Table of Contents

- Step‑by‑Step Guide to PNC Bank Credit Card Login

- 1. Create Your Online Banking Profile

- 2. Access the Login Page

- 3. Enter Your Credentials

- 4. Navigate the Dashboard

- Troubleshooting Common Login Issues

- Forgot Username or Password

- Account Locked After Multiple Failed Attempts

- Browser Compatibility and Cookies

- Enhancing Security While Logging In

- Multi‑Factor Authentication (MFA)

- Secure Password Practices

- Recognizing Phishing Attempts

- Using the PNC Mobile App for Credit Card Management

- Link to Related Guides

- Understanding Account Features Accessible After Login

- Statement Retrieval and Dispute Management

- Reward Tracking and Redemption

- Setting Up Alerts and Notifications

- Integrating PNC Login with Personal Finance Tools

- Data Privacy Considerations

- What to Do If You Suspect Unauthorized Activity

- Immediate Steps

- Follow‑Up Actions

- Future Enhancements and Roadmap

PNC Bank credit card login is the gateway to managing your finances, checking balances, and reviewing transactions from anywhere. Whether you are a first‑time user or a seasoned cardholder, understanding the exact steps and security measures can save time and prevent frustration. This article walks you through the entire process, from setting up your online profile to resolving login problems, while highlighting best practices for safeguarding your account.

The digital banking experience has evolved dramatically over the past decade. PNC’s online platform now offers a clean interface, mobile app integration, and multi‑factor authentication to keep your information secure. However, these enhancements also mean that users must stay informed about the latest procedures. By following a clear, narrative path, you will see how each feature fits into the broader picture of secure access.

Below, we explore the essential steps to log in, the tools available for password recovery, and the extra layers of protection that PNC provides. Along the way, you’ll find practical tips that align with broader credit‑card management strategies, such as the insights shared in balancing benefits and risks of multiple credit cards. Let’s begin the journey toward seamless, secure access.

Step‑by‑Step Guide to PNC Bank Credit Card Login

1. Create Your Online Banking Profile

- Visit the official PNC website and locate the “Enroll” or “Register” button.

- Enter your 16‑digit credit card number, Social Security Number (or Tax ID), and your date of birth.

- Choose a unique username—preferably a combination of letters and numbers that does not include personal identifiers.

- Set a strong password that meets PNC’s requirements: at least eight characters, a mix of uppercase and lowercase letters, a number, and a special character.

- Agree to the terms of service and confirm your email address through a verification link.

2. Access the Login Page

After registration, you will be redirected to the login portal. The URL typically begins with https://www.pnc.com and includes “login” in the path. Bookmark this page for future use, but always verify the address bar to avoid phishing sites.

3. Enter Your Credentials

- Type your username exactly as you created it.

- Enter the password, taking care to respect case sensitivity.

- If you have enabled multi‑factor authentication (MFA), you will receive a one‑time code via text message or an authenticator app.

- Enter the code in the designated field and click “Sign In.”

4. Navigate the Dashboard

Once logged in, the dashboard provides a snapshot of your credit card balance, recent transactions, and upcoming payments. From here, you can download statements, set alerts, or enroll in additional security features.

Troubleshooting Common Login Issues

![[Windows 11/10] Troubleshooting - PIN (Windows Hello) Login Failed](https://blog.avaller.com/wp-content/uploads/2026/01/windows-11-10-troubleshooting-pin-windows-hello-login-failed-5-630x380.webp)

Forgot Username or Password

If you cannot recall your username, click the “Forgot Username?” link. You will be prompted to provide the last four digits of your Social Security Number and your credit card number. PNC will then email you a reminder.

For a forgotten password, select “Forgot Password?” and follow these steps:

- Enter your username and the last four digits of your SSN.

- Answer the security questions you set up during registration.

- Choose a new password that complies with the complexity rules.

- Confirm the change via an email link or a text message code.

Account Locked After Multiple Failed Attempts

PNC locks an account temporarily after several unsuccessful login attempts to protect against brute‑force attacks. To unlock, wait 15 minutes or use the “Unlock Account” option, which typically requires you to verify your identity through a phone call or a code sent to your registered mobile number.

Browser Compatibility and Cookies

Modern browsers such as Chrome, Firefox, Safari, and Edge work well with PNC’s platform. Ensure that cookies and JavaScript are enabled; otherwise, the login page may not load correctly. Clearing the cache occasionally can also resolve unexpected glitches.

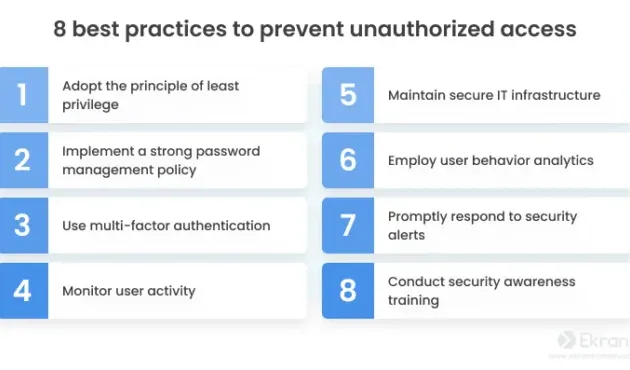

Enhancing Security While Logging In

Multi‑Factor Authentication (MFA)

PNC encourages every cardholder to enable MFA. This adds a second verification step beyond the password, dramatically reducing the risk of unauthorized access. Options include SMS codes, email codes, or authenticator apps like Google Authenticator or Authy.

Secure Password Practices

- Change your password at least every six months.

- Avoid reusing passwords across multiple financial institutions.

- Consider a reputable password manager to generate and store complex passwords.

Recognizing Phishing Attempts

Phishing emails often mimic PNC’s branding but contain malicious links. Always hover over links to view the actual URL. If an email asks for personal details or login credentials, forward it to phish@pnc.com for verification.

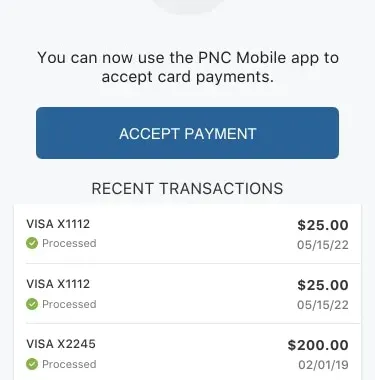

Using the PNC Mobile App for Credit Card Management

The PNC Mobile app mirrors the online dashboard and provides additional conveniences such as biometric login (fingerprint or facial recognition). After installing the app from the Apple App Store or Google Play Store, follow the same enrollment steps as the web version. Once logged in, you can:

- View real‑time transaction alerts.

- Freeze or unfreeze your credit card instantly.

- Set up travel notifications to avoid declined transactions abroad.

Link to Related Guides

For a broader perspective on securing credit‑card accounts across different banks, you might explore the guide on fast, secure access to your credit card account. The principles of strong authentication and regular monitoring apply universally.

Understanding Account Features Accessible After Login

Statement Retrieval and Dispute Management

Downloading monthly statements in PDF format allows you to keep a personal archive. If you spot an unfamiliar charge, the platform offers a “Dispute Transaction” feature where you can submit supporting documentation directly.

Reward Tracking and Redemption

Many PNC credit cards include rewards programs—cash back, points, or travel miles. The rewards tab displays current balances, redemption options, and expiration dates. Regularly checking this area helps you maximize benefits without missing out.

Setting Up Alerts and Notifications

Custom alerts can be configured for balance thresholds, payment due dates, or large transactions. These notifications arrive via email, SMS, or push alerts, giving you real‑time awareness of account activity.

Integrating PNC Login with Personal Finance Tools

For users who rely on budgeting software such as Mint, YNAB, or Personal Capital, PNC offers read‑only API access through secure token authentication. By linking your credit card, you can automatically import transactions, categorize expenses, and track spending patterns without manual entry.

Data Privacy Considerations

When granting third‑party access, verify that the service uses encryption and complies with industry standards like PCI DSS. Regularly review the list of authorized apps in the “Connected Apps” section of your PNC dashboard.

What to Do If You Suspect Unauthorized Activity

Immediate Steps

- Log in and use the “Freeze Card” function to prevent further charges.

- Contact PNC’s 24/7 fraud hotline (1‑800‑762‑2265) to report the incident.

- Review recent transactions and flag any that you did not authorize.

- Update your password and enable MFA if it was not already active.

Follow‑Up Actions

PNC will open an investigation, issue a provisional credit if needed, and may send you a replacement card. Keep a record of all communications, including dates, representative names, and case numbers.

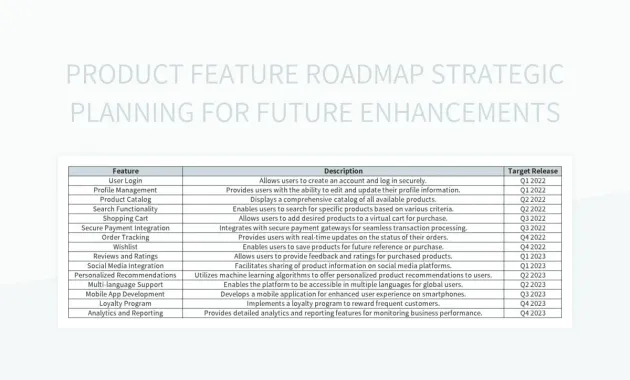

Future Enhancements and Roadmap

PNC continuously invests in technology to improve user experience. Upcoming features include biometric verification through facial recognition on the mobile app, AI‑driven fraud detection alerts, and a streamlined “One‑Click” login for verified devices. Staying aware of these updates can further simplify your login routine while maintaining high security standards.

By following the steps outlined above, you can confidently access your PNC Bank credit card account, manage your finances, and protect your personal information. Regularly reviewing security settings, using the mobile app’s convenience features, and staying informed about phishing threats ensure a smooth, uninterrupted banking experience.