Table of Contents

- Understanding Direct Deposit for Cash‑Back Rewards

- How the ACH Process Works

- Eligibility and Setup: Getting Your Direct Deposit Ready

- Required Information

- Timing Your Redemption

- Advantages of Direct Deposit Over Alternative Methods

- Speed and Convenience

- Security and Traceability

- Flexibility in Fund Usage

- Potential for Higher Reward Rates

- Common Pitfalls and How to Avoid Them

- Incorrect Bank Details

- Insufficient Account Balance for Verification

- Missing Minimum Redemption Thresholds

- Timing Conflicts with Account Changes

- Tips to Maximize Your Cash‑Back Returns

- Consolidate Rewards Across Multiple Cards

- Pair Cash‑Back Redemption with Budgeting Tools

- Leverage Seasonal Bonus Offers

- Stay Informed About Policy Changes

- Monitor Your Statements Regularly

Redeeming cash back as direct deposit has become the preferred choice for millions of credit‑card users who want their rewards to land instantly in their bank accounts. The process is simple, yet many cardholders overlook the details that can turn a smooth transaction into a frustrating delay. This article walks you through the entire journey—from enrollment to the moment the funds appear in your account—while highlighting the advantages, potential pitfalls, and best practices.

Imagine you’ve just paid off a large grocery bill with a card that offers 2 % cash back on everyday purchases. At the end of the month, the issuer sends a statement showing a $120 reward. Instead of waiting weeks for a mailed check or juggling multiple gift‑card codes, you elect to have that $120 deposited directly into your checking account. Within a business day, the money is ready to cover your next expense, and you never have to worry about losing a paper check.

In the following sections, we will break down the mechanics of direct deposit, explain how to set it up correctly, and provide actionable tips to ensure you get the most out of every cash‑back opportunity. Whether you are a seasoned rewards hunter or a first‑time user, the narrative will guide you through each step as clearly as a short factual story.

Understanding Direct Deposit for Cash‑Back Rewards

Direct deposit, also known as electronic funds transfer (EFT), moves money from the issuer’s reward pool straight into the bank account you specify. The method relies on the Automated Clearing House (ACH) network, which processes millions of transactions daily. Because the transfer is digital, it eliminates the need for physical checks, reduces processing time, and minimizes the risk of lost or stolen payments.

How the ACH Process Works

- Initiation: After the billing cycle closes, the issuer tallies eligible cash‑back amounts and flags any pending rewards.

- Verification: The system cross‑checks the bank account details you provided—routing number, account number, and account type—to ensure compatibility.

- Batch Transfer: Rewards are grouped with other ACH transactions and sent to the ACH operator, which then routes them to your bank.

- Settlement: Your bank receives the funds, credits your account, and typically notifies you via email or mobile alert.

Because the ACH network operates on a next‑day settlement schedule, most issuers can post the cash‑back to your account within one to three business days after the statement closes.

Eligibility and Setup: Getting Your Direct Deposit Ready

The first step to redeeming cash back as direct deposit is confirming that your card’s rewards program supports electronic payouts. Most major issuers—such as Citi, Chase, and Capital One—offer this option, but some niche or store cards may limit redemption to gift cards or statement credits.

Required Information

- Bank routing number (nine digits)

- Account number (varies by institution)

- Account type (checking or savings)

- Full legal name as it appears on the account

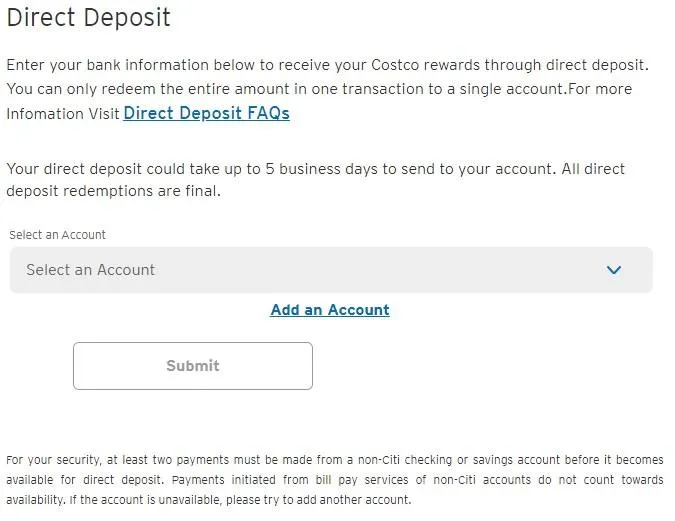

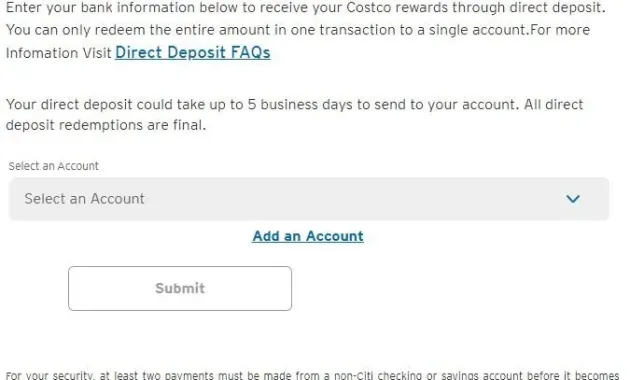

When you log into the issuer’s online portal, look for a “Rewards” or “Cash‑Back” section. There will be an option to “Add Bank Account” or “Edit Payout Method.” Follow the prompts, double‑check each digit, and save the information. Many platforms will perform a small test transaction—usually less than $1—to verify the account, which will appear as a pending entry on your bank statement. Once verified, the account becomes eligible for future cash‑back deposits.

For a practical illustration, see how the Getting Started: Setting Up Your Rewards Account guide walks new users through the same process, emphasizing the importance of accurate data entry and regular account reviews.

Timing Your Redemption

Most issuers allow you to redeem cash back at any point after the statement closes, but some impose minimum thresholds (e.g., $25 or $50). Planning your redemption around payroll dates can ensure the funds are available when you need them most. If you have a recurring expense—like a mortgage or subscription—consider scheduling the redemption a few days before the due date to keep your cash flow uninterrupted.

Advantages of Direct Deposit Over Alternative Methods

While checks and gift cards have traditionally been the go‑to options for cash‑back redemption, direct deposit offers several compelling benefits that align with modern financial habits.

Speed and Convenience

Electronic transfers complete in 1‑3 business days, whereas mailed checks can take up to two weeks, especially during holiday seasons. Direct deposit also eliminates the need to manually input a gift‑card code each time you shop.

Security and Traceability

ACH transactions are encrypted and tracked, providing a clear audit trail. If a discrepancy arises, you can reference the transaction ID, whereas a lost check offers limited recourse.

Flexibility in Fund Usage

Cash in a checking account can be used for any expense—paying bills, investing, or saving—without the restrictions that accompany store‑specific gift cards. This flexibility is especially valuable for users who prefer a single, consolidated source of funds.

Potential for Higher Reward Rates

Some issuers boost cash‑back percentages for users who choose direct deposit, viewing it as a cost‑effective payout method. While the increase is modest, it can add up over time.

Common Pitfalls and How to Avoid Them

Even with a straightforward process, errors can occur. Recognizing these pitfalls early can save you from missed rewards or delayed payouts.

Incorrect Bank Details

A single transposition error in the routing or account number can cause the ACH transfer to bounce, leading to a reversal and possible fees. Always double‑check the numbers and consider copying them from an online statement rather than typing them manually.

Insufficient Account Balance for Verification

If the test transaction used for verification exceeds the available balance (common with overdraft‑protected accounts), the verification may fail. Ensure your account has a small buffer before initiating the setup.

Missing Minimum Redemption Thresholds

Attempting to redeem below the issuer’s minimum will result in the request being declined. Keep a running tally of your cash‑back balance and schedule redemptions when you cross the threshold.

Timing Conflicts with Account Changes

Changing your bank account close to the redemption date can create a mismatch, especially if the issuer has already queued the ACH file. Update your payout method well in advance of any planned redemption.

Tips to Maximize Your Cash‑Back Returns

Beyond the mechanics of direct deposit, strategic behavior can amplify the value you receive from cash‑back programs.

Consolidate Rewards Across Multiple Cards

If you hold several cash‑back cards, consider transferring balances to a single card that offers a higher redemption rate for direct deposit. Some issuers allow you to move points or cash between accounts, turning lower‑rate rewards into higher‑value cash.

Pair Cash‑Back Redemption with Budgeting Tools

Use personal finance apps to automatically allocate incoming cash‑back to savings goals or debt repayment. This approach turns a passive reward into an active financial improvement.

Leverage Seasonal Bonus Offers

Many issuers run limited‑time promotions—such as “Earn 5 % cash back on groceries for the next 3 months.” Combine these bonuses with direct deposit to see the rewards appear in your bank account faster.

Stay Informed About Policy Changes

Credit‑card issuers occasionally adjust payout methods, fees, or minimum thresholds. Subscribe to issuer newsletters or follow reputable blogs like Which Card Wins the Cash‑Back Battle? to stay ahead of any changes that could impact your redemption strategy.

Monitor Your Statements Regularly

Regularly reviewing your statements ensures you catch any missed cash‑back opportunities, such as purchases that qualify for a category bonus but were not credited. Promptly contacting customer service can often resolve these issues before the next cycle.

By integrating these tactics with the reliable direct deposit method, you can transform everyday spending into a steady stream of cash that directly supports your financial goals.

In practice, the journey from earning cash back to seeing it land in your bank account is seamless when you follow the steps outlined above. You begin by confirming eligibility, accurately entering your banking details, and timing your redemption to match your cash‑flow needs. The ACH network then handles the transfer swiftly, delivering funds securely and without the hassle of physical checks or gift cards. With an awareness of common errors and a set of proven strategies, you can maximize the value of every reward, turning routine purchases into tangible financial benefits.

Ultimately, redeeming cash back as direct deposit is more than a convenience—it is a strategic tool that aligns reward earnings with modern banking practices, offering speed, security, and flexibility. By treating your cash‑back like any other income source and integrating it into your broader financial plan, you ensure that every dollar earned works harder for you.