Table of Contents

- How Amazon Points Work and Why They Matter

- Conversion Basics

- Top Credit Cards That Offer the Highest Amazon Points

- 1. Amazon Prime Rewards Visa Signature Card

- 2. Citi® Double Cash Card (Amazon Bonus Version)

- 3. Chase Freedom Unlimited® (Amazon Enhanced Category)

- 4. Capital One Venture X Rewards Credit Card

- How to Maximize Amazon Points Across Your Card Portfolio

- Leverage Introductory Bonuses

- Combine Card Benefits with Amazon Prime Benefits

- Use Category‑Specific Rotating Bonuses

- Pay Attention to Redemption Options

- Stay Secure While Shopping

- Fees, Eligibility, and Additional Perks

- Annual Fees vs. Net Benefit

- Credit Score Requirements

- Additional Card Perks That Complement Amazon Shopping

- Real‑World Scenarios: Applying the Best Card to Different Shopper Profiles

- Scenario 1: The Prime‑Heavy Household

- Scenario 2: The Mixed‑Category Spender

- Scenario 3: The High‑Spending Traveler

- Future Outlook: How Amazon Rewards May Evolve

When it comes to shopping on Amazon, the lure of points that turn into cash‑back or travel rewards can make a huge difference in your monthly budget. Which credit card gives the most Amazon points is a question that many frequent shoppers ask, but the answer isn’t always straightforward. The landscape changes with promotional offers, rotating categories, and the way each issuer treats Amazon purchases. This article walks through the current market, highlights the cards that consistently outperform the rest, and shows you how to extract maximum value without getting tangled in fine print.

We’ll start by outlining the mechanics behind Amazon points, then move on to a side‑by‑side comparison of the most rewarding cards available in 2024. After that, practical strategies for boosting your earnings will be presented, followed by a look at fees, eligibility, and ancillary benefits that often tip the scales. Whether you are a new cardholder or a seasoned points collector, the information below provides a factual roadmap to help you decide which card aligns best with your Amazon spending habits.

How Amazon Points Work and Why They Matter

Amazon points are essentially a loyalty currency that can be redeemed for purchases on Amazon.com or transferred to airline and hotel partners, depending on the card’s reward program. The value of a point typically ranges from 0.5 ¢ to 1 ¢, but some cards boost that value during special promotions. Understanding the conversion rate is crucial because a “high‑earning” card may not always translate into higher savings if the points are worth less.

Conversion Basics

- Standard value: Most cash‑back cards treat each point as 1 ¢, making a 5 % reward equal to $0.05 per dollar spent.

- Travel partners: Cards that allow point transfers often assign a higher value (e.g., 1.2 ¢ per point when transferred to a preferred airline).

- Promotional boosts: Seasonal offers can temporarily increase the earning rate to 7 % or more on Amazon purchases.

Because Amazon purchases can span everything from everyday groceries to big‑ticket electronics, the total annual spend can be significant. A card that earns 5 % on Amazon alone could generate several hundred dollars in rewards for a moderate spender.

Top Credit Cards That Offer the Highest Amazon Points

Below is a curated list of cards that consistently rank at the top for Amazon points in 2024. The selection criteria include base earning rate on Amazon, introductory bonuses, transfer flexibility, and overall cost of ownership.

1. Amazon Prime Rewards Visa Signature Card

- Base earn rate: 5 % back on Amazon.com purchases for Prime members (4 % for non‑Prime).

- Reward type: Cash‑back points redeemable as statement credit toward Amazon purchases.

- Annual fee: $0 (requires an active Amazon Prime subscription, $139/year).

- Why it tops the list: The 5 % rate is unmatched for everyday Amazon spending, and the cash‑back is applied directly to future purchases, effectively reducing the net cost of items.

2. Citi® Double Cash Card (Amazon Bonus Version)

- Base earn rate: 2 % cash back on all purchases (1 % when you buy, 1 % when you pay).

- Amazon bonus: 2 % additional cash back (total 4 %) on Amazon purchases during the first 12 months after account opening.

- Reward type: Cash back that can be redeemed as a statement credit or transferred to a Citi ThankYou® Points account for travel.

- Annual fee: $0.

- Why consider it: While the baseline is lower than the Amazon Prime Visa, the introductory boost and the card’s flexibility for non‑Amazon spending make it a solid all‑rounder.

3. Chase Freedom Unlimited® (Amazon Enhanced Category)

- Base earn rate: 1.5 % cash back on all purchases.

- Amazon boost: 3 % cash back on Amazon.com purchases for the first year, then 1.5 % thereafter.

- Reward type: Chase Ultimate Rewards® points (1 ¢ per point when redeemed for travel through Chase, 0.8 ¢ for cash back).

- Annual fee: $0.

- Why it matters: The card’s ability to earn points on a wide range of categories, combined with a solid Amazon rate, offers balanced value for households with diverse spending patterns.

4. Capital One Venture X Rewards Credit Card

- Base earn rate: 2 X Points per dollar on all purchases.

- Amazon multiplier: 5 X Points per dollar on Amazon purchases for the first 12 months (subject to a $5,000 spend cap).

- Reward type: Travel credits and flexible points convertible to airline partners at up to 2 ¢ per point.

- Annual fee: $395.

- Why it stands out: Although the fee is high, the combination of travel benefits and an aggressive Amazon bonus makes it attractive for high‑spending, travel‑oriented shoppers.

How to Maximize Amazon Points Across Your Card Portfolio

Even the best‑rated card can fall short if you don’t employ a strategic approach. Below are practical steps that can help you extract every possible point from your Amazon purchases.

Leverage Introductory Bonuses

Many cards offer a higher earn rate for a limited time. For example, the Capital One Venture X provides a 5 X Points boost for the first year. Align your large Amazon purchases—such as holiday gifts or home appliances—with these introductory windows to capture the maximum rate.

Combine Card Benefits with Amazon Prime Benefits

If you already pay for Amazon Prime, the Amazon Prime Rewards Visa eliminates the need for an extra cash‑back calculation; you simply receive a 5 % statement credit. Pair this with Prime’s free shipping and exclusive deals, and the overall effective discount can exceed 7 % on certain items.

Use Category‑Specific Rotating Bonuses

Cards like the Chase Freedom Flex™ rotate quarterly categories that sometimes include Amazon. By adding the card to your wallet during a quarter when Amazon is featured, you can earn an additional 5 % cash back on top of the base rate.

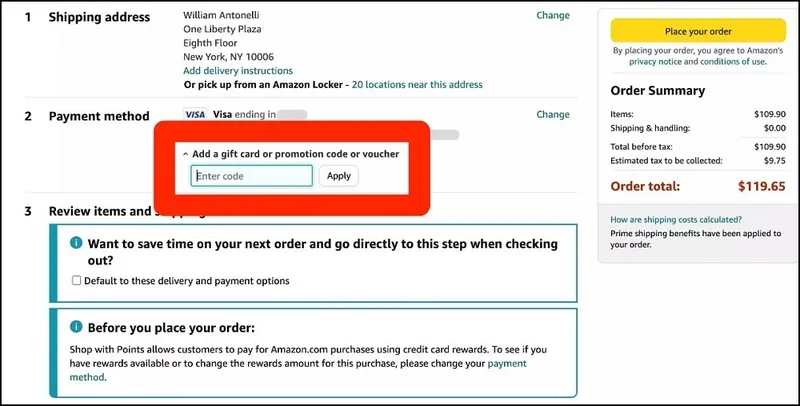

Pay Attention to Redemption Options

For cards that offer point transfers (e.g., Citi ThankYou® or Chase Ultimate Rewards®), calculate the conversion value before redeeming. Transferring to a travel partner may increase the effective value of each point, especially if you have upcoming trips.

Stay Secure While Shopping

Protecting your card information is essential, especially when shopping online. Learn more about safeguarding your card against skimmers in our guide How to Protect Your Credit Card from Skimmers – 7 Actionable Steps You Can Take Today. A secure transaction ensures you don’t lose points to fraud.

Fees, Eligibility, and Additional Perks

While reward rates dominate headlines, the true cost of a card is often hidden in fees and eligibility requirements. Below we break down the most common considerations.

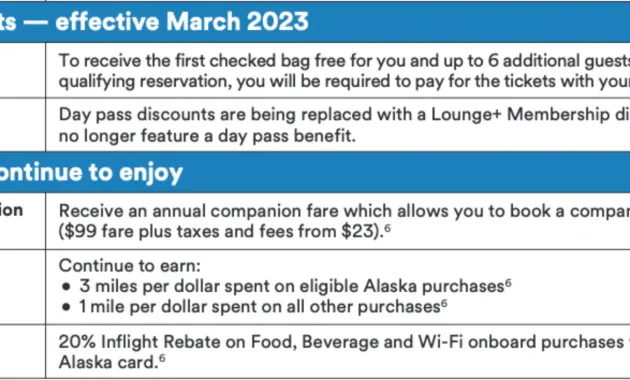

Annual Fees vs. Net Benefit

Cards with higher annual fees, such as the Venture X ($395), typically bundle travel credits, lounge access, and higher point values. Calculate your expected Amazon spend and compare the net benefit after subtracting the fee. For many users, a $0 fee card like the Amazon Prime Visa offers a higher net return if Amazon is the primary purchase category.

Credit Score Requirements

- Excellent (720+): Required for premium travel cards (e.g., Capital One Venture X, Chase Sapphire Preferred).

- Good (680–719): Sufficient for most cash‑back cards, including the Amazon Prime Rewards Visa.

- Fair (620–679): May qualify for basic cards but with lower earn rates or higher APR.

Additional Card Perks That Complement Amazon Shopping

- Extended warranties and purchase protection—useful for big‑ticket Amazon items.

- Paperless statements to reduce clutter and improve organization. Read more about the advantages in Why Choose Paperless Statements?

- Apple Pay compatibility for quick checkout on mobile devices. Discover why this matters in Why Apple Pay Compatibility Matters for Credit Card Choice.

Real‑World Scenarios: Applying the Best Card to Different Shopper Profiles

To illustrate how the top cards perform in everyday life, let’s explore three common shopper profiles.

Scenario 1: The Prime‑Heavy Household

Emily and her family spend an average of $1,200 per year on Amazon, primarily groceries, household items, and streaming services. With an active Prime membership, the Amazon Prime Rewards Visa returns $60 in statement credits (5 % of $1,200). Because the card has no annual fee beyond the Prime subscription, the net benefit is a straight 5 % discount.

Scenario 2: The Mixed‑Category Spender

James uses his card for a blend of travel, dining, and Amazon purchases totaling $2,500 annually on Amazon alone. He opts for the Chase Freedom Unlimited, earning 3 % on Amazon for the first year ($75) and 1.5 % thereafter. The additional points earned on travel (5 % through Chase Sapphire Preferred) offset the lower Amazon rate, making the overall portfolio more rewarding.

Scenario 3: The High‑Spending Traveler

Maria travels frequently and spends $4,000 per year on Amazon, mainly for tech accessories and books. She chooses the Capital One Venture X to capture the 5 X Points boost during the first year, earning 20,000 points (valued at $400 if transferred to a travel partner). Even after accounting for the $395 annual fee, Maria nets a $5 advantage, plus the card’s travel perks.

Future Outlook: How Amazon Rewards May Evolve

Amazon continues to experiment with its own branded credit cards and partnership structures. While the current top performers remain stable, potential changes include:

- Increased collaboration with fintech firms to offer instant point redemption at checkout.

- Dynamic earn rates that adjust based on user purchase patterns, rewarding higher spenders with tiered percentages.

- Greater integration of Amazon’s own loyalty program, Amazon Prime Rewards, potentially allowing points to be used across more services such as Twitch and Audible.

Staying informed about these developments will help you pivot your strategy and retain the highest possible point yield.

In summary, the credit card that gives the most Amazon points depends on your individual spending habits, existing memberships, and willingness to pay annual fees. For pure Amazon spenders with a Prime subscription, the Amazon Prime Rewards Visa Signature Card delivers an unbeatable 5 % back. If you want flexibility across travel and everyday purchases, cards like the Capital One Venture X or Chase Freedom Unlimited provide strong secondary benefits while still offering competitive Amazon rates. Evaluate the total cost, assess your annual Amazon spend, and align the card’s ancillary perks with your lifestyle to ensure the points you earn translate into real savings.