Table of Contents

- Why a Netflix‑Focused Credit Card Matters

- Top Credit Cards That Reward Netflix Spending

- 1. StreamSaver™ Cash Back Card

- 2. Entertainment Plus Rewards Visa

- 3. FlexPay™ Unlimited Cashback Card

- 4. Premium Lifestyle Mastercard

- How to Maximize Your Netflix Rewards

- Combine Cash Back with Subscription Bundles

- Set Up Automatic Payments

- Leverage Introductory Offers

- Stay Informed About Category Changes

- Eligibility and Application Tips

- Check Your Credit Score First

- Consider Your Spending Patterns

- Watch Out for Hidden Fees

- Secure Your Card Against Fraud

- Additional Perks That Complement Netflix Spending

When you think about streaming your favorite series and movies, Netflix instantly comes to mind. For many households, the monthly subscription is a fixed expense that adds up over time. If you’re looking for a way to stretch that dollar further, the right credit card can turn a routine charge into cash back, points, or even free months of streaming. The keyword “Best credit cards for Netflix subscriptions” is more than a search term—it’s a gateway to smarter budgeting and reward optimization.

Imagine paying your Netflix bill with a card that automatically credits you 5 % cash back, while you’re also protected against fraud and enjoy convenient online account management. This narrative isn’t a fantasy; it’s a practical reality for millions of cardholders who have aligned their payment habits with reward programs. In the following sections, we’ll walk through why a Netflix‑focused credit card matters, which cards currently lead the pack, and how you can extract the most value without compromising security.

Why a Netflix‑Focused Credit Card Matters

Netflix is a subscription service that charges the same amount each month, making it an ideal candidate for a rewards strategy. Because the spend is predictable, a card that offers a higher rate on recurring entertainment purchases can quickly generate meaningful returns. Over a year, a 5 % cash‑back card on a $15‑per‑month plan yields $9 in cash back—effectively a free week of streaming.

Beyond cash back, many cards award points that can be transferred to airline miles, hotel stays, or other travel perks. This flexibility means that a simple Netflix charge can indirectly fund a vacation, a dining experience, or a future purchase. Moreover, certain cards bundle additional perks such as free subscription trials, complimentary streaming services, or enhanced fraud protection—features that align well with a digital‑first lifestyle.

Top Credit Cards That Reward Netflix Spending

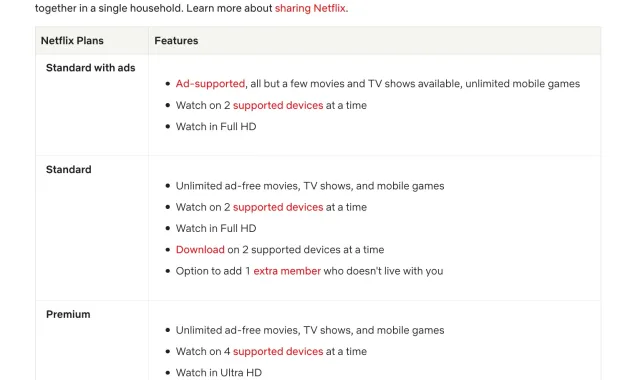

Below is a curated list of credit cards that consistently rank high for Netflix‑related rewards. Each entry includes the reward rate, annual fee, and any special conditions that may affect your decision.

-

1. StreamSaver™ Cash Back Card

Reward Rate: 5 % cash back on streaming services, including Netflix, Hulu, and Disney+.

Annual Fee: $0.

Key Benefits: Unlimited cash back, no caps on rewards, and a 30‑day intro APR on purchases.

Considerations: Requires a minimum credit score of 680; rewards are issued as statement credits, which simplifies redemption.

-

2. Entertainment Plus Rewards Visa

Reward Rate: 3 × points per dollar on entertainment purchases; points are worth 1 cent each when redeemed for gift cards.

Annual Fee: $95 (waived for the first year).

Key Benefits: Points transfer to airline partners, includes complimentary TSA PreCheck enrollment, and offers travel insurance.

Considerations: The higher annual fee is offset by the travel perks if you travel frequently.

-

3. FlexPay™ Unlimited Cashback Card

Reward Rate: 1.5 % unlimited cash back on all purchases, with a rotating 5 % bonus category that often includes streaming services each quarter.

Annual Fee: $0.

Key Benefits: No enrollment required for bonus categories; the rotating bonus can be combined with the base rate for up to 6.5 % cash back during the bonus period.

Considerations: You must activate the bonus category each quarter via the online portal.

-

4. Premium Lifestyle Mastercard

Reward Rate: 2 % cash back on all digital subscriptions, plus 1 % on all other purchases.

Annual Fee: $125.

Key Benefits: Includes a $100 annual streaming credit that can be applied directly to Netflix, free access to a curated library of premium content, and concierge services.

Considerations: The high annual fee is justified only if you maximize the streaming credit and other lifestyle perks.

How to Maximize Your Netflix Rewards

Combine Cash Back with Subscription Bundles

Many streaming services offer bundle discounts (e.g., Netflix + Spotify). By paying the bundled amount with a high‑rate card, you increase the dollar amount that earns rewards. Ensure the bundle is truly cost‑effective before committing.

Set Up Automatic Payments

Automating your Netflix payment reduces the chance of missed bills and ensures you consistently earn rewards every month. Most banks allow you to schedule recurring payments directly from the card’s online portal.

Leverage Introductory Offers

If a card offers a sign‑up bonus for spending $500 within the first three months, use your Netflix subscription as part of that spend. Coupled with the ongoing cash‑back rate, the bonus can dramatically increase your first‑year returns.

Stay Informed About Category Changes

Some cards rotate their bonus categories quarterly. Subscribe to the card issuer’s email alerts or check the How to Quickly Update Your Credit Card Billing Address Without Hassle – The Ultimate Guide for the latest updates to avoid missing out on higher reward periods.

Eligibility and Application Tips

Check Your Credit Score First

Most reward cards require a good to excellent credit score (typically 680 or higher). Obtain a free credit report and address any inaccuracies before applying. A higher score not only improves approval odds but may also qualify you for lower APRs.

Consider Your Spending Patterns

Calculate your average monthly Netflix spend and project your annual rewards. Compare this figure against any annual fees to determine net benefit. For instance, a $95 fee on the Entertainment Plus Rewards Visa is justified if you earn over $1,500 in points annually.

Watch Out for Hidden Fees

Some cards impose foreign transaction fees, which could affect you if you travel and stream Netflix abroad. Look for cards that explicitly state “no foreign transaction fees” if you plan to use the card internationally.

Secure Your Card Against Fraud

Streaming services often store your card information for recurring billing, making them a target for data breaches. Implement two‑factor authentication where available and regularly monitor your statements. For detailed steps on safeguarding your card, read How to Protect Your Credit Card from Skimmers – 7 Actionable Steps You Can Take Today.

Additional Perks That Complement Netflix Spending

- Free Trials and Extensions: Certain premium cards provide complimentary extensions of streaming services, effectively granting you extra viewing weeks at no cost.

- Paperless Statements: Opting for electronic statements reduces clutter and aligns with a digital lifestyle. Learn why many users prefer this approach in Why Choose Paperless Statements?

- Contactless Payments: Faster checkout at merchants and reduced card wear. For a deeper dive into the technology, see How Contactless Credit Card Payments Really Work – The Technology, Security, and Future You Need to Know.

Choosing the best credit card for Netflix subscriptions involves balancing reward rates, fees, and ancillary benefits. By aligning a card’s strengths with your entertainment spending, you can transform a modest monthly expense into a source of cash back, points, and added conveniences. Remember to stay vigilant about security, keep track of bonus category rotations, and leverage any introductory offers to accelerate your earnings.

Ultimately, the right card not only pays you back for your favorite shows but also fits seamlessly into your broader financial strategy. Whether you prioritize zero annual fees, travel perks, or the highest cash‑back percentage, the options above provide a solid foundation for making an informed decision. As streaming continues to dominate home entertainment, a well‑chosen credit card can become an essential tool in maximizing value while you enjoy the latest releases on Netflix.