Table of Contents

- Understanding the Legal Status of a Deceased Cardholder’s Credit Card

- Key legal concepts to know

- Immediate Actions for Executors and Family Members

- Step 1: Gather the necessary documents

- Step 2: Notify the credit card issuer

- Step 3: Secure the physical card

- Closing vs. Transferring a Credit Card Account

- When to consider closing the account

- When transferring may be advantageous

- Handling Outstanding Balances and Disputes

- Paying the balance directly

- Negotiating with the issuer

- Disputing unauthorized charges

- Protecting the Estate’s Credit and Preventing Fraud

- Monitor credit reports

- Secure online access

- Maintain documentation

When a loved one passes away, the emotional weight of loss often overshadows the practical tasks that must be addressed. One of those tasks is figuring out what to do with the deceased’s credit cards. The keyword “how to handle credit card after death of owner” becomes a pressing question for families, executors, and estate lawyers alike. Understanding the proper procedures helps prevent unnecessary fees, protects the estate’s value, and safeguards the surviving relatives from potential fraud.

The reality is that a credit card does not simply disappear when its holder dies. The account remains active until the issuer is officially notified, and any pending charges continue to accrue interest. Ignoring the account can lead to mounting debt, damaged credit for the deceased’s estate, and legal complications for heirs. By approaching the situation methodically—starting with clear communication and documentation—families can navigate the process with confidence and preserve the financial legacy left behind.

Understanding the Legal Status of a Deceased Cardholder’s Credit Card

Credit card agreements are contracts between the issuer and the cardholder. Upon death, the contract does not automatically terminate; instead, it becomes subject to the estate’s administration. The estate, represented by the executor or personal representative, inherits the responsibility to settle outstanding balances unless the account was jointly held or designated as a payable‑on‑death (POD) arrangement.

Key legal concepts to know

- Estate liability: The deceased’s unpaid credit card debt is generally considered a liability of the estate, not of the surviving spouse or children, unless they are co‑signers.

- Joint accounts: If the card was a joint account, the surviving holder remains fully liable for the balance.

- POD designations: Some cards allow a “payable‑on‑death” beneficiary. In that case, the balance can be transferred directly to the named individual, bypassing the probate process.

Knowing these distinctions early helps the executor decide whether to close the account, continue payments, or transfer the balance. For families who also manage other financial tools, the year‑end credit card summary can be a valuable snapshot to assess total exposure.

Immediate Actions for Executors and Family Members

The first 30 days after a death are crucial. Promptly addressing the credit card mitigates the risk of unauthorized charges and protects the estate’s assets.

Step 1: Gather the necessary documents

- Original death certificate (multiple copies are often required).

- Copy of the will or court‑appointed letters testamentary.

- Recent credit card statements showing the latest balance and transaction history.

Step 2: Notify the credit card issuer

Contact the issuer’s “deceased customer” department—usually reachable via a dedicated phone line or email. Provide the death certificate and request that the account be flagged as “deceased.” Most issuers will freeze the account to prevent new purchases while you arrange settlement.

Step 3: Secure the physical card

Collect all cards from the deceased’s belongings, wallet, and safe deposit box. Cut the cards into pieces or shred them to ensure they cannot be used fraudulently. This simple act stops potential misuse and eases the issuer’s verification process.

Closing vs. Transferring a Credit Card Account

Deciding whether to close the account or keep it open depends on the balance, the estate’s liquidity, and any ongoing benefits associated with the card.

When to consider closing the account

- The balance is modest and the estate has sufficient cash to pay it off quickly.

- The card carries high annual fees that would burden the estate.

- There are no valuable rewards or protections that the heirs could benefit from.

When transferring may be advantageous

- The deceased held a premium card with travel insurance, purchase protection, or a substantial rewards balance.

- The executor wishes to retain the card’s benefits for a surviving spouse who may qualify for a similar card.

- The estate is insolvent, and the issuer agrees to settle the debt for a reduced amount while keeping the account open for a short period.

In some cases, the issuer may allow the surviving spouse to assume the account, especially if they are an authorized user. This approach can preserve rewards points, which might be redeemed later. For guidance on redeeming points, see our guide to redeem points for gift cards, which outlines the steps to claim valuable balances before the account closes.

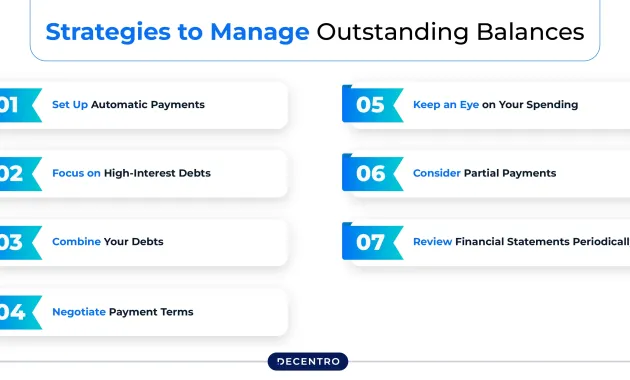

Handling Outstanding Balances and Disputes

Once the account is flagged, the executor must address any unpaid balance. The strategy hinges on the estate’s assets and the creditor’s policies.

Paying the balance directly

If the estate has liquid assets, the executor can write a check or initiate a bank transfer to settle the debt. Keep detailed records of the payment, including the transaction receipt and a copy of the cleared statement, to provide evidence to the probate court.

Negotiating with the issuer

In situations where the estate lacks sufficient funds, many issuers are willing to negotiate a settlement. This may involve a reduced lump‑sum payment or a payment plan that draws from the estate’s ongoing income (e.g., rental properties). Document any agreement in writing and have the executor sign it.

Disputing unauthorized charges

If the statement shows charges that occurred after the death, the executor should file a dispute. Most issuers have a 60‑day window to contest a transaction. Follow the process outlined in the step‑by‑step guide to dispute a credit card transaction, providing the death certificate and proof that the card was no longer authorized for use.

Protecting the Estate’s Credit and Preventing Fraud

Even after the account is closed, the estate remains vulnerable to identity theft. The executor should adopt preventive measures to safeguard the deceased’s financial identity.

Monitor credit reports

Request a copy of the deceased’s credit report from the three major bureaus—Equifax, Experian, and TransUnion. Review it for any new accounts, inquiries, or suspicious activity. Place a fraud alert or a credit freeze if any irregularities appear.

Secure online access

If the deceased used online banking, change the password and security questions, then log into the account to confirm it is closed. Some issuers also allow the executor to maintain limited access for monitoring purposes. Our article on how to log into a Regions Bank credit card account provides tips on navigating such portals safely.

Maintain documentation

Keep all correspondence, payment receipts, and settlement agreements in a dedicated folder. This record will be essential if the probate court requests proof of debt settlement or if a future dispute arises.

By following these steps, families can reduce the emotional and financial stress that often accompanies the loss of a loved one. The process may seem daunting, but a systematic approach—starting with notification, securing the card, evaluating options, settling balances, and protecting against fraud—ensures that the estate’s assets are preserved and the deceased’s financial obligations are responsibly concluded.

In the end, handling a credit card after death is as much about honoring the memory of the person who built that financial life as it is about protecting the surviving family’s future. With clear guidance and diligent execution, the transition can be managed smoothly, allowing loved ones to focus on remembrance rather than paperwork.