Table of Contents

- Historical Background: The Need for Reform

- Key Drivers of Legislative Action

- Core Provisions of the CARD Act

- 1. Transparent Disclosure Requirements

- 2. Restrictions on Rate Increases

- 3. Limits on Fees and Penalties

- 4. Payment Allocation Rules

- 5. Age‑Related Protections

- Impact on Consumers and Issuers

- Consumer Benefits

- Issuer Adjustments

- Compliance and Enforcement

- Key Enforcement Actions

- Long‑Term Effects and Ongoing Debates

- Areas Under Review

The CARD Act of 2009, formally known as the Credit Card Accountability, Responsibility, and Disclosure Act, emerged as a decisive response to growing consumer complaints about opaque credit‑card terms and predatory practices. From the moment it was introduced, the legislation aimed to bring transparency, fairness, and accountability to an industry that had long operated with minimal oversight. By mandating clearer disclosures, limiting fee abuse, and strengthening consumer protections, the Act set a new baseline for how banks and issuers interact with cardholders.

Understanding the CARD Act is essential for anyone who uses a credit card, whether you are an occasional shopper, a frequent traveler, or a small‑business owner managing expenses. The law touches on everything from interest‑rate hikes to how issuers can change fees, and even the way they communicate new terms. For readers interested in the broader landscape of credit‑card usage, the Act also intersects with topics such as authorized users versus joint account holders, a nuance explored in detail here.

Below, we walk through the historical context that led to the law’s passage, unpack its core provisions, and examine the real‑world effects on consumers and issuers alike. The narrative follows a chronological arc—starting with the pre‑Act environment, moving through congressional debate, and ending with post‑implementation outcomes—providing a comprehensive picture without resorting to opinionated language.

Historical Background: The Need for Reform

During the early 2000s, credit‑card issuers faced little regulatory scrutiny regarding how they structured fees, interest rates, and billing practices. Consumers reported sudden interest‑rate hikes after introductory periods, undisclosed penalties, and confusing billing statements that made it difficult to understand their obligations. A series of high‑profile lawsuits and growing media attention highlighted systemic issues, prompting lawmakers to act.

Key Drivers of Legislative Action

- Rate‑Increase Shock: Many cardholders experienced dramatic jumps in annual percentage rates (APRs) after promotional periods, often without clear notice.

- Opaque Fees: Late‑payment fees, over‑limit fees, and annual fees were frequently applied without transparent justification.

- Billing Confusion: Statements bundled multiple charges, making it hard for consumers to pinpoint the source of a balance increase.

These pain points galvanized consumer‑advocacy groups, who lobbied Congress for stronger protections. The resulting bipartisan effort culminated in the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act, signed into law by President Barack Obama on May 22, 2009.

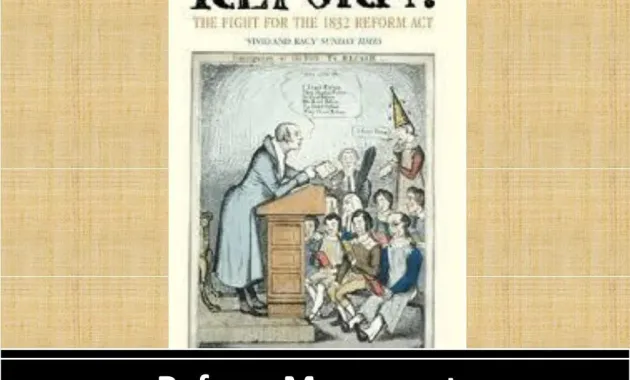

Core Provisions of the CARD Act

The CARD Act introduced a suite of rules designed to protect consumers while preserving the credit market’s functionality. Below are the most significant provisions, each of which reshaped issuer behavior.

1. Transparent Disclosure Requirements

Issuers must now provide clear, understandable information about interest rates, fees, and terms before a consumer applies for a card. This includes a conspicuous “APR” label and a plain‑language summary of how interest will be calculated. The goal is to eliminate hidden surprises that previously lurked in fine print.

2. Restrictions on Rate Increases

Interest‑rate hikes can only occur under specific conditions:

- If the cardholder is more than 60 days late on a payment.

- If the issuer provides at least 45 days’ written notice before the increase takes effect.

- Rate changes cannot be applied to existing balances unless the cardholder was already delinquent on those balances.

This provision directly addressed the “rate‑increase shock” that plagued many consumers before 2009.

3. Limits on Fees and Penalties

The Act capped several common fees:

- Late‑payment fees cannot exceed $8 for the first occurrence and $5 for subsequent ones within a billing cycle.

- Over‑limit fees are prohibited unless the consumer has opted in, and even then, the fee cannot exceed $10.

- Annual fees must be clearly disclosed at the time of application.

4. Payment Allocation Rules

When a cardholder makes a payment that does not cover the entire balance, the issuer must first apply the payment to the balance with the lowest interest rate. This prevents issuers from allocating funds to high‑interest balances while leaving lower‑interest debt untouched—a practice that previously increased overall interest costs for consumers.

5. Age‑Related Protections

Credit cards cannot be issued to individuals under 21 unless they meet one of three criteria: (1) have a co‑signer, (2) can demonstrate an independent source of income sufficient to cover the credit limit, or (3) have a written agreement to repay the debt. This measure aimed to protect young adults from accumulating debt they could not afford.

Impact on Consumers and Issuers

Since its enactment, the CARD Act has produced measurable changes across the credit‑card ecosystem. Consumers enjoy greater predictability and fewer surprise fees, while issuers have adapted their product designs and marketing strategies to comply with the new rules.

Consumer Benefits

- Reduced Surprise Costs: Transparent disclosures and capped fees have lowered the incidence of unexpected charges.

- Improved Credit Management: Payment allocation rules help borrowers pay down debt more efficiently.

- Greater Confidence: Knowing that rate hikes require advance notice empowers cardholders to plan their finances.

Issuer Adjustments

Financial institutions responded by redesigning credit‑card offers. Many introduced tiered reward structures that align with the new fee caps, while others increased the use of introductory 0% APR periods to attract new customers without violating rate‑increase restrictions. The industry also invested in more sophisticated compliance systems to track and report required disclosures.

For readers curious about how issuers manage risk, the practice of freezing cards—often triggered by suspicious activity—remains a critical safeguard. An explanation of those triggers can be found here.

Compliance and Enforcement

The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) share responsibility for enforcing the CARD Act. They conduct regular examinations of banks, investigate consumer complaints, and can impose civil penalties for non‑compliance. Since 2009, the CFPB has issued numerous enforcement actions, resulting in millions of dollars in restitution for affected consumers.

Key Enforcement Actions

- 2012: A major issuer was fined for failing to provide proper notice before increasing APRs on existing balances.

- 2015: The CFPB secured a settlement requiring an issuer to redesign its over‑limit fee policy and to reimburse affected cardholders.

- 2020: A multi‑bank investigation uncovered systemic violations of payment allocation rules, leading to a joint settlement that benefited thousands of consumers.

Long‑Term Effects and Ongoing Debates

More than a decade after its passage, the CARD Act remains a cornerstone of U.S. consumer‑credit regulation. However, the credit‑card landscape continues to evolve with fintech innovations, digital wallets, and new pricing models. Policymakers and industry leaders regularly debate whether additional reforms are needed to address emerging challenges such as subscription‑based credit products and algorithmic credit‑scoring mechanisms.

Areas Under Review

- Dynamic Pricing: Some fintech firms experiment with interest rates that adjust in real time based on user behavior, raising questions about how the Act’s rate‑increase provisions apply.

- Data Transparency: Calls for clearer reporting on how personal data influences credit decisions echo the Act’s original spirit of disclosure.

- Extended Warranty Benefits: As credit cards increasingly bundle ancillary services like extended warranties, regulators examine whether additional consumer protections are required—see an overview of those benefits here.

Despite these ongoing discussions, the fundamental principles of the CARD Act—fairness, clarity, and accountability—continue to guide both legislation and industry practice.

In summary, the Credit Card Accountability, Responsibility, and Disclosure Act of 2009 transformed the credit‑card market by mandating transparent disclosures, limiting abusive fees, and protecting vulnerable borrowers. Its legacy is evident in the more predictable billing cycles and clearer communication that millions of consumers now experience. As the financial ecosystem adapts to new technologies and consumer expectations, the Act’s framework serves as a benchmark for future reforms, ensuring that the balance between innovation and consumer protection remains steady.