Table of Contents

- Understanding the Core Factors Lenders Evaluate

- Debt‑to‑Income Ratio (DTI)

- Credit Utilization

- Payment History

- Hard Inquiries

- Credit Mix and Length of Credit History

- Strategic Steps to Optimize Credit Card Usage Before a Mortgage Application

- Pay Down Balances Early

- Freeze or Reduce New Credit Applications

- Maintain Low Utilization Across All Cards

- Automate On‑Time Payments

- Review Your Credit Report for Errors

- Leverage Revolving Credit Knowledge

- How Lenders Use Credit Card Data in the Underwriting Process

- Real‑World Scenarios: Credit Card Impacts in Action

- Scenario 1: The High‑Balance Borrower

- Scenario 2: The New Card Applicant

- Scenario 3: The Strategic Pay‑Off

- Common Myths About Credit Cards and Mortgages

- Preparing for the Mortgage Application: A Checklist

When you sit down to apply for a mortgage, the lender’s primary focus is not just the property you want to buy, but also the financial habits that sit in your wallet. Among those habits, the way you use your credit cards can play a pivotal role. A single credit card balance, payment history, or even the number of cards you hold may tip the scales toward approval or denial. Understanding exactly how a credit card affects a mortgage application equips you to make informed decisions that safeguard your home‑buying dreams.

This article walks through the mechanics behind credit card usage and mortgage underwriting. We’ll explore the metrics lenders scrutinize, the common pitfalls that borrowers overlook, and the strategic actions you can take to present a stronger application. By the end, you’ll have a clear roadmap for aligning your credit card behavior with mortgage eligibility requirements.

Understanding the Core Factors Lenders Evaluate

Lenders assess credit card activity through several interrelated lenses. Each lens feeds into a larger picture of risk, influencing the loan terms they are willing to offer. Below we break down the most critical components.

Debt‑to‑Income Ratio (DTI)

The debt‑to‑income ratio is the proportion of your monthly debt obligations to your gross monthly income. Credit card balances count as revolving debt, and every dollar you owe raises your DTI. Most conventional lenders aim for a DTI below 43%, though some programs, such as FHA loans, may allow higher ratios if other factors are strong.

For example, if you earn $6,000 per month and carry $800 in minimum credit card payments, your DTI sits at roughly 13% just from cards. Adding a mortgage payment of $2,000 would bring the total DTI to about 46%, potentially pushing you beyond the comfort zone of many lenders. Reducing credit card balances before you apply can therefore lower your DTI and improve your loan prospects.

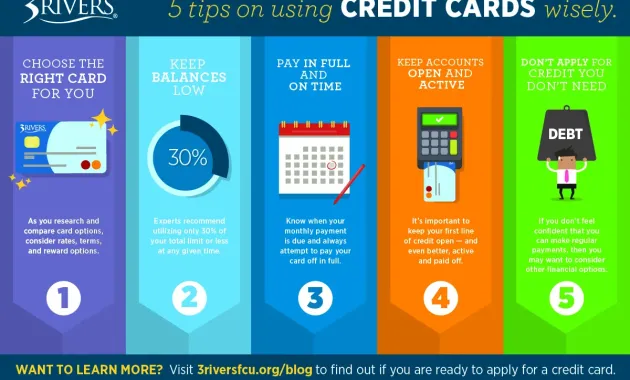

Credit Utilization

Credit utilization measures the percentage of your total available credit that you are using. It is calculated by dividing your total credit card balances by your total credit limits. A high utilization rate—generally above 30%—signals to lenders that you may be over‑relying on credit, which can negatively affect your credit score and raise red flags during underwriting.

Imagine you have three credit cards with limits of $5,000 each, for a total of $15,000. If you carry $6,000 in balances across those cards, your utilization is 40%. Paying down those balances to bring utilization under 30% (ideally under 10%) can improve both your score and the perception of financial stability.

Payment History

Payment history is the single most influential factor in most credit scoring models, accounting for roughly 35% of a FICO score. Missed or late credit card payments become part of your credit report and can linger for up to seven years, dragging down your score and making lenders view you as a higher risk.

Consistently paying credit card bills on time demonstrates responsible financial behavior. Even a single 30‑day late payment can cause a noticeable dip in your score, potentially affecting the interest rate you qualify for on a mortgage.

Hard Inquiries

When you apply for new credit, lenders perform a hard inquiry on your credit report. Each inquiry can lower your score by a few points, and multiple inquiries in a short period may amplify the impact. Since mortgage applications themselves generate a hard inquiry, adding new credit card accounts shortly before applying can compound the effect.

To minimize this impact, avoid opening new credit cards or applying for additional credit in the six months leading up to your mortgage application. If you must open a new card, do so well in advance—ideally more than a year before—to give your score time to recover.

Credit Mix and Length of Credit History

Lenders also consider the variety of credit accounts you hold (credit mix) and the average age of your accounts. A well‑balanced mix that includes revolving credit (credit cards) and installment credit (auto loans, student loans) can be a positive signal. However, opening a brand‑new credit card can lower the average age of your credit history, which may slightly reduce your score.

Maintaining older credit cards, even if you use them sparingly, can preserve the length of your credit history. This “credit aging” benefit often outweighs the small risk of a higher utilization rate if you keep balances low.

Strategic Steps to Optimize Credit Card Usage Before a Mortgage Application

Now that we’ve identified the key metrics, let’s explore actionable strategies to align your credit card behavior with mortgage underwriting expectations.

Pay Down Balances Early

Start reducing credit card balances at least 60 days before you plan to submit your mortgage application. Lenders typically pull the most recent credit report, and balances reported at the time of the pull will affect both your DTI and utilization. Paying down high‑interest cards first can also save you money in the long run. For practical tactics on lowering interest, see our guide on how to stop credit card interest accumulation.

Freeze or Reduce New Credit Applications

Resist the urge to chase new credit offers during the mortgage preparation phase. Each new application triggers a hard inquiry and may shorten your average account age. If you already have a pending credit card application, consider canceling it before the mortgage process begins.

Maintain Low Utilization Across All Cards

Distribute any remaining balances across multiple cards to keep utilization under 30% on each. Alternatively, request a credit limit increase on existing cards; a higher limit lowers utilization without the need to pay down the balance as aggressively. Just ensure you do not increase spending as a result of the higher limit.

Automate On‑Time Payments

Set up automatic payments for at least the minimum amount due to guarantee on‑time payment history. Over time, consider automating a higher payment amount to accelerate balance reduction while still ensuring punctuality.

Review Your Credit Report for Errors

Obtain a free copy of your credit report from each of the three major bureaus (Equifax, Experian, TransUnion) and verify that all credit card entries are accurate. Dispute any inaccuracies promptly, as erroneous late payments or balances can unfairly lower your score.

Leverage Revolving Credit Knowledge

Understanding the nuances of revolving credit can help you manage your cards more effectively. Our article on what exactly is a revolving line of credit offers deeper insight into how revolving accounts differ from installment loans and why lenders view them the way they do.

How Lenders Use Credit Card Data in the Underwriting Process

During underwriting, lenders pull your credit report and run a series of automated and manual checks. Credit card data informs several specific underwriting decisions:

- Credit Score Thresholds: Many lenders set minimum credit score requirements (e.g., 620 for conventional loans). Credit card payment history and utilization heavily influence this score.

- Risk-Based Pricing: Borrowers with higher scores and lower DTI often qualify for better interest rates. Conversely, higher credit card debt can lead to higher rates or the need for additional documentation.

- Eligibility for Government‑Backed Loans: Programs like FHA, VA, and USDA have distinct credit criteria, but all consider credit card behavior as part of the overall credit profile.

- Verification of Income and Expenses: Lenders may request recent credit card statements to verify cash flow, especially for self‑employed borrowers.

Because credit card information permeates every step of underwriting, even seemingly minor issues—like a short‑term spike in utilization due to a holiday shopping spree—can influence the final decision.

Real‑World Scenarios: Credit Card Impacts in Action

Scenario 1: The High‑Balance Borrower

Maria holds two credit cards with a combined limit of $10,000 and carries $4,500 in balances. Her utilization stands at 45%. Although her credit score is 710, the high utilization drags it down to 680. When she applies for a $250,000 mortgage, the lender flags her DTI as borderline and offers a higher interest rate. After paying down the balances to $1,000 total (10% utilization), her score improves to 735, and she secures a lower rate, saving thousands over the loan term.

Scenario 2: The New Card Applicant

James recently opened a new rewards credit card three months before applying for a mortgage. The hard inquiry lowered his score by five points, and the new account reduced his average credit age. The lender requested additional documentation to offset the perceived risk, delaying the approval process by two weeks. Had James waited six months before opening the card, the impact would have been negligible.

Scenario 3: The Strategic Pay‑Off

Lena strategically paid off a $2,000 balance on her high‑interest card two months before her loan application. This action lowered both her DTI and utilization, resulting in a 20‑point boost to her credit score. The lender approved her loan with a 0.25% lower interest rate, translating to monthly savings of $50 over a 30‑year term.

Common Myths About Credit Cards and Mortgages

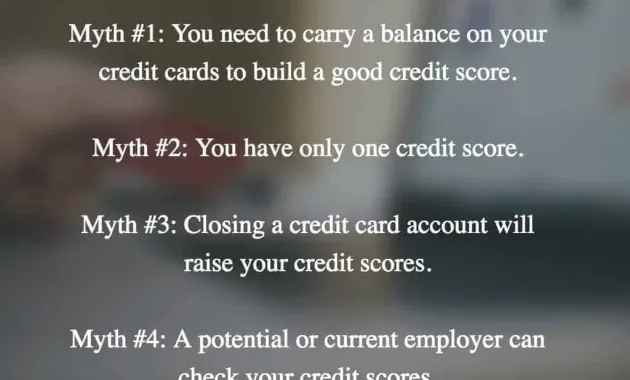

- Myth: Closing old credit cards improves your score.

Fact: Closing an account reduces your total available credit, raising utilization, and shortens your credit history, both of which can lower your score. - Myth: Carrying a small balance each month improves your score.

Fact: Modern scoring models do not reward carrying balances; paying in full each month is financially wiser. - Myth: Only the number of credit cards matters.

Fact: Lenders look at balances, payment history, and utilization, not just the count of cards.

Preparing for the Mortgage Application: A Checklist

- Review credit reports for errors and dispute inaccuracies.

- Pay down credit card balances to achieve utilization below 30%, ideally under 10%.

- Maintain on‑time payments for at least six months before applying.

- Avoid new credit inquiries and new card openings for six months.

- Request credit limit increases on existing cards if needed, without increasing spending.

- Gather recent credit card statements for documentation, if required.

- Consider consulting a mortgage broker to understand lender‑specific criteria.

By following this checklist, you position yourself as a low‑risk borrower, increasing the likelihood of loan approval and more favorable terms.

In the end, credit cards are not obstacles but tools that, when managed wisely, can enhance your mortgage eligibility. A disciplined approach to balance reduction, utilization control, and timely payments creates a credit profile that speaks confidence to lenders. As you embark on the journey to homeownership, let your credit card habits reflect the same care and foresight you will bring to maintaining your future home.