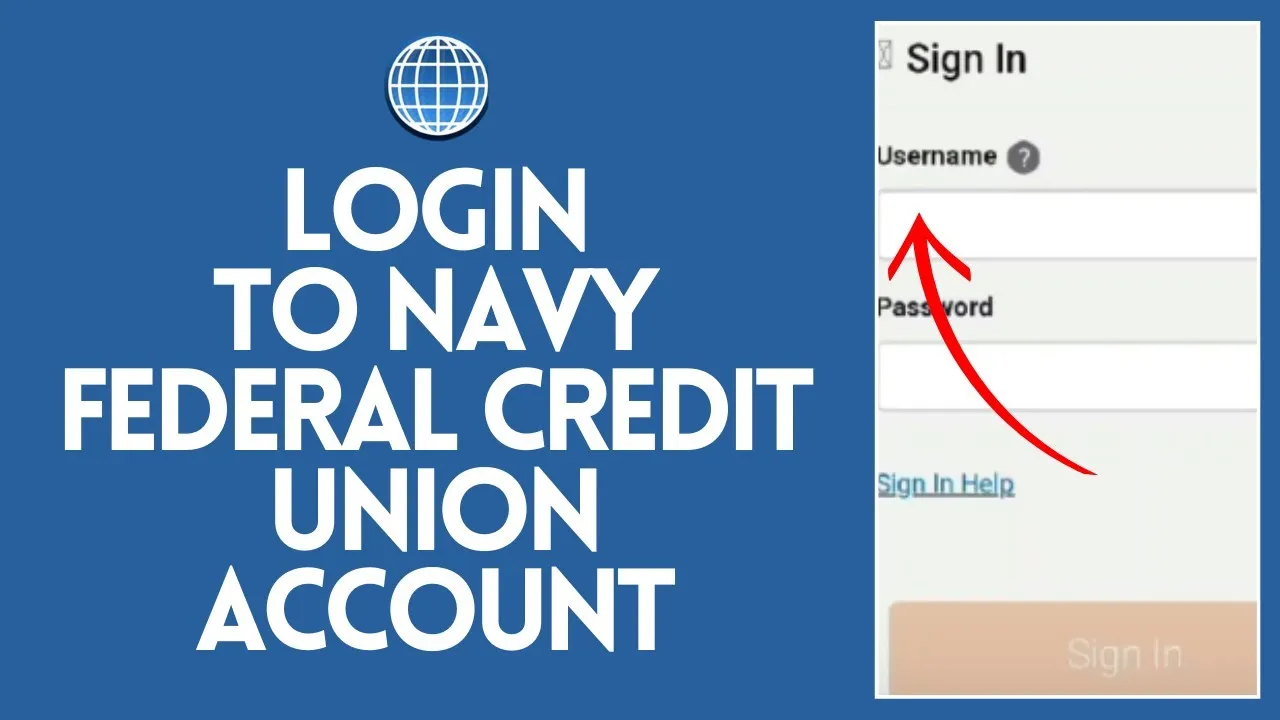

The actual login process mirrors the standard online banking sign‑in, with a few nuances that enhance security. Below is a step‑by‑step walk‑through:

- Open the Navy Federal website or mobile app. Use a supported browser (Chrome, Edge, Safari) or the latest version of the iOS/Android app.

- Enter your member username. This is the same identifier you use for all other Navy Federal services.

- Type your password. If you have enabled multi‑factor authentication (MFA), you will be prompted for a verification code.

- Select “Rewards” from the main menu. The portal redirects you to the rewards dashboard without requiring a separate sign‑in.

- Review your points, cash back, and available offers. All data is refreshed in real time.

If you have opted for the Online Account Management: The Core Hub feature, the rewards section appears as a tile on your home screen, further reducing the steps needed to check balances.

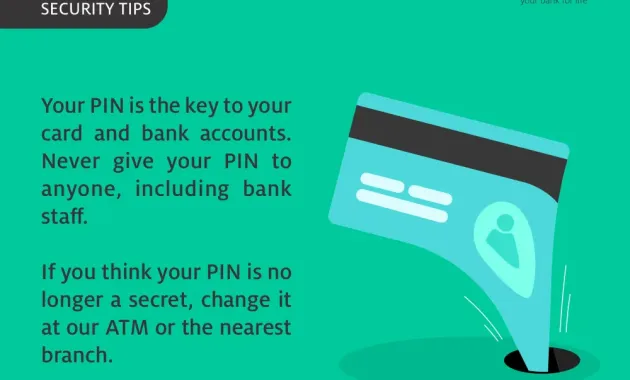

Multi‑Factor Authentication (MFA)

Security is a cornerstone of Navy Federal’s digital services. When you enable MFA, a one‑time passcode is sent to your registered mobile device or generated by an authenticator app. This extra layer protects against unauthorized access, especially when you log in from a new device or location.

Common Issues and How to Resolve Them

Even with a robust system, members occasionally encounter obstacles. Below are the most frequently reported problems and practical solutions.

Forgotten Username or Password

Use the “Forgot Username?” or “Forgot Password?” links on the sign‑in page. The process involves verifying your identity through a series of security questions or a code sent to your registered email or phone number. After resetting, consider updating your password to a unique phrase that includes numbers and symbols.

Login From an Unrecognized Device

If you attempt to log in from a device the system does not recognize, you may receive a temporary lockout message. In this case, select “Verify My Identity” and follow the prompts to confirm your membership. Once verified, the device will be added to your trusted list.

Rewards Not Updating After a Purchase

Points are typically posted within 24‑48 hours after a qualifying transaction. If you do not see the expected credit after this window, contact Navy Federal’s rewards support. Have your transaction details handy, including date, amount, and merchant name.

Tips to Maximize Your Rewards Earnings

Beyond simply logging in, there are strategic actions you can take to accelerate point accumulation and increase redemption value.

- Enroll in bonus categories. Navy Federal often runs limited‑time promotions for grocery, travel, or online shopping. Enrolling ensures you earn extra points on these purchases.

- Link eligible credit cards. Some Navy Federal credit cards offer higher reward rates. Adding them to your rewards profile consolidates earnings.

- Use the mobile app for in‑store purchases. Certain promotions are exclusive to app‑based transactions.

- Monitor expiration dates. Points may expire after a set period of inactivity. Regular logins keep your account active.

For a broader perspective on how reward credit cards compare, the Ultimate 2026 Credit Card Playbook provides a detailed analysis of cash‑back versus points‑based programs, which can inform your choices when selecting a Navy Federal card.

Leverage the “Refer a Friend” Feature

When you refer a new member who opens a qualified account, both parties receive bonus points. Tracking these referrals is simple through the rewards dashboard, and the bonuses are automatically added after the new member’s account is approved.

Mobile App vs. Desktop: Which Is Best for Rewards?

Both platforms give full access to the rewards portal, but each has distinct advantages.

Desktop Experience

The desktop site offers a larger screen for detailed transaction histories, charts, and downloadable statements. It is ideal for members who prefer to analyze their earnings over long periods.

Mobile App Experience

The app excels in convenience. Push notifications alert you to new promotions, and a quick tap can redeem points for gift cards or travel vouchers. The app also supports biometric login (fingerprint or facial recognition), adding another security layer.

Choosing between the two depends on your personal workflow. If you regularly monitor your balance at a desk, the desktop may feel more comfortable. If you are often on the go, the app ensures you never miss a reward opportunity.

Security Practices That Protect Your Rewards

Beyond MFA, Navy Federal employs several advanced measures to safeguard member data.

- End‑to‑end encryption for all data transmitted between your device and the server.

- Continuous monitoring for suspicious login attempts, with automatic alerts sent to your registered contact methods.

- Regular security patches and updates to both the website and mobile applications.

The importance of immediate detection is underscored in the article Why Immediate Reporting Matters, which explains how early alerts can prevent fraud before it impacts your account balance.

Frequently Asked Questions (FAQ)

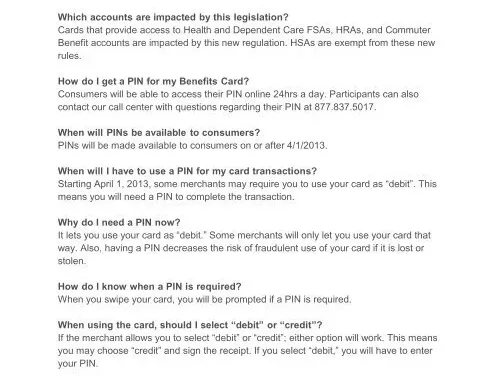

Do I need a separate password for the rewards portal?

No. The rewards dashboard uses the same credentials as your primary Navy Federal online banking account. This unified login reduces password fatigue and streamlines security management.

Can I redeem rewards for cash?

Yes. Points can be converted to cash back, which is deposited directly into your Navy Federal checking or savings account. The conversion rate varies by promotion, so review the current rate before redeeming.

Is there a limit to how many points I can earn?

There is no overall cap on point accumulation, but individual promotions may impose daily or monthly limits. These limits are clearly displayed on the promotion page.

How do I contact rewards support?

Support is reachable via the secure messaging feature inside your online account, by phone at the member services line, or through the in‑app chat function. Provide your member number and a brief description of the issue for faster resolution.

What should I do if I suspect unauthorized activity?

Immediately lock your account through the “Security Settings” page, then contact Navy Federal’s fraud department. Prompt action limits potential loss and initiates an investigation.

By following the steps outlined above, Navy Federal members can confidently navigate the rewards login process, troubleshoot any obstacles, and fully exploit the benefits embedded in their membership. Regular engagement with the portal not only keeps you informed about earned points but also helps you stay ahead of security updates and new promotional offers. As the digital landscape evolves, Navy Federal continues to refine its rewards platform, ensuring that members receive value in a secure, user‑friendly environment.